Reading last week’s statement from the not-very-transparent, not-very-accountable, Reserve Bank Monetary Policy Committee I was struck by both the bleakness of the statement and the do-little-or-nothing passivity of the monetary policymakers.

I guess you could argue it wasn’t much different than the previous month’s statement – which wouldn’t be much consolation, since that statement itself was pretty downbeat – but the relentlessness struck me. There was almost nothing positive in the commentary, even six months on from when the Committee belatedly recognised the Covid economic risks and started adjusting policy. The risks, both globally and domestically, are deemed to be to the downside – which seems right to me – and this around a base scenario in which the “the Committee expects a rise in unemployment and an increase in firm closures”. There is, again rightly, an emphasis on the susbstantial uncertainty firms and households face, again here and abroad, as the future course of the virus is really little more than anyone’s guess. We are told – in, I think, materially stronger words than they’ve used before – that “monetary policy will need to provide significant economic support for a long time to come to meet the inflation and employment remit”.

And yet what did they actually do? Nothing.

Seven months on from when they should have been first easing monetary policy, we still have an OCR that is only 75 basis points lower than it was at the start of the year. The Committee continues to cling to their bizarre March pledge – made in a climate of extreme uncertainty – not to change he OCR for a year, a pledge that has/had no solid economic foundations to it. They would prefer people to believe that in some sense they “can’t” move, but all it takes to know that is simply false is a look across the Tasman to Australia where, with a higher inflation target, and higher inflation expectations, short-term wholesale interest rates are 20 basis points lower than those here. Even if you buy the Bank’s claim that the OCR can’t be taken negative yet, there is no obstacle at all to them cutting the OCR to zero now. It should have been done months ago. It should be done now – their own outlook (all that downside talk) tells you as much. (20-25 basis points is, of course, not that much, and not a macro game-changer in and of itself, but in an all-hands-to-the-pump scenario, every little helps – and it would be a third more OCR easing than we’ve had to date.)

And, of course, the claim that the OCR can’t be taken negative now should itself be taken with a considerable pinch of salt. If true, it should of course lead to serious questions of the Bank’s competence and basic preparedness, which don’t yet seem to have been asked (although the Board’s Annual Report must be due out in the next few days, so perhaps…..unlikely as it is …..there will some sign of holding management to account). But it was never very convincing. For a start, had the Reserve Bank simply taken the OCR negative a few months ago it would have (a) rewarded the institutions that had read the – all too visible – international signs and got ready, and (b) encouraged the others to adapt very quickly. Even if the argument was partially defensible in February/March, it is now September….they’ve had months to get it right, and (on the MPC’s own reckoning) the economy could have done with more stimulus over that period. More generally still, a significant part of the way monetary policy works in an open economy is through (a) signalling and (b) the exchange rate: had the MPC moved aggressively months ago, or even now – not next March/April – it would likely have generated a lower exchange rate, supporting the New Zealand economy, and underpinned inflation expectations.

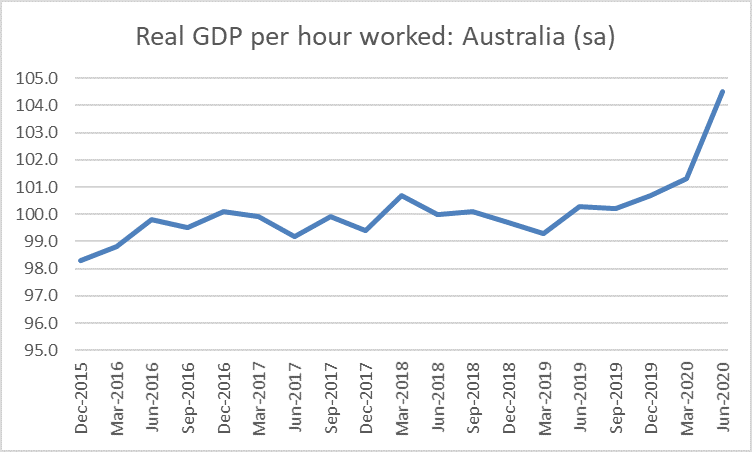

(As a reminder, the exchange rate has barely changed from where it was at the end of last year, real (1 and 2 year fixed) mortgage rates seem to be down perhaps 20-30 basis points since the end of last year, and the inflation expectations – whether survey measures or market measures – seem to be down about 50-60 basis points. Oh, and in case people hadn’t noticed, the unemployment rate has risen and the MPC expects it to rise further. Their August inflation projections – including all that fiscal policy – was also well below target. It is hard to imagine in any other circumstances a central bank doing nothing.)

