This is getting to be a bit of a half-yearly ritual, but politicians’ words are one thing, and the best professional judgements of our Treasury forecasters are another. The latter aren’t necessarily very accurate at all, but as their website blares

The Treasury is New Zealand’s lead advisor to the Government on economic and financial policy

Heaven help New Zealand you might think, given that both Treasury and the government seem lost in the nebulous alternative reality of the living standards framework, wellbeing budgets, and a grab bag of alternative indicators that may – or may not – matter to anyone much other than them.

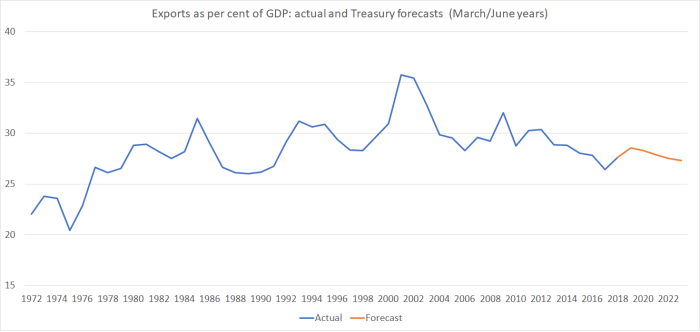

But they are the official advisors, charged by law with producing independent forecasts twice a year. And the forecasts I’ve been particularly interested in for a while have been those for the export (and import) share of GDP. The previous government, somewhat unwisely set themselves numerical targets for the export share of GDP – reality bore no relationship to the targets. The current government avoided that particular mistake, but senior ministers – all the way up to the Minister of Finance and the Prime Minister – talk regularly about rebalancing the economy and gettings the signals right in ways that lead to more exports and higher productivity.

But here are the numbers, for exports as a share of GDP, from last week’s economic and fiscal update.

You can read the earlier decades in various ways. If you wanted to be particularly negative you could note that we got to an export share of GDP in 1980 which we haven’t sustainably exceeded since then. But if you were of a more charitable disposition you might suggest that, broadly speaking, things were still getting better until about 2001 (although you shouldn’t put much weight on that peak – it was an unusual combination of a year of a very weak exchange rate and very high dairy prices). But this century hasn’t been good, and this decade has been bad.

As a reminder it isn’t that exports are in some sense special, but that successful economies typically have plenty of growing firms that are producing goods and services that are making inroads in the very big market of the rest of world. That, in turn, enables us to enjoy for of what the rest of the world produces. For small economies in particular, exports are typically a very important marker.

If you were of a generous disposition you might note that a temporary dip in the export share of GDP might not have been unexpected, or even inappropriate, for much of this decade. After all, the Canterbury earthquakes meant that resources had to be diverted to repairs and rebuilding, and resources used for one thing can’t be used for other things. The exchange rate is part of the reallocative mechanism. And the unexpected surge in the population, as a result of high net immigration (a good chunk of it changing behaviour of New Zealanders), arguably had the same sort of effect.

But the largest effects of the earthquake are now well behind us, and even net immigration inflows are also dropping back. And yet the Treasury forecasts – the orange line in the chart – show no sustained rebound in forecast export performance at all. In fact, by the final forecast year (to June 2023) the export share of GDP will be so low than only one year in the previous thirty will have been lower. Not only is there no sign of a structural improvement – a step change that might one day see New Zealand exports matching or exceeding turn of the century levels – there isn’t even a reversal of the decline this decade, which might plausibly be attributable to unavoidable pressures (eg the earthquakes).

For anyone concerned about the long-term performance of the New Zealand economy – which appears to exclude our political officeholders, who could actually do something about it, but choose not to – it is a pretty dismal picture. Something like the current level of the real exchange rate seems to be Treasury’s “new normal”, and absent huge positive productivity shocks that is a recipe for continued structural underperformance.

Still on the HYEFU, I’ve long been intrigued by the Labour-Greens pre-election budget responsibility commitment around government spending (which continues to guide fiscal policy).

Rule 4: The Government will take a prudent approach to ensure expenditure is phased, controlled, and directed to maximise its benefits. The Government will maintain its expenditure to within the recent historical range of spending to GDP ratio.

During the global financial crisis Core Crown spending rose to 34% of GDP. However, for the last 20 years, Core Crown spending has been around 30% of GDP and we will manage our expenditure carefully to continue this trend.

As someone who thinks that there is plenty the government spends money on that just isn’t needed (and eliminating which would, in turn, leave room for some of the areas where more spending probably is needed), this commitment has never really worried me. But then I’m not a typical Labour/Greens voter.

