In my post yesterday, I noted (with illustrations) that looking back over at least the last 20 to 25 years:

…our interest rates (a) are and have been higher than those abroad, (b) this is so for short and long term interest rates, (c) is true even if we look just at small countries, and (d) is true in nominal or real interest rate terms. And the gap(s) shows no sign of closing.

Not much about that is really controversial at all. But quite why these gaps have been large and persistent is more contested. It isn’t the sort of stuff the mainstream media focuses on – they tend to be more interested in the historically low level of (New Zealand and foreign) interest rates – but getting to the correct answer matters, not just analytically but in thinking about policy responses to New Zealand’s long-term economic underperformance.

In thinking about the issue, it is important to bear in mind a few things:

- short and long term interest rates are related, and there can be information in the relationship between them,

- short-term interest rates are set by the central bank in response to (perceived) domestic inflation pressures, and

- interest rates in different countries are related at least in part, by expectations (implicit or explicit) about movements in the exchange rates between those two countries’ currencies.

Broadly speaking, I think there are three hypotheses that are canvassed when these issues are discussed in New Zealand (and there is a fourth, suggested by some recent literature, that a few commenters here have raised).

But first, lets clear away some of other possible answers.

The explanation isn’t domestic monetary policy. Sometimes people have argued that (a) our target was more demanding than those in other countries, or (b) that our Reserve Bank was excessively “hawkish”, inclined to see inflation under every stone, and so holding short-term interest rates persistently higher than they need to be. In fact, our inflation target is very similar to those in most other advanced countries. The Reserve Bank makes mistakes – sometimes they even persist for a couple of years – and sometimes gaps between our interest rates and those abroad are affected by those mistakes. But other central banks make mistakes too (all of them are human, with much same limitations). And taking a longer-term perspective, on average over time our Reserve Bank actually delivered inflation outcomes a bit higher than the target they’d been given. Given the target, monetary policy (pre-2008/09 was typically a little loose (since then it has probably been a little tight). All in all, differences in monetary policy conduct or targets just can’t explain those persistent differences in real interest rates.

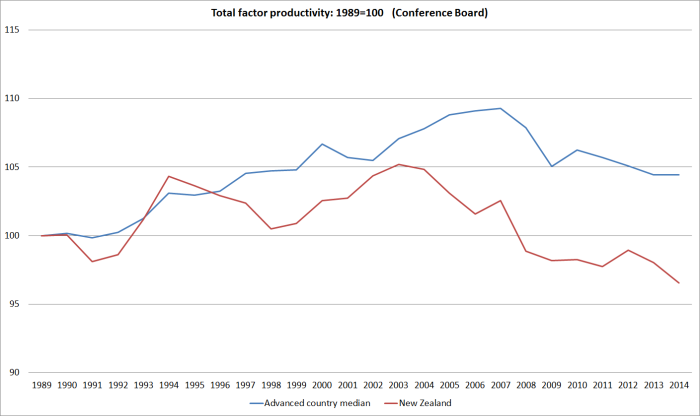

There is another possibility that be cleared away even more quickly. If a country had very strong persistent productivity growth it would tend to have higher interest rates than would be seen in other countries. There would be lots of profitable investment opportunities in that high productivity growth country, lots of (expected) income growth to consume in anticipation of, and so on. And over time, that high-productivity growth country could expect to see its real exchange rate rise. Unfortunately, high productivity growth isn’t the story of New Zealand in the last few decades. Indeed, more often rather the reverse.

Here is a chart I haven’t shown for a while: total factor productivity for New Zealand and for a median of the large group of advanced countries for which the Conference Board has estimates back to 1989.

Rapid productivity growth isn’t even close to a relevant story explaining New Zealand’s persistently high real interest rates.

