For some reason the other day I was prompted to have a look at how many research papers the Reserve Bank had published in recent years. This chart resulted.

Only one in the last two years, and that one paper – published last February – had five authors, four of whom worked for other institutions (overseas). It was really quite staggering. It wasn’t, after all, as if there had been no interesting issues, policy puzzles or the like over the last two years. It wasn’t as if universities had suddenly stepped up to the mark and were producing a superfluity of research on New Zealand macro and banking/financial regulation issues. It wasn’t even as if the Bank had suddenly been put on tight rations by a fiscally austere government – in fact, the latest Funding Agreement threw money and the Bank and staff numbers have blown out. Rather, or so it appears, management just stopped publishing research.

These research Discussion Papers are usually quite geeky pieces of work, formal research that is subjected to some external review before publication, and often written with the intention of being of a standard that might be submitted to an academic journal. The Reserve Bank had put quite an emphasis on this sort of research (mostly on macroeconomic matters) for probably 50 years, as one part of the sort of analytical work that underpins its policy, operations, and communications.

Of course, what ends up in published research papers like this isn’t all the thinking, analysis, or even research that the Bank has been doing – ever, not just now. Apart from anything else, they have a variety of other publications, including the Analytical Notes series that was started up a decade ago to fill a gap (for example, less-formal research, often with shorter turnaround times), and even the Reserve Bank Bulletin which had had a mix of types of articles, but itself appears to have been in steep decline. There are speeches from senior managers, but as I’ve pointed out previously these days these are few and rarely insightful (not much research, here or abroad, informs them). There will be other analysis and research that simply never sees the light of day – the Bank not being known for its transparency – but what appears in public is likely to be an indicator of what does (or doesn’t) lie beneath the surface. The Bank still has some staff who appear to have formal research skills – indeed a year ago they recruited one of New Zealand’s best economists apparently to work on preparations for the next review of the monetary policy Remit – but what we see is thin pickings indeed. Most of most able researchers of the last decade have left, and as far as I can see there is no one working in the research function with any long or deep experience of the New Zealand economy and financial system.

Recall that the previous Governor espoused a goal that the Bank should be not just adequate but the “best small central bank” in the world, while the current one often reminds people of his mantra “Great team, best central bank”, suggesting a vision not even constrained by the (small) size of New Zealand.

Does any of this matter? I could probably mount an argument that much of what the Bank is charged by Parliament with doing could, in principle, be done with little or no formal research (of the type that appears in Discussion Papers). In principle, a keen appetite for the products of overseas research, a climate that encouraged debate and diversity of ideas, active engagement with other central banks, and a steady flow of less-formal analysis wouldn’t necessarily lead to particularly bad outcomes. And having been around in the days when the Bank was doing some world-leading stuff (notably inflation targeting, but also some of the bank regulatory policies) it is fair to note that little or none of that drew on (or was reflected in) formal RBNZ Discussion Papers.

But it isn’t really the standard that we should expect these days, nor is there any sign that people in other countries do. It is not that a single research paper is likely to decisively change any particular policy setting (perhaps not even 5 or 10 would) and many of the papers might go nowhere much at all. But a flow of formal published research is one of the marks of an institution that thinks, that has an intellectually vibrant culture, that is open to new ideas etc etc. And on some policy calls, we really have a right to expect that the Bank – with huge amounts of policy discretion, and quite limited accountability – is doing world-standard research of its own, and/or commissioning it from others, and making that research available for challenge, scrutiny etc. One might think here of appproaches to bank capital policy, where the current Governor took a bold non-consensus decision, but where the institution has no published record of any substantive serious research. Sometimes these things might just be about trying to find frameworks that make some sense – never all of it – of what has been going on, or bringing formal evidence to bear on (for example) what the LSAP has accomplished.

But, these days, there is little sign of any of it from our central bank – and as a straw in the wind, it is at one with a record of few (and rarely good) speeches, inaccessible MPC members (themselves ruled out from doing research), and policy documents that rarely seem to reflect robust analysis.

Of course, one can expect formal research outputs to fluctuate a bit from year to year. Topics come and go, immediate management priorities come and go, particularly able and productive researchers come and go. But one paper (and that mostly co-authored) in two turbulent years isn’t a sign of an institution that any longer takes seriously generating research output, or the sort of climate that makes an institution attractive to really able people.

