In the wake of the upset Australian election result on Saturday, I thought it might be a good day for a quick post on some Australia/New Zealand economic comparisons.

I often bang on about New Zealand’s atrociously poor longer-term economic performance, but if Australia’s longer-term performance is less bad by comparison, we are about the only country that makes them look less bad.

At present, for example, average real GDP per hour worked in Australia is about 15th in the OECD, with quite a gap to 14th. To New Zealand readers that probably doesn’t sound too bad, said quickly, but in 1970 – when the OECD series starts – Australia ranked 8th. A hundred years or so ago, on the eve of World War One, Australia’s real GDP per capita – the only measure for which there are long-run historical estimates – was 1st equal among the countries that now make up the OECD (with New Zealand and the United States).

But my particular focus this morning is exports, as a share of GDP. There is an old mercantilist sort of view – which at times seems to be held by Donald Trump – that somehow exports are a superior form of economic activity, and that whereas exports are in some sense good, imports are bad. That isn’t my story at all. Exports and imports are both good – gains from trade and all that. In many respects, at least at a national level, one doesn’t go too far wrong in saying that we export so that we can import. Of course, firms export not countries, but over time and in the aggregate, our appetite for cars, jet aircraft, overseas holidays or Hollywood movies is only able to be met if we find other products and services we (firms based here, employing us etc) can successfully sell to the rest of the world. And since, especially for small countries, there is a lot bigger market in the whole world (even just the whole advanced world) than at home, export success often tends to go hand in hand with wider economic success: it isn’t that the exports, per se, make you prosperous, but that you’ve been able to generate (or even dig up) products and services that other people will pay for: you’ve passed the (demanding) market test. Empirically, countries that have sustainably caught up – in GDP per capita or GDP per hour worked terms – almost without exception have had strongly performing export sectors.

But what about New Zealand and Australia?

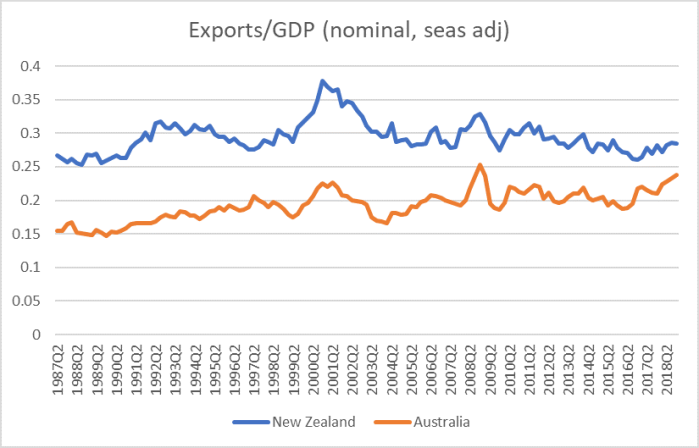

Here is the (nominal) share of exports in GDP for the two countries for the period since our quarterly data starts in 1987 (as the paeans to Bob Hawke last week remind us, at the time both countries were doing fairly far-reaching economic reforms). This is simply the nominal value of exports over nominal GDP.

That gap has closed, a lot, over the decades, perhaps especially over the last 15 years or so.

It is worth remembering two stylised facts:

- remote countries tend to trade less internationally than do countries close to lots of other countries/markets (distance really does reduce economic opportunitites), and

- small countries tend to trade internationally more (share of GDP) than large ones.

In economic terms, New Zealand and Australia are almost equally remote (arguably they a bit more so than we, since Australia is big relative to New Zealand). So, all else equal, one wouldn’t really expect a country five times the (population) size of the other to be exporting a similar share of their GDP – New Zealand should be well ahead.

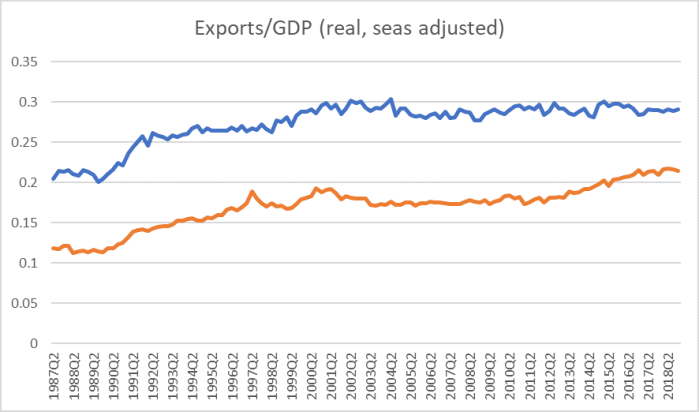

There is another possible exports/GDP measure. This chart uses deflated (“real”) series for both exports and imports. Statisticians tend to frown on it – and I mostly don’t use it – but it does strip out the direct effects of terms of trade fluctuations, which (for Australia in particular) can be large.

In New Zealand, there has been no increase in the volume of exports as a share of GDP this century. In Australia, by contrast (and after a flat period) there has been a substantial increase this decade, primarily as the newly-exploited mineral resource projects have come on stream. In both countries, the real volume of exports has increased – in New Zealand’s case by about 50 per cent since 2002 – but in New Zealand trade with the rest of the world is a smaller share of GDP now, and in Australia it is larger.

Of course, even this story has its complexities. Much of the mineral sector operating in Australia is foreign-owned, so that a chunk (but by no means all) of the benefit of the export surge is accruing to foreign shareholders rather than to Australians. But without the surge in mineral exports – a windfall to a considerable extent (although with a policy framework that allowed developments to proceed) – it is hard not to look at Australia and conclude that on the present suite of economic policies – much the same as prevail in New Zealand – their relative productivity and income performance would have deteriorated even further over the years.

Perhaps the gaps between New Zealand and Australia would have narrowed a bit, but from the wrong direction. Much better would be if both countries were doing something that credibly might move them back up the advanced country rankings. If the re-elected Coalition is less likely to further damage Australia’s economic prospects than Labor, no party on either side of the Tasman really seems to have serious analysis or ideas – or to particularly care – about reversing decades of relative decline.

If we took our timber exports as an example and then took out say 50% turned them into chair legs instead of box wood that might increase the value of those exports three fold. Problem is that Govt. policy doesn’t encourage that kind of behavior.

Apply that to milk products, mining resources, and many other exports and do it in a determined way then we will get somewhere.

Organic kiwifruit get a premium and so will lots of other produce. We have the knowledge and the skills but not the will.

The other big issue is the social welfare waste and merry go round. All that including the many forms of welfare create an increase in GDP with out any corresponding increase in production nor efficiency.( Kind of like selling houses to one another when really the value proposition hasn’t changed.). The latest example being the CHCH gig (again) and the move to raise minimum wages and install bashing tax on employers.

A comparison of the cost of welfare in both countries and others versus GDP or GDP per capita could reveal our problem.

The bashing tax I refer to is domestic Violence leave. Its ain’t the employers fault nor I suggest their responsibility to pay for that but we now have to. Imagine the Chinese putting that cost on their employers, I think not.

LikeLike

There have been lots of suggestions over the decades that Fonterra and other exporters should move from volume commodities to higher-value finished goods. This sounds good in principle, until you ask “If we convert our timber into chairs (perhaps not chair legs), who is going to sell them?” Economists tend to assume this problem away, but business practitioners realise how difficult it is.

Ikea is not primarily a furniture manufacturer – for all I know, or any of their customers care, the goods may be made in China, as iPhones are. Ikea is a design and marketing company, and has spent decades perfecting their appeal to a segment of the market. There is very little value added in the process of turning wood into flat-pack furniture for Ikea – anyone can do that, and competition drives the margins to subsistence level. The value is all in the design and the marketing. Boutique firms like Karen Walker appreciate this: her website says “Karen Walker is a design company”, and the clothes are made by contracting firms in NZ and (mostly) China.

A hundred years ago, the world was very different, and there was real value added in manufacturing and even in the production of some raw materials. Branding was primitive, and a generic strategy of focusing on manufacturing finished products made sense (and arguably brought the US its huge economic growth). Wishing that NZ could get back to the #1 productivity ranking that it held in those days seems like empty nostalgia.

There are more small firms than one might imagine that generate value globally from NZ (as Karen Walker does), but they are all small. When they get large, they have to be taken overseas to be near the markets. If there is to be significant growth in productivity, the only option seems to be to encourage the growth of thousands of Karen Walkers across a range of industries. But these firms will not be manufacturing much, and will certainly not be taking any noticeable proportion of locally grown timber or milk. And so alongside them, Fonterra will still be exporting milk powder and cheese. Nothing in Fonterra’s DNA equips it to be a global consumer goods specialist like Nestlé, and if it could develop such a capability then the marketing and branding would eventually have to separate from the production side. This would leave the farmers once again to do what they do best: produce milk. But that is no longer a high-value activity.

LikeLiked by 1 person

I largely agree. I guess my bottom line is that if there were (consistent expected) profits in adding more value here people would be doing so (firms are rational, looking for profit opportunities).

It is also worth remembering that exports can be artificially boosted by govt subsidiies, actual or implicit. In a NZ context, there are explicit ones like large film subsidies, implicit ones like tying residence points/work rights to study at NZ tertiary institutions, and environmental ones (eg full costs of dairy runoffs not yet internalise). Animal emissions not yet taxed or in ETS might count as another one, altho that is more arguable, since no one else yet treats animal emissions that way (if everyone did, perhaps the global diary sector would be smaller, but our share of it prob wouldn’t be greatly impaired).

LikeLike

To get a better understanding of the long term tends, shouldn’t the graphs also plot imports, as the exports doesn’t reflect the any changes in the level of self sufficiently of the economies.

LikeLike

Yes, but it clutter the charts, and imports and exports are highly correlated with each other over the longer-terms.

LikeLike