Decades ago I worked for a central bank in another country. I woke up one morning to learn that the Governor had been sacked, and by the time I got to work he was clearing his desk. He hadn’t done a bad job – and was one of the more inspiring people I ever worked for – but had fallen foul of the government (Minister of Finance and his colleagues/bosses). The law as it was meant that Governor could be removed whenever the government felt like it. for whatever reason the government felt like. It wasn’t a good model.

In the numerous attempts to capture just how independent various central banks are, one of the dimensions that usually appears is something around the dismissal provisions for key decisionmakers (in these days of committees and board, not just the Governor). Many older pieces of central banking legislation make it very hard to remove the Governor (in particular), removal often requiring things like the bankruptcy, severe mental or physical breakdown/incapacity, or imprisonment (and perhaps even a vote of Parliament). The Reserve Bank of New Zealand Act 1989 was quite unusual for its time, in that it made it easier to remove the Governor, but not because the Minister didn’t like the Governor’s policy calls (and all power was vested in the Governor personally) but if the Governor had failed to deliver on the policy targets he had agreed with the Minister that the Bank would pursue. Under the Act (and rightly so) the Bank didn’t get to define its own goals: the Governor got independence at an operating level to pursue an agreed policy target, and could be removed (at least in principle) if he did a poor job of using the operational independence. The Governor could not be sacked simply because the Minister got annoyed with him, or because the Governor had been appointed or reappointed by a ministerial predecessor of a different party.

That is pretty much as it should be. You can argue (and I long have argued) that even with a well-written law it is hard to make such accountability effective, and the dismissal of a Governor on policy grounds is almost inconceivable (reappointment could, in principle, be another issue) but the balance on paper is probably more or less right.

But these days we have a Monetary Policy Committee to make monetary policy decisions. The government chose to adopt a model in which several external members serve on the MPC, and I’m pretty sure it would not be hard to find speeches from the Minister of Finance championing this innovation and the important contribution people with a diverse range of views and experience would bring to monetary policy decisionmaking.

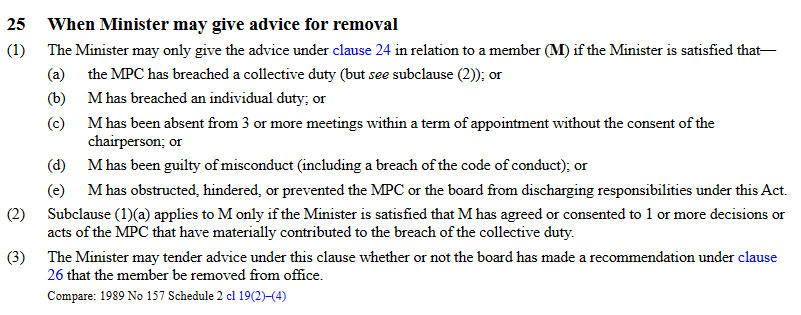

In principle, appointments to the MPC are at a considerable arms-length from the Minister (the Board proposes candidates and the Minister can’t substitute people he or she prefers). On paper, members of the MPC can’t be removed because the Minister doesn’t like them or because they advocate monetary policies the Minister doesn’t like. It is hard to remove an MPC member

(Actually doing monetary policy in accordance with the Remit is one of the “collective duties”.)

What is more, at least on paper MPC members can only serve two terms, so if there is a bit of an incentive to stay on the right side of the Minister in the run-up to reappointment, at least any such period shouldn’t last long.

If you believe in an operationally independent central bank (and, on balance, I still probably favour one), the basic framework looks good. The Act does actually allow the Minister to explicitly override the Bank on monetary policy, but that has to be done openly and formally, not by the dangling threat of dismissal.

But then the Caroline Saunders term came to end (or so it appeared) and we were sent back to check the statute books. I wrote about it here. There we were reminded that there was a provision for an MPC member to have their term extended for up to six months. This appeared to be a more or less sensible provision given that election timing sometimes interferes with the making of permanent appointments or reappointments to significant government roles (although other than for the Governor hardly a vital provision given that there are seven MPC members in total, and the MPC could probably function just fine for a few months with 5 or 6 members), and it was quite similar to a position in the UK central banking law.

What probably few of us noticed was that the law also contained a provision under which when an MPC member’s term of office ends they can simply remain in office unless or until the Minister of Finance actively appoints another person or tells the person whose term in ending to go.

Caroline Saunders’ first term as an external MPC member expired a month ago and she is still in office (it is now May and the Reserve Bank website shamelessly continues to describe her term ending in April). There has been not a word from the Minister of Finance or the Bank (Board or Governor) as to what is going on. In effect, the Minister of Finance has transformed Saunders’ position from one that looked like an explicit fixed term one to one in which she serves from day to day at the pleasure of the Minister of Finance. Just like my story in the first paragraph. It is a terrible way to be doing things (and a month on is clearly a conscious and deliberate choice by Robertson, not a matter of a few days until last minute reappointment loose ends could have been tied up).

