With various media reports around – and numerous annoyed locals – about Wellington public transport operators failing to deliver contracted services (cancelling services) because they haven’t (note the choice of word) recruited and retained sufficient drivers, perhaps it is time to haul up from the archives a couple of posts I wrote early last year on these and related issues. Those posts were focused on bus drivers, while the latest stories feature both buses and commuter trains. I see that, once again, there is talk of overseas recruitment.

This was my first post, sparked by reports that one company was wanting to recruit abroad to fill its vacancies.

Extracts:

What prompted this post was the story this week about a bus company – Ritchies – wanting immigration approval to recruit foreign bus drivers. Bus drivers don’t make the list MBIE released of occupations for which there were more than 100 (so-called) Essential Skills visas issued last year, but these occupations were some that did.

| Essential skills visa approvals 2016/17 |

| Truck Driver (General) |

400 |

| Winery Cellar Hand |

396 |

| Waiter |

345 |

| Sales Assistant (General) |

320 |

| Personal Care Assistant |

289 |

| Massage Therapist |

259 |

| Baker |

231 |

| Painting Trades Worker |

220 |

| Builder’s Labourer |

185 |

| Kitchenhand |

181 |

| Fast Food Cook |

118 |

| Farm, Forestry and Garden Workers nec |

116 |

| Bar Attendant |

102 |

On the face of it, such roles don’t seem notably more (or less) taxing than being a bus driver. It is a responsible role, but not one requiring huge amounts of skills or training (according to the story I linked to above 6 to 8 weeks training suffices). It isn’t the sort of role one naturally thinks of when officials and ministers talk about skills-focused immigration programmes.

The case Ritchies make is that they can’t find locals – New Zealanders, or people already here – to fill new roles.

Auckland Transport awarded Ritchies Coachlines the contract to run buses on the North Shore from September.

But the company said so far it had not been able to find enough drivers locally and had asked Immigration New Zealand if it could bring in 110 of them from overseas to plug the gap.

And I’m sure that is correct. If you pay low enough wages, it is hardly surprising that people with other New Zealand options aren’t lining up to work for you.

At least on the union’s telling

“The problem with Ritchies is that they pay over a dollar an hour less than the industry so their retention rates are minimal. People get trained up then they’ll go to other bus companies where the rates are better. Again Ritchies brings it upon themselves.

On the face of it, it looks like another case of a service contract won largely on the basis of (assumed) low labour costs.

The company more or less acknowledges the point

Mr Todd said the company would continue trying to recruit locally but only had until late June before it would need to look overseas for drivers including in Fiji, Samoa and the Philippines.

He admitted the $20.20 an hour it paid drivers would be difficult to get by on in Auckland but said this was the budget it had to work with.

“Lets face it, any job in the world, if you pay enough, you’ll get people to do it but…those costs will have to be passed on.”

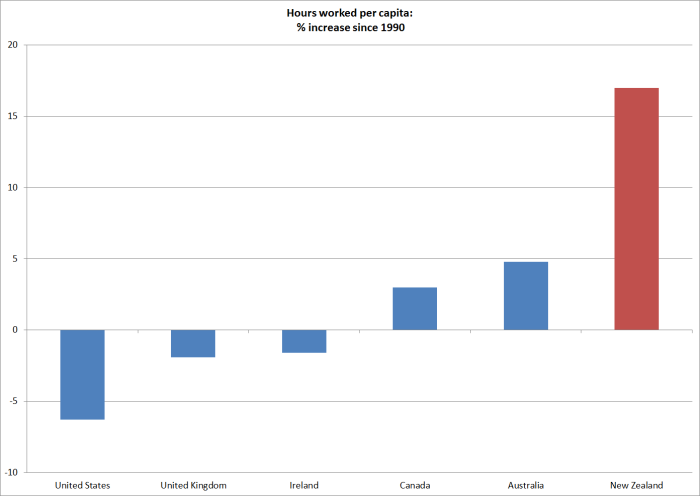

I don’t really see the specific company as the bogey-man here. They are operating in an environment – bidding for public contracts – where the overall level of funding seems to implicitly rely on access to very cheap labour (in this case, according to the company, from Fiji, Samoa, and the Philippines – the jobs presumably not being attractive to bus drivers from the advanced world, since New Zealand is now a low income advanced country).

The same goes, more or less, for some other public-funded industries. Rest-homes, for example, rely heavily on immigrant labour from poorer countries: the existing level of rest-home subsidies constrain their options pretty severely. No individual firm has a great deal of market power. But the overall market is nonetheless skewed by policy choices successive governments have made about access to immigrant labour to fill what are mostly quite modestly-skilled roles.

It is why we need not small tweaks at the margins – should or shouldn’t bus drivers (waiters, kitchenhands, or whatever) be on the approved list – but an overhaul of the entire immigration system.

But as part of that we should:

- establish a strong presumption against use of unskilled immigrant labour (which mostly – although not entirely – competes with and tends to drive down returns to domestic unskilled labour), and

- get ministers and officials out of the game of determining which specific roles people can and can’t hire short-term immigrant workers for.

