There is increasing attention being paid (among a certain class of nerdy central bank watcher) to the scale of the losses to the taxpayer central banks have run up as a result of their large-scale bond purchases (particularly those) over the time since Covid broke upon us in early 2020. In New Zealand, the best estimate of those losses was about $9.5 billion as at the end of September (to its credit, the Reserve Bank of New Zealand marks to market its bond holdings – and thus its claim on the Crown indemnity – something many other central banks don’t do).

A particularly interesting paper in that vein turned up a couple of days ago, published by the UK Institute for Fiscal Studies and written by (Sir) Paul Tucker, formerly Deputy Governor of the Bank of England and now a research fellow at Harvard. The 50+ page paper has the title Quantitative easing, monetary policy implementation and the public finances. (Public finances are quite the topic of the month in the UK, but although many of the numbers in the paper are very up to date, I suspect the paper itself was conceived before the fiscal/markets chaos of recent weeks.)

Tucker is particularly clear on what QE actually was: it was a large-scale asset swap in which the Crown (specifically its Bank of England branch) bought back from the private sector lots of long-term fixed rate government bonds, and in exchange issued in payment lots of (in our parlance) settlement cash balances held by banks and on which the (frequently reviewed) policy interest rate (here the OCR) is paid in full. When such an operation is undertaken, the entities undertaking the swap (and the taxpayer more generally) will lose money if policy rates rise by materially more than was expected/implicit when the swap was done. It is not a new insight – and I’ve been running the asset swap framing here since 2020 -but Tucker puts its very clearly, and in a context (UK) where the focus is less on the mark to market value of the bond position, and more on the annual cash flow implications (over time they are two ways – with different emphases – of putting much the same thing).

Tucker seems, at best, a bit ambivalent about the 2020 QE, illustrating nicely that whereas the early UK QE was done when actual and implied forward bond yields were still quite high, that was by no means the case by the start of 2020. But as he notes, that is water under the bridge now. Big bond purchases did happen, partly because few central banks have really got rid of the effective lower bound (although here he is too generous to many central banks, including the BoE, since few sought to reach the practical limits of negative rates (on current technologies) when they could have in 2020). But whether or not QE could have been avoided, given the macro outlook as it stood in March 2020, (whether by more reliance on fiscal policy or deeper policy rate cuts) it wasn’t. Central banks now have large bond positions, purchased at exceedingly low yields, being financed at increasingly high short-term rates.

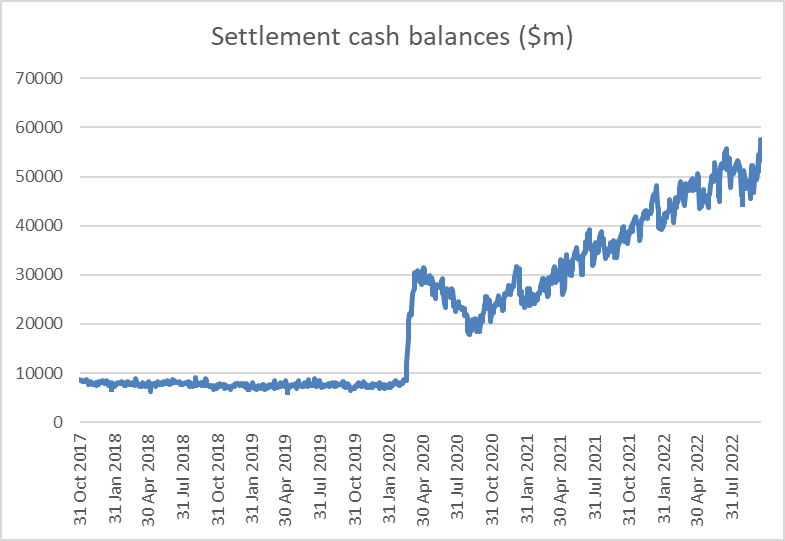

In New Zealand, for example, total settlement cash balances have just been hitting new highs, in excess of $50 billion

Not all of this is on account of the LSAP (New Zealand’s QE). Weirdly, the Reserve Bank is still making concessional funding available to banks under the crisis Funding for Lending programme, but at least they are paying on the resulting settlement cash balances what they are earning from the loans. And fluctuations in government spending, revenue, and borrowing also affect the level of settlement cash balances.

