I’ll get back to some extensive original material next week, but I have been reflecting a bit on the attack on the Reserve Bank by Arthur Grimes, former chief economist of the Bank (and later chair of the Bank’s monitoring board). The most recent version ran on Radio New Zealand yesterday morning. As I noted on Twitter, there was a fair amount there I agreed with (notably the observations on the poor quality make-up of the MPC) and a fair amount I disagreed with.

Grimes has been critical of the Bank (and the government) for some considerable time, going back to the amendment to the statutory objective (adding a secondary element of “supporting maximum sustainable employment). Since the pandemic descended on us, his criticism has centred not on CPI inflation (actual or prospective) but on house prices.

Almost a year ago, he had an impassioned piece on these themes published in the Listener. I responded to it in a post, the relevant bits of which I reproduce below.

At which point in this post, I’m going to turn on a dime and come to the defence of both the Bank and the government. A couple of weeks ago the Listener magazine ran an impassioned piece by Arthur Grimes arguing that the amendment to the Reserve Bank Act in 2018 was a – perhaps even “the” – main factor in what had gone crazily wrong with house prices in the last few years. Conveniently, the article is now available on the Herald website where it sits under the heading “Government has caused housing crisis to become a catastrophe”.

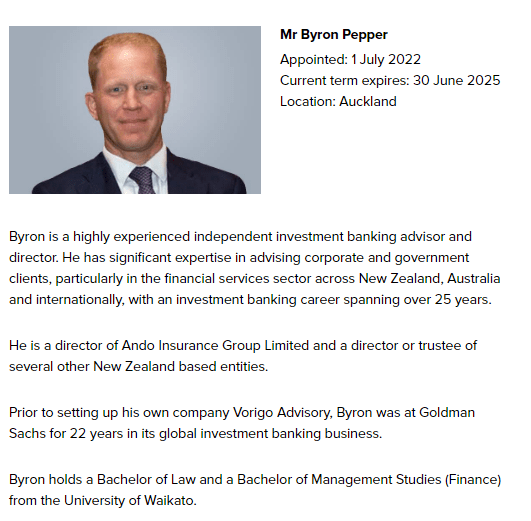

Grimes was closely involved in the design of the 1989 Reserve Bank Act, and for a couple of years in the early 1990s was the Bank’s chief economist (and my boss). He left the Bank for some mix of private sector, research, and academic employment, but also spent some years on the Reserve Bank’s board – the largely toothless monitoring body that spent decades mostly providing cover for whoever was Governor. These days he is a professor of “wellbeing and public policy” at Victoria University.

However, whatever his credentials, his argument simply does not stack up, and given some of the valuable work he has done in the past, on land prices, it is remarkable that he is even making it.

There is quite a bit in the first half of the article that I totally agree with. High house prices are a public policy disaster and one which hurts most severely those at the bottom of the economic ladder, the young, the poor, the outsiders (including, disproportionately, Maori and Pacific populations). But then we get a story that house prices have been the outcome of the interaction between high net migration and housebuilding. As Arthur notes, immigration has hardly been a factor in the last 18 months (actually it has been negative, even if the SNZ 12/16 model has not yet caught up) and there has been quite a lot of housebuilding going on.

And yet in the entire article there is nothing – not a word – about the continuing pervasive land use restrictions (and only passing mention about the past). If new land on the fringes of our cities – often with very limited value in alternative uses – cannot easily be brought into development (if owners of such land are not competing with each other to be able to do so) there is no reason to suppose that even a temporary surge in building activity will make much difference to a sustainable price for house+land. Instead, any boost to demand will still just flow into higher prices.

Remarkably, in discussing the events of the last year there is also no mention of fiscal policy – the boost to demand that stems from a shift from a balanced budget just prior to Covid to one that, on Treasury’s own numbers, is a very large structural deficit this year.

Instead, on the Grimes telling the problem is a reversion to “Muldoonism” – not, note, the fiscal deficits, but the amendment to the statutory goal for the Reserve Bank’s monetary policy enacted almost three years ago now. Recall the new wording

The Bank, acting through the MPC, has the function of formulating a monetary policy directed to the economic objectives of—

(a) achieving and maintaining stability in the general level of prices over the medium term; and

(b) supporting maximum sustainable employment.

The main change being the addition of b).

Grimes has been staunchly opposed to that amendment from the start, but his assertion that it makes much difference to anything has never really stood up to close scrutiny. It has long had more of a sense about it of being aggrieved that a formulation he had been closely associated with had been changed.

He has never (at least that I’ve seen) engaged with (a) the Governor’s claim (which rings true to me) that the changed mandate had made no difference to how the Bank had set monetary policy during the Covid period, (b) the more generalised proposition (that the Governor is drawing on) that in the face of demand shocks a pure price stability mandate (and the RB’s was never pure) and an employment objective (or constraint) prompt exactly the same sort of policy response, or (c) the extent to which the New Zealand statutory goals remains (i) cleaner than those of many other advanced countries and yet (ii) substantially similar (as the respective central banks describe what they are doing) to the models in, notably, the United States and Australia. Similarly, he never engages with the straight inflation forecasts the Bank was publishing this time last year: if they believed those numbers, the purest of simple inflation targeting central banks would have been doing just what the RB did (and arguably more, given that the forecasts remained at/below the bottom of the target range for a protracted period).