There is another possible story which hasn’t really entered the mainstream of the New Zealand debate, but should be covered off for completeness. It notes that New Zealand is a small country, with quite a volatile terms of trade, and that the currencies of such countries offer less good diversification opportunities, suggesting that anyone investing here would require a higher return than elsewhere. It sounds initially plausible, but it has a number of problems. The first is that our interest rates have been persistently higher than those in other not-large countries with their own currencies (I showed the chart against the median on Australia, Canada, Sweden, and Norway in the previous post). And the second is that if this were an important channel, it would suggest that small countries face a higher cost of capital than large ones, which would limit the growth prospects of small countries. But (badly as New Zealand specifically has done) there is no real sign that small countries typically grow (per capita, or per hour worked) more slowly than large ones. At present, I don’t think it is a particularly strong candidate to explain New Zealand’s persistently high interest rates. Apart from anything else, if this were the story, why would New Zealand have accumulated – and maintained – such a large negative net international investment position (NIIP) (still among the largest of the OECD countries)?

Perhaps somewhat related, but from an older set of models, is the idea that New Zealand has some combination of persistently good investment opportunities, and modest national savings rates, and requiring foreign funding for such opportunities needs to pay a premium rate of return. It is nothing to do with specific New Zealand risks (small, volatile etc) simply that capital needs a premium to attract it away from home, no matter where home is. Again, it sounds plausible, but runs into some problems. Perhaps the most important is that this story cannot explain why the real exchange rate should also have been persistently high (on a pure time series basis for at least the last decade, but relative to the growing productivity differentials for rather longer than that). Typically, part of the way New Zealand might attract the foreign capital it needs is through some mix of a lower (than usual, or easily explainable) exchange rate, and higher interest rates: from a foreign investor’s perspective it is the total return that should matter, not just the interest rate. Senior Reserve Bank people have, at times, sought to invoke this explanation as at least part of the story.

A more prominent explanation for New Zealand’s persistently high interest rates points to the large negative NIIP position and asserts that the explanation for high interest rates is pretty straightforward: lots of debt means lots of risk, and hence the need for a substantial risk premium on New Zealand interest rates. Taken in isolation – if someone told you only that a country had a large negative NIIP position this year – it might sound plausible. Once you think a bit more richly about the New Zealand experience it no longer works as a story.

First, our NIIP has been large (and negative) for a very long time now – for at least the last 25 years, and over that time there has been no persistent tendency for the NIIP position to get better or worse. By contrast, 20 years earlier than that New Zealand had almost no net foreign debt. The heavy government borrowing of the 70s and 80s had markedly worsened the position. It is quite plausible that foreign lenders might then have got very nervous and wanted a premium ex ante return to cover the risk. In fact, we know some (agents of) foreign investors got very nervous – there was the threat of a double credit rating downgrade in early 1991. But when lenders get very nervous, borrowers tend to change their behavior, voluntarily or otherwise, working off the debt and restoring their creditworthiness. And in New Zealand, the government did exactly that – running more than a decade of surpluses and restoring a pretty respectable government balance sheet. But the large interest rate differential has persisted – in a way that it did in no other advanced country (including those that went through much worse crises and threats or crises than anything New Zealand has seen in the last 25 years).

We also know that short-term interest rates are set by the Reserve Bank, in response to domestic inflation pressures. But long-term interest rates are set in the markets. If investors had really been persistently uneasy about New Zealand’s NIIP position, we might not have seen it much in short-term interest rates, but should certainly have expected to see it in the longer-term interest rates. (That, after all, is what we see in various euro countries that have lapsed in and out of near-crisis conditions). But one of the other features of the New Zealand experience is that over the last 25 years is that New Zealand’s long-term interest rates have been a bit lower relative to New Zealand’s short-term interest rates, than is typically seen in other countries. In one obvious place one might look for direct evidence of such a risk premium, it just isn’t there.

In fact, on this measure we look a lot more like Norway – which has a huge positive NIIP position (net foreign assets) and very little government debt.

In fact, on this measure we look a lot more like Norway – which has a huge positive NIIP position (net foreign assets) and very little government debt.

