I write a lot here about issues around the Reserve Bank. Some of those issues are quite obscure or abstract, and I know some readers find some of those posts/arguments a bit of a challenge to grasp.

But yesterday we had as straightforward an example as (I hope) we are ever likely to find.

Inflation is very much in focus at present. Measure of inflation expectations get more attention than usual. There is a variety of measures, both surveys (in New Zealand mostly conducted for the Reserve Bank and by ANZ) and market prices. The Reserve Bank has been surveying households for 27 years, with a fairly consistent (although expanded on a couple of occasions) range of questions. At the Bank there was always a degree of scepticism about the survey – household respondents always seemed (eg) to expect inflation to be quite a lot higher than it actually was – but it was one more piece in the jigsaw, and if one couldn’t put much weight on the absolute responses, changes over time did seem to line with what households might be supposed to be feeling/fearing.

Of the questions, probably the one least hard for households to answer seemed to be the fairly simple one

No numbers needed, just something directional. We have 27 years of data.

The latest results of the survey came out yesterday. The Bank puts out a little write-up and posts the data in a spreadsheet on their website. Yesterday, the write-up didn’t mention this question at all, but the spreadsheet suggested that a net 95.7% of respondents expected inflation to increase over the next 12 months. That seemed like it should be a little troubling, given how high the inflation rate already is.

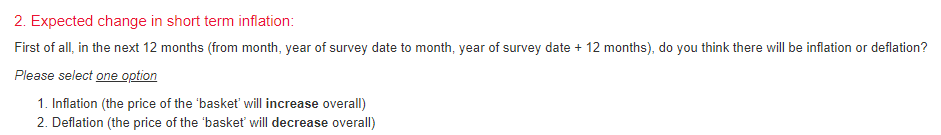

Except that……it turned out that the Reserve Bank had changed the question, without telling anyone, without marking a series break or anything. The new question is

And that is a totally different question. The old question is about whether inflation will increase or decrease, while the new one is about whether there will be inflation or deflation. At almost any time in the 88 year history of the Bank it would not be newsworthy if 95.7 per cent of people expected there to be inflation. There almost always is.

It isn’t necessarily a silly question in its own right (on rare occasions there are deflation “scares”) but (a) it is a much less useful question most of the time than the question that had been asked and answered for 27 years, and (b) you can’t just present the answers to one questions as much the same thing as the answer to the other. Especially when not telling users of the data.

It was real amateur-hour stuff. Now, in fairness to the Bank, there is a detailed account of the changed questions on the website, but when there was no hint that question had changed there was no motive to go on a detective hunt to find it.

The Bank tells us they have had a 38 per cent increase in the number of senior management positions in the last year, with no increase in the things they are responsible for, and they can’t even get fairly basic things like this right. They’ve destroyed the single most useful question in the survey, and right at the time when every shred of information on attitudes to inflation should be precious. And then seemed barely even to be aware of what they’d done – presenting the answers to two quite different questions as if they were in fact very much the same.

There were a few people yesterday suggesting it was some nefarious plot to reduce access to awkward data at an difficult time. I don’t believe that for a moment – although for wider peace of mind I have lodged an OIA request to confirm (and to find out whether, for example, MPC members even knew of the change). This was a stuff-up pure and simple, which management and senior management (for which the Governor is accountable) should never have allowed to happen. High functioning organisations don’t make stuff-ups like this.

Which is a convenient lead in to an article published this morning.

About five weeks ago Stuff’s business editor asked if I’d like to write a column for them on the Reserve Bank under Adrian Orr. I did so (a few days later) and the final version appeared this morning. I only had 800 words, and there was a lot of ground one could have covered, so much of the story has to be very compressed (and quite a few problem areas left out altogether). You can read the final Stuff version here, or the text I originally wrote is below. Were I writing it now rather than a month ago, I would put more weight on the inflation story – core inflation now having blasted through the top of the target range – but I wanted to distinguish between forecasting mistakes (which are somewhat inevitable, and the best central banks will make them) and things that are much more directly within the control of the Governor, the Board, and the Minister of Finance.