Now defenders of the Reserve Bank will, of course, point out that the MPC is talking up some sort of “Funding for lending” scheme that it now says “would be ready before the end of this calendar year” (while also noting that “the design of the programme would be agreed and published ahead of deployment” – but there is only one more scheduled MPC meeting before the end of the year). The idea of this scheme is to lend to banks directly at a rate close to the (unnecessarily high) OCR, with the aim to “lower the financial system’s funding costs, and therefore borrowing costs for firms and households, and support the availability of credit to the economy”.

I don’t greatly like these sorts of schemes – although the details, which apparently won’t be consulted on, may matter. By contrast to the OCR, which is an instrument that works pervasively and unconditionally, FFL-type schemes are often available to some market participants but not others (undermining a core principle of efficient policy design, around competitive neutrality), and are often tied to some officials’ preferences around increases in lending to the private sector, whether or not such lending makes much sense in the prevailing economic climate (hint: in an environment of extreme uncertainty, of the sort the MPC talks of, not many firms are going to be voluntarily taking on much debt, and banks would generally be rightly cautious – even if not with the added uncertainty about the Bank’s new capital requirements next year). And an FFL is no substitute for an OCR adjustment when it comes to influencing the exchange rate, typically a really important part of the New Zealand transmission mechanism.

But here’s the thing. They’ve had a scheme like this in Australia since March. Term deposits rates in Australia have for a long time been closer to wholesale rates than has been the case in New Zealand, but – on checking this morning – are still materially higher than Australian wholesale rates. And although our Reserve Bank has been talking up an FFL scheme for some time now there is no hint in the schedule of retail rates banks are offering that, for example, 3-6 months are holding up but that longer-term rates (relevant to the period when an FFL will be deployed) have fallen away sharply, or at all. Big banks seem to be offering much the same rates for six month retail term deposits as they are for 1 to 5 year term deposits, just as they were at the start of this year. It just isn’t obvious that a realistic FFL is likely to make much difference to retail rates – and actual term rates suggest banks rather share that perception. It would be good to be wrong on this – all the evidence and the MPC comments suggest the economy needs the additional support – but nothing at present suggests it is likely.

Meanwhile, of course, months and months into this severe recession, there is no sign that the MPC or the Bank is doing anything about removing the real effective floor on the OCR (at perhaps -0.5 or -0.75), that results from the official provisions – regulatory interventions – that mean deposits are convertible to cash at par in unlimited quantities, with cash paying a zero interest rate. We have interminable debates and commentary on what macro difference a small further cut to the OCR – to just slightly negative – might make, but nothing on making feasible and useful the sort of deeply negative interest rates the economy might actually need. It is a cavalier indifference to the state of the economy and the plight of the unemployed – and to the health of the public finances – that seems to be shared by most central banks – which makes it no more excusable. One can, reasonably, haggle about whether threshold effects mean that,say, a -0.25% OCR would make much difference – although (a) the ECB seems persuaded, and (b) retail deposit rates in NZ would still be well above zero in such an environment. There should be much less room for doubt about the gains from a deeply negative OCR, including for the exchange rate and inflation expectations.

Of course, those on the left are often keen on fiscal policy substituting for monetary policy – especially while they are in power and get to choose the goodies being handed out – but that isn’t a path to an efficient allocation of resources, a wise evaluation of investment options (what do politicians have on the line?) and does nothing at all for promoting the health and growth of the tradables sector of the New Zealand economy. Whatever the merits of something like the wage subsidy scheme initially, fiscal policy initiatives seem to have become over recent months increasingly dependent on who you know, who is in favour, which project rings political bells, and not on a pervasive, fairly neutral, support framework in which politicians aren’t using your resources and mine to pick winners (unlikely to be so in actuality), rewards favourites and so on. Monetary policy operates much better as a countercyclical stabilisation tool for many reasons, if only central bankers would use it aggressively, or their political masters simply insist they do. It is fit for purpose, and respects the proposition that private firms and households are generally better at spending wisely than governments, in a way that handouts to Green schools, Pacific churches, this or that council, or whatever do not.