And remember, too, the point I made earlier about the exchange rate. When risk concerns about a country/currency rise, one of the first things one typically sees – at least in a floating exchange rate country – is a fall in the exchange rate. It is a bit like how things work in equity markets. When investors get uneasy about a company, or indeed a whole market, they only rarely succeed in getting higher dividends out of the company(ies) concerned. If the companies were sufficiently profitable to support higher dividends the concerns probably wouldn’t have arisen in the first place. Instead, what tends to happen is that share prices fall – and they fall to the point where expected dividends, and the expected future price appreciations of the share(s) concerned, in combination leaves investors happy to hold those shares. In that process, an increased equity risk premium is built into the pricing.

At an economywide level, if investors had had such concerns about the New Zealand economy and the accumulated net debt position, the most natural places to have seen it would have been in (a) higher long-term bond yields, and (b) a fall in the exchange rate (and perhaps a persistence of a surprisingly weak exchange rate). But we’ve seen neither in New Zealand. Had we done so, presumably domestic demand would have weakened, and net exports would have increased. The combined effects of those two shifts would have been to have reduced the negative NIIP position, and reduced whatever basis there had been for investors’ concerns. Nothing in the New Zealand experience over the last 20 years or more squares with that sort of story.

And that is the really the problem with the most common stories used to explain New Zealand’s persistently high interest rates. They simply cannot explain the co-existence of high interest rates and a high exchange rate over long periods.

My alternative approach seeks to do so.

It involves looking at the stylized facts and suggesting that perhaps they point in the direction of an abundant supply of credit from abroad (perhaps something almost like the horizontal supply curve of the textbooks), combined with some factors that give rise to persistently strong demand for scarce domestic resources. That in itself shouldn’t really be terribly controversial. There are pleasing stories which, if true for New Zealand, would produce that sort of combination. If New Zealand individuals and firms were generating a world-beating stream of new ideas and business opportunities, business investment would be strong, productivity growth would be strong, and a “strong demand meets ready supply” story would have everyone nodding approvingly. But….we know that productivity growth has been persistently weak (there are good years and bad ones, but the trend story is pretty disappointing) and business investment has also been weak (in long-term cross-country comparisons). And with that disappointing productivity growth, households also wouldn’t have been rationally consuming in expectation of even stronger future income growth than we see in most countries.

So I’ve suggested looking at “demand shocks” instead, and particularly those that might arise from outside the system (the private economy), focusing on activities/choices/initiatives of government. Governments are not as responsive to market prices as the rest of us.

Again, there is nothing overly controversial about this idea in principle. A big increase in domestic government spending on goods and services, for example, will tend to push up the real exchange rate, and quite possibly push up domestic interest rates as well. My favourite example is prisons. Relative to a no-crime hypothetical, a government that finds itself needing to build more prisons, needs to get command of the resources to build those prisons, and then staff them. Doing so will tend to bid up the price of domestic goods and services (including labour) – and raising the price of non-tradables relative to tradables is one of the definitions of the real exchange rate. Resources used for building and staffing prisons (and actually, the people imprisoned and no longer in the labour market) can no longer be available for generating tradable products. The higher real exchange rate squeezes some of that production out.

But my specific version of the demand story looks at our immigration policy. Government decisions on how many non-New Zealanders too admit each year – themselves largely reached independently of the state of the New Zealand business cycle – can be presented, quite reasonably as a “demand shock”. The net impact of additions to the population from outside the system – births are conceptually a little different – tends to boost demand more than it does supply in the first couple of years after the migrant arrives. And if there was simply one wave of migrants – as in some of the events studied in the literature – the effects would wash through fairly quickly. But in fact, we have a new large wave each year, and have had really ever year since around 1990 (immigration was being liberalized over several years around that time). Each new migrant needs – just as they did at time Belshaw was writing – quite a lot of new physical capital (houses, roads, schools, offices, factories etc) and they bring almost none of it with them. Additional demand for those real resources has to be met by squeezing out other forms of demand – and that is what persistently higher real interest rates and exchange rate tend to do. The fuller version of my story was in a paper I wrote a few years ago for a Reserve Bank and Treasury forum on exchange rate issues.

