My wife and son were watching the rugby test on Saturday evening but, not being overly interested in rugby, I started paying attention to the companies that were advertising at the ground.

All Blacks tests are one of the international showcases of New Zealand, with a substantial overseas broadcast audience. And that particular test was against the Wallabies, and Australia is the largest export market for New Zealand firms’ goods and services.

I can’t be sure I jotted down all the advertisers: I was dependent on the camera angles Sky showed and I wasn’t paying rapt attention to every second of the game.

But these were the companies/brands whose adverts I thought I spotted:

AIG, Adidas, American Express, Ford, Mobil, Asteron Life, DeWalt, Stihl, KitKat, Gatorade, Kia

Kennards, Owens, Resene, ASB, Pacific Build Supply, Bedpost, Barfoot and Thompson, Drymix, Rebel Sport, G.J. Gardner, Steinlager, Air New Zealand, Mainfreight and Zestel Gum (yes, I had to look up that one) and Auckland (Council or a CCO).

So I noted 26 advertisers. One was a local government agency. Of the remaining 25, 11 were overseas firms/brands, selling into the New Zealand market and in other countries.

It was the other group of firms/brands that interested me. Of them, as far as I could tell only two were New Zealand based internationally-oriented firms: Air New Zealand, and Mainfreight (which now has substantial overseas operations). And Air New Zealand, while currently very successful, collapsed only 15 years ago, remains majority state-owned, and one assumes its continuing independent status largely depends on the heavily regulated nature of the international airline and landing rights market.

I gather there are some reasonable substantial exports of Steinlager, but then Steinlager is a product/brand now produced by a Japanese-owned company.

Perhaps on another occasion a rather different mix of companies would have been advertising, and the New Zealand based ones might have been a more outward-oriented group. But in microcosm, it did seem to capture something of the strangely-imbalanced New Zealand economy, struggling to make inroads in international markets or against international competition.

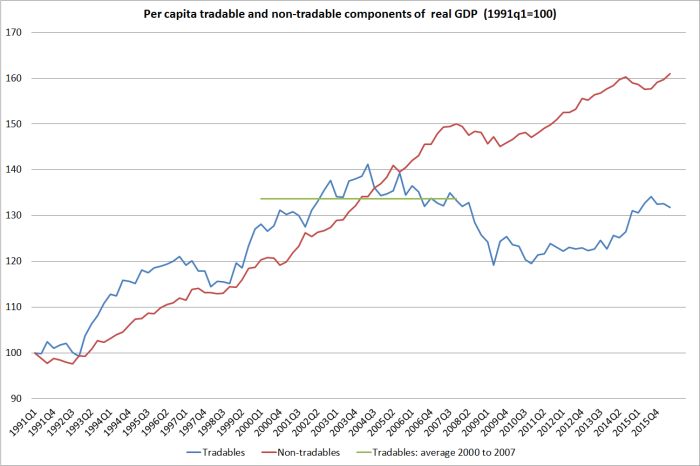

That phenomenon is nicely illustrated by my regular chart showing tradables and non-tradables components of GDP (recall that primary production and manufacturing, and exports of services make up “tradables” – and the rest of GDP is non-tradables). It is only a rough indicator, but it seems to have told quite sensible, intuitively plausible, stories.

In per capita terms, tradables sector GDP is still lower than it was on average in the first eight years of the 2000s (prior to the recession). In fact, the peak in the series was way back in 2004q2. There has been no sustained growth in average per capita tradables sector production for 15 years.

That shouldn’t really be very surprising. With able people and fairly good institutions, still the main thing New Zealand has going for it, as location for internationally-oriented businesses, is the natural resources that are here. And when the population increases as rapidly as it has in the last 15 years, with no major new natural resources to tap, and with sustained upward pressure on the real exchange rate, it is hardly surprising that there has been so little (per capita) tradables sector growth.

Or so few successful outward-oriented New Zealand firms to advertise to the world from Eden Park.

I hear Phil Goff wants to spend $1bn on a stadium.

LikeLike

I shook my head in disbelief when I read it, but I probably shouldn’t have been surprised……both parties are about as bad, but he was a senior minister in the govt that poured hundreds of millions into the Eden Park/World Cup party of 2011.

Bread and circuses….and no underlying productivity growth

LikeLiked by 2 people

While your broad point is reasonable – I think Phil Goff was in opposition in 2011.

LikeLike

indeed, but the World Cup spend-up etc was all initiated by the previous government.

(tho embraced by the current one)

LikeLiked by 1 person

Bread and circuses….and no underlying productivity growth

Worldwide productivity is grinding to a halt

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11734676

Worth a read.

LikeLike

Singapore is barren of natural resources and relies entirely on migrants including Lee Kuan Yew whose parents migrated from China.

LikeLike

And NZ is relatively well provided for in natural resources, and is governed by John Key whose parents immigrated from UK/Austria…..

But, in a sense, what of it? I’m not opposed to immigration in some general all-encompassing sense. My point is really that our economy has been underperforming for decades, and at the same time bringing in huge numbers of migrants. We have to take seriously that sustained underperformance. Having thought about the issue a lot over quite a long time, I increasingly suspect that location really matters. Singapore has a great location in an age when Asia is re-emerging. We have a great location for avoiding wartime invasions, and that is about all it is great for.

In some places it makes some sense to bring in lots of people. In others it doesn’t. Economic geography matters. It isn’t everything by any means – NZ’s GDP per capita now is almost certainly far higher than if there had been no European settlement etc – but once you compare similar peoples/similar institutions across different locations it seems to matter quite a lot. Formal studies tend to confirm that view.

LikeLiked by 1 person

It means that you do not need natural resources. All you need to people. The more the better. Our economy is underperformed due to hawkish Reserve Bank governors with trigger happy interest rate policies. Too much interference just makes the average entrepreneur extremely cautious due to the stop and start nature of our economy. NZ business spend more time watching than doing.

LikeLike