The Governor of the Reserve Bank must have been feeling under a bit of pressure recently about the LSAP programme. Losses have mounted and some more questions have started to be asked – by more than just annoying former staff – about value for money.

And thus on Thursday morning “Monetary Policy Tools and the RBNZ Balance Sheet” dropped into inboxes. It was an 10 page note setting out to defend the Bank and the MPC over the bond-buying LSAP programme and the inaptly-named Funding for Lending programme, the crisis facility under which the Bank is still – amid an overheated economy and very high core inflation – lending new money to banks.

Of course, the Monetary Policy Statement had been out the previous day. Had the Governor been serious about scrutiny and engagement, he’d have released his note a day or two before the MPS (or even simultaneous to the MPS). Then journalists could have read the paper and asked questions about it in the openly-viewed press conference. The Bank’s choice not to do so revealed their preferences. Oh, and then the note was released less than an hour before the Finance and Expenditure Committee’s hearing on the MPS, and since FEC no doubt had other things to consider it is unlikely any of the members had read the note before the hearing. That too must have been a conscious choice by the Bank (one that didn’t go down well with the Opposition members).

I noted earlier that the paper was 10 pages long, but there wasn’t a lot of substance. We still have nothing but the Bank’s assertions for their claims that the LSAP programme was worthwhile, and while we are told that they hope to provide some more analysis in a review document at the end of the year, attempting to kick for touch for another four months frankly really isn’t good enough. And, of course, we’ve heard nothing at all from the three non-executive MPC members who share responsibility for the programme. As it is, the 10 page note does not even provide a serious attempt at a rigorous framework for evaluating costs, benefits, and risks – there is more handwaving, and attempts to blur any analysis, than serious reasoning.

There are two separable strands. I am going to focus on the LSAP rather than the Funding for Lending programme (FLP), but it is worth making a few points on the latter:

- the Bank claims that the FLP was necessary because banks were not yet operationally capable of managing a negative OCR, but the FLP was only finally launched in December 2020, and the Bank has separately told us that by that time banks’ system were in fact capable of coping with a negative OCR. Sure, the FLP had been foreshadowed over the previous few months and probably had some impact on retail rates then, but then the possibility of a negative OCR had also been foreshadowed,

- the FLP was misnamed from the start (creating of lot of unnecessary controversy at the time about housing finance), with the name feeding an entirely fallacious mentality that shortages of settlement cash were somehow a constraint on bank lending. I am pleased to see that in this document the Bank (now that it suits) explicitly states “there is little evidence that higher settlement cash balances resulting from these programmes have directly impacted bank lending”. Paying the full OCR on all settlement cash balances – a Covid novelty that continues – will also have that effect.

- it remains extraordinary that the Bank is still undertaking new lending under the FLP until the end of this year. It was a crisis programme, launched belatedly when crisis conditions had all but passed anyway, and there has been no clear justification for continuing new loans for at least the last year (recall the Bank wanted to raise the OCR last August). Arguments about predictable funding streams just fall flat, when the entire economic and financial climate was so uncertain, and when banks like everyone else recognise that circumstances have moved on from where they were two years ago. The Bank’s claim – that somehow banks would not future bank commitments seriously if they terminated early – deserve little more than to be scoffed at. And although the Bank will tend to play this down, we can tell that the FLP is relatively cheap funding – if it were not, banks would not still be tapping the facility. Similarly, arguing (as they do) that the OCR can offset the FLP is to concede the point: increases in the OCR should be leaning against real inflation pressures, not counteracting other lingering stimulatory crisis interventions.

But enough of the FLP, daft as it is still to be running it, the costs and risks are fairly small.

Not so the LSAP, where costs and risks are demonstrably high (now conceded by the Bank) while the alleged benefits are hard to pin down (not helped by the Bank making no serious public effort so far), and the water is being deliberately muddied by the Governor’s bluster and absence of careful delineation of the issues and arguments.

On financial costs, this from the Bank’s document is clear and straightforward (and I would hope might finally silence those who keep trying to claim they aren’t “real” costs, are all “within the Crown” or whatever). The Bank is clear that the financial losses themselves are real.

The best estimate of the net cost of LSAP is measured by the value of the Crown’s indemnity – unrealised losses based on current market valuation, reflecting a higher OCR – and losses realised by RBNZ upon the sale of the Bonds.

As to quantum, the claim under the indemnity fluctuates each day, and some of the Bank’s claim has now been paid by Treasury, but the Bank’s Assistant Governor was happy at FEC to use a ballpark $8bn figure. $8bn is roughly $1600 per man, woman, and child in New Zealand.

