For just over six months now I’ve been on the trail of questionable appointments to the new Reserve Bank Board. Most of the Board members aren’t really fit for office in anything other than ornamental roles – this in the midst of the worst monetary policy failure in decades and the Board being responsible for key appointments and for holding the MPC to account. But my main focus has been on the appointment last October of Rodger Finlay, while he was chair of the majority owner of Kiwibank, with a lesser focus on Byron Pepper, appointed in June this year while also serving as a a director of an insurance company operating in New Zealand (the largest shareholder in which was another insurance company subject to prudential regulation by the Reserve Bank.

The Reserve Bank has spent months trying to avoid/delay answering questions about these appointments. For any first time readers, the appointments themselves are made formally by the Minister of Finance, but materials previously released make it clear that the Reserve Bank (and The Treasury) were actively involved in the selection and evaluation of candidates for Board positions (as is quite customary).

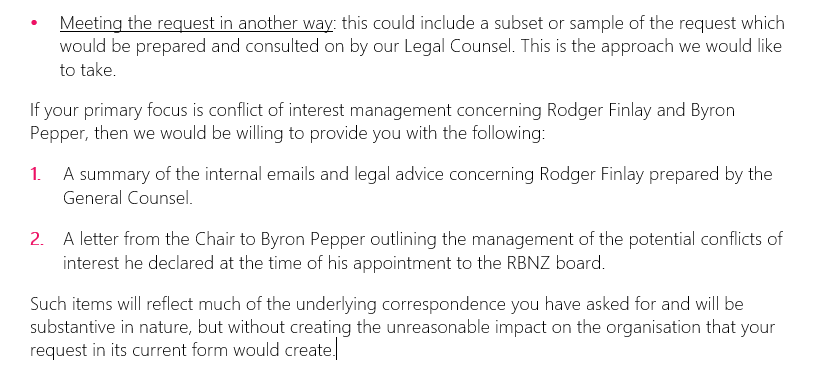

A few weeks ago, the Bank gave me Hobson’s choice. Either face the likelihood of them declining the entire OIA request I had had with them (with the chance that one day, a year or two hence, the Ombudsman might make them give me more) or accept something of a black-box offer.

I took the offer. Yesterday I received their response.

RB pseudo OIA response re Finlay and Pepper Dec 2022

As I will lay out, there is some interesting material included, but as I had half-expected it is a pretty cagey and dishonest effort, since it includes nothing at all about how conflicts of interests had or had not been handled in the selection, interview, and evaluation process prior to the appointments being made.

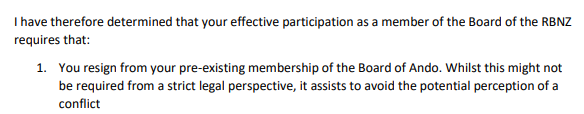

Taking Pepper first, the documented provided is a four page letter dated 27 July 2022 (a month after Pepper’s appointment had been announced) to Pepper from Neil Quigley, the chair of the Board. In that letter, which addresses advice from both internal and external legal counsel, Quigley acknowledge that Pepper himself had been entirely upfront

I acknowledge that you have pro-active and transparent in declaring the above interests in each of your pre-appointment discussions with RBNZ board members and senior executives of The Treasury, and that you subsequently confirmed these in your pre-appointment interests disclosure to RBNZ staff.

But…

The RBNZ is …. under constant scrutiny from both its regulated institutions, market participants and interested members of the public as a whole. The RBNZ is also subject to the Official Information Act, and more generally as a public institution has an obligation to respond in good faith, and within the limits of privacy and commercial sensitivity, provide good faith responses to

questions and enquiries received. As a result, the RBNZ needs to set the highest standards, and take appropriately conservative approaches to the management of interests and the avoidance of both actual and perceived conflicts of interest, as both Mr McBride and Mr Wallis point out in their advice to me. This also means that the RBNZ needs to avoid complexity and opaqueness in managing in the interests of Board members, because these are challenging to explain to journalists and to the

public.

and “the legal position will not stop interested members of the public from asking us how we manage the situation”.

Quigley (no doubt here also by this time reflecting the stance of the Governor) writes

Pepper then chose to give up the insurance company directorship (he could presumably instead have resigned the Reserve Bank directorship).

A few quick points:

- one might have some sympathy with Pepper himself. He appears to have hidden nothing, and the Reserve Bank Board role was the first government appointment he appears to have received. A really strong ethical perspective should probably have had him recognising from the start that it was going to be a dreadful look to be both an insurance regulator (director thereof) and director of an insurance company operating in New Zealand (even one not directly regulated by the Bank), but (a) he’d been open, and (b) had got through the recruitments consultants the government was using, discussions with senior RB and Treasury figures, and Cabinet.

