The government’s economic policy, such as it is, in response to the coronavirus situation has the distinct feel of inadequacy. Hamish Rutherford did a big piece late last week on the Minister of Finance, but interesting as it was what was most notable was the utter absence of any overarching narrative or strategy. Of course, we have the wage subsidies – now apparently being paid in respect ofmore than a third of the entire employed population – but that is about it. There is the business loan guarantee scheme, and although time will tell I suspect that won’t be very much used (not many businesses will sensibly support much more debt). There is much talk of special deals for favoured big firms, but Air New Zealand (first round) aside we’ve seen nothing more on that front. And more generally there is no sign of anything systematic to assist the broadly-defined business sector, the bits that don’t necessarily grab headlines or have strong political connections. The Minister appears utterly unbothered by the high interest rates firms and households are paying, in a climate in which time currently has no (and probably negative) value. With a lockdown that, while far from total, is still more stringent than those in many countries, the economic dislocation is going to be enormous. And yet weeks pass and the government appears to have nothing systematic to offer. Sadly, they still no sign of recognising that an “income loss insurance” model remains the best way to think through this episode and organise the economic policy response.

But today I wanted to focus on the Reserve Bank again: two lots of comments in recent days from the Governor, and one from the Bank’s chief economist (who is appointed by the Minister of Finance to serve on the Monetary Policy Committee). None of it is reassuring.

On Friday, there was an interview with the Herald’s Liam Dann. It was pretty soft stuff: Dann gets interviews with the Governor (and his predecessor) and maintains access by never asking searching questions. As I noted to someone the other day, that approach has the advantage (I suppose) of providing a platform for the Governor, but has the disadvantage for the wider public of only providing a platform, and never challenge or scrutiny. The Governor, of course, doesn’t like challenge or scrutiny, despite being a very powerful public official.

And so, for example, the Governor was never once asked why the Monetary Policy Committee promises not to cut interest rates any further (even though the economic dislocation must be much more savage than envisaged when they made the pledge) or why retail interest rates that are substantially positive in real terms makes any sense whatever in an economy like that we face now.

It was a soft interview so most of what he said wasn’t very noteworthy. But a couple of things caught my eye. Orr was asked about the Bank’s $30 billion government bond buying programme,

The RBNZ has committed to up $30 billion worth of QE in the next year.

Where does that money come from?

It was effectively drawing down on New Zealand’s current and future collective wealth, Orr said.

“The Government, whenever it spends, it has to raise its own money through taxes and borrowing. Bonds are a form of IOU that the Government writes,” he said.

But that is to confuse two quite different things. The bond-buying programme itself is nothing more nor less than an asset swap. The Reserve Bank buys government bonds on which it earns a yield to maturity probably averaging a bit under 1 per cent, and in exchange banks end up holding deposits at the Reserve Bank, currently paying 0.25 per cent. There is no particular expected value cost of that operation at all. What is drawing down New Zealand’s “current and future collective wealth” is the fiscal policy responses to the crisis, but they have nothing whatever to do with the Reserve Bank.

And then there was the claim, by the Governor mind, that New Zealand had the “best banking system in the world”. On this occasion, I happen to agree with him that our banking system will prove one of the best-capitalised and soundest around (which doesn’t mean that the toxic brew of rapidly rising unemployment and falling asset prices could not yet lead to some difficult times). Even if our headline bank capital ratios are not super-high by international standards, the way the rules are applied mean that the effective buffers are high here even by international standards (and our banks have pretty vanilla assets).

It is just that none of this is what the Governor was saying last year when he was pushing to double the capital ratios applying to banks. Then we heard about inadequate current capital levels really were for severe shocks, and a reluctance ever to produce, or engage with studies suggesting that bank capital ratios here were already high by international standards. Strong parent banks also help New Zealand, but again last year Orr was often heard rather cavalierly almost championing the case for disinvestment and local listings.

When people who are supposed to be serious public figures just spin like this, and flit from one convenient line to another as suits, it is important that they are called out and challenged. But, in truth, were it not for Orr’s op-ed in the Sunday Star-Times (reproduced here), I’d probably have let in pass: one can’t write about everything. But then there was the op-ed, the one that prompted one correspondent to head his email

What!!??

followed by the suggestion that

The guy’s on drugs!!!

If only, because then we might hope for better the next day. Instead this seems to have been the calm lucid thoughts of one of the most powerful public officials in New Zealand. Spare us then.

Anyway, what does the Governor has to say?

He opens this way

Working at the Reserve Bank for the people of New Zealand is a privilege and at a time like now there is no shortage of motivation. We are working both as a skeleton crew at our premises and remotely. Productivity has been high, as is the case across all essential services, and I have personally appreciated and needed the connectivity.