In the rest of this post, I am drawing on three sources of Bank comment: the 10 page document itself, the Bank’s appearance at FEC on Thursday (comments from Orr, Silk, and Conway, the chief economist), and the Governor’s full interview with the Herald (linked to in this article). Orr has made stronger claims orally than what is in the formal document, asserting twice that the wider economic gains of the LSAP programme were “some multiple” of the financial losses, following up to add that in his view it wasn’t even close. “Some multiple” must mean at least two, so at minimum the Governor is asserting (and recall there is no evidence advanced and not much argument) that the LSAP resulted in real economic gains of at least $16bn. At minimum, he is claiming a benefit of about 5 per cent of GDP at the time the LSAP was first launched. These are really huge claims, and you’d think he’d have at least some disciplined framework to demonstrate their plausibility (even just as ballpark estimates).

Instead, we are offering not much more than handwaving, and lines that at best veer close to outright dishonesty.

There seem to be three broad strands to whatever case Orr is trying to make:

- there is the “least regrets” rhetoric,

- there is talk (especially in the Herald interview) of the gains from bond market stabilisation back in March 2020, and

- there is lots of talk (even the chief economist went down this line at FEC) about how much stronger than forecast the economy has been than was being forecast in 2020.

As Orr now tells it, “least regrets” meant the Bank would run monetary policy in such a way that it would prefer to see a grossly overheated high inflation situation (actual outcome) than a deep depression and entrenched deflation. Perhaps many people might share that preference if it was the only choice. But it wasn’t, and we’d be better off sacking and replacing all involved if they really want us to believe it was. Go back to 2020 and then when they were first talking about “least regrets” it was the much more reasonable framing (eg here) that, at the margin, and given that inflation had undershot the target for 10 years, they might be content with (core) inflation being a little above the target midpoint for a while rather than jump on things too early and risk keeping the unemployment rate higher than necessary for longer than necessary. Not everyone would necessarily have agreed with them on that, but it would have commanded pretty widespread assent (I wasn’t unhappy myself)….and in any case was entirely hypothetical at the time since, as I’ve documented in recent posts, actual inflation forecasts (Bank and private) were well below the target midpoint even as the Bank added no more stimulus beyond that (from OCR, LSAP, FLP or whatever) already embedded in the economic and inflation forecasts. So don’t be fooled by Orr rhetoric suggesting we should smile benignly on their handling of things because “the alternative was some Armageddon”. We pay him and his offsiders a lot of money to help ensure that those aren’t the choices.

Back when the LSAP programme was first announced – 23 March 2020 – there was a twin (related) motivation: generally to ease monetary conditions, and specifically to underpin the functioning of the government bond market. Global government bond markets were then in a mess, reflecting primarily US-sourced extreme illiquidity and flight to cash (at the time stock markets had been falling very sharply too). For those interested, here are a couple of links to what was going on at the time (here and here). Government bond rates were rising (even as policy rates had been cut): the disruption was real enough and it was getting very difficult to place paper. I’ve even gone on record here in the past stating that, even allowing for the moral hazard risks, I had no particular objection to some stabilising interventions, especially in the Covid context.

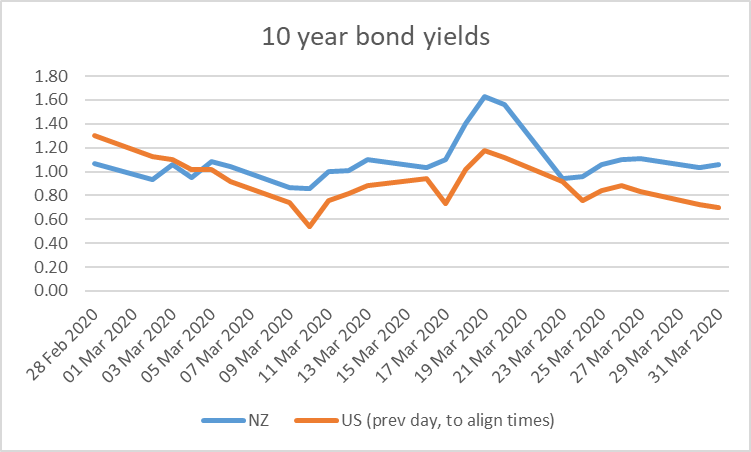

But here is a chart of US and NZ 10 year government bond rates for the month of March 2020 (with the US rates lagged a day to line with the NZ ones – changes in NZ bond rates in the morning are usually mostly a reflection of what has happened in the US overnight (the previous day for them).

