This afternoon brings the release of the Monetary Policy Committee’s latest Monetary Policy Statement and OCR decision. Most commentators expect the Bank to cut the OCR by another 25 points. I’m more focused on what they should do than on what they will do – the two can diverge for quite a while at times – and I’ve been consistently clear that the OCR should be cut further. If the MPC was wavering though, you’d have to suppose that they would want to avoid a second successive big surprise for markets which would – rightly – renew the focus on how poor their communications have been this year.

The last piece of data relevant to the decision was finally released by the Bank yesterday afternoon: their survey of the macroeconomic expectations of a few dozen supposedly somewhat-expert observers (of whom I’m one). As I’ve noted already, this release once again gives the lie to the repeated Bank claims of how open and transparent they are: survey responses were due on 22 October, the Bank could easily have had them a couple of days later at most, and yet they held the information to themselves – to no public benefit at all – until 12 November. As for private benefits/costs, having the information in public on a timely basis might have spared poor Westpac from going out on a limb calling no change in the OCR, only to reverse themselves yesterday. Market whipsawing, in the absence of data the Bank already had, serves no public benefit.

The expectations survey has been running, in one form or another (changing questions, big reductions in numbers surveyed) for more than 30 years now and provides a fairly rich array of data (although there are some important gaps – eg immigration, the terms of trade – the Bank refuses to remedy). We know that the surveyed expectations (mostly a quarter ahead, a year ahead, or two years ahead) aren’t in any sense accurate predictions about what actually happens in future. But neither are the Reserve Bank’s forecasts (and that isn’t a criticism of anyone: forecasting is hard, shocks happen). What they do provide is a useful read on how the somewhat-expert observer community sees things, in a reasonably internally consistent manner – eg answers about GDP or unemployment are presumably done simultaneously with (recognising two-way influences) views on the future OCR or the future exchange rate.

The headline news – well, only media coverage – in yesterday’s release was the further fall in (mean) inflation expectations. Two-year ahead expectations had fallen quite a lot in the previous survey, and there was no bounceback, just a further fall from 1.86 per cent to 1.81 per cent. You wouldn’t want to make much of it – dig just a little deeper and the median expectation didn’t change at all – but the absence of any bounce, especially coming on the back of the 50 point cut, explicitly linked to inflation expectations and a desire to keep them close to 2 per cent – should still have disconcerted MPC members.

And these weren’t inflation expectations conditional on the OCR remaining at the current 1 per cent. Instead respondents expect a 25 basis point cut today (median OCR expectation for the end of the year is 0.75 per cent) and a further cut next year. And they still expect no recovery in medium-term inflation (and in financial markets themselves, the implied 10 year average inflation expectations – the breakeven rate between indexed and nominal bonds – are still pretty close to 1 per cent, when the Bank’s target is 2 per cent).

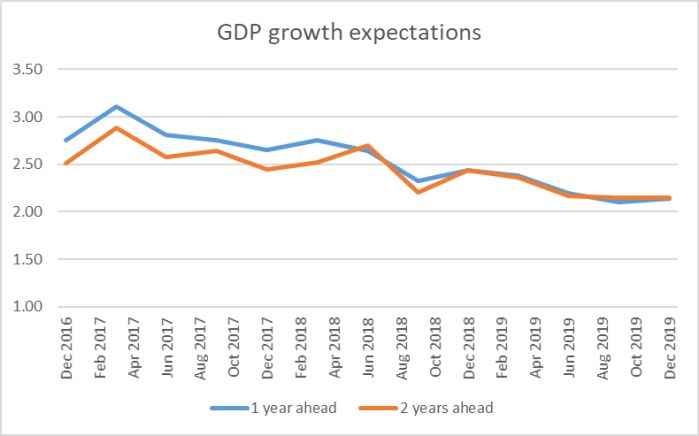

Consistent with this, there is no rebound expected in economic growth either, whether as a result of things already in train or of those further expected OCR cuts.

No respondents expected a recession, although the lowest individual expected 2 year ahead growth rate was as low as 0.6 per cent.

