A few weeks ago SNZ published the annual regional GDP data. These data don’t tend to get much coverage, partly because of the (probably inevitable) long publication lags (the headline data are for the year to March 2022, the sectoral data by region for the year to March 2021) and partly because the numbers are for nominal GDP only. One might also have feared that Covid lockdown and border closure effects would further muddy anything that could be taken from the last couple of years of data.

But the data are worth persevering with, and there are all sorts of interesting snippets one can find.

First, here is how the regional shares of GDP have changed this century to date (the first data available are for the year to March 2000). Bay of Plenty’s share of total national GDP has increased from 5.2 per cent in 2000 to 6.0 per cent in the year to March 2022.

The high placings of Waikato and Bay of Plenty weren’t a surprise, but I hadn’t expected to see three South Island regional council areas in the top six places, or that the South Island’s share of the national economy has actually increased this century. Most of the laggards are in the bottom half of the North Island, perhaps most notably Wellington – an area not only sustained by government spending and employment, but with local authorities and related lobby groups who’d like you to believe that Wellington was some sort of cool tech hub, and thus well-positioned for the 21st century.

(Eyeballing the data, Covid didn’t seem to have affected the rankings materially – numbers to March 2022 being much the same as those to March 2020).

Wellington’s decline has been fairly unbroken

On the other hand, here are a couple of idiosyncratic stories: big temporary lifts for Taranaki (Tui oil) and Canterbury (earthquakes make you poorer but generate a lot of (gross) new activity in the repaid and rebuild phase).

What about population shares?

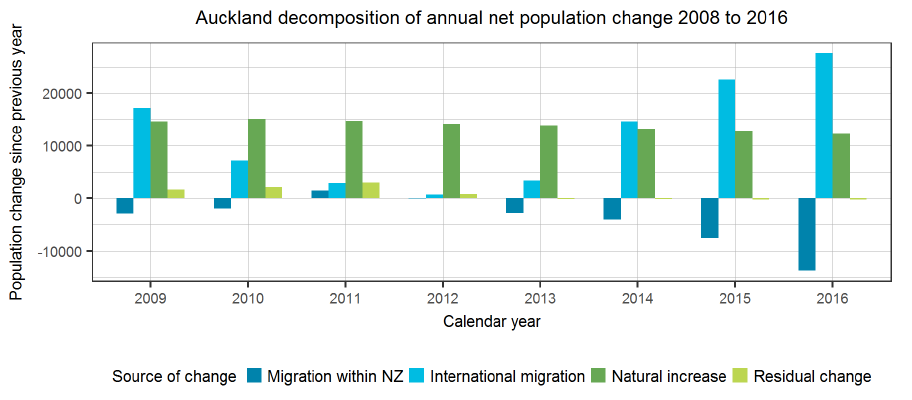

Here, a positive number means population in that region has grown faster than the national average (eg Auckland’s population has grown from 31.0 per cent of the total to 33.2 per cent). Almost all the above-average growth has been in the North Island, with some contribution from Tasman/Nelson, and Canterbury more or less holding its own. The bottom half of the North Island has again lagged behind. (At a regional council level, no area has had a fall in population over the century to date).

Of the bigger urban areas, Wellington has had the slowest rate of population growth (behind even Otago).

What of GDP per capita? The good news is that all the places that had GDP per capita above the national average in 2000 (Auckland, Wellington, Taranaki) were closer to the national average by 2022. and apart from Northland and Hawke’s Bay all the region with average GDP per capita in 2000 were at least a bit closer to average by 2022. Southland, which includes Queenstown, now has GDP per capita just a bit above the national average. Convergence…..it isn’t really that common these days. But it has happened here.