Some people worry that I must be assuming some irrationality or market failure (crutches which, quite rightly, economists are wary of relying on). But I’m not. Recall that the active agent here is mostly a body outside the market: the government, which for whatever reason decided that it wanted to bring in 45000 to 50000 non-citizens per annum. The people who come are presumably being quite rational. The people whose firms respond to new fixed capital demands (and other requirements of a growing population) are being quite rational. There is quite real new demand in front of them. The central bank which raises interest rates, and the markets which push up longer-term interest rates, are also presumably being quite rational. There is more demand pressure in the New Zealand economy. Perhaps the one area in the story that is a bit of a surprise is that long-term interest rates haven’t stayed up as high, relative to short-term interest rates, as we might expect. I’m not sure why that is – but it is a hard observable fact, present in the data without any need to torture it first.

My own hypothesis – and it is pretty tentative – is that few people in international markets really realise the importance of persistently high immigration in boosting demand. And most of them – quite rightly – operate with a mental model that envisages convergence with world real interest rates in the long haul. If immigration policy were overhauled and drastically cut back, exactly that sort of long-term interest rate convergence would occur. In a way, it might be just as well that many investors haven’t quite realized – over many years – how persistently large the gap between New Zealand and world interest rates would remain. If they had (or even did today), the rational response would have been to bid the exchange rate quite a lot higher than it has actually been. Investors – and international agency experts – have often expected New Zealand’s exchange rate to come down, partly because they kept, mistakenly, expecting the interest rate convergence that never happened (yet). Expectations drive pricing, and if people think the interest rate gap will remain larger for longer, relative expected returns on different assets are only roughly equalized if the exchange rate goes still higher now, so that it can fall further some time in the future.

Is my story the correct one? I don’t know, but I’ve been running it now for six or seven years, and as the ideas have had more exposure I’ve not been presented with any counter-arguments or evidence that would undermine my sense that “repeated demand shocks” (largely resulting from our immigration policy) are a material part of the story for why our interest rates have remained so persistently high relative to those in the rest of the world. It is a difficult story to test in a formal empirical way – something that probably frustrates me as much as it does some of the sceptics – partly because it isn’t some generalized global story about all immigration everywhere, but about how events and policy interventions have unfolded in his specific economy, with its own specific set of other stylized facts (including, for example, the modest national savings rate).

Like all hypotheses, mine is put out in part to prompt reactions, to identify holes in other stories, and to help prompt alternative, perhaps richer, stories. For now, however, I’m pretty confident that mine is the only one of the stories on offer that can reasonably account for the combination of:

- persistently high (relative to other countries) real interest rates,

- a persistently high real exchange rate,

- long-term interest rates lower relative to short-term rates than is typically seen,

- a high (almost entirely private) negative NIIP position,

- all over a period where productivity growth has continued to lag behind that seen in most other advanced countries.

It might not be the whole story, but it feels a lot like a significant step towards such a story.

An interesting article. I just wish you’d had more fun with the sentence “..births are conceptually a little different…”

LikeLike

Careful, Michael — you wrote in the second bullet point: “short-term interest rates are set by the central bank in response to (perceived) domestic inflation pressures”

Am I wrong in saying that the RBNZ does not set interest rates, but rather, tries to influence interest rates by altering the OCR? And am I wrong in asserting that the OCR is a clumsy tool at best?

Am I wrong in asserting that a full sovereign money system would be more efficient than the present bank-created debt-money system? After all, in a full sovereign money system the RBNZ would have direct control of the quantity of money in circulation, so as to keep CPI inflation almost always within the government-set target band. Am I wrong in asserting that potential economic growth would be higher as businesses would be able to retain more profit with which to finance expansion, without so much reliance on debt-money issued by banks?

LikeLike

The Rb sets, directly, the OCR, which indirectly influences other interest rates. As my post the other day on projections showed, the transmission to say 90 day rates is quite tight. And even for longer-term rates there is a signfificant influence over time. The biggest single proximate factor explaining why our long term rates are persistently higher than those are is that our OCR is – and is expected to stay – higher than comparable policy rates abroad. Quite why that is is the focus of this post.