To be clear:

- there is nothing to have stopped the Minister of Finance formally reappointing Saunders to a further full four year term (at least, so long as the Minister’s handpicked underqualified Board was willing to recommend here),

- there would have been nothing to have stopped the Minister formally extending Saunders’ term for up to six months (seems not to even require a Board recommendation), a term that itself would have been short but fixed.

But there is no sign that the Minister or the Board have put in place any process to reappoint or replace Saunders (although I have various OIAs in which may shed some light), and instead the Minister has setted for a de facto “dismissable at will, serving at the pleasure of the Minister” model. It has got no coverage, but it should have, including because it sets a terrible precedent.

Since he has said nothing,and has been exposed to no media or parliamentary scrutiny, I have no idea what is going on in Robertson’s head here. I don’t really believe that he has done it to exert policy leverage over Saunders (“keep voting a way I’m comfortable with or you’ll be gone tomorrow) both because no one believes the external members wield or attempt to wield any clout, and because Saunders has a day job in other fields (she doesn’t really need the MPC role). It is also odd because the election is approaching and you’d have assumed this government wouldn’t want to risk leaving an open seat for an incoming Minister to fill early on (they will already be unable to appoint pre-election a replacement for another external MPC member, Peter Harris, whose term expires in October). Perhaps I’m being too charitable, but whatever the explanation (a) we should be getting one, and (b) if small things are allowed to slide it opens the way to more serious abuses and pressure by others later. MPC members simply should not be dismissible at will, and at present Caroline Saunders is. The current situation reflects poorly on the Minister, but also on the Board and the Governor (who have presumably gone along), and actually on Saunders, who if she cares at all about operational independence for monetary policymakers should have insisted that she be reappointed formally or, if not, should have walked (which she could have done with no drama whatever). An incoming government that was serious about fixing the deficiencies in Robertson’s legislative reform of the Reserve Bank should simply repeal the “serve at the pleasure of the Minister” provision (I am not aware that comparable advanced country central legislation elsewhere has that sort of provision, especially when there is already statutory provision for a short fixed-term extension to deal eg with election timing issues).

Changing tack, I stumbled on this call for papers on the Reserve Bank website the other day

Were it the website of a university sociology department or policy centre it might all be rather unexceptional, but this is the central bank.

The Reserve Bank of New Zealand Act, freshly minted, sets out objectives for the central bank and functions for the Reserve Bank. I won’t bore you with another big cut and paste. Suffice to say, neither of those sections mention, or even hint at, “financial inclusion”. In fact, the words don’t appear in the Act at all.

Now, the Reserve Bank would no doubt point out the under the new Act there is a new document, the Financial Policy Remit. The first one is here. But the legislation itself makes it clear that whatever the Minister puts in the Remit, it is all about the exercise of the Bank’s statutory powers, fulfilling its statutory functions and purposes. It isn’t licence for the Bank to go spending public money and scarce management focus on just anything it, or even the Minister, might like.

. Much of the Remit wouldn’t get too much argument from most people, and the government’s “desired outcomes” are well within a reasonable range of possible emphases, as guidance for how prudential and crisis management powers should be exercised.

“Inclusive: does get a passing mention there, but over the page under “Other government policy priorities” we get this (1 of 4)

You might, or might not, think that sensible, but…..it has got nothing to do with anything the Reserve Bank has statutory responsibility for, or powers (which can only be exercised for statutory purposes). If there was a policy role for any agency, you might expect them to be turned to MBIE (ministry of subsidies) or The Treasury.

The Reserve Bank got a huge budget increase a few years ago (although the surprise inflation they inflicted on themselves and the rest of us means the real increase is less than they thought), so you might have thought that the Bank had money, time, and staff galore to throw at hosting symposia. In fact, they seem not to have had the resources or the interest in hosting workshops, symposia or conferences on issues they are actually responsible for – including ones where there have been major recent puzzles and failures.

They have a Seminars and Workshops page. Here are the events of the last few years

Readers of a charitable disposition – shouldn’t we all be? – might look at that top entry and think “well, that is clearly topical and something they were responsible for”. Unfortunately, it is also almost two years ago (before either the inflation or LSAP losses were much in focus at all), and as my write-up of the event records, it was much more of a Treasury event with little on monetary policy and no serious policy contribution from any Reserve Bank figure.

Since then, basically nothing. The Bank is currently finalising its advice on the next Monetary Policy Remit, and although they took public submissions on that there has been no workshop or conference or call for papers. Late last year, the Bank published its five-yearly review of the MPC’s conduct of monetary policy, and there has been no workshop or conference or call for papers on any of that. Serious speeches on monetary policy (let alone financial regulation and supervision, which most Bank staff now work on) are all-but non-existent. And the Bank publishes no research itself on financial stability or regulatory matters, and hardly any on things relevant to monetary policy. Lose $10bn of taxpayers’ money and have core inflation blast well beyond the top of the target range, and we get….well, almost nothing. Not even an apology, let alone some serious engagement, scrutiny and critical review and analysis.

