Mervyn King was successively chief economist, Deputy Governor and Governor of the Bank of England over 20+ years. Now in private life, with all the honours the UK can bestow (as Lord King, and a Knight of the Garter). he periodically offers his thoughts – lucidly, rigorously, and respectfully (a model, in that regard, for any central bank Governor) – on various economic policy issues. There was. for example, his book The End of Alchemy a few years ago (which I wrote about here). There is a new book, with another respected UK economist John Kay, due out early next year.

Over the weekend, at the IMF/World Bank Annual Meetings, King delivered the prestigious Per Jacobsson Lecture in Washington DC (video rather than lecture text). His lecture has had quite a lot of media coverage (for example here), with an emphasis on the idea that we are “sleepwalking towards a new crisis” and with various ideas and emphases for reform.

There are things to agree with and to disagree with in the lecture. He is clearly right to be expressing concern about the likely economic and political consequences of any new severe downturn, with little conventional monetary policy capacity at the disposal of the authorities. If/when such a downturn happens it is going to be very difficult to navigate successfully. That message needs to uttered loudly and often, to alert the public and (perhaps) galvanise some policymakers.

Where I’m rather more sceptical is around Lord King’s expressed enthusiasm for the idea that the disappointing growth performance over the last decade or so is primarily a problem of a shortfall of demand. Of course, it is likely that there is a demand (and monetary policy) element to the story – in most places, inflation has undershot targets and as central banks (and markets) have been repeatedly surprised by the fall in market interest rates, they’ve had a bias to hold policy rates higher than they probably should have been.

But King’s story is a much more radical one than that.

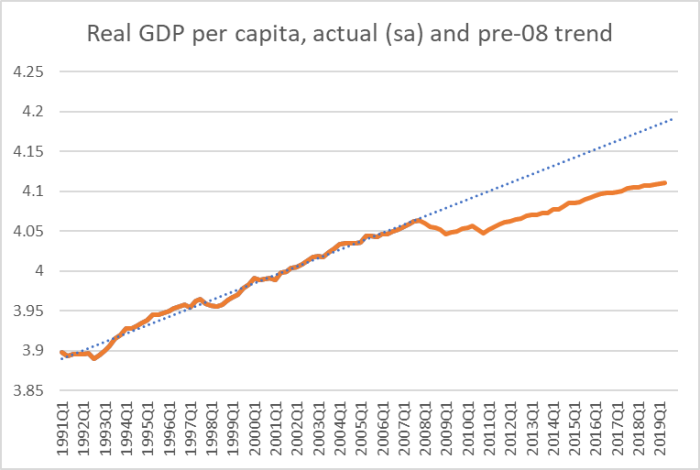

One of the ways he set up his story was by analogy with the last great period of macroeconomic disappointment, the Great Depression. He notes that in most advanced countries now real per capita GDP is well below the level implied by the trend in the decades running up to 2008. Here is a New Zealand version of the sort of chart he has in mind.

And then he moves on to assert (a) that similar charts could have been produced in the mid-late 1930s, extrapolating trend growth in real per capita GDP for the 20th century up to the Depression and yet (b) by 1950 actuals had returned to the pre-Depression trend. So, he argues, we should not jump too readily to the conclusion that what we are seeing now is fundamental, grounded in supply-side problems. It might simply be an insufficiency of demand and with the right policies we too might find ourselves, 20 years on from the 2008/09 recession, back on the long-term trend line.

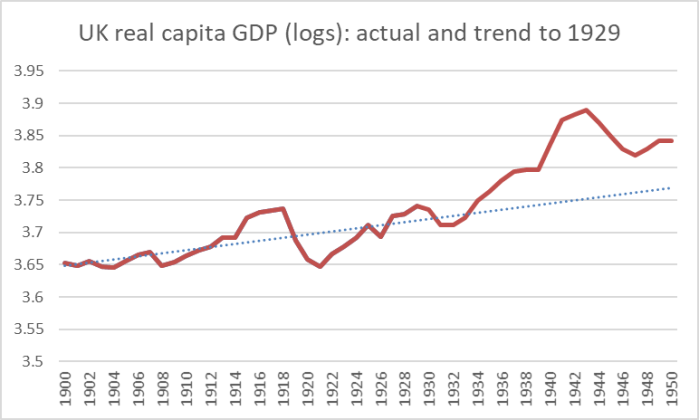

King’s story of the 1930s holds very well for the United States, where (for example) the unemployment rate was savagely high throughout the 1930s (a notable contrast to the situation today). I’ll illustrate that in a moment. But it isn’t a story that generalised even then. Here, for example, is UK real GDP per capita for the first half of the 20th century.