To date our ‘bubble’ has mostly included the Government, Treasury, and New Zealand’s banks, non-bank deposit takers, and insurance companies. We have proved we can work together for a common goal – cash-flow and confidence – at pace. We recognise the threat of COVID-19 to our collective well-being and have responded accordingly to ensure we address the issues at hand and reduce the impact on future generations.

One can probably skip over most of that, although do note that strange final sentence. Probably the best way to “reduce the impact on future generations” would be to do very little now, especially around fiscal policy. But most people – rightly in my view – don’t think that makes much sense, and are encouraging governments to adopt policies that do spread much of the economic impact onto future generations (that is what increased government debt means).

Then he gets more specific

To maintain commitment to our future prosperity, we have ensured that the cost of borrowing is very low through reducing the OCR to 0.25 percent and undertaking ‘Quantitative Easing’ (QE). The latter involves us buying Government Bonds (public debt) from banks and swapping it for cash – so that the banks can on-lend. This activity keeps long-term interest rates low, where we need them, as well as helping the Government to fund its own expanding activities.

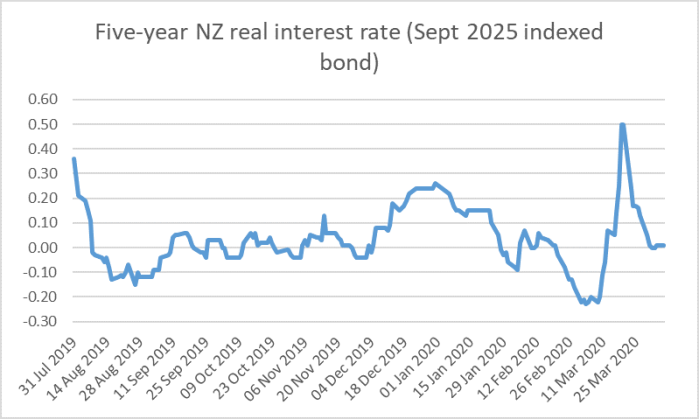

Perhaps he simply hasn’t noticed quite where retail interest rates are, but by no reasonable standards can those rates be called very low in the specific context we now face. Perhaps he hasn’t noticed that the OCR cut was a mere 75 basis points, belatedly, and that by contrast in the much less significant economic shock of 2008/09 the OCR was cut by 575 basis points. As for “keeping long-term interest rates low, where we need them”, it is certainly true that Bank announcements have limited any rise in bond yields, but had the Governor not noticed that even a five year real interest rate (and probably most would still think things would get largely back to normal by the end of five years) is still no lower now than it was late last year, or even in mid-February when the Governor and the MPC were talking up the outlook for the world economy?

And, of course, no mention at all of the way medium to long-term inflation expectations have been falling away.

Then the spin changes tack

Further assisting banks is the ‘capital relief’ we provided them, encouraging banks to use their rainy day funds given that it is raining. We insisted banks hold large capital buffers despite their considerable consternation. They can now use them as necessary.

Except that, as the Governor knows, the new capital requirements had not yet come into force, and banks had done little yet to increase actual capital. Actual capital ratios now are almost certainly much as they would have been had the Governor never embarked on his crusade.

But it is at the end of the piece that the Governor seems to become simply detached from reality.

Income support, mortgage relief, business lending, tax relief, and a broad range of regular welfare assistance is available and needs to be used. Support each other, think beyond just the next six months or more, and visualise the role you can and will play in the vibrant, refreshed, sustainable, inclusive New Zealand economy.

It is as if the pandemic is a refreshing shower of rain on a hot summer’s day, clearing the air, helping the garden etc. Perhaps in lockdown the Governor has been digesting some bastardised version of Schumpeter’s creative destruction, with a dose of Andrew Mellon (“liquidate, liquidate, liquidate”) thrown in for good measure. We’ll emerge, it seems, better for the experience?

Wasn’t this the same Governor who only months ago was regaling us with stories (often overblown) of how terrible economic crises were – mental health, inequality, or whatever, as well as the economic costs – and in particular how his aggressive bank capital proposals were to spare us from all this. Not a “crisis as refreshing shower of rain” then as I recall.

But who really knows what he is going on about. These are going to be unbelievably tough times for many individuals and firms – but not, of course, for central bankers and most core public servants – which it is going to take years to fully recover from (some just never will) and yet still the Governor is chanting from the Labour playbook with his mantra of the “sustainable, inclusive” New Zealand. I suppose dead economies don’t emit, but they don’t tend to be very sustainable or inclusive (whatever those words actually mean either). Apart from anything else it is unbelievably tone-deaf.

For those who simply want cheering up (there were a few in the comments section on Stuff), find an old episode of Dads’ Army or a more-modern comedy act. From a central bank Governor we should hope for seriousness, rigour, and a gravitas fitting to the moment. We simply don’t get it from Orr.