But…..indigenous financial inclusion is apparently where the Governor and Board have decided to establish their research/workshop priorities.

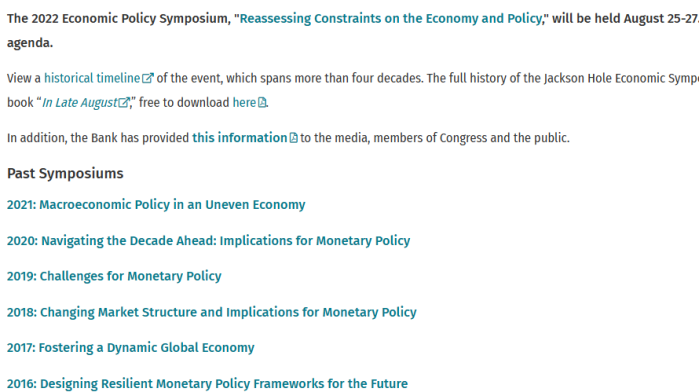

Of course, many other central banks these days hare off down paths that seem barely relevant to the purposes they were established for (that entire Central Bank Network for Indigenous Inclusion fits that bill – and won’t anyone think of the Icelanders) but I can’t spot one whose only conference or serious workshop in several years is on something they have no serious responsibility for at all. Among the almost-countless such events hosted by bits of the ECB or the Fed (yes, they are big economies) the best known is of course the annual Jackson Hole symposium. These are the topics from the last few years

The Reserve Bank of New Zealand doesn’t have those sorts of resources or the pulling power. We are a small and not very wealthy country. But in such countries, scarce public resources should be being used in ways ruthlessly aligned to institutional priorities and statutory functions. The Reserve Bank’s workshop, by contrast, has the feel of management and the Board plundering the public purse to pursue personal ideological whims and interests. The same management and Board that displays no interest whatever in serious scrutiny or engagement or research on things they are actually responsible for, where they have made big calls in recent years, some of which have already proved deeply costly.

Jackson Hole it ain’t.

Here, you can go four years and not hear a speech or a paper from even a single external MPC member – members barred from doing any further research or analysis themselves. But never mind I suppose they say, it is only taxpayers’ money.

Reblogged this on Utopia, you are standing in it!.

LikeLike

Copied from a bleated comment on your Sources of Inflation post.

I could probably toss this into the mix anywhere but Arnold Kling’s comments are interesting.

https://www.econlib.org/library/columns/y2023/klingfinancialpolicy.html

He seems to be saying Central Bank independence is a chimera (as we have certainly seen in NZ) since Governments need to keep debt/credit markets alive to feed their endless desire to spend money they don’t have (yet).

Keeping the “square of power” apparatus functioning may well be an underappreciated reason for creating crises so they they can fix them for us….. We may well face the sad prospect of Orrs for ever… 🙂

LikeLike

In previous comments I’ve often admitted to failing to fully grasp some of the content of your articles. Macro-economics is an undiscovered territory but I usually think I’d understand if I tried harder. However those three words: ‘indigenous financial inclusion’ are puzzling; I do not understand which word is modifying which. From context I’m guessing indigenous means indigenous to NZ so therefore Māori so why not say so?

It will all become clear when the symposium is over and a report produced. I expect there will be an English translation.

LikeLike

In this instance , Merriam- Webster’s “Did You Know” section is instructive”:

Symposium (Noun):

“It was drinking more than thinking that drew people to the original symposia and that gave us the word symposium. The ancient Greeks would often follow a banquet with a drinking party they called a symposion. That name came from sympinein, a verb that combines pinein, meaning “to drink,” with the prefix syn-, meaning “together.” Originally, English speakers only used symposium to refer to such an ancient Greek party, but in the 18th century British gentlemen’s clubs started using the word for gatherings in which intellectual conversation was fueled by drinking. By the end of the 18th century, symposium had gained the more sober sense we know today, describing meetings in which the focus is more on the exchange of ideas and less on imbibing”

Ironically the RBNZ’s symposium will no doubt be going back to the 18th century ‘Colonists’ version of things ( minus the intellectual bit), but it will be all Greek to most people in today’s cost of living crises.

LikeLiked by 2 people

Shades of Nero and his fiddle?

The thought of Adrian in a toga is not particularly inspiring…

LikeLike

The “collective duty” was to achieve a midpoint inflation rate of 2%? Does the failure allow the Minister to dimiss the Govenor and members of the MPC?

Are we really saddled with this incompetance for another 4 years?

LikeLike

Recall that Orr just began a new 4 year term so even if he could be dismissed for some monetary policy failings they would have to be ones made since March this year. The opportunity to do something serious directly about him passed when Robertson reappointed him.

LikeLike