The first few decades of the 20th century hadn’t been great for the UK, but then the UK experience of the Great Depression was fairly mild and by 1937/38 the economy was running above the pre-Depression trend (and remained so all the way through to 1950).

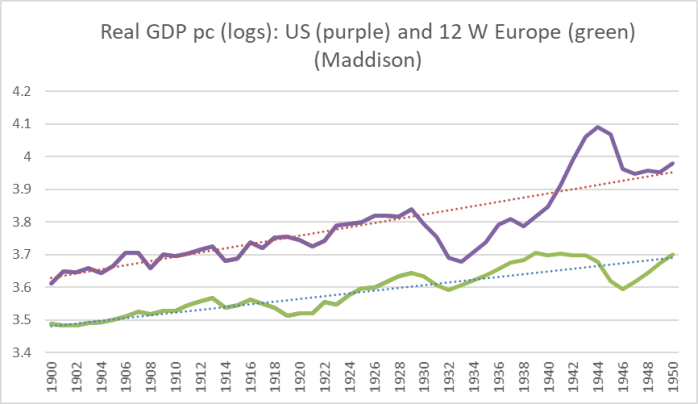

Rather than illustrates dozens of different countries, in this chart I’ve shown the situation for the US and for Maddison’s grouping of 12 larger Western European countries.

You can see King’s point very starkly for the US, but for the Western Europe grouping it isn’t there at all – the picture is more like that for the UK (above). (For what it is worth, New Zealand was also above the trend line by 1937/38 – a overheating economy running towards a fresh crisis – and Australia was a bit below its pre-Depression trend line.)

So the general story just doesn’t seem to stack up very well at all. There were significant demand (and monetary issues) associated with the Great Depression, but mostly they were dealt with within a few years. The US was the glaring outlier – a country that then managed to have another pretty severe downturn in 1937/38 as a result of its own demand (mis)management choices.

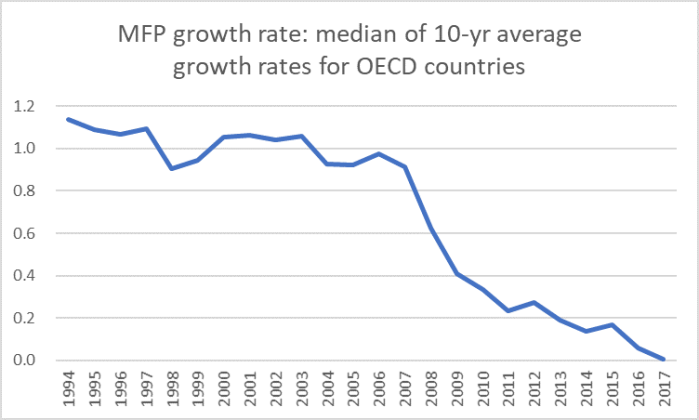

As is now widely recognised, global productivity growth has slowed very substantially. Here is one illustration, using the OECD’s multi-factor productivity data for 23 OECD countries (the “older” OECD countries – none of the former eastern bloc OECD members are yet included). I’ve calculated rolling 10 year average growth rates for each country and then taken the median of those growth rates.

Being a median measure, you can tell that almost half these advanced countries had (typically slightly) negative annual average MFP growth over the last decade. In the decade to 2007 (say) only two did.

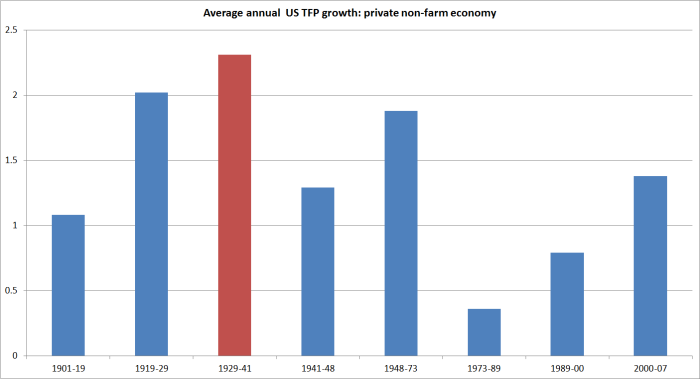

By contrast, here are leading economic historian Alexander Field’s estimates for multi/total factor productivity in the US in decades past.

The period when overall economic activity lagged behind trend so badly, which pretty much everyone agrees was largely down to demand shortfalls, was also the period of very strong underlying TFP growth.