- did Neil Quigley (and Orr and the rest) not appreciate previously that appointees to the new, much more powerful, Reserve Bank Board were going to receive scrutiny, and that actual, potential or perceived conflicts of interest would inevitably be a major focus for a Board responsible for prudential regulatory policy across banking, non-bank deposit-taking, payments systems, and insurance? If not, why not?

- even at the late date of the letter, Quigley seems to regard the problem as being as much the OIA rather than the importance of appointments to powerful regulatory agency bodies being above reproach or ethical question. In fact, it is blindingly clear that Quigley, Orr and the rest of them approached Board appointments only with the narrowest legal constraints in mind. If, as the law was written, the Pepper (or Finlay) appointments were not illegal (and they weren’t) there could be no problem. Astonishingly, in both cases The Treasury – much more experienced in making and advising on government board appointments generally – seems to have gone along (as did the Minister of Finance and his colleagues). It is a poor reflection on all involved.

And that is all I want to say about Pepper. In the end, the right thing seems to have been done, but only after public and media scrutiny and criticism. Recall that a few years ago Orr got on his high horse about “culture and conduct” in the financial sector: we really should have been able to expect a much higher pro-active standard around key appointments than was evident here, and as so often concerns brought to light on the things we the public get to see leave one wondering about the standards the Bank and Board chair apply in areas we don’t easily get to see.

What of the Finlay issues?

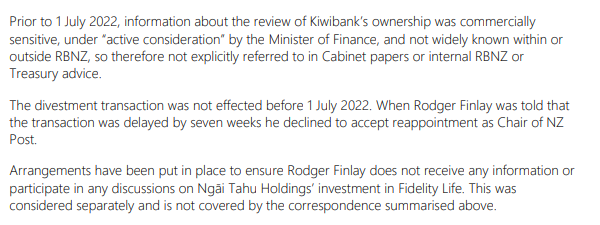

What has been released (link above) is a three-page summary, apparently prepared by the Bank’s in-house lawyer summarising various selected bits of correspondence relevant to the handling of Finlay’s conflicts of interest but only from the time his appointment to the Reserve Bank Board, from 1 July 2022, was announced in October 2021 (plus some editorial spin intended to try to shape the interpretation drawn by readers). Between those two dates Finlay was paid to serve on the “transition board” handling the establishment of the new governance regime, but previous OIAs have disclosed that he also routinely attended meetings of the then-official Reserve Bank Board during this period. My OIA request had explicitly covered a period starting on 1 April 2021, shortly before the public advertisements had appeared for positions on the new Reserve Bank Board, and it is telling that the Bank has chosen to release nothing from the selection and evaluation period.

Were this Reserve Bank document to be the only material we had, it might appear that everyone had acted honourably and appropriately in a slightly difficult time (what with secret discussions around the future ownership of Kiwibank going on in the background that very few people – Treasury, Bank or even Ministers – could reasonably be made aware of).

Thus

- on 18 October 2021 we are told that Rodger Finlay “had outlined all interests that might potentially be relevant. In particular, he declared interest [in] (as a director of) NZ Post and Ngai Tahu holdings.” (this latter, which I have not focused on relates to the substantial – but not controlling – stake Ngai Tahu was taking in an insurance company that is subject to Reserve Bank prudential supervision)

- on 20 October, the Governor asked about commitments Finlay had made about “management of conflicts of interest”, with Quigley weighing in that the Bank needed to “remain conservative on this front and maintain a very low risk appetite, particularly regarding Kiwibank”

- on 17 November, a couple of senior Bank staff met Finlay who “outlined how particular interests could be eliminated before 1 July 2022 [presumably a first reference to the prospect of changed Kiwibank ownership] and how any COIs that could not be eliminated could be managed post 1 July 2022”

- on 23 November, the Governor noted that “Kiwibank’s ownership structure would be resolved by July 2022….The Governor sought more information on how any conflicts through Ngai Tahu Holdings could be managed”. Quigley responded “noting that it is important to avoid or resolve perceived COIs as it is to avoid or resolve actual COIs”, noting that he would discuss the Nagi Tahu situation further with Finlay, but “expected NZ Post will resolve itself by July 2022”.

- on 17 March 2022, Finlay emailed the chair and Governor indicating he had been advised that NZ Post’s divestment from Kiwibank would be complete before 1 July 2022, and that he was no longer chair of the Ngai Tahu Holdings Audit Committee.