There wasn’t much sign of an expected strengthening in the labour market either (although those series have been volatile and the survey was taken before last week’s labour market data were published).

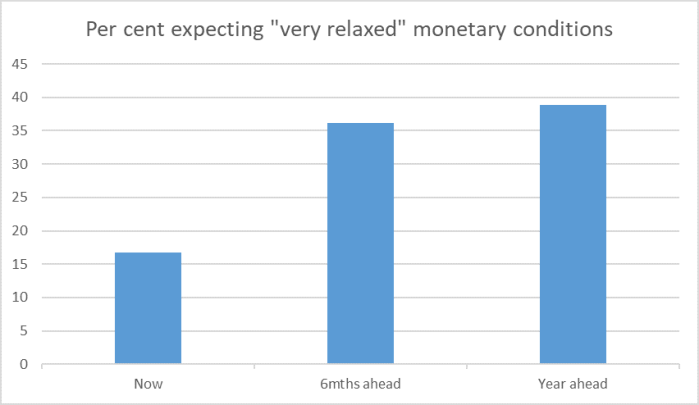

What about overall monetary conditions? The survey asks about assessments – on a seven step scale – as of now, and expectations for (on this occasion) the end of March and the end of September 2020 (the latter roughly a year ahead), “Monetary conditions” isn’t defined – it is up to each respondent to factor in things considered relevant. What was striking this time was the sharp increase in the proportion of respondents expecting monetary conditions to become “very relaxed”

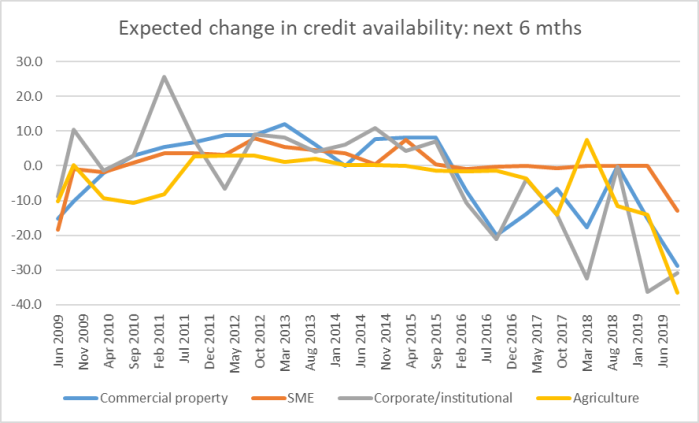

I was left wondering what weight respondents were giving to tightening credit conditions (this chart from the Bank’s credit conditions survey, also released after the expectations survey was done)

But whatever went into those “monetary conditions” answers, they weren’t producing an expected rebound in either growth or inflation.

In a speech a couple of weeks ago the Bank’s Assistant Governor ran one of his boss’s frequent lines bemoaning the risks central banks face if they simply follow short-term market prices (since those prices themselves include market implicit expectations of what central banks will do). It was – and is – a real but overstated point. But it is also where surveys of macroeconomic expectations are relevant and useful, not subject to the same critique. This pool of respondents – with no better or worse information on average than the MPC – expressed not just expectations for the OCR but for overall monetary conditions, and for economic activity and inflation. So they factored in what they expect the Reserve Bank to do, and are (in effect) feeding back a collective assessment that it really looks, at best, like barely enough. Who knows why: perhaps expected adverse world developments, perhaps more initial weakness here, perhaps a weaker transmission mechanism, but the data (expectations) are there for all to see.

Against that backdrop the MPC would really have to produce a quite compelling alternative narrative to justify not cutting the OCR further now, perhaps especially when there isn’t another review until February.

(As I’ve noted before, there is a rich amount of data in this survey not open to the public. For example, on the OCR expectations question at least one respondent expected the OCR to be zero by September and another for it to be 1.25 per cent. It would be fascinating to see the – one hopes consistent – forecasts of each of those respondents and the stories that underpin them. Reminding ourselves of the sheer uncertainty of the future, and the possible stories that might underpin such alternative outcomes, can be a useful discipline.)