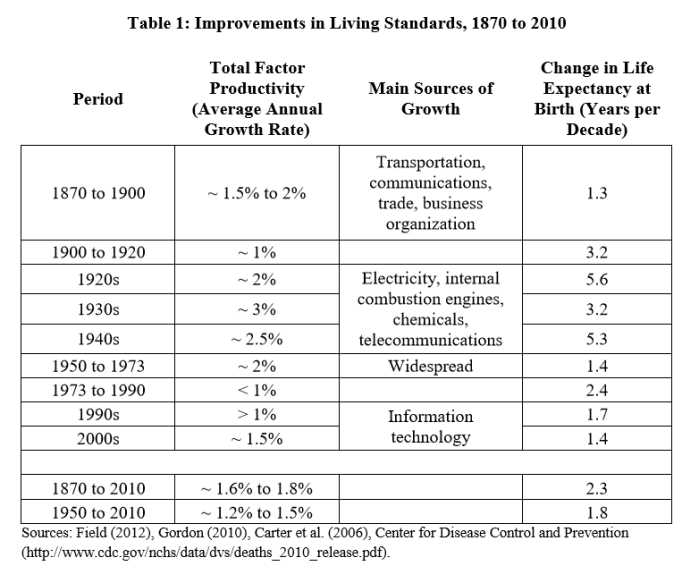

In a similar vein, here is table from a 2013 CBO report on TFP growth in historical perspective (which also draws on Field).

Historical estimates get reworked, and I’ve seen some revisions to some of these numbers. But they don’t change the story of strong underlying TFP growth in the 1930s – all it took was enough demand to translate those new possibilities into higher per capita GDP (back to the longer-term trend line in the charts above).

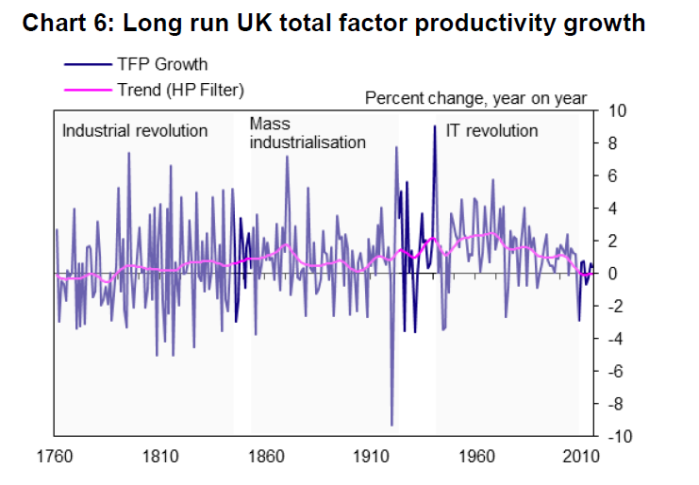

What about other countries? Here is chart from a speech given a couple of years back by the Bank of England’s chief economist

It is harder to read, but there is no sign of any slump in TFP growth in the 1930s there either (then again, as illustrated above, demand didn’t look to lag badly for long at all in the UK).

There is a story, that King also tried to tell, that somehow the incipient productivity gains now simply can’t be realised – let alone translated into higher GDP per capita – because the demand isn’t there and because of heightened policy and trade uncertainty. But that doesn’t ring true either. After all, equity markets have been strong, real borrowing costs have been low (unlike the 1930s), and – if anything – the IMF is worrying about corporate sector overborrowing and vulnerabilities associated with it. That borrowing might not have been funding much new investment, but business credit conditions haven’t exactly been very tight for years now.

And as for uncertainty, yes we all now that the general policy and trade policy indexes are quite high at present, but (a) trade policy uncertainty has really only become a big issue since the start of 2017 and the economic underperformance was well in place before then, and (b) consider the 1930s…..the demise of the Gold Standard, ongoing sovereign debt defaults (including the US and the UK), Smoot-Hawley and all the associatred/subsequent trade protection, the rise of Hitler, Japan’s invasion of China, the growing fear of war. I’d have thought all those made for much greater uncertainty than we see today, but even if you read things differently, it was hardly a decade that made for a stable and certain political or business climate. And yet…..consider the realised TFP growth, consider (outside the US) the return to pre-1929 real GDP per capita pathways, contrast it with what we’ve seen in the last decade, and you should doubt that the 1930s provides much useful insight on our current situation.

I don’t have a compelling story for why the productivity slowdown has been so stark and sustaine among countries at or near the frontier. But a demand-based story doesn’t yet seem very credible, and if such a case is to be made it is going to need to rest in argumentation, theory and evidence, based on something other than parallels with the 1930s.

(And, of course, whatever the frontier story none of it should be of much relevance to New Zealand, starting from average productivity levels so far behind those of the frontier economies.)