To that end, I’ve argued previously for a system in which Essential Skills visas are granted on these terms:

a. Capped in length of time (a single maximum term of three years, with at least a year overseas before any return on a subsequent work visa, with this provision to apply regardless of skill level).

b. Subject to a fee, of perhaps $20000 per annum.

And this was the follow-up post from a couple of weeks later.

Extracts

In a typical market, there aren’t sustained physical shortages – the price adjusts. If in this case the price (driver wages) wasn’t adjusting – if anything there was a suggestion Ritchies would be paying less than the previous operator – it suggested the plan was to close the gaps another way (bringing in more relatively unskilled people from abroad.) Ritchies has moral agency in that – they made a choice to bid that way, and should live with the consequences if it doesn’t work (if, for some reason, MBIE turns down their application to bring in relatively unskilled workers from abroad). But I didn’t want to focus on the individual company, since they are responding to incentives set up by various arms of government – Auckland Transport offering the contracts, and even more so MBIE (as part of the New Zealand government) in making immigrant labour relatively readily available for what are really quite unskilled roles. And it isn’t as if Ritchies is the only company operating this way. Another operator has won most of the bus routes in Wellington, to take over in July, apparently operating on very similar assumptions about access to new immigrant labour.

I had some comments directly from people involved in the industry, on both sides. In substance they were making quite similar points. As one observed, demand growth (in this case for bus drivers) can always be met by expanded capacity (immigration) or higher prices (or wages). They went on to argue that the ability of some companies to import drivers meant they won contracts, and that it was as clear a case of immigration driving down wages as you could find.

Of suburban driver jobs, I observed last week

It is a responsible role, but not one requiring huge amounts of skills or training (according to the story I linked to above 6 to 8 weeks training suffices). It isn’t the sort of role one naturally thinks of when officials and ministers talk about skills-focused immigration programmes.

One driver confirmed that training story noting that his employer

…took me on with just a car licence. They spent about 8 weeks training me up and paid for the costs of getting a heavy traffic licence and a P endorsement (essentially a “fit and proper” test.)

In terms of (price-based) evidence of labour market pressures, this driver observed that over five years or so his basic hourly rate has increased by only around 1 per cent per annum (if so, that would be less than the average rate of CPI inflation, so a reduction in real wage rates).

There seem to be a variety of ways to spin the story as to how much bus drivers are being paid, and what the new entrants (Auckland and Wellington) are offering or planning to offer. …..[But] there doesn’t really seen to be much dispute that the new operators – claiming an inability to find sufficient local labour – are not offering drivers more than the current operators. Indeed, the general sense seems to be that pay for equivalent effort would be less than at present.

And in a typical, well-functioning, market, when demand exceeds supply – and not just for a day or two – the price of the product or service in question will rise (not fall). Quite how much the rise will be will depend on the elasticities of supply and demand – maybe a lot more potential drivers would emerge for slightly higher wages (or maybe not), and maybe bus patronage would drop away sharply with slightly higher fares (wages are by far the largest component in bus company costs) or maybe not. But you wouldn’t expect to see the relevant price – bus driver wages – under downward pressure when there is incipient excess demand for drivers.

(It is not as if the outgoing operators have had abundant labour. As one correspondent noted “Go wellington have about 340 drivers for the current contract but even with huge active recruitment and training from scratch they only get 100 new per annum which is as many as they lose”.)

In fact, the way the bus driver labour market exists seems to be possible only because our governments – present and past – have opened up a channel through which supply can be increased, at or below the current price. Open up incipient excess demand at current – or lower – than prevailing wages, and then get in workers on a (so-called) Essential Skills visa.

Bus drivers aren’t an occupation that appears on the official “skill shortage list” (if they were there would no further labour market test involved for any firm wanting to hire foreign labour). Occupations such as bricklayers, plasterers, bakers, and jockeys are on the list. But not being on the list doesn’t mean bus companies can’t hire foreign drivers. There are just more hoops to jump through – which is why employers who think they might have multiple vacancies (like the bus companies) are strongly urged (by MBIE) to seek an “approval in principle”.

MBIE’s employer guide is here. You’ll see that for unskilled or modestly skilled jobs, part of the required test is to check with WINZ as to whether there are New Zealanders seeking work they can refer to the employer. Bus drivers are in that category…….

That looks mildly encouraging. You can’t just offer the minimum wage (for a job in New Zealand typically paying $5 an hour more than that) and expect to get your approval in principle to bring in foreign workers. But if your wage contract is a little different from other operators (perhaps base rates are a bit higher, but other payments are lower?) or even if you can find one other company somewhere in the country paying the same overall rate, you have to wonder (based on total numbers approved if nothing else) how rigorous MBIE is in enforcing the test. And why, for example, it isn’t given more prominence in their guide to employers?