But you can think of the approximately $50 billion of LSAP bond purchases (over 2020 and the first half of 2021) as having a counterpart in the level of settlement cash balances. On $50 billion of settlement cash, the Reserve Bank pays out interest at a current annual rate (OCR of 3.5 per cent) of $1750 million per annum. All the conventional bonds were bought at much much lower yields than that (unlike the Bank of England, our Reserve Bank did buy some inflation indexed bond, but they were less than 5 per cent of the total purchases.) This is a large net cost to the taxpayer.

The policy thrust of Tucker’s paper is to explore the idea of cutting those costs by changing policy and not paying interest on the bulk of settlement balances (or paying a materially below-market rate). Central banks did not always pay market rates on settlement cash balances, but it has become the practice over the last 20-25 years (in the Fed’s case being rushed in in late 2008 to hold up short-term market rates, consistent with the Fed funds target, when large scale bond purchases began). New Zealand followed a similar path.

Paying different rates on different components of settlement cash balances is quite viable. For some years until early 2020, for example, the Reserve Bank paid full market rates on balances it estimated each bank needed to hold (to facilitate interbank payments etc), while paying a below market rate on any excess balances (which were typically small or nil). The ECB and the Bank of Japan introduced negative policy interest rates some years ago, but protected the banks by paying an above-market rate on most of their settlement cash holdings, only applying the negative rate at the margin.

As a technical matter there would be no obstacle to the Bank of England (or the Reserve Bank of New Zealand) announcing that henceforth they would pay zero interest on 80 per cent of balances – some fixed dollar amount per bank – while only paying the policy rate (the OCR) on the remaining balances. Since the OCR would still apply at the margin, that part of the wholesale monetary policy transmission mechanism should continue to function (compete for additional deposits and you would still receive the OCR on any inflows to your settlement account). The amounts involved are not small: in the UK context (they did QE a lot earlier) Tucker talks of “the implied savings would be between 30 billion and 40 billion pounds over each of the next two financial years” – perhaps 1.5 per cent of GDP. In New Zealand, if we assume the OCR will be 4 per cent for the next couple of years, applying a zero interest rate to $40 billion of settlement cash would result in a saving of $1.6 billion a year (almost half a per cent of GDP). You could pay for quite a few election bribes with that sort of money.

It is an interesting idea but it seems to me one that should be dismissed pretty quickly, even in the more fiscally-challenged UK (where they already impose extra taxes on banks). It would be an arbitrary tax on banks, imposed on them because it could be (no vote in Parliament needed), by a central bank that would be doing so for essentially fiscal reasons (for which it has no mandate). Tucker rightly makes the point that central bankers should not seek to do their operations in ways that are costly to the taxpayer when there are cheaper (less financially risky) options available, but the time to have had those conversations was in March 2020 (preferably earlier, in crisis preparedness) not after you’ve taken a punt on a particular instrument and the punt has turned out badly (and costly).

It might be one thing to decide not to remunerate settlement cash balances, and thus “tax” banks, when those balances are tiny (for a long time we ran the New Zealand system on a total of $20 million – yes, million – of settlement balances) and quite another when those balances are at sky-high levels not because of any choices or fundamental demands by banks, but solely as a side-effect of a monetary policy operation chosen by the central bank (and in both countries indemnified by the Crown). Even central banks have no particular interest in there being high levels of settlement balances (it isn’t how they believe QE works); it is just a side effect of wanting to intervene at scale in the bond markets. But central banks have a choice, while the banking system as a whole does not (banks themselves can’t change the aggregate level of settlement cash, which is totally under the control of the central bank). The Tucker scheme – which to be fair, it isn’t entirely clear he would implement were he in charge – forces banks to hold huge amount of settlement cash, and then refuses to remunerate them on those balances.

To implement it would be a fairly significant breach of trust. Here, the Reserve Bank has kept on (daftly) offering Funding for Lending loans arguing that it needs to keep faith with some moral commitment it claims to have made, despite the crisis being long past. I don’t buy the “anything else would be a betrayal” line there – where in any case the amounts involved are small (this funding might be 25 basis points cheaper than they could get elsewhere) – but it would much more likely to be an issue if the Bank (or overseas peers) suddenly recanted on the practice of paying market interest on all or almost all settlement balances. $1.6 billion a year, even divided across half a dozen banks, would attract attention.

