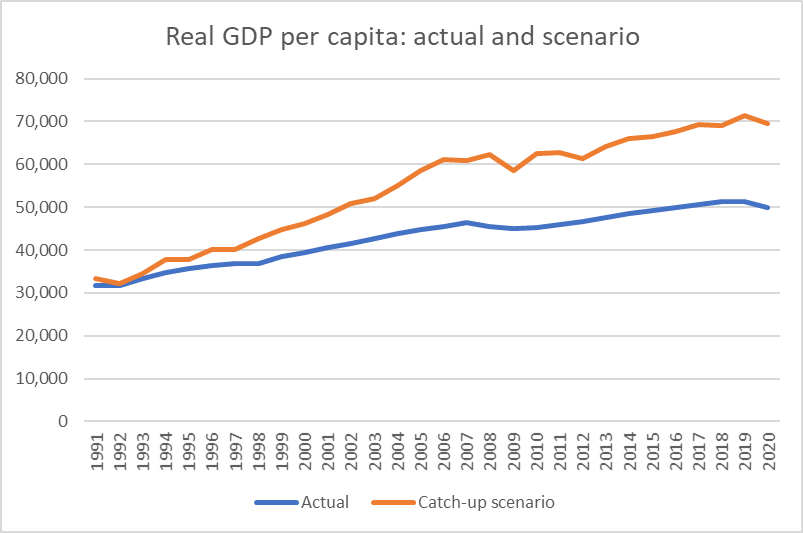

In my post on Monday I drew attention (again) to the fact that New Zealand has made no progress at all in reversing the decline in relative economywide productivity (relative to other advanced countries) since what was hoped to be a turning point, with the inauguration of widespread economic reforms after the 1984 election. If anything, the gaps have widened a bit further, and more countries (most former Communist ones) have entered the advanced country grouping, first matching and now overtaking us. Despite being so far behind the OECD leaders there are also clear signs that labour productivity growth has slowed further in the last decade or so.

All that discussion proceeded using simple measures of labour productivity (real GDP per hour worked). The data are readily available for and are more or less comparable across a fairly wide range of countries, and there is meaningful levels data. Labour productivity is a common measure in such discussions, even though total (or multi) factor productivity (TFP or MFP) is the in-principle preferred measure. It is the bit of growth in output or output per capita that can’t be explained just by the addition of more inputs (labour or capital). Some decades ago the late Robert Solow, recently deceased, observed that in modern economies perhaps 80 per cent of the growth in output per capita had been attributable to TFP.

It is a line that should be taken with several pinches of salt since in practice (a) TFP is an unobservable residual, and b) much of the innovation and new knowledge often thought of as the basis for TFP growth is probably embedded in better human and physical capital and the disaggregation is a challenge (to say the least). Thriving economies are likely to have better smarter people, better tangible and intangible capital, all used in better smarter ways etc.

But with all these caveats I thought it might still be worth having a fresh look at the OECD’s MFP data for the last few decades. They only have MFP (growth) data for a subset of (24) member countries (mostly the “old OECD”, and including none of the central European countries). For New Zealand, the first MFP growth data is for 1987, and with the annual data available only to 2022 that gives us 36 years of data.

There is a lot of year to year noise in the series, but for illustrative purposes I simply split the data in two, to compare the record for the 18 years to 2004 with the 18 years to 2022. As it happens, the global slowdown in productivity growth in leading economies (US and northern Europe) can be dated to about 2005.

New Zealand averaged annual MFP growth of 0.9 per cent in the first 18 year period, and only 0.2 per cent per annum in the second 18 year period to 2022. It is a pretty dire picture. (All data in this post use arithmetic averages, but using geometric would not make any material difference.)

Now, champions of the reform story might be tempted to look at that simple comparison and say something like “yes, you see. In the wake of the decade of far-reaching reform New Zealand made real and substantial economic progress, but then after the reform energy faded and drift took hold it all faded away to almost nothing.

Unfortunately for that story, here is how New Zealand MFP growth record compares (on the OECD’s particular methodology) for New Zealand and (the median) for the other countries (most of them) for which there is a complete set of data.

We all but matched the average growth performance of those other advanced OECD economies in the earlier period, in the wake of our reform process, but even then didn’t do well enough to begin to close the large levels gaps that had opened up in earlier decades. And then in the more recent period, we’ve done worse again: the comparator group (typically richer and more productive, nearer the productivity frontiers) slowed markedly, but we slowed a bit more still. When you start so far inside productivity frontiers there is no necessary reason why New Zealand could not have made some progress closing the gaps even if the frontier countries themselves ran into difficulties. But no. (Over that second 18 year period when New Zealand averaged 0.2 per cent per annum MFP growth, South Korea - also well inside productivity frontiers on an economywide basis – is estimated to have averaged 2 per cent per annum MFP growth).

It is only one model, and only one set of comparators but there is simply nothing positive in the New Zealand story. There is, and has been, no progress in closing those gaps, and our living standards suffer as a result.

And what of Solow’s 80 per cent? In New Zealand real GDP per capita increased by an average of 1.7 per cent per annum between 1987 and 2004. MFP growth averaged 0.9 per cent over that period. For the period 2005 to 2022 average annual growth in real GDP per capita increased by an average of 1.4 per cent per annum, but over that period MFP growth averaged just 0.2 per cent per annum. (The comparisons are no more flattering if one uses the OECD “contributions to labour productivity growth” table as the basis for comparison.)

Whichever measure of productivity one looks at the New Zealand performance is poor. Champions of reform 40 years ago would, I think, have been astonished if they’d been told how poorly New Zealand would end up doing. I hope they’d be even more alarmed at the indifference to that woeful record that now seems to pervade official and political New Zealand.

[And since I’ve already had one past champion of the reforms objecting to my characterisation in this post and Monday’s post, I’m equally sure that all serious observers now - ie excluding our political leaders and officials - have their own story about what else should (or in some cases shouldn’t) have been done over recent decades. That doesn’t change the fact - on my reading and my memory – that if asked in say 1990 most would have envisaged several decades of catch-up growth as the decline of the previous decades was slowly reversed. It is quite clear from the documentary record that that was the goal, and the intense political disputes of the era were not about that goal.]