Because, you see, MBIE is really keen that firms hire foreigners. In fact, they have whole website pages devoting to extolling the virtues of immigrant labour – so much so that one has to wonder whether they really see themselves working in the interests of New Zealand citizens. Employers are told

“Hiring migrants is a great way for you to maintain and grow your business”

And then the first item under that “Why hire migrants?” employers are told

Migrant workers can do more than just fill a gap in your staffing. They bring with them an international perspective and connections, provide support to up-skill local employees, add diversity, and generally can help businesses to stay ahead of their competition.

The “international perspective and connections” being oh so important for bus drivers, bricklayers, or even the cafe or retail managers or aged care nurses (occupations topping the work visa approval list). There is no hint for example that there might be any disadvantages – eg lower returns to New Zealanders in similar occupations, or the simple fact that, in aggregate, migrants add more to demand pressures (including for labour) than they do to supply in the short-term.

If we are going to have government officials administering something like a mass market Essential Skills visa scheme, and deciding who does and doesn’t get approval, surely a key aspect of any labour market test should be something along these lines?

“has the effective wage or salary rate for this occupation risen materially faster than wages and salaries more generally in New Zealand over the past couple of years?”

If not, how can you seriously use the term “skill shortage”? Even if wages in a particular occupation have risen faster than the norm, it takes time for locals to respond and shift occupations, so one wouldn’t necessarily want to jump at the first sign of a bit of real wage inflation in a particular occupation, but if after a couple of years the pressures were persistent then some sort of Approval in Principle for temporary migrant labour – at wages at or above those now prevailing in the domestic market – might make some sense as a shock absorber. But MBIE seems perennially averse to markets adjusting in ways the generate higher real wages, even though that outcome is one core part of what we look for from a successful economy. Successive Ministers of Immigration – from both main parties – seem to buy in to the story, and believe that central planning by them and MBIE bureaucrats is going to work better than the price system. It wasn’t a good system in the Soviet Union, and it isn’t here.

I can’t see a reason why we should be giving Essential Skills visas for suburban bus drivers, and we shouldn’t be creating a system where firms are encouraged to bid in the expectation that they can use that system, rather than pay a market-clearing wage for New Zealand resident workers.

More generally, I don’t think there is particular merit in a system in which officials are picking and choosing which firms can and can’t hire short-term workers. As I noted in my previous post I favour something along these lines

To that end, I’ve argued previously for a system in which Essential Skills visas are granted on these terms:

a. Capped in length of time (a single maximum term of three years, with at least a year overseas before any return on a subsequent work visa, with this provision to apply regardless of skill level).

b. Subject to a fee, of perhaps $20000 per annum.

If an employer really can’t find a local hire for a modestly-skilled (or unskilled) position, they’d be able to get someone from overseas, but only by paying (to the Crown) a minimum annual fee of $20000. It is pretty powerful incentive then to train someone local, or increase the salary on offer to attract someone local who can already do the job. If you can’t get a local to do a job for $40000 per annum, there might well be plenty of people to do it for $50000 (and still cheaper than paying the ongoing annual fee for a work visa employee).

There are lots of operational details that would need to be refined, but as a starting point it seems like a pretty attractive system. In the current situation, if bus companies really can’t find New Zealanders to drive, they could hire foreigners, but would have to pay an additional annual fee to the Crown of $20000 for each approval (but also wouldn’t otherwise have to jump through bureaucratic hoops, legal fees etc). I’d be really surprised if there were any bus drivers then on Essential Skills visas or – reprising the list from my previous post – kitchenhands, waiters, or massage therapists. But, you never know. If the market price adjusted that much that it was still better to hire a foreigner, that price adjustment might be a pretty compelling argument for a rather more genuine “skill shortage” than what we have now.

Perhaps in the end, MBIE won’t allow the bus companies to hire immigrant labour to fill the vacancies. I’d welcome that, but the bigger issue isn’t any particular role, but how the system as a whole is designed and operated.

That’s the end of the extracts from last year’s posts. There are lots of words there, but surely the bottom line is that for any modestly-skilled occupation for which there isn’t a sudden totally unexpected change in demand (and the number of people wanting to use public transport just doesn’t fluctuate that much), persistent “shortages” tell you more about the wages and other terms and conditions being offered than they do about any real sense of unavailable labour? People will typically pursue the best opportunities available to them. Make bus (or train) driving somewhat more attractive – which is what the market signals are suggesting should happen – and some more people will be interested in, perhaps even keen on, driving a bus or a train.

And lets not allow the immigration system to be used to avoid responding to domestic labour market signals, especially in non-tradables parts of the economy. There is a place for immigration – a reasonably generous approach to refugees, and an openness to some really highly-skilled people who might want to settle here (probably quite a small modest number given distance, modest income relative to other advanced countries, and the revealed preference experience – only a small proportion of our actual migrants have been particularly highly-skilled).

(And, to be clear, the overall wage effects of high immigration are ambiguous, in part because in aggregate immigration boosts demand more than supply in the short run, and there are repeated waves of migrants, and thus repeated short-runs. I am not one of those arguing that immigration policy is driving wages systematically down. This post is about the impact in specific localised markets, and even more about the rules regarding labour market tests.)