I’ve heard a couple of suggestions as to why an additional impost on banks might be fair. One was that QE may have helped set fire to the housing market, boost bank lending and bank profits, and thus an additional tax now might be equivalent to a windfall profits tax. I don’t buy either strand of that argument – I don’t think the LSAP made that much difference, but if it did it was supposed to do so (transmission mechanism working) – but even if I did in 2020, we are now seeing the reverse side of that process: house prices are falling, housing turnover is falling, new loan demand is falling, and there will be loan losses to come. Most probably any effects will end up washing out.

The second was the bond market trading profits the banks may have made in and around the LSAP. Perhaps there were some additional gains, but it is hard to believe they were either large or systematic (and won’t have come close to $1.6 billion per annum).

And the third was the Funding for Lending programme. No one can pretend that was not concessional finance for banks (were it otherwise banks would not have used the facility at scale), but the amounts involved don’t compare: $15 billion of FfL loans might have a concessional element over three years of $100m or so, not really defensible, but not $1.6 billion per annum either.

The taxpayer is poorer as a result of the LSAP and how market rates turned out (as Tucker rightly notes, it needn’t have turned out that way, although by 2020 the odds were against them – and as I’ve pointed out often there is no sign in NZ at least that a proper ex ante risk analysis was done). Those costs have to be paid for and will mean, all else equal, that taxes are higher over time. But conventional fiscal practice is not to pick on one sector and put the entire additional tax burden on them (“broad base, low rate” tends to be the New Zealand mantra). And that is so even if some in the New Zealand political space – sometimes including the Governor – seem to have a thing about (evil and rapacious) “Australian banks”.

Tucker devotes some space to the question of how banks would react (other than heavy lobbying on both sides of the Tasman and fresh pressure for the Governor to be ousted). Even if short-term wholesale rates – the policy lever – aren’t likely to be changed, banks are unlikely to just sit back and take the hit: they may not be able to recoup all or even most of it, but it isn’t hard to envisage higher fees, higher lending margins, tighter credit conditions across the board, including as boards become more wary about New Zealand exposures. Non-bank lenders – who hold no settlement balances – would be at a fresh competitive advantage (akin to what we saw with financial repression of banks decades ago)

But unfortunate as it would be if a change of this sort of made now – essentially an ex post tax grab so focused it would come close to being a bill of attainder – I might almost be more worried about the future. One might have hoped that the episode of the last couple of years would have made central banks more cautious about using large-scale bond buying instruments (and finance ministries more cautious about underwriting them), with a fresh focus on removing the effective lower bound on nominal interest rates (or if they won’t do that then looking again at the level of the inflation target). But knowing that big bond purchases could be done freely, with the taxpayer capturing all of any financial upside, and banks (and customers) wearing all/most of any downside, skews the playing field dramatically (and also further reduces the financial incentive on governments to keep inflation down – since the real fiscal savings on offer rise the higher nominal interest rates are. And what of banks? If there really is a place for future QE – I’m sceptical but I’m probably a minority – up to now banks have had no really significant financial stake one way or the other, but adopt the Tucker scheme once and banks will know it could be used on them again, and they will become staunch opponents (in public and in private) of any future large scale bond buying operations for purely their own financial reasons. And that is no way to make sensible policy.

Tucker has produced a 50 page paper which will repay reading (for a select class of geeky reader – although it is pretty clearly expressed). Since it is 50 pages there is plenty there I couldn’t engage with in depth in this post, but in the end my bottom line was initially “count me unpersuaded”, and then the more I thought about it the more I hoped that no one here would seriously consider the option (ideally not in the UK other). Far better to accept that losses have been made, that those costs will have to be paid for by taxpayers’ generally, and to redouble the efforts to ensure that in future crises there is less felt need for central banks to engage in such risky operations. Central banking, well done, really should involve neither large risk nor large cost to the taxpayer, and there are credible alternatives, even if neutral real interest rates stay very low (as Sir Paul assumes, and as still seems most likely to me).

UPDATE: Thanks to the reader whose query made me realise that in my haste to produce some stylised numbers, I forgot that the LSAP bonds had been purchased at price well above face value. The actual settlement cash influence from all LSAP purchases (central and local government bonds) was $63.9 billion. The rest of the analysis is unchanged, but the numbers (floating rate financing cost) are larger.