The OCR was never envisaged as a tightly calibrated control mechanism, but rather an indirect mechanism.

LikeLike

Perplexing topic. A couple of thoughts:

i) the link between higher productivity and higher interest rates; if productivity is about a greater volume of output with the same inputs, it is growth that increases but not necessarily interest rates; alternatively, given productivity mainly occurs within businesses, assuming unit mark-ups are constant, higher productivity would imply the likelihood of falling prices, lower inflation, and lower policy rates?

ii) overall portfolio flows seem to play a role in the real exchange rate path e.g performance of the NZX from the GFC lows?

iii) NZ external debt is mainly via the banking sector – for the ‘risk premium’ argument, would it make sense to look at NZ bank credit spreads through time relative to banks in other currency areas?

LikeLike

Hi Michael, have you looked at the Israeli experience with high levels of immigration in the early 90s? Some of the stylized facts you describe for NZ look qualitatively similar to some of the stylized facts for Israel in the early 90s. There is a paper by Hercowitz and Yashiv that makes note of the real appreciation that occured in the exchange rate during this period (http://ftp.iza.org/dp475.pdf). A paper by Cohen and Hsieh (http://www.biu.ac.il/soc/ec/wp/11-01/11-01.pdf) makes note of the lower capital to labour ratio that occured due to higher immigration, which resulted in higher interest rates over that period.

LikeLike

Thanks. YEs, the Israel experience is interesting, both in the really large surge in the early 90s, and the ongoing quite high rates of immigration. For the former, I don’t think anyone really doubts the sorts of effects I write about – but those effects would be one off and wash through after a few years. the more interesting question is what happens if you keep on having a new quite large wave of migrants each year. Context matters too. In a high saving economy – Singapore for example – labour and savings are natural complements. In NZ, we’ve had lots more labour and only modest savings rates.

Israel is also an interesting economic underperformer – long-term productivity growth about as bad as that in NZ despite all the high tech hype. I would suggest rapid population growth is the whole story, but I doubt it has helped much.

In the other direction, is the experience of countries with significant migration outflows and flat or falling populations (eg much of Eastern Europe). There is an argument that by taking pressure off domestic resources, that outflow helped those countries lift productivity and per capita income for those who stayed. I touch on that briefly in my 2013 paper linked to in the post.

LikeLike

Tourists targets have now lifted to 7 million within the next 7 years. So you think that has no impact on short term resources and the NZD with the corresponding higher interest rates? 10% to 15% annual growth in numbers and no new hotels. Auckland has been commented on RNZ this morning to become a mega city as the gateway city into NZ.

LikeLike

Micheal, you refer alot to NIIP but you have never provided any numbers that break down what this is made up of or where the RB takes this NIIP into consideration. The RB makes no reference to NIIP within their statistical analysis.

All I get which is quite clear to me is that NZ Households have $156 billion in cash savings deposits against House debt of $139 billion from RB statistics. Interest rates have been held up probably because there are more people with savings deposits than debt beholden and politically therefore keeping interest rates higher wins the popular vote.

LikeLike

The tables at this link will give you detailed numbers.

http://www.stats.govt.nz/browse_for_stats/economic_indicators/balance_of_payments/BalanceOfPaymentsYearEnded_HOTPYe31Mar16.aspx

I will try to write something about the data soon, and what they are (and aren’t) useful for. From an Rb perspective, they tend to cite them mostly in a financial stability context.

LikeLike

Logic then dictates that with higher savings than debt, higher interest rates encourage higher consumption and contribute to higher inflation at least from savers working quite the reverse to what was intended because of this unfounded assumption by the RB that NZ is a poor indebted nation.

Todays NZHerald puts New Zealand at the very top of the list of nations in prosperity.