Grimes seems to be running a line that the LSAP was the problem

The central culprit has been monetary policy that has flooded the economy with liquidity. This liquidity in turn has found its way into the housing market.

But there is just no credible story or data that backs up those claims. Banks simply weren’t (and aren’t) constrained by “liquidity”. The LSAP was financially risky performative display, but it made no material difference to any macro outcomes that matter, including house prices.

There is quite a lot of this sort of stuff.

Grimes ends on a better note, lamenting the refusal of governments – past and present – to contemplate substantially lower house prices, let alone take the steps that would bring them about (his final line “And no politician seems to care enough to do anything about it” is one I totally endorse). But in trying to argue a case that a change to the Reserve Bank Act – that had no impact on anything discernible as it went through Parliament or in its first year on the books – somehow explains our house price outcomes (especially in a world where many similar price rises are occurring, and where there was no change in central bank legislation), seems unsupported, and ends up largely serving the interests of the government, by distracting attention from the thing – land use deregulation – that really would make a marked difference and which the government absolutely refuses to do anything much about.

There is nothing much in that I would change today. In particular, in continuing to attack the change in the wording of the mandate (a matter on which reasonable people might differ, but which most economists would argue largely served to reflect how the Bank had been – and had been expected to be – running policy for the previous 25 years), he has not (that I’ve seen) been willing to engage with the points I’ve noted above which the Bank might reasonably be expected to mount in its defence.

Similarly, he never engages with the straight inflation forecasts the Bank was publishing this time last year: if they believed those numbers, the purest of simple inflation targeting central banks would have been doing just what the RB did (and arguably more, given that the forecasts remained at/below the bottom of the target range for a protracted period)

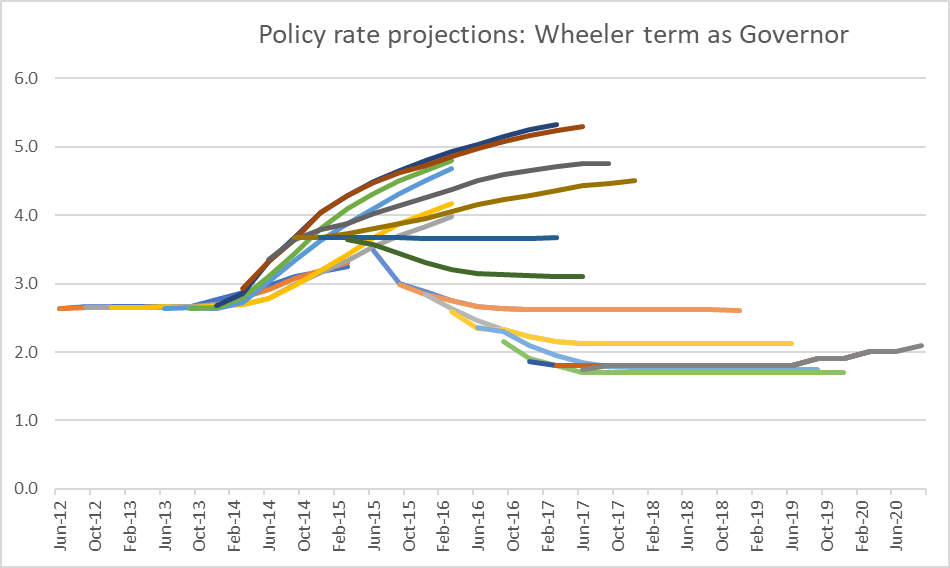

As Arthur correctly noted in his RNZ interview yesterday, monetary policy lags are quite long. The Bank has to be looking ahead in setting policy. Many estimates are that the lags for the main effects of monetary policy might be 18-24 months. Thus, June quarter 2022 inflation might be most affected by monetary policy choices in late 2020. Here is a summary of the key variables in the Bank’s November 2020 MPS projections (“baseline scenario” as they were calling it at the time)

If this was genuinely their best view at the time (and there is no obvious reason to doubt that) then a textbook pure inflation-targeter (which has never described the Reserve Bank under any of its inflation-targeting Governors) would have looked at these forecasts – inflation at about 1 per cent in mid 2022 – and might reasonably have concluded that more monetary policy stimulus was required.

It all just goes to my argument that the big problem (with hindsight) in the first year or more after Covid hit was a forecasting mistake – the Bank (and most other forecasters) proved to be using the wrong models for thinking about how Covid would affect key economic variables. For much of that time, the thrust of the Bank’s forecasts were not so different from those of other forecasters. Where, in my view, they become much more culpable is from the middle of last year when, with core inflation evidently rising beyond the target midpoint, they were slow to start tightening, and sluggish in the adjustments they did make. But, again, by then both inflation and unemployment numbers (actual and indications of the future) were pointing in the same direction.