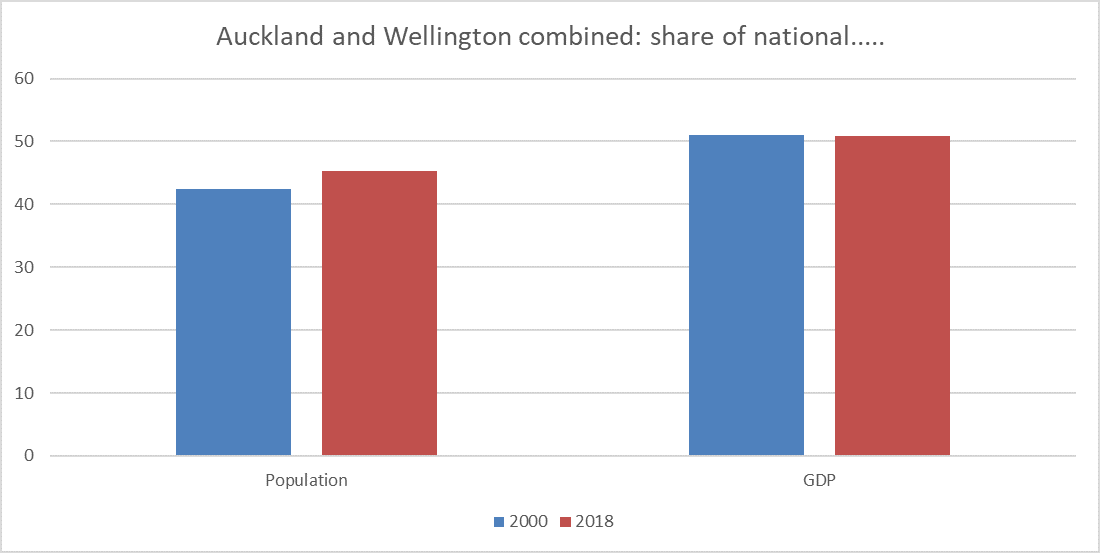

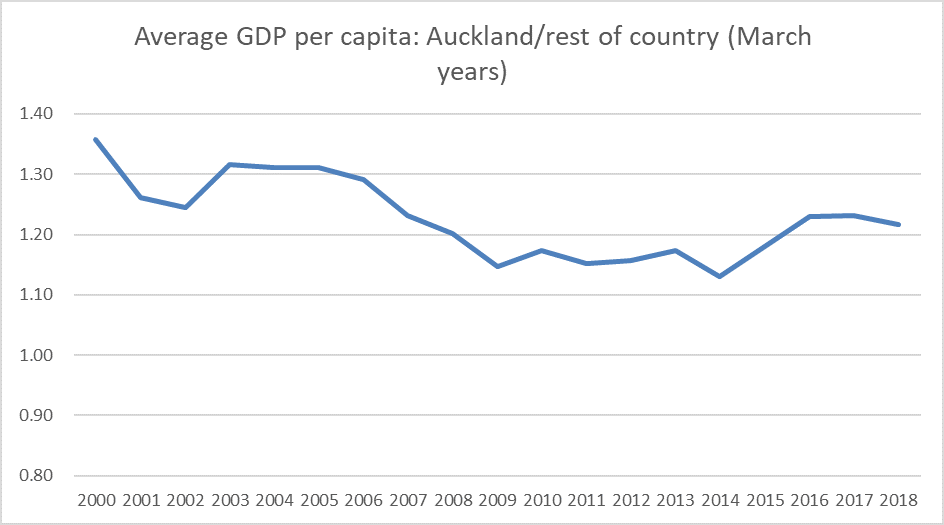

The biggest, by far, chunk of the population is in Auckland. Here is what has happened to average GDP per capita in Auckland this century relative to the national average.

My story on this data is that (a) it is quite heavily influenced by construction cycles (a smaller boom in the mid-00s and rising to record levels of construction now), but that (b) if anything the underlying trend is downwards. That second strand might seem a bold claim, but construction really has been at unprecedented levels in the last few years and GDP per capita relative to national average still isn’t back to 2000 levels. It will be fascinating to see what happens to this series over the next few years.

(More generally, and I have written on this before, the margin between GDP per capita in Auckland and the rest of the country is very small compared to what we see in almost all European countries’ biggest cities, and in places like New York and San Francisco in the US. All that talk of “one global city” etc simply isn’t reflected in the economic outcomes).

But if the Auckland story is underwhelming – not much sign of leading edge productivity growth etc – here is the same chart for Wellington

Yes, average GDP per capita is higher than in Auckland (now just), but look at the magnitude and sustained nature of the decline of the century. And a big chunk of Wellington’s GDP isn’t really subject to market tests.

The sectoral GDP data by region lag by a year and the latest data are for the March 2021 year. But here is a time series chart for a couple of key sectors, and one other.

Wellington has become more dependent on core government functions this century, and the category where you might expect to find all those high-tech industries (included the taxpayer subsidised film industry) has shrunk quite considerably as a share of regional GDP (almost as much of a shrinkage as in the share of manufacturing).

That tech-y looking sector has been shrinking as a share of GDP everywhere, and it is still a larger share in Wellington than in Auckland or the rest of the country, but it doesn’t seem like the sort of story the Wellington boosters would like to tell.

And if Wellington is more of a professional services sort of place than Auckland or the rest of New Zealand (lots of public sector consultancy services being sold?) nothing much about the experience this century stands out either.

And for those interested, here is the construction sector share of (nominal) GDP

There aren’t any big messages from this post (mostly just the fruit of fossicking in the data) except perhaps the continuation of the regional economic story of this century, the unbroken relative decline in Wellington – whether population, GDP, or GDP per capita, all accompanied by increasingly unaffordable housing, and all despite things like film subsidies and an increasing size of government. Without those twin subsidies, would Wellington have anything more going for it than Dunedin?