“New Zealand has ranked first in the Prosperity Index for six of the last ten years

.New Zealand has had the biggest prosperity surplus in the world every year for the past decade. This surplus has grown slightly since 2007, indicating that New Zealand is delivering ever higher levels of prosperity with its growing wealth.”

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11741682

LikeLike

A couple of thoughts: –

1) I wonder what would happen if NZ fully taxed interest payments to overseas investors rather than the 2% tax that can be levied? What would interest rates/exchange rate do?

2) If I understand your immigration argument correctly, then I perceive a problem with it. Surely it would have to relate to net immigration, as I don’t see there being any significant increased demand if one person leaves NZ and another arrives. There is no need for extra hospital beds, schools, roads, utilities, houses etc. Arguably their might be a small increase in purchases of new TVs (by immigrants), and sales of used TVs (by emigrants), but I don’t see that activity as being significant. But if 100k arrive and 50k leave, then I can see that the net 50k could have an impact. But if I read the data correctly NZ’s net PLT immigration has been pretty low, apart from a few blips, for at least 30 years.

LikeLike

The 2% tax you refer to on overseas interest is not a tax. It is a deduction for Approved Issuer Levy payable by the bank as a borrower of overseas funds. More akin to a Levy payable to the Government but recovered from the lender.Original intent of AIL to facilitata the issuance of bonds and interbank lending but has now applied to overseas deposits. That AIL rate is now Zero. The 2% is now Zero percent.

LikeLike

Re your tax question, I used to have all that worked out in my mind, but it was a very long time ago now. To a first approximation, I think it would result in a lower exchange rate, but wouldn’t make much difference to NZD interest rates (which are set domestically in relation to actual/expected inflation pressures). Arguably, long-term govt bond yields might be a bit higher, since those bonds are (currently) largely held by foreign investors. But I’ll think some more about it.

Re the interest rate story, I probably should be a little more specific (but in that post was mostly trying to establish the probable importance of a sequential demand shocks story, rather than rehashing at full length the immigration story.

Yes, clearly it is overall savings and investment tendencies that drive interest rates, rather than simply any component in isolation. I wouldn’t accept your characterization of the net PLT inflows as typically “pretty low”, but agree that they are important. It is worth remembering that our overall population growth in NZ has been pretty rapid in the last 25 years (not the highest in the OECD but upper quartile), and we haven’t had (say) an upper quartile savings rate to match.

You might recall from the post my emphasis on the idea of some force “outside the system”. My proposition – with, I think, some fairly good support from econ theory – is that left to itself the private economy would tend to converge to where theory suggests it would go: the real exch rate would have fallen roughly in line with our poor productivity performance, and real interest rates would tend to have converged towards the world. The “private economy” here includes the choices of NZers to go or stay, and to invest in NZ or not. But something seems to keep pushing our economy away from that sort of convergence: my suggestion is that it is the government-controlled bit: ie the inflow of non-NZers, that is explicitly policy controlled. Our controlled inflow is certainly large by historical standards, and looks doubly anomalous because it involves the govt trying to push things in the opposite direction to the private economy (people leaving NZ, as in the past say they left Taihape or Invercargill).

It is not a general proposition that all high immigration countries will have high real interest rates. Demonstrably they don’t. One needs to know the contextual situation in each of those countries. For example, as I often note, in Singapore they have a very high savings rate, which would if anything seem likely to drive interest rates below world rates, In Singapore high rates of immigration seem to offset that tendency – savings and additional migrants (in a country with lots of econ opportunities thanks to location etc) are complements. That doesn’t seem like the story in NZ – where the opportunities don’t seem great, accordingly the savings rates are modest, and yet the govt keeps intervening to jam more people in.

I might try a fuller post addressing this point – since it is one that often comes up in one form or another.

LikeLike

Singapore has a high savings rate driven by compulsory superannuation that is variable dependent on strength of the economy. Employer and Employee super contributions hit a high of 30% pre GFC but has now been adjusted post GFC to 16% . Compared to our meagre 3% employer contributions plus another 3% employee contributions, no wonder our savings rate is akin to a retirement into poverty.

LikeLike