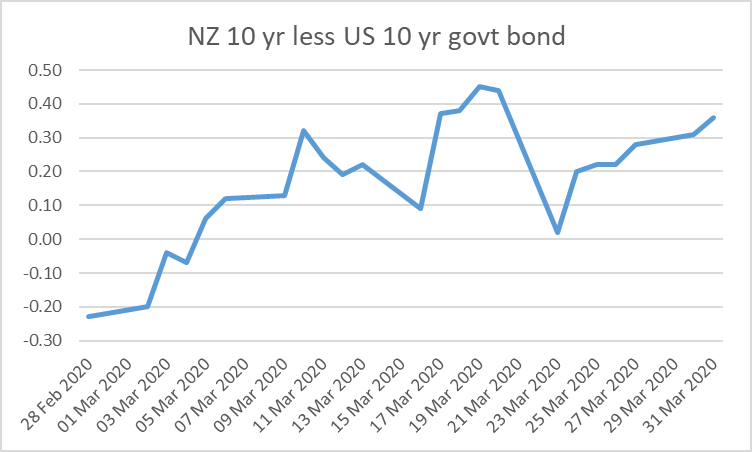

You can see yields rising in that third week of the month even though both central banks had cut policy rates sharply that week (and the Fed had announced restarting of bond purchases). The NZ market is less liquid at the best of times than the US one. But yields in both countries peaked on 19 March (NZ).

As did the gap between New Zealand and US rates. Days before the Reserve Bank did anything or even announced their own LSAP (although they had foreshadowed that one might be coming).

And if the Reserve Bank announced its LSAP on 23 March, on the same day (but remember the time difference) the Fed greatly expanded its own bond-buying programme. Almost immediately New Zealand long-term bond yields were back down to around 1 per cent.

Simple charts of yields – of the most liquid part of each market – don’t directly get to the illiquidity in other markets, but all indications are that the worst (globally) was already over by the time the Reserve Bank made its announcement, and given the US-sourced nature of the shock, it seems far more likely that the US actions were the more decisive policy contribution to stabilising markets. I don’t want to begrudge the Bank its small part in domestic market stabilisation (and they had some other interventions, including thru the fxs swaps market – but remember it is the LSAP they are defending), but even if we run through to 10 April, total bond purchases by the RBNZ to that point was only $3.6bn. Sure, a willingness to go on intervening offered a bit of cheap insurance to market participants, but if Orr wants to make much of what those earlier operations contributed (and it really can’t be much, given lockdowns, extreme economic and policy uncertainty etc) it relates to less than a 10th of the risk the Bank eventually exposed the taxpayer to through the LSAP.

(And if you want to note that over the month New Zealand bond yields did not fall as much as those in the US, recall that at the start of much US policy rates had much more room to fall than NZ ones did – and expectations of future short rates are the main medium-term influence on bond yields).

The third broad strand of Orr’s defence now appears to rest on how unexpectedly strong the economy (and inflation) proved to be.

From the 10 page report

His new chief economist tried the same line at FEC, with less nuance, and Orr himself when asked by Nicola Willis what evidence there was of the net benefits of the LSAP responded succinctly “the economy we live in today”.

It really is borderline dishonest. After all, all those dismal 2020 sets of forecasts – the Bank’s, the Treasury’s, and the myriad private sector ones – all included the effects of the policy stimulus (including the LSAP), and views on the path of the virus itself, so the resulting massive forecast error (for which I am not particularly blaming anyone) logically cannot be proof – or even evidence – of the effectiveness of a single strand of monetary policy (LSAP), or even of macro policy taken together. Since Orr and Conway are smart people, and know this point very well, it must be a deliberate choice to continue to muddy the waters as they do. They never even address the probability – high likelihood in my view – that most economists simply got wrong the extent of the adverse demand shock. At very least any serious analysis would have to unpick the various elements.

Instead, in none of their written material, or the comments of Orr and his offsiders, has there been any attempt (even conceptually) to think about the marginal effects of the LSAP programme itself. It was a discretionary (and last minute) addition to the toolkit. And even if we granted them a free pass for the first $3.6 billion or so of purchases (see above) all the rest was their choice. We know the financial costs (that $8bn or so of losses) but the alleged huge gains (Orr’s “multiples”) are unidentified – no effort has even been made. As just one small example, when the Herald’s journalist asked Orr whether, for example, they could have done less LSAP and instead cut the OCR to zero (which as even the Bank notes has no material market risk), Orr simply avoided answering the question.