You suggest Michael that in New Zealand the LSAP didn’t make much difference. The analysis of QE being done now by central banks supports that view. For example, the Reserve Bank of Australia concluded “the bond purchase program is estimated to have lowered long term Australian government bond yields by around 30 basis points”. There is no reason to believe the outcome of the RBNZ program was very different. Yet post COVID yields fell by multiples of that number. So, if QE caused only 30 bp of the decline we saw in NZ, what caused the rest? Simple: slashing the OCR combined with the “coat tail” effect of NZ rates following the major markets. All we had to do was cut the OCR and let the market take longer dated rates down for us. Instead, the RBNZ, unable to resist playing along with the big boys, added 0.30% at a cost of $9.5 billion.

LikeLike

The problem with Economists writing up papers on Financial matters is the simple fact that most economists cannot read a Balance Sheet. Although the words, Cash Settlement Account is foolishly bandied about to demonstrate that the account is fully paid, economists are actually wrong. If you can actually read a Balance Sheet you can clearly see that the Cash Settlement Account is a Liability account on the Balance Sheet of a Central Bank including the RBNZ. A liability account means that monies is owed to a third party and not fully paid up. In the case of the RBNZ, they have 2 sets of Cash Settlement Accounts, ie Various Banks Cash Settlements Accounts and Crown Settlement Account.

Whether in error or not our RBNZ was actually very conservative in undertaking NZ QE. It started with $100billion planned, stopped at $59billion and ended being only around $27billion. Around $32billion ended being repaid to reduce the Various Banks Cash Settlement Account and ended up on the Crown’s Settlement Account instead.

The RBNZ is still holding $55billion in NZ bonds which it paid $59billion for. The upfront $5billion cost has already paid to the various banks and they have already recorded record profits in the pandemic year when NZ QE was undertaken.

LikeLike

Correction: The upfront costs of $4billion has already been paid to the various banks and they have already recorded record profits….

LikeLike

Hello Michael,

I worked in Simon Tyler’s Foreign Reserves team at the RBNZ from 2004 – 2007. Following that I spent 7 years at ANZ and have now been out of financial markets for 8 years but maintain an interest in developments. I find your work here with Croaking Cassandra incredibly interesting and enlightening and have been wanting to ask you your thoughts about monetary policy “management” since the GFC.

Once the dust had settled following the GFC (and one could argue that that was as early as 3 years after the initial event) why did the global central banks not withdraw the QE they delivered during that period, effectively “re-loading the gun” for any future crisis? Obviously we were lucky that NZ did not embark on QE during that period, but it seems to me that Adrian (the perennial dove that he is) even had no interest in gradually raising the OCR to reload our own monetary weapons. In that way NZ was left with little choice (still arguable in my view) but to embark on the LSAP given Adrian’s dovish bent (and the banks claims about not having the technology to breach the zero bound).

I am not an economist and I bow to your superior knowledge in this area but I keep coming back to Milton Friedman’s quote that “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” With that in mind the five-fold increase settlement cash balances must be significant in the general changes in price levels in NZ. I guess the difference between using interest rates and money supply as monetary tools is that one is the stroke of a pen whereas the other can be an incredibly difficult genie to get back in the bottle. However your comment on not paying interest on “excessive” cash balances at the RBNZ may (correct me if I am wrong) be a means to indeed controlling the genie. Surely if the banks received zero then they would move that cash to an earning asset, purchase the bonds back from the RBNZ thereby allowing cash balances to revert to those necessary to allow the payment system to operate as before with balances circa $9bln. As an aside I can still recall the days of Don Brash’s inflation fight when the cash balance was minus $5mln.

I guess the question about this approach is the impact, would it be too severe too quickly and creating another risk (unintended consequences)? It seems that central banks have been for too long scared to “rock the punchbowl” and we are now reaping what has been sown in the form of inflation we definitely did not want.

If you have time I would welcome your thoughts on this and thank you again for your informative emails.

Kind regards

Greg Wilson

1 Kahu Street

Mangakino 3421

P.O. Box 50

Mangakino 3445

021 610089

LikeLike

[…] couple of weeks ago I wrote a post here, prompted by a paper by the former Bank of England Deputy Governor Sir Paul Tucker. […]

LikeLike