But if it didn’t bother me, it did puzzle me. Why would the parties of the left, evincing (otherwise) no conversion to the cause of smaller governments, (a) commit themselves to such a relatively moderate share of GDP in govermment spending, and then (b) aim to undershoot that?

Here is what I mean. In the chart I’ve shown Treasury’s core Crown expenses series as a share of GDP, including the projections from last week’s HYEFU. I’ve also shown averages for the periods each of the previous three governments were responsible for (thus the former National-led government mainly determined fiscal outcomes for the year to June 2018).

On the government;s own numbers (and these are pure choices, made by ministers), core Crown spending in the coming five fiscal years (including 2018/19) will be lower every single year than the average in each of the three previous governments, two of which were led by National. Sure, there was a severe recession in 2008/09 – not that fault of either main party here – and then a severe and costly sequence of earthquakes (ditto), but on these numbers government operating expenditure as a share of GDP in 2022/23 will be so moderate that in only two years of the previous fifty (Treasury has some not 100% comparable numbers back to the early 70s) was spending even slightly lower (those were the last two years of the previous government).

It seems extraordinary.

It isn’t as if the economy is grossly overheated (which might suggest a need for considerable caution, since GDP might soon go pop). Treasury estimates that the output gap is barely positive over the entire projection perion (the numbers so small we might as well just call them zero). Of course, Treasury (and other forecasters) never forecast recessions, and it seems quite likely that some time in the next five years we will have one. All else equal, a recession would raise government spending as a share of GDP, but even a 4 per cent loss of GDP in a recession – which would be pretty severe, similar to 2008/09 – would only raise the share of spending to GDP by little over one percentage point. Spending, at the trough of a severe recession, would still be under 30 per cent of GDP – which was presented in the budget responsibility rules as something they want to fluctuate around, not as an untouchable electric fence.

The only plausible explanation I can see – after all, the government show no “small government” inclinations when it comes to, eg, regulation – is the weight they ended up placing on the net debt target. But that was even more arbitrary than the spending rule.

In isolation, they could spend $5 billion more in 2022/23 and still only have spending as a share of GDP at around the average level of the previous Labour-led government. Given the low quality of many of the things they are already spending on (fee-free tertiary education, regardless of means or ability, or the Provincial Growth Fund, to take just two examples), I’m reluctant to encourage them. But it still looks odd.

The Treasury is New Zealand’s lead advisor to the Government on economic and financial policy.The Treasury is New Zealand’s lead advisor to the Government on economic and financial policy.The Treasury is New Zealand’s lead advisor to the Government on economic and financial policy.The Treasury is New Zealand’s lead advisor to the Government on economic and financial policy.

“The Treasury is New Zealand’s lead advisor to the Government on economic and financial policy”

and

“Heaven help New Zealand you might think, given that both Treasury and the government seem lost in the nebulous alternative reality of the living standards framework, wellbeing budgets, and a grab bag of alternative indicators that may – or may not – matter to anyone much other than them.

But they are the official advisors, charged by law with producing independent forecasts twice a year.”

In the document entitled “Safeguarding the future of our financial system – The role of the Reserve Bank and how it should be governed – Phase 2 of the Reserve Bank Act Review”, published jointly with the RBNZ on 1 November 2018, the NZ Treasury and the RBNZ showed the whole world that their understanding is that banks are mere financial intermediaries and not the money creators that they actually are.

It is therefore no wonder that their forecasts are worthless!

Adrian Orr, the RBNZ governor, and Gabriel Makhlouf, the Secretary for the Treasury, should hang their heads in shame!

Unfortunately, the situation is so dire that the leaders of the government, with the possible exception of Winston Peters (and IMHO he’s too scared to rock the boat and tell the truth), are equally as ignorant.

LikeLike

Banks are both money creators is they write loan contracts and also financial intermediaries as they do collect savings deposits and they do lend out to make a margin.

“Banks fund their lending by raising funds in the form of (savings)deposits, debt securities, and loans. From 2007, the greatest growth in funding was in the form of (savings)deposits, up 92% at March 2017. However, in 2017 (savings)deposit growth slowed. This partly reflects households making fewer additional (savings)deposits in banks, from $14 billion in 2016 to $11 billion in 2017. With lower (savings)deposit growth, banks borrowed more in the form of debt securities in 2017 than they did in 2016.”

https://www.interest.co.nz/property/97285/stats-nz-says-property-assets-owned-kiwis-increased-value-more-300-billion-over-10

LikeLike

” Why would the parties of the left, evincing (otherwise) no conversion to the cause of smaller governments, (a) commit themselves to such a relatively moderate share of GDP in government spending, and then (b) aim to undershoot that?”