Alarming Decline

By Michael Reddell

Over the four years Adrian Orr has been Reserve Bank Governor, this powerful institution, once highly-regarded internationally but already on the slide under his predecessor, has been spiralling downwards. The failings have been increasingly evident over the last couple of years. Here I can touch briefly on only a few of the growing number of concerns.

One can’t criticise the Reserve Bank too much for running monetary policy based on an outlook for inflation and the economy that, even if wrong, was shared by most other forecasters. Until late 2020 the general view of the economic consequences of the Covid disruptions had been quite bleak. Notably, inflation was widely expected to be very low for several years. The Bank got that wrong, and so inflation (even the core measures) has been a lot higher than expected. If they were going to err – after 10 years of inflation undershooting the target – it may have been the less-bad mistake to have made. But they have been slow to reverse themselves – the OCR today is still lower than it was two years ago – and slower to explain.

The Bank is much more culpable for the straightforward lack of preparedness and robust planning. Orr had been quite open, pre-Covid, that he wasn’t keen on big bond-buying programmes, and if necessary preferred to use negative interest rates. But when Covid hit it turned out that the Reserve Bank had done nothing to ensure that commercial bank systems could cope with a negative OCR. They couldn’t. So instead, as if keen to be seen to be doing something, the Bank lurched into buying more than $50 billion of government bonds. Buying assets at the top of the market is hugely risky and rarely makes much sense, but the Bank kept on buying well into 2021. As interest rates rise, bond prices fall. The accumulated losses to the taxpayer are now around $5 billion ($1000 per person, simply gone). And yet the Bank has never published its background analysis or risk assessment, it offers up no robust evidence that anything of any sustained value was accomplished, and the Governor refuses to even engage on the huge losses.

What of the new Monetary Policy Committee itself? From the start the Governor and the Minister agreed that anyone with current expertise in monetary policy issues would be excluded from the Committee. For the minority of outside appointments, a willingness to go along quietly seems to have been more important than expertise or independence of thought. Meanwhile, staff (Orr and three others who owe their jobs to him) make up a majority of the Committee. Minutes of the Committee are published but deliberately disclose little of substance, there is no individual accountability, and four of the seven MPC members have not given even a single published speech in the almost three years the Committee has been operating. Speeches given by the senior managers rarely if ever reach the standard expected in most other advanced countries. Meanwhile, the in-house research capability which should help underpin policy and communications has been gutted.

And then there is the constant churn of senior managers. In some cases, people who were first promoted by Orr have since been restructured out by him. In just the last few months, the departures have been announced – not one of them to another job – of four of the five most senior people in the Reserve Bank’s core policy areas: the Deputy Governor, the chief economist, and the two department heads responsible for financial regulation and bank supervision. It isn’t a sign of an institution in fine good health.

And all this has unfolded even as total staff numbers have blown out, supported by the bloated budget the government has given the Governor. Orr often seems more interested in things he has no legal responsibility for than in the handful of (sometimes dull but) important things Parliament has specifically charged the Bank with. Perhaps worse, he has a reputation for being thin-skinned: not interested in genuine diversity of views or at all tolerant of dissent, internally or externally. One might just tolerate that in a commanding figure of proven intellectual depth, judgement, and operational excellence, but Orr has exemplified none of those qualities.

How to sum things up? Lack of preparedness, lack of rigour and intellectual depth, lack of viewpoint diversity, lack of accountability, lack of transparency, lack of management depth, lack of open engagement, and lack of institutional memory. It is quite a list. The Governor is primarily responsible for this dismal record of a degraded institution but it is the Minister of Finance who is responsible for the Governor.

This really is a matter of ministerial responsibility.