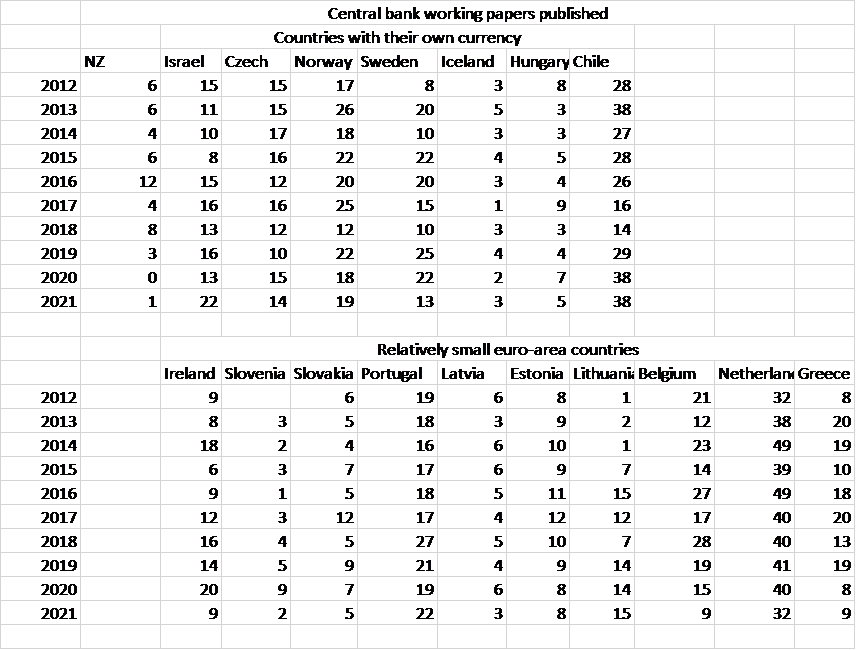

What about other countries? I went counting.

Much discussion in New Zealand compares us to other Anglo countries, and in central banking terms, Australia, Canada and the UK have had similar (inflation-targeting) macro policy frameworks.

Of course, each of these are much bigger countries than New Zealand (and on that basis one might think the RBA rather light on its published research) but (a) there aren’t huge economies of scale in central banking (our economic puzzles can be just as intractable as those of much larger countries), and (b) both the RBA and the Bank of Canada have a narrower range of policy responsibilities than the Reserve Bank of New Zealand.

So how does the RBNZ compare with the central banks of other small advanced countries?

Central banks of very small countries (in this case, Iceland and Slovenia) have tended not to publish much formal research – although still more than the RBNZ in the last couple of years – and one might wonder at the budgetary priorities of the central bank of Lithuania (just under three million people and without a monetary policy of its own), but even before this decade the flow of formal research from our central bank looks to have been at low end of what one might expect given (a) our population, (b) the wider range of issues the RB is responsible for, and (c) the idiosyncratic nature of some aspects of our economy. There is no single right or wrong volume of formal research, but next-to-no published research simply looks like a dereliction of duty. (One might have hoped that a Board chaired by a university vice-chancellor – one with a reputation of getting research metrics looking good – might have raised questions, but…….this is the mostly-useless Reserve Bank Board.)

Again, does it matter? In my more cynical moments over the years I used to observe that perhaps the main difference inventing inflation targeting made was that we subsequently got invited to a better class of international conference. It might not sound much, but it is a straw in the wind for something that really does matter – the connectedness of the institution, the exposure to ideas, the ability to get leading people to take an interest and visit etc etc. We used to have that. Not all the conferences were useful, not all the visitors were useful, and so on, but becoming known as a central bank that (a) rules out from its MPC anyone with ongoing expertise in monetary policy, (b) publishes hardly any serious research, and (c) where senior management, if they speak at all (recall that the chief economist gave not a single published speech), make only the lightest-weight speeches isn’t a recipe for keeping engaged with the world, or the flow of ideas or research. When you are all already small, remote, idiosyncratic, and not as rich as Croesus (we can’t just throw money at potential visitors) it is a poor lookout.

These outcomes must have been the result of deliberate decisions. They need not be forever. Capability can be rebuilt, although doing so in an enduring way takes time and leadership. Who Orr appoints to the current key vacancies is likely to reveal quite a bit as to whether the Governor has any interest in creating a research-informed Reserve Bank, across the range of key policy areas he is responsible for. If not – and most likely not – it will be another sign of a deeply troubled institution, taking a similar path of decline to too many other New Zealand institutions in recent years. Responsibility for that rests not just with individual officials, but with a government (and Minister of Finance in particular) who seems not to care.

Seems like that old chestnut: ‘More research is needed’ really is true!

Hope you are well Michael!

LikeLike

Thanks Rodney. I couldn’t see the image you attached.

Re Geoff, yes I could write a critical post if I were inclined (and have on some things previously). As I understood it he left SNZ in really big financial difficulties and got out just in time. (That said, Liz McPherson seemed like a typical SSC appointee these days). But – and your comments align with this – he seemed to be a wily political operator (merits of which prob depend on whether he is on your side or not!), and I have heard National MPs speaking quite highly of him (perhaps only relative to Orr and perhaps Wheeler: I’d certainly regard him as the one figure of stature at the Bank since Grant left.

As for my health, mostly better but apparently little resilience. Driving 2/3rds of the way to BoP at Christmas knocked out (2-3 naps a day) for a week, and driving 2/3rds of the way home again (both times with a teenage driver to help) had much the same effect. One day….I will be fully right.

LikeLike

The introduction of karakia and incantations as a regular feature of the RBNZ’s daily cultural activities is unlikely to benefit the intellectual outputs of the organisation.

LikeLike

Reblogged this on Utopia, you are standing in it!.

LikeLike

[…] Croaking Cassandra Blog writes on the declining research output at RBNZ: […]

LikeLike

Research, and the evidencing of it, might not always lead to the correct decision, but it helps improve the odds as it (should) create an environment of debate and challenge around the backdrop to some of those decisions. As Einstein noted, “If we knew what it was we were doing, it would not be called research, would it’. Perhaps the omnipresent RBNZ has taken the deity metaphor literally and knows all, about all things…. unfortunately recent outcomes suggest otherwise.

Proverbs 12-15 anyone?

LikeLiked by 1 person