In the immortal words of Omar from The Wire: “Indeed”.

This bias to parsimony shows just how far the fear of public debt has intruded the soul of today’s crop of progressive politicians.

The deficit hawks have clearly won the ideological battle in NZ. They have succeeded in making the vast majority believe that NZ faces a Greek style debt crisis should the government tax a little less or spend a little more.

LikeLike

It’s called neoliberalism, and epitomises what as a forensic engineer I say just about every day — incompetence is everywhere you look!

But things don’t have to be this way forever. We could switch to a Sovereign Money banking and monetary system, in which banks truly are mere financial intermediaries, and all new money, which ‘we the people’ need to expand the monetary system, is created by an independent arm of our sovereign government at a rate to just match economic growth so as to keep the long-term mean inflation rate at zero, and gifted to our government for it to spend into permanent circulation, with a consequent reduction in the total tax take.

This would give us ‘people’s capitalism’ with steady economic expansion and almost no booms or busts.

LikeLike

I disagree with ending endogenous money. I think that is probably a bit like the Soviet Gosplan trying to run a consumer economy and predict exactly the entire country’s preferences and likely behaviour.. It’s rather difficult to decide by appointed committee exactly how much money an economy needs. But regulate finance to make it boring again.

But I do agree with government using its currency issuing capacity as sovereign (no pegs, no debt in foreign currency, no gold standard) for public purpose. Why wouldn’t you? As long as it doesn’t cause harmful inflation, why would you worry? Japan’s experience and radicals like former reserve bank governors like Adair Turner support overt monetary finance.

In NZ we are so heavily indoctrinated about the perils of public debt. So much so that we may well do self-inflicted harm in the next recession and go nuts on austerity.

LikeLike

The very nature of traditional Monetary policy has been to create booms and busts which cleans out excessive behaviour and allows new businesses to start up and thrive. The problem we currently have is exactly that, the Peoples capitalism ie China has forged ahead with a Sovereign Money banking system but directed towards all boom and no busts. Every time we go through a bust phase, you come up against a Chinese economy on a continuos growth phase which has lead to a massive wealth transfer over the last 4 decades.

LikeLiked by 1 person

I find kind of surprising the casualness with which you seem to approach the overall level of government spending. That extra 2 or 3% of GDP is not free money. Presumably it ultimately has to be paid for by someone performing a productive activity to generate taxation revenue at some point now or in the future. If central government consumption accounts for 30% of GDP is big money and a significant intervention in the economy and and prudence (rule 4) would seem to be an extremely desirable discipline when determining how that money is allocated. And respectful to the taxpayers on whom the burden falls to to pay these amounts. Furthermore the fiscal picture can change incredibly fast, especially if, as you suppose, another recession is likely in due course.

LikeLike

What is a problem is that the government would readily commit to a billion dollars in culling diseased cows and compensating kiwifruit growers for kiwifruit viruses but have not even concerned themselves with NZ intellectual property and the future high tech space industry exhibited by leading edge former high tech companies like Rocketlab gets sold to US interests for a meagre $200 million. A year later Rocketlab is valued in excess of $1.5 billion. We have monkeys in government.

LikeLike

Don’t forget that Shane Jones is busy burning through his $3 billion in his extravagant Regional provincial fund with at least $200 million mulching trees rather than planting them. Talk about incompetence.

LikeLike

To be clear, that bit of the post is about politics not economics. As I hope I made clear I don’t personally support higher government spending – in fact with appropriate NZS reforms (for example) I believe we can and should spend less in total, while still addressing some obvious shortfalls. The mystery to me is simply why an avowedly left-wing govt, that went into last year’s election with a theme of persistent and widespread underspending is itself spending so little. And this in a country with basically no net government debt at all.

LikeLike

Taxinda Ardern’s and Grant Robertson’s idea of rebalancing the economy is taxes and more taxes. The lies spun at Election of No New Taxes have instead seen a bunch of new taxes. Regional fuel tax, National fuel tax, now ACC wants to add a ACC fuel levy on top. Bring out the Yellow vests.

Now we have Property Ring fencing affecting investment property. Guess who pays? The tenant. A loss of tax losses is effectively a new tax. Jacinda is a liar everytime she opens her mouth.

LikeLike

Michael Cullen has called his Capital Gains Tax proposals initiated by Grant Robertson a Almost but not quite Robin Hood Tax. In other words, steal from share portfolios, steal from the business owners and steal from property investors. Steal holiday homes, steal inheritance and give it away to drug dealer friends of Jacinda Ardern.

LikeLike