In the editorial at the end of the document this appears

(That final paragraph is not very satisfactory, since my OIA request had been explicitly about conflicts of interest generally, and not just the Kiwibank case, although it is slightly encouraging that the Bank has at least been cognisant of the conflict, even if it is not dealt with at all adequately by the restriction mentioned, since it seems Finlay is free to participate in discussions and votes on policy matters that affect a regulated company he has a significant interest in, as director of a significant shareholder.)

All that might sound fairly exculpatory for the Bank (perhaps especially Quigley, who seems to have been more concerned than management) and for Finlay – all honourable people acting in an honourable and above-board way, and all that.

Except that (a) not only does none of this cover the period before Finlay was appointed, but (b) what little the Bank released is far from all we now know about what went on. I’ve written various posts on various material Treasury and the Minister of Finance have released. Of particular interest is the “incident report” prepared over the signature of Treasury deputy secretary Leilani Frew. You will recall that the Secretary to the Treasury had had to apologise in writing to the Minister of Finance in late June for the failure of Treasury staff to ensure that Finlay’s conflicts re Kiwibank were disclosed in key papers to the Minister and to Cabinet. The “incident report“, which I wrote about here, had been requested by the Secretary, to identify what went wrong and what lessons there were for the future. Since it wasn’t written for publication, and The Treasury had by this time already owned up to an error, and since it covers the full period, it should be treated as a much more reliable and complete account than what the Bank has now selectively released.

Of direct relevance

Conflicts of interest were closely considered throughout this process. G & A Manager Gael Webster sought statement of conflict protocols from the Chair of the RB board, set up the process for the appointment of Transition board members and the new board, and contracted Kerridge & Partners to run the recruitment process, initially for the Transition board.

Kerridge met with the Treasury and RB Governor where conflicts were discussed, and Kerridge was provided with the Bank’s conflict protocols.

We also already knew, and the incident report confirms, that Finlay himself disclosed no possible conflicts to the consultants or the interview panel (not Kiwibank, not Ngai Tahu).

The report goes on

The due diligence interview with Mr Finlay proceeded with a panel comprising Sir Brian Roche as chair, Neil Quigley and Tania Simpson from the current RB board, Caralee McLeish, Wayne Byres (chair of the Australian Prudential Regulation Authority), and Murray Costello. The panel knew that Mr Finlay was chair of NZ Post which owned a majority share in Kiwi Group Holdings Ltd, which in turn owned Kiwibank, which is subject to regulation by the RB.

Sir Brian recalls conflicts being discussed but it was considered Mr Finlay was not conflicted. The RB’s Conflict of Interest policy stated that Mr Finlay would have a conflict that should be declared if he was a director of Kiwi Group Holdings Ltd, or a director of its subsidiary banking company Kiwibank Ltd. Neither of those situations existed and Mr Finlay is completely removed from the governance and operations of Kiwibank.

This reflects poorly on every single one of these people. There is no sign any of them were yet aware of the Ngai Tahu issue (which, see above, the Bank itself now appears to regard as a real conflict) but as regards Kiwibank they seem to have been driven by a narrow and legalistic interpretation – that can only have come from the Reserve bank side – that whatever was not illegal was therefore entirely proper and unproblematic).

Now, quite possibly – we don’t know – discussions around the future ownership of Kiwibank were already underway by mid last year (when the interview and evaluation were going on), but we know that The Treasury staff dealing with this appointment were not aware of that project until March/April this year, it seems unlikely the matter would have been disclosed to a foreign regulator (Byres, Kiwibank having no Australian presence), there is no sign Roche was aware (or surely he would have mentioned it as a consideration when asked in June/July 2022 by people who themselves were now aware), and even if Quigley was aware there is no obvious reason Simpson should have been advised (the old RB Board being purely advisory on policy matters). It seems quite safe to conclude that judgements – in which the Reserve Bank shared – about Finlay’s acceptability for the Reserve Bank Board role were made in the expectation that he would continue to be NZ Post chair and that NZ Post would continue to own the majority of Kiwibank. And it is just inconceivable how they – and especially the RB people, who should have been most concerned with, and conscious of, appearance risk – thought it was okay.

(In the material the Bank released there is an attempt to minimise Finlay’s role at Post and Post’s role re Kiwibank, but none of it changes the fundamental fact that Reserve Bank policy decisions would potentially severely affect the operations and fortunes of an entity NZ Post, chaired by Finlay, majority owned.)