I’ve run through previously the various reasons to be sceptical that the LSAP had much useful macro effect (those vaunted $16bn of gains Orr would need to show). In particular, even if the impact on longer-term bond rates was as large as Orr has claimed (again numbers that have never been documented), it isn’t at all obvious how that would have translated to large useful macro gains. It is commonly understood that the most important element in the interest rate bit of the New Zealand transmission mechanism is the short-end. Short rates (1-2 year bond rates) shape most retail lending rates, and are themselves largely influenced by expectations of the future OCR. Had the Bank been interested, say, in managing down a 3 year bond rate – as the RBA was – it could have done that directly, at very little financial risk. But instead they focused their bond buying at the longer end of the yield curve. Government borrowing costs may have been a bit less than otherwise as a result, but monetary policy isn’t supposed to be about getting cheap finance for the government but about macro stabilisation. Few private borrowers take borrowing at long-term fixed rates.

The Bank also claims that the exchange rate may have been lower than otherwise as a result of the LSAP. Perhaps, but (a) it depends on the counterfactual (they could have lowered that OCR further instead but chose not to) and (b) in most models the real economic effects of exchange rate moves take quite a long time to be felt, and even the Reserve Bank argues (contrary to quite a lot of literature) that the impact of the LSAP was decaying over time.

And it is worth pointing out that, as their document notes, they used the LSAP because of issues around operational readiness of banks for negative OCRs, but whose responsibility over the previous decade had it been to have ensured that banks were operationally ready? The taxpayer was exposed to the massive financial risk from the LSAP – without, it appears, any robust prior risk analysis – because of the Bank’s own failures. Just maybe there were some macro gains, but in a better world we’d have got those without the huge financial risk (and $8bn of losses). (A former colleague noted to me the other day that if we’d wanted to throw around an extra $8bn we’d almost certainly have gotten more macro bang for the buck by just giving $1600 to every man, woman and child and setting them free to spend – probably would have seemed a bit more equitable too.)

Oh, and did I add that if the last big macro policy tool deployed – the LSAP – was really as potent as the Governor seems to claim, then given how overheated the economy has been and the fresh ravages of high core inflation, it might have been much better (and lower risk) if the keys to the ill-prepared drawer marked LSAP had never been found and the instrument left untouched. We pay central bankers to do (materially) less badly than this, even (especially?) in difficult and uncertain times.

Bottom line: there has so far been no serious attempt by the Reserve Bank to frame an analysis that looks at the marginal impact of the LSAP programme, whether numerically or conceptually. Until there is, everything else they utter on the subject is really just defensive bluster. The public deserves better from senior officials of such a powerful institution. But as so often with the Bank, the question again arises as to why those paid to hold the Governor and MPC to account seem utterly uninterested in doing so.

Reblogged this on Utopia, you are standing in it!.

LikeLike

Hi Michael Did you mean inaptly named or ineptly named? I think “ineptly named would” be a more suitable description, more fitting of Orr’s ineptitude! Sincerely Peter

Peter J. Morgan B.E. (Mech.), Dip. Teaching

Honorary Chairman and Chief Executive Officer, Environomics (NZ) Trust

13 Stratford Avenue, Milford, Auckland, NEW ZEALAND

mobile: 021 489 497 email: pjm.forensic.eng@gmail.com

LikeLike

I’ll stick with “inaptly”. The name led them into trouble and was misleading but it was deliberately and consciously done.

LikeLike

Did the Finance Minister sign off on this or was it within the governors sole discretion?

LikeLike

$16,000 per capita … are you sure?

LikeLike

A good assessment……..one point that could have been emphasized is that global bond markets are interconnected and when the Big Boy (the US) moves, all the major economy bond markets follow suit – especially the “dollar block” Canada, Australia and NZ. So, our bond yields would have fallen significantly without any buying from the RBNZ. But, armed with indemnity, the RBNZ was like a kid in a Lolly shop; they couldn’t resist pigging out.

LikeLiked by 1 person

At the risk of being pedantic, couldn’t a multiple actually be some fraction of, or even negative?

LikeLike

It clearly isn’t negative in Orr’s mind. I suppose it could be 1.5x but his tone suggested something much larger and more clear cut. Ideally he would publish some estimates and supporting analysis and we could see (and scrutinise).

LikeLike

[…] Source link […]

LikeLike

[…] as Riddell points out there was never much upside to the programme in the first place – although Orr is now trying to argue that there was, but as has become usual with the RB, has no quantifiable argument to back up that […]

LikeLike