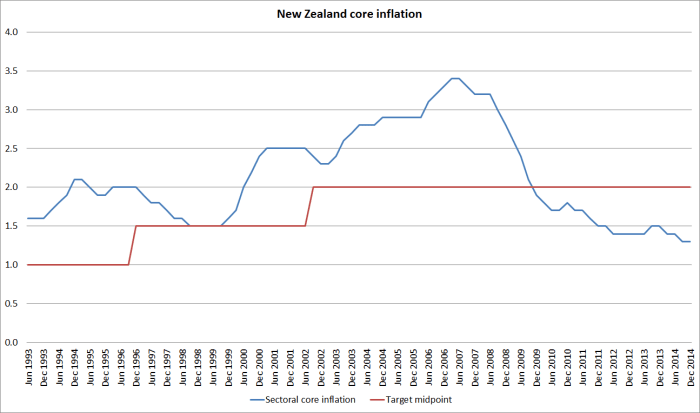

Tomorrow morning Graeme Wheeler, the single unelected official responsible for the conduct of New Zealand’s monetary policy, will announce his latest OCR decision. That decision will, no doubt, already have been made – lags between decision and announcement are longer in New Zealand than in most other countries, even more so at Monetary Policy Statements – and the only discussion now will be around wording the one page press release. Do we really need to say anything this time about future policy? Will that slight change of words spook the markets? Is that claim really defensible? How appropriate is it to comment on another country’s monetary policy? How does talk about the exchange rate and the medium-term challenges it poses fit in a statement about today’s OCR. How will local economists read it? How will offshore markets read it? Where are the political fishhooks? Don’t we need a comma there rather than a semi-colon? And so on. But the heart of the matter is the OCR decision itself – where will the interest rate the Bank pays on (some) settlement cash balances be set for the next six weeks or so. The key influence on that should be the inflation target: a range of 1 to 3 per cent annual CPI inflation, with a focus on keeping future inflation “near the 2 per cent target midpoint”. The Reserve Bank would no doubt argue that that is exactly what they have been doing. The target is not about inflation today, it is about “future inflation outcomes over the medium term”. The Reserve Bank’s published inflation forecasts always show inflation coming back towards the target midpoint a year or two ahead. They do that by construction, but policy over the last few years has been set consistent with that view. The judgement was that interest rates needed to be first at 2.5 per cent, and then move progressively higher, to ensure that future inflation did turn out consistent with the inflation target. Reading through the Monetary Policy Statement from last March, when the OCR increases began, it is quite clear that the Bank expected to see more non-tradables inflation, higher inflation expectations and higher wage inflation, even with the programme of OCR increases they had in mind. But the Reserve Bank was wrong. There is no particular shame in being wrong, so long as one learns from one’s mistakes. It isn’t clear that the Reserve Bank has been very good at that. Of course, what matters is not that so-called headline inflation was 0.1 per cent in the last year. All sorts of things will throw headline inflation around in the short-term and generally it won’t make sense for monetary policy to try to offset them. That is why people develop measures of core inflation – simple ones like CPI ex food and energy (volatile items), trimmed means, weighted medians, and the sectoral core factor model. Core inflation has been falling  So have household inflation expectations

So have household inflation expectations  So have business wage and inflation expectations

So have business wage and inflation expectations  And dairy prices – a major influence on incomes, and incentives to invest – have been coming in much lower than the Reserve Bank expected, consistent with the pretty relentless decline in global commodity prices. Had the Reserve Bank had known last March how the New Zealand economic data would turn out, I don’t think Mr Wheeler would have seriously considered raising the OCR then. Had they done so anyway, they would, I hope, have faced very serious questions from their Board and from the Finance and Expenditure Committee: raising the OCR while showing forecasts suggested that core inflation would keep falling even further below the target midpoint looks like something other than inflation targeting. Everyone makes mistakes, and economic forecasting is something of a mug’s game, But it is the Reserve Bank that chooses what weight to put on its own forecasts, and how far ahead to look. When they have been so persistently one-sided in their errors, it is surely time to down-weight the forecasts quite considerably. The “model” – the way of thinking about what is going on – just isn’t helping much, if at all. Such one-sided errors aren’t new. During the boom years, the Reserve Bank was consistently surprised by how strong inflation was. We didn’t fully understand what was going on, but didn’t correct for that and, as a result, by the end of the boom core inflation measures were above the top of the target range. The underlying belief that surprisingly strong inflation pressures were just about to end is quite strongly parallel to what seems to be going on now – an apparent wish to believe that whatever has kept inflation down is just about to end. With perfect foresight the OCR would not have been raised to 3.5 per cent. No one has perfect foresight, but knowing what we now know there is a strong case for starting to lower the OCR now. As it is, it is not just that nominal interest rates were raised by 100 basis points last year (and not just the OCR, but floating mortgage rates) but that as inflation expectations are still falling, real borrowing rates are still rising further. Perhaps it would be different if there were strong, well-substantiated, reasons to think that underlying inflation pressures were just about to recover strongly – and I stress “strongly”; it has taken five years or more for core inflation to drift this far below the target midpoint. But there aren’t. The construction cycle looks to be pretty close to peaking . Recall that the gearing-up of activity in Christchurch represented the biggest single project pressure on resources in New Zealand at least since Think Big, and yet core inflation just went on falling. There is no sign of business or consumer confidence pushing up to new heights. Export commodity prices are weak, especially for dairy – and the exchange rate is at a level which, if sustained, can only act as a drag on other tradables sector activity. And while I wouldn’t suggest setting policy on a non-consensus forecast for the rest of the world, no one really sees global activity or inflation posing a material new inflationary risk in New Zealand in the next year or two. If anything, the deflationary clouds continue to gather. John McDermott’s speech last week was slightly encouraging – a very belated recognition of just how weak inflation has been, and how little the Reserve Bank (or anyone) really understands about what is going on. But I noted then this disconcerting line from the speech:

And dairy prices – a major influence on incomes, and incentives to invest – have been coming in much lower than the Reserve Bank expected, consistent with the pretty relentless decline in global commodity prices. Had the Reserve Bank had known last March how the New Zealand economic data would turn out, I don’t think Mr Wheeler would have seriously considered raising the OCR then. Had they done so anyway, they would, I hope, have faced very serious questions from their Board and from the Finance and Expenditure Committee: raising the OCR while showing forecasts suggested that core inflation would keep falling even further below the target midpoint looks like something other than inflation targeting. Everyone makes mistakes, and economic forecasting is something of a mug’s game, But it is the Reserve Bank that chooses what weight to put on its own forecasts, and how far ahead to look. When they have been so persistently one-sided in their errors, it is surely time to down-weight the forecasts quite considerably. The “model” – the way of thinking about what is going on – just isn’t helping much, if at all. Such one-sided errors aren’t new. During the boom years, the Reserve Bank was consistently surprised by how strong inflation was. We didn’t fully understand what was going on, but didn’t correct for that and, as a result, by the end of the boom core inflation measures were above the top of the target range. The underlying belief that surprisingly strong inflation pressures were just about to end is quite strongly parallel to what seems to be going on now – an apparent wish to believe that whatever has kept inflation down is just about to end. With perfect foresight the OCR would not have been raised to 3.5 per cent. No one has perfect foresight, but knowing what we now know there is a strong case for starting to lower the OCR now. As it is, it is not just that nominal interest rates were raised by 100 basis points last year (and not just the OCR, but floating mortgage rates) but that as inflation expectations are still falling, real borrowing rates are still rising further. Perhaps it would be different if there were strong, well-substantiated, reasons to think that underlying inflation pressures were just about to recover strongly – and I stress “strongly”; it has taken five years or more for core inflation to drift this far below the target midpoint. But there aren’t. The construction cycle looks to be pretty close to peaking . Recall that the gearing-up of activity in Christchurch represented the biggest single project pressure on resources in New Zealand at least since Think Big, and yet core inflation just went on falling. There is no sign of business or consumer confidence pushing up to new heights. Export commodity prices are weak, especially for dairy – and the exchange rate is at a level which, if sustained, can only act as a drag on other tradables sector activity. And while I wouldn’t suggest setting policy on a non-consensus forecast for the rest of the world, no one really sees global activity or inflation posing a material new inflationary risk in New Zealand in the next year or two. If anything, the deflationary clouds continue to gather. John McDermott’s speech last week was slightly encouraging – a very belated recognition of just how weak inflation has been, and how little the Reserve Bank (or anyone) really understands about what is going on. But I noted then this disconcerting line from the speech:

We remain vigilant in watching wage bargaining and price-setting outcomes. Should these settle at levels lower than our target range for inflation, it would be appropriate to ease policy.

In 2012, the Governor and Minister explicitly, and consciously, decided to include a focus on the target midpoint in the PTA. It is the midpoint, not the bottom of the target range which the Bank should be focusing on. I can really only see one argument against an OCR cut, a line which I’ve seen reported in various media: the housing market, and what lower interest rates might do to house prices. There are several points worth making briefly here:

- In its monetary policy, the Reserve Bank is explicitly not charged with managing house prices. The only target for monetary policy – agreed with the Minister – is for the CPI. Neither existing house prices nor land prices are in the CPI, and the CPI’s treatment of housing is one the Reserve Bank has endorsed.

- To the extent that rising house and land prices in some parts of the country reflect the interaction of regulatory obstacles and population pressures, they are real relative prices changes – not something that, even in principle, monetary policy should be paying much attention to.

- House prices in much of the country have been flat or even falling. There is no evidence of some generalised speculative dynamic, let alone a credit boom.

- Any possible threats to future financial stability – the case for which the Reserve Bank has not yet convincingly made – should be dealt with through prudential regulatory tools. Higher required capital ratios, or higher risk weights on housing loans, would be an orthodox response if a cost-benefit analysis suggested that larger buffers were required.

Finally, the Reserve Bank does not have an explicit “dual mandate”. But any time a central bank engages in discretionary monetary policy – as opposed to, say, a long-term fixed exchange rate – it is assumes such a responsibility de facto. Changes in the OCR affect output and employment in the short to medium term. Perhaps I’ve completely lost perspective, but it disconcerts me how little public attention the Reserve Bank gives to the number of people unemployed (and underemployed). At 5.7 per cent, the unemployment rate is still well above normal, and underemployment measures in the HLFS have not come down much at all. The decision to hold the OCR is not just a decision between higher and low inflation. If it were, there would still be a case for a cut. But the cut/hold choice is also one between a faster reduction in the number of people unemployed and a slower reduction. Involuntary unemployment is a blight, that scars families and individuals, and often has permanent adverse economic effects on the unemployed. When there is so much inflation leeway – inflation so far below target, with few looming inflation pressures – the plight of the unemployed should get more attention from the Reserve Bank, and from those who hold it to account.