The “we all knew what we were doing and there was never going to be a problem because the Kiwibank ownership would be resolved before 1 July 2022” line just does not wash. A much more compelling story is that all involved were running with narrow legalistic interpretations – it was lawful, therefore just fine – and had lost any sense of the big picture around integrity and appearances of integrity. For some reasons – not really clear, although I’ve heard suggestions they are similar personalities – Orr wanted Finlay and nothing was going to stand in the way.

The story the Bank now spins about how “we were all doing the right thing but just couldn’t write it down, even in Cabinet papers” doesn’t stack up for a moment:

- it is entirely inconsistent with the fact of the Secretary to the Treasury’s written apology

- it is inconsistent with the account of that interview panel (and of Finlay’s non-disclosure of any conflicts)

- it is inconsistent with the twin facts that (a) the Minister of Finance had to consult with Opposition parties on the appointment and b) that the appointment was disclosed on the RB website by the end of 2021 (even if no one much noticed then). Had the true story really been “oh, we’ll have changed the ownership of Kiwibank by 30/6/22 so that NZ Post won’t own it by then” the commerical-in-confidence story would have prevented them giving an honest answer to any Opposition party that had been on the ball and asked about apparent conflicts, or the people like me and the journalists who wrote about the issue if we had picked it up earlier.

- there is no sign in any of the papers released of the Bank raising any concerns late in the piece as it became clear that the Kiwibank ownership situation would not be sorted out by 30 June 2022 (no sign eg of them urging the Minister to get Finlay to take leave of absence from the RB Board until it was sorted out). All the signs are that they just did not care very much, if at all. It wasn’t unlawful, and if it wasn’t ideal it was still okay. If there is evidence that this is not the correct interpretation they could readily have released it.

No, the decision to appoint Finlay back in October 2021 was clearly taken on the narrow basis that the law did not prevent Finlay being appointed even if he chaired the majority owner of Kiwibank. And that reflects very poorly on everyone involved – Orr, Quigley, Byres, Treasury and the Minister of Finance (and his colleagues). It would not have happened in any moderately well-governed country, but it happened here, made worse by the refusal of the Reserve Bank (Governor and chair) to take any responsibility for an egregious misjudgment, the sort of defensiveness that feeds the slow corruption of the state.

Suppose that Finlay was really appeared like a potential star catch as a potential Reserve Bank Board member (not clear why he might but just suppose). Suppose too that you (Governor, Minister, Board chair, Secretary to the Treasury) knew that negotiations were getting underway to get Kiwibank out from under NZ Post, and you thought those would be likely to be sorted out by mid 2022. It would have been easy enough, and entirely proper, to have made an in-principle decision to appoint Finlay but to delay any consultation with the Opposition and any announcement until the conflict – real and substantial – was removed. Perhaps that might have meant Finlay taking up his appointment at the Reserve Bank on 1 September rather than 1 July, and his services – just another professional company director (as Treasury notes in that report “there were other candidates the Minister could have considered for the Reserve Bank”) – wouldn’t have been available to the Governor during the transition period. It would have been a perfectly right and proper thing to have done. But Orr – and apparently Quigley, MacLeish, and Robertson – just didn’t care. In Orr’s case, still doesn’t it seems. As so often with him, responsibility, contrition, and doing the honourable thing (doing, and being seen to do) count for little or nothing. There are no standards, just the bare minimum of (inadequate) legal restrictions, and whatever he can get away with.

UPDATE 23/12: The Bank has chosen very consciously to play silly games and to deliberately not provide any material re Finlay for the period prior to mid-October 2021, the period in which the selection, evaluation, assessment and recommendations to the Minister of potential candidates was taking place. It is clearly the period they don’t want light shed on, and as would have been very clear from my earlier writings it was a period of considerable interest to me (and was explicitly covered in my original requests). Accordingly, I have lodged a new request with the Bank for all material relevant to the selection, evaluation etc of Finlay and Pepper, for the periods up to mid-October 2021 in Finlay’s case and up to 30 June 2022 in Pepper’s case.

For those interested in reading further, Jenee Tibshraeny had an article in the Herald this morning prompted by the OIA material in this post. including a brief and unconvincing comment from Finlay (the first we’ve heard from him I think).

Congratulations on your persistence in pursuing this conflict of interest.

It is to be hoped that if similar instance occur the powers that be might be a wee bit more circumspect – but possibly with Orr in charge they couldn’t give damn.

LikeLike

Reblogged this on Utopia, you are standing in it!.

LikeLike

No upper house for scrutiny , a bought and paid for press , doing things “the maori way”, just the slippery slope on the road to Honiara.

LikeLike