Finally, earlier in the week I wrote a post here about expertise and the Monetary Policy Committee in which, among other things, I lamented again the absurd policy adopted three years ago by Adrian Orr, the Bank’s Board, and the Minister of Finance, excluding from consideration for (external) MPC positions anyone with any ongoing systematic interest in macroeconomics or monetary policy. This morning Jenee Tibshraeny of interest.co.nz had a new article focused on that restriction. She has comments from various economists, the only one sort of defending it one who was adviser in Robertson’s office at the time the restriction – one without parallel in any other advanced country central bank – was put on, but had also asked Robertson and the Bank (Orr or Quigley or both?) whether the same restriction would be applied to filling the upcoming vacancies.

It should be incredible, literally unbelievable, if we had not seen so much from Robertson and Orr over recent years careless of the reputation, capability or outcomes of the Bank. As it is, it is just depressingly awful. One hopes – probably idly – that the Opposition political parties might think it an issue worth addressing. After all, not only are qualified people with an ongoing analytical etc interest in monetary policy excluded from the external MPC positions, but the latest appointment to an internal position (by Orr, Quigley and his board, and Robertson in concert) suggests the bias against actual expertise and knowledge might now be being extended to encompass executive roles.

Reblogged this on Utopia, you are standing in it!.

LikeLiked by 1 person

We really are in a great deal of trouble when core agencies like the Reserve Bank are failing. New Zealand is adrift and the storm-clouds are growing ever more dark. The greatest threat has to be the escalating pace of inequality. The bottom forty percent are being squeezed from every direction and their prospects are seriously bad as inflation erupts. Infrastructure is collapsing and new projects can’t get off the ground for lack of management expertise. The government’s centre-piece is a tram to Auckland Airport for the Middle Class which defies any economic rationality or sense of equity. For reasons of ideology this government is hellbent on centralizing everything from the three waters to procurement of essential goods. So now people have to show six forms of identity to a bureaucrat to get their Rapid Antigen Tests and then find there are none available. None of this makes any sense, quite the opposite.

Just over thirty years ago the “end of history” was proclaimed on the fall of the Soviet Union. It now appears we are trying to reinvent the Soviet economy in New Zealand. We will have the same outcomes: economic breakdown, poverty and radical political change.

LikeLiked by 3 people

Good article

Regards

Cam

LikeLiked by 2 people

Michael,

All your blogs point to one major issue in NZ that is the declining quality of our institutions. One should not look elsewhere (including migration!) to understand why we are 20+ percent poorer than Australia or the top half of the OECD. Fix our institutions the rest will follow!

Martin

LikeLike

Wonder how that 2020 $35mio p.a increase in the RBNZ’s funding is working out:

‘Unlike other Government agencies that seek funding through the annual budget process, the Reserve Bank makes money for the Crown through its balance sheet activities.’

A: $5bio plus and counting ‘hole’ in the Crown’s finances….. not much of a money maker there.

‘Mr Orr says it is a substantial and important increase, which means the Bank can address the critical risks to delivering its mandate, respond to areas of past underinvestment, and establish a long-term model to promote the wellbeing of New Zealand’

A: With inflation surging to 30 year highs might be fair to assume that most New Zealanders aren’t feeling that well unless of course there are the highly remunerated top heavy leadership team at the RBNZ.

‘The bulk of this increased spending will focus on expanding and enhancing the Bank’s core activities, particularly investing in financial supervisory and enforcement capability, as recommended by the International Monetary Fund’s 2017 Financial Sector Assessment Programme (FSAP) Review.’

A: Seems like most of the money has been spent on non-core activities and staff (Climate, Tree God Carvings, support staff etc).

‘Spending will also be directed towards supporting the Bank’s day-to-day operations and investing in the upkeep of its assets. This includes modernising the technology infrastructure and keeping security architecture up to date, designing a suitable vaulting and distribution system for cash, and expanding our reach to stakeholders in Auckland.”

A: FTA data breach – The loