I was chatting to someone yesterday about what was behind the undisciplined, highly political, way in which Reserve Bank Governor Adrian Orr has taken to the job. My interlocutor reckoned Orr might have his eye on a high place on Labour’s 2023 list (“doing a Brash”). I was a bit sceptical – he’d be about 60 and Jacinda Ardern about 43 – but then I guess this is the era where a youngish (only 72) Trump could be facing off against either Bernie Sanders (77) or Joe Biden (76). I still doubt Orr has a conscious personal party political goal in mind – and if he did, it would be highly inappropriate for him to be serving as Governor – and suspect it is mostly about revelling in being a big fish in a small pond, the opportunity to strut his personal ideological commitments using a statutorily provided (and funded) bully-pulpit to do so. By comparison, the basics of the day job must seem rather technocratic and dull – hence, no doubt, why we’ve had no public speeches about either monetary policy or financial regulation. Anyone seen any sign of developed Reserve Bank senior management thinking about, for example, handling the next serious recession – starting from an OCR of 1.75 per cent or less? Thought not. Or, for that matter, robust and honest articulations of the case for much-increased minimum bank capital ratios.

Instead we hear him on all sorts of stuff that is no part of the responsibility of the Reserve Bank. There is infrastructure, thinking long-term (in the Governor’s view he apparently does, but we don’t, think long-term enough), and lots and lots on climate change, all entirely predictably left-wing (not even interestingly left wing) in nature. Oh, and of course there is the tree god nonsense. There are only so many hours in the day, so time spent on this stuff – and time spent getting his staff to do it – is time not spent on core business. And this from an institution that claims to be underfunded.

Early last month, I wrote a post, Other People’s Money, prompted by a newspaper advertisement from the Bank for a “Cultural Capability Adviser Maori”. I noted then

So what is he up to with his “Te Ao Maori strategy…designed to build a bankwide understanding of the Maori economy”? Given his statutory responsibilities – and those in charge of public agencies are supposed to operate constrained by statute – what makes the so-called “Maori economy” any different than the “European New Zealander economy”, the “Asian economy”, the “British immigrant economy”, the “Pacific economy” and so on, for Reserve Bank purposes and policy?

The Bank’s claim is that this new understanding will “enable improved decision making…about monetary policy and financial soundness and efficiency”. Yeah right.

I lodged an Official Information Act request for material relating to the decision to create this position, including “any material covering the estimated costs and benefits of such a position”.

It took them a while – more than 20 working days – to respond but I eventually received 25 pages of material. There was, of course (this is the Reserve Bank after all), no cost-benefit analysis, and more remarkably there was no mention (explicit or implicit) of any opportunity cost of the resources devoted to the Governor’s latest whim. It is as if the Bank thought it had more or less unlimited resources and no clear need to prioritise – I guess that is what using other people’s money, in an institution with very weak external budgetary controls can come to.

The direct financial costs were outlined – almost a million dollars over three years, and a couple of hundred thousand a year thereafter (about as expensive as slushy machines for prison officers, and at least someone gets some benefit from those). A million here and a million there and pretty soon you are talking serious money.

And all this for an organisation that, of all those in the entire public sector, must have the least compelling need for a Maori strategy (for this cultural capability adviser is only one bit of the wider strategy). As a reminder, these are the key Reserve Bank functions

- the Bank issues bank notes and coins. That involves purchasing them from overseas producers, and selling them to (repurchasing them from) the head offices of retail banks;

- it sets monetary policy. There is one policy interest rate, one New Zealand dollar, affecting economic activity (in the short-term) and prices without distinction by race, religion, or culture. Making monetary policy happen, at a technical level, involves setting an interest rate on accounts banks hold with the Reserve Bank, and a rate at which the Reserve Bank will lend (secured) to much the same group. The target – the inflation target, conditioned on employment (a single target for all New Zealand) – is set for them by the Minister of Finance.

- and it regulates/supervises banks, non-bank deposit-takers, and insurance companies, under various bits of legislation that don’t differentiate by race, religion or culture.

The Bank has chosen to put some decorative Maori motifs on the bank notes it issues, but that is about the limit of it.

Sure, there is a handful of other functions. They can intervene in the foreign exchange market (one dollar for all), and they operate a wholesale payments system (NZClear), but it doesn’t alter the picture. There is just no specific or distinctive European, Maori, Pacific, Chinese, Indian or whatever dimension to what the Bank does (or what Parliament charged it with doing). I looked up the list of institutions which are members of NZClear, and (unsurprisingly) there was not a single specifically Maori one (Swiss, German, Indian, American, British, Tongan, Fijian, Sri Lankan – those last three other central banks – and so on).

The Reserve Bank is essentially a “wholesale” institution. The actions the Bank takes affect all of us to some degree or other, and so they need to open and accountable in communicating what they are doing, but it just isn’t the sort of agency that has a direct client base (or clients with culturally specific issues relevant to its statutory responsibilities) where race, culture, ethnicity, or whatever is an important consideration. And so the million dollars – and all the uncosted staff time – is just money down the drain, advancing the Governor’s personal ideological and social whims, not the statutory responsibilities of the Bank.

There is a great deal of unsupported nonsense in the document. But it starts here

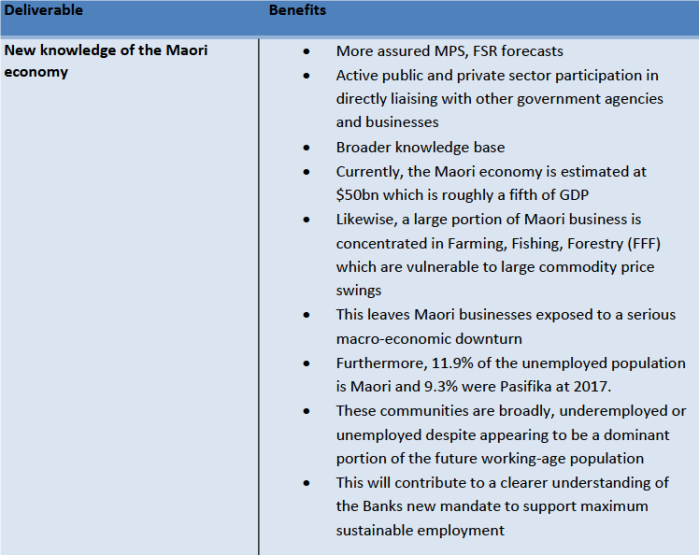

And here is one of the key sets of deliverables

Which is, itself, a grab-bag of unsupported stuff. “More assured forecasts” would, of course, be great, but from an institution whose inflation forecasts have been wrong (one-sided bias) for eight or nine years now, doing the core job more accurately seems rather more important. The documents never suggest how their better understanding of “the Maori economy” will improve the forecasts – as distinct perhaps from making the Governor feel better about them.

Notice too that reference to “the Maori economy”: not only is $50 billion rather less than one-sixth of GDP, but the $50 billion they are talking about is a collection of assets (a tiny portion of total assets of New Zealanders), and GDP is a collection of income flows. Since Maori are a significant chunk of the population, I’m sure they do make up quite a share of the economy, but most assets owned by Maori people aren’t included in that headline-grabbing number (any more than my house is in some “European New Zealander economy”).

There is a similar degree of vacuousness about the references to the financial system. It all the feel of someone making stuff up to backfill another of the Governor’s whims.

What of some other stuff. Among the responsibilities of the cultural capability adviser this was listed first

Lead development and implement an institutional language plan for the Reserve

Bank of New Zealand

You do rather get the sense, reading through the documents, that Reserve Bank staff will be under pressure to learn Maori whether they want to or not. Again, perhaps there might be merit in that if the Bank were a customer-facing body dealing with (say) troubled families in the Ureweras, but this is the (wholesale) central bank.

I don’t suppose anyone (perhaps other than the Governor, and probably not even him – he’s smarter than that) really believes the nonsense front line rhetoric about better policy. It all seems much more about these “deliverables”

In other words, how “woke” can we be?

It is all pretty incoherent. For a start, there is that reference to the ‘growing multicultural nature of New Zealand”, and yet this is an explicit Maori strategy, with no hint of comparable ones for Chinese cultures, Indian cultures, South African cultures, Filipino cultures, Samoan cultures…..let alone, Muslim, Christian or atheist cultures. Another $1m for each perhaps? I thought not (and nor should there be).

Perhaps all this stuff will go down well among some in the Labour Maori caucus, in the further reaches of the Green caucus, and among some of those the Governor will be distributing largesse among. Perhaps Guyon Espiner will be a bit softer next time he interviews the Governor. But I find it harder to believe that this sort of strategy is going to, in any way, enhance the Bank’s standing in middle New Zealand. And nor should it. As for staff, I suspect there will be a selection process at work (perhaps a bit like the Treasury) – capable people who care more about serious analysis and policy (actually doing the Bank’s statutory job) will select out (or not be hired) and the place will increasingly be filled with cheerleaders for the Governor’s political and social agendas.

I don’t usually like to scoff at overseas travel budgets – there is often real value in building connections and relationships – but I had to in this set of documents. $40000 for international travel for a Maori strategy, when Maori culture has no substantial home but New Zealand, seeemed, shall we say, not exactly an abstemious use of public money.

Here is a graphic for the Governor’s Maori strategy

The writing is a bit hard to read, but it is just full of earnest trendy, rather unsubstantiated, feel-good stuff. Unconscious bias holds back the Bank’s policy outputs we are told. It would be fascinating to see the evidence base for that, including (for example) why it was an issue around Maori dimensions of the economy/financial system and not, say, Chinese, Indian or Fililpino bits. Fortunately, monetary and banking policy operate indiscrimately (in the good sense of that terms) – there is, for example, precisely nothing the Bank can do that will affect long-term unemployment at all, let alone differentially affect that of Maori. It is all a political front, using your money. But – bottom right corner – no doubt the Governor and has staff will be self-actualising in a humanistic way.

(Oh, and recall that that island – pictured in the top right hand corner – isn’t even New Zealand, but Bora Bora – the Maori strategy moving the Bank towards French Polynesia!)

I could go on, but I’ll leave it to anyone interested to plough through the verbiage (“we will actively seek to operate within the virtuous circle of sustainable economic development”, or references to “Cultural Security” – did this get lost from an MCH document?) and the rather non-questions (“Do Maori use cash differently to other people groups?” – perhaps Catholics, atheists, Freemasons. Green Party supporters, or lefthanders do as well, but why would we want to spend scarce public money to find out?).

One of the points former Bank of England Deputy Governor Paul Tucker made in his book, Unelected Power, that I wrote about quite a bit last year, is that when central bankers start pursuing issues that range well beyond their narrow areas of specific responsibility, they run a real risk of undermining the willingness of the wider community to let them (fallible individuals, with limited accountability) exercise the discretionary power in their core responsibilities. Sometimes people will agree with the errant central bankers on individual issues – I often agreed with the substance of what Don Brash was saying when he strayed off-reservation, even as I thought he was very unwise to do so – but over time it leaves a growing proportion of the population uneasy about overmighty public officials using platforms and money provided by all of us to pursue personal whims, personal social and political agendas. If we can’t have a central bank that (a) sticks to its knitting, and (b) does that knitting excellently, we might as well just hand all the powers back to the politicians. We elected them and can kick them out again. We just have to put up with the Governor pursuing his whims at our expense, with very few effective constraints.