As I noted yesterday, the IMF released several “selected issues” background papers in association with the release of the New Zealand Article IV report. These papers are usually a little more in-depth than the main report, and the topics chosen reflect some mix of the expertise and interests of the people on the staff team and the priorities of the New Zealand agencies involved (Treasury and the Reserve Bank). In my experience, the efforts of the team are often spread too thinly and so unfortunately not many of the papers have added very much to the understanding of the macroeconomic issues facing New Zealand.

The papers this time are:

- Prospects for potential growth in New Zealand

- House prices, household debt, and financial stability in New Zealand, and

- New Zealand – Options for Tax Policy Reform

It would be interesting to know whose initiative the last paper was done at. My guess is that Treasury may have reacted to the Fund’s anguishing about savings with the comment “well, show us what might actually make a difference”. Unsurprisingly, the Fund doesn’t conclude on an optimistic note:

while there is some ambiguity on the effectiveness of tax incentives to raise private savings, short of the introduction of a compulsory savings scheme there are no alternatives to providing incentives.

There are real doubts our policies will work, but……we have to do something. Not exactly reassuring.

The potential growth paper has a few interesting charts, and recognizes the probable importance (as a symptom) of the ex ante savings/investment imbalances [1] that have given us persistently high real interest rates (relative to those abroad) and a real exchange rate that has been persistently out of line with medium-term fundamentals. But the authors don’t have much of substance to offer on the way ahead. They, like everyone else, can see the gaps between us and the world, but they don’t seem to have a “model” – a way of thinking about or understanding the issues – that can usefully help respond to the specifics of New Zealand’s underperformance.

They believe

there are few if any low hanging fruit in terms of reform……..however, there may be targeted areas for improvement

They claim that

increasing New Zealand’s international exposure is a major aspect of productivity oriented reforms

but the actual list of reforms, and the evidence or arguments connecting them to the desired outcomes, is thin (and sometimes questionable), to say the least

- “directly enhance innovation through greater expenditure on R&D”

- “increase labour productivity through education”

- user and congestion charging for infrastructure, and

- “more frequently update immigration targets and skill shortage categories”

The final paragraph of the whole paper begins by noting that there are “no obvious liberalization policies at hand”, and then lapses into the rather trite (because there is nothing to back it)

efforts would have to be made to exploit opportunities for greater international integration in order to boost competitiveness and overcome the disadvantage of distance

But for all this, in its apparent enthusiasm to accentuate the positive the IMF actually understates just how poorly New Zealand has done in recent years (or decades). In particular, I was surprised to find this assertion in the report, citing the experience over the period 1995 to 2012.

Compared with other OECD countries, New Zealand’s TFP growth performance compares favorably

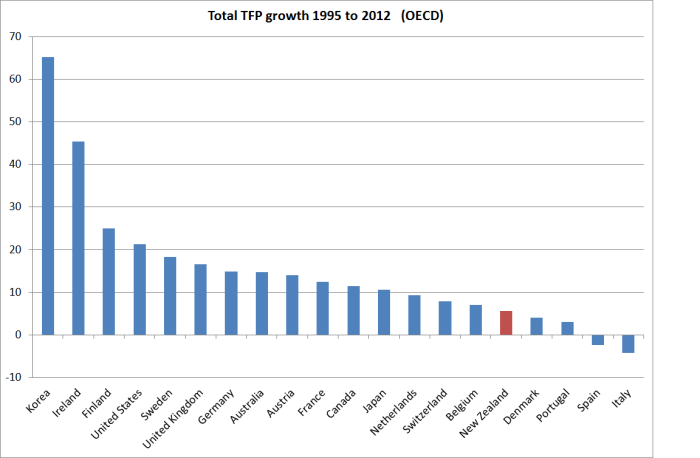

I was taken aback by this claim, and wondered what I had missed, so I went to check the data on the OECD website. The OECD compiles TFP estimates for only 20 of its member countries. Here is the total growth in TFP for each of them for that 1995 to 2012 period.

We’ve been the lower quartile country for that whole period. The only four countries which did worse over that period are either in the euro or tied to it (Denmark), and three of them (Spain, Italy, and Portugal) have had a simply atrocious economic performance in recent years. If one looks as just the most recent 10 year period for which the OECD has data (2003 to 2013) we were actually second worst of all these OECD countries.

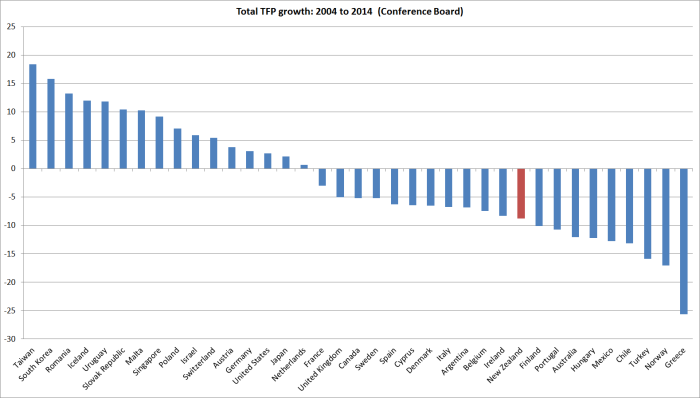

Estimating TFP growth rates involves a model – a way of estimating the contribution of capital and labour to growth, isolating the resulting TFP residual. The OECD’s approach isn’t the only one, and I’m not sufficiently expert in the field to offer an opinion on which approach is best. One other big international database that reports TFP estimates in the Conference Board, which produces estimates for a much wider range of countries.