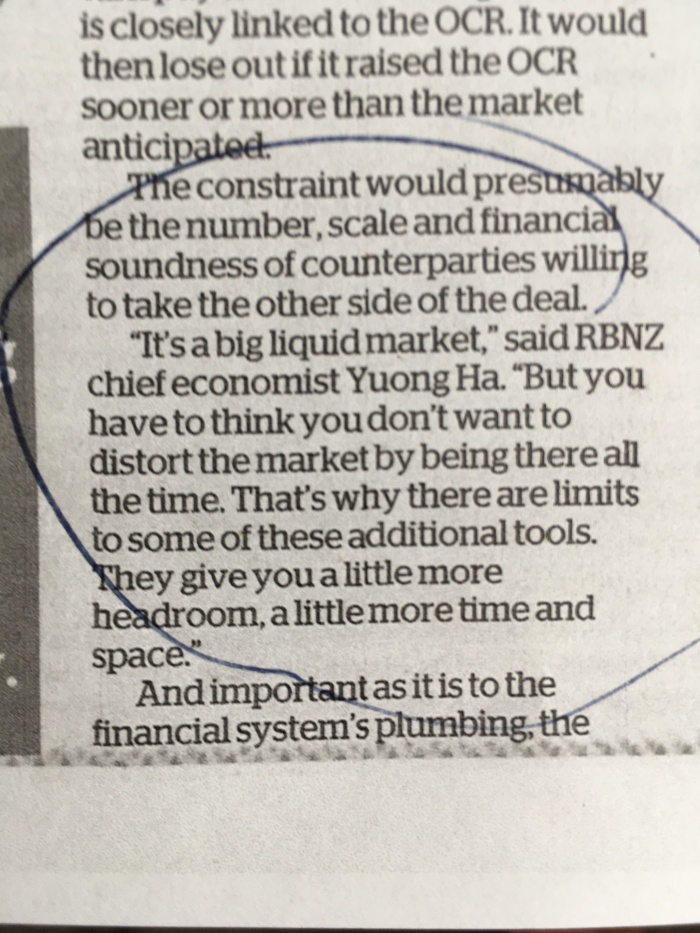

Sadly, of course, the poor quality of our current crop of senior central bankers doesn’t stop with the Governor. Yesterday, Bloomberg reported on some written answers to questions on monetary policy that they had managed to extract from the Bank’s chief economist Yuong Ha. One had to wonder why the Bank insisted on questions and answers in writing (isn’t a phone call typically quicker) but perhaps the Governor wanted to ensure that his chief economist stayed on message: it was after all only a few weeks ago that Ha hadn’t kept up sufficiently and acknowledged that things like large scale asset purchase programmes aren’t really much of a substitute for conventional monetary policy

Just “a little more headroom, a little more time and space”, which doesn’t quite cut it in the biggest slump in modern history.

Anyway, Bloomeberg’s Matthew Brockett apparently asked about the MPC’s refusal – pledge, promise – to cut the OCR any further. And the written response was as follows

The main reason the Reserve Bank committed to keeping its benchmark rate at 0.25% for at least a year “was to take away the imminent distraction of needing banks to prepare their systems for a negative OCR,” Chief Economist Yuong Ha said in written responses to questions from Bloomberg News. “That situation will change over time,” but the RBNZ was not working with banks on the issue at the moment, he said.

So they’ll leave the OCR hundreds of basis points above where any guide, such as a Taylor rule, might suggest it needs to be because they don’t want to inconvenience some of the banks. Poor borrowers, but apparently never mind because Messrs Orr and Ha don’t want to put the banks to any trouble. It is simply extraordinary.

As I’ve discussed previously, in 2012 an internal working party on preparing for a new crisis recommended that the Reserve Bank work with banks to ensure their systems could handle negative interest rates. That was almost eight years ago. For several years not only have various advanced country central banks had negative policy rates, but much of the sovereign debt in advanced countries has been trading at negative yields.

And yet it appears our central bank did nothing, and is still doing nothing. I’ve been impressed by stories of government agencies standing up whole new electronic systems in a day or so in the midst of this crisis. Perhaps for those banks – protected by the RB – who weren’t ready, it would take a bit longer than that, but there is just no apparent sense of urgency. As, of course, has been true of the Monetary Policy Committee since this crisis first began.

Even if some banks – and Orr or Bascand told us previously it was only some – aren’t ready for negative rates, there is still the question of why the Bank has set a floor on the OCR at 0.25 per cent. Why not 0? (After all, the OCR is a deposit rate not a mid-rate). 25 points isn’t that much, but in a climate where every little bit helps, there is simply no good reason at all for sitting at 0.25 per cent.

Brockett appears to have asked Ha whether the OCR could be cut in increments less than 25 basis points. Ha noted, rightly, that such moves aren’t common, and then fell back on another weird line of argument

“We also have to avoid unnecessary volatility in interest rates and exchange rates in setting monetary policy,” Ha said.

Well, yes, sure…..but precisely what, if anything, does that have to do with the question of whether the OCR should be cut to, say, 0.1 percentage points, even if for some arbitrary reason they won’t take it zero. And this wasn’t even the first thing that came out of a flustered official’s mouth; recall that these were written responses to written questions.

The lot of them seem badly out of their depth, playing distraction, and not doing what we should expect from a capable central bank in the heart of our economic crisis of such magnitude. That isn’t just Orr or Ha, but the other members of the Monetary Policy Committee: the internals (probably the best of them) Deputy Governor Bascand, and Christian Hawkesby, and the three stooges (sorry, externals) of whom, from whom, we never hear anything and for whom there seems to be not the slightest accountability: Bob Buckle, Peter Harris, and Caroline Saunders. To which one could add the Reserve Bank Board, especially their chair, Neil Quigley.

There really is almost no point in a discretionary monetary policy central bank if in the biggest crisis, and deflationary shock, any of us are ever likely to see, monetary conditions aren’t materially eased by the central bankers.

But, of course, ultimate responsibility rests with the Minister of Finance, Grant Robertson. He appointed Quigley. He endorsed Board recommendations to appoint all the other MPC members. He has the power to have any of them dismissed if they aren’t doing their job, which by any reasonable interpretation they haven’t and aren’t. He has the power to directly override the MPC and insist, say, on a much lower OCR, and the moral suasion capability to insist that such cuts were passed through to retail interest rates (easing servicing burdens, redistributing income in ways consistent with the nature of the crisis, supporting medium-term inflation expectations, lowering the exchange rate, and setting signals about the conditions potential borrowers will face when we finally begin to emerge). But, lacking any obvious strategy, and always reluctant apparently to do anything that isn’t conventional wisdom, the Minister of Finance sits on his hands and does nothing. I doubt it is the case that the Minister doesn’t care, but it comes to the same thing when he is unwilling to demand action or to take the steps open to him to break out of the central bankers’ straitjacket.

Reblogged this on The Inquiring Mind and commented:

This was a most interesting post from Michael Reddell. The post looks at several issues which we are faced with as a result of the present health and resulting economic crisis.

I was particularly struck by this paragraph:

‘But today I wanted to focus on the Reserve Bank again: two lots of comments in recent days from the Governor, and one from the Bank’s chief economist (who is appointed by the Minister of Finance to serve on the Monetary Policy Committee). None of it is reassuring.’

This post raises several important issues

LikeLike

You expect rather too much from the Minister of Finance. He has little background in these matters. Consequently he finds himself considerably out of his depth and happy to be led by any apparently plausible official. Be kind.

LikeLike

Only one we can really hold to account. But yes the bench of senior officials is generally pretty unimpressive, be it Tsy, RB, MBIE or wherever.

LikeLike

In addition, the RBNZ has not provided any quantitative data on the consequences of, say, their capital relief. No guidance on the accounting for losses under IFRS9, no clarity on the buffers to be used. The effects on risk weights.

I can see that the Terrace 2 hosts a skeleton workforce, but it looks like Orr has no command over his WFH prudential staff.

LikeLike

One wonders – has anyone picked up the phone and asked the big-4 retail banks if they are capable or incapable of handling negative interest rates? If incapable what have they been doing for 8 years

LikeLike

Yes, would be a good question for some journalist.

I have OIAed the RB for material relevant to this issue, altho of course that will not name names (OIA protections of commercial confidentiality). Oh, and the response prob won’t turn up for a couple of months.

LikeLike

“…in a climate in which time currently has no (and probably negative) value” – negative real rates I assume? yet, most people would intuitively attach a positive value to their time regardless given that, in the long run, we are…?

LikeLike

yes, to clarify, the passage of time: ie interest is usually thought of as a reward for waiting, deferring consumption, offset by the value someone else can make over time by using those same resources.

LikeLike

Good evening,

Just a brief couple of comments /queries.

1 Has the PTA agreements been changed to allow the direct Goernment input you are recommending.

2 Are there no Reserve bank people that are achieving appropriate outcomes? That would surprise me greatly.

3 My view is that the stability achieved over the last few years, unlike some past years is a credit to their management.I hope it will continue.

Rosecevans

LikeLike

On 1. the RB Act specifically allows the Minister to override the normal remit.

On 2. their have been no dissents recorded by any MPC member since the system started last year.

On 3, that stability clearly is not continuing. As just one example see the sharp fall in inflation expectations in today’s ANZ survey.

LikeLike