I had a quick look at 37 pretty advanced economies for which the Conference Board reports complete data. For the IMF’s chosen period – 1995 to 2012 – there were only seven countries that had recorded less TFP growth than New Zealand had done (the ones who did worse than us on the OECD measure, and Chile, Norway, and Greece (for whom the OECD reports no data). So even on this measure, for this range of countries, we’ve been no better than a bottom quartile performer. The Conference Board has data for all 37 countries as far back as 1989- and since then, only Spain, Portugal, Greece, Turkey and Hungary have done worse than us.

The Conference Board reports estimates up to 2014. Here is how those 37 countries have done over the most recent 10 years for which they have data, 2004 to 2014.

The picture doesn’t really change. It is, perhaps, a little less bad than on the OECD’s ranking, but again we’ve been no better than a lower quartile performer.

TFP isn’t the be-all and end-all, and for minerals producers in particular it can be driven downwards in periods of high commodity prices (because less accessible, or lower grade, resources are (profitably) mined). But there is really no way of looking at the New Zealand performance and reading it as any sort of good news story.

It is surely about time that the elites – be it leading offshore agencies like the IMF and OECD, or our political and bureaucratic ones – began to recognize, and state openly, just how consistently poor New Zealand’s economic performance has been, and to acknowledge just how limited or inadequate the policy responses they put up to deal with it are, and have been. Identifying policy responses might be hard – although I reckon that a major reorientation of our immigration policy would go a fair way – but the first step is an honest assessment that recognizes that what we have been doing simply hasn’t been working. And it is no use falling back on “but its nice place to live” – as I’ve noted previously, Uruguay looks to have nice beaches – or “but lots of people want to come here” – well, of course, poorly performing as we have been, we are still richer than China, India, South Africa or the Philippines. The better test is what our own people are doing – and they just keep on leaving, even though the hurdles to doing so (in Australia in particular) have been getting higher

[1] They even approvingly cite my 2013 paper.

“It is surely about time that the elites – be it leading offshore agencies like the IMF and OECD, or our political and bureaucratic ones – began to recognize, and state openly, just how consistently poor New Zealand’s economic performance has been”,

Perhaps their salaries depend on not stating it?

Amateur psychological theory: if you spend much time in Auckland, you may detect that many “middle class” people are amazingly complacent about their low-growth economy. I suspect it’s to do with house prices – most own houses, and have seen their paper wealth increase by hundreds of thousands, if not millions, in the past few years. The dollar is strong, and holidays to Europe are suddenly affordable. Talk to a few (native-born) people who are locked out of the property market, though, and they’re angry. I suspect this latter demographic doesn’t get as much face time with the IMF.

LikeLike

I’m sure your final para captures something about what is going on – and which helps explain the political complacency too. Labour could call out the gross failure and reframe the debate – except that they seem to lack the capaibility, are constrained in part by their own past in govt, and aren’t quite sure that the easiest way back to govt might be the “minimize the target” approach, appearing “safe” and minimizing the differences to the current govt.

IMF and OECD salaries certainly don’t depend on silence….altho the local meetings, esp with ministers, might be less cordial if the points were made more starkly

LikeLike

Another part of the explanation has to be that the IMF and OECD are overly committed to this sort of social-democratic philosophy that has been called out previously on this blog. One of the lessons of Europe, for me, is that social democracy is a very hard system to make work. It seems to carry the seeds of its own demise; the non-market part of the system seems to grow a little bit each year until the whole thing sort of grinds to a stop. There are success stories, and Ireland, Sweden and Germany all seem like fine places to live. But in each of those cases it took a kind of crisis to persuade the public to rebalance the system to the point where ongoing productivity growth was possible. I think New Zealand may have missed such an opportunity in 2009-11.

LikeLike

I’m interested in your thoughts on how immigration policy could be reshaped to improve New Zealand’s economic performance – can you point me in the direction of a post on what your policy prescriptions would be? (or if you are able to elaborate in the comments or in a new post I would appreciate it immensely – no doubt other readers would too!)

RE: the comments above – as a young Aucklander I agree with much of this sentiment, people’s attitudes seem to ring true with the “we are in the midst of a boom” yet when when you scratch beneath the surface you find a picture of static incomes, slack demand etc. Also no-one seems to be able to answer the question of what real economic value Auckland provides for anywhere or anyone that would justify such a premium on asset values (i.e. like Hong Kong, San Francisco, London etc. enjoy)

This fundamental disconnect makes me nervous for the future as New Zealand’s “real” economic activity doesn’t appear to be improving although people are behaving as though it is – which tends to make for a nasty mess at some stage…

LikeLike

I don’t think I’ve devoted a whole post to the topic but the essence of my proposal would be to cut the annual target for residence approvals from the current 45-50K to perhaps 15K. In association with that we should (and would probably have to) further shift the emphasis for those who are approved to (a) spouses of those New Zealand citizens marrying foreign citizens, and (b) most of the remainder being only the most highly skilled people. I’d probably get rid of the special deals for Pacific migration (altho recongise there could be foreign policy cnsiderations constraining the pace at which that could be done), and largly eliminate any parent or sibling migration. That would leave the refugee quota.

Although they are probably less important in the long run, I’d also argue for getting out of many of the working holiday schemes we’ve got into over recent years (or at scaling them back) and for tightening up very substantially on the use of short-term work visas. There will always be a few positions that can’t be filled at any price in NZ, but the way the work visas scheme is run means migrants are largely treated as a substitute for wage increases for New Zealanders.

LikeLike

Having read your other recent posts, the IMF articles and other analysis I agree with what you are saying.

Anything that can encourage New Zealand companies to invest in capital (including human) rather than going for a short-term cost advantage should be applauded I would think.

Thanks for your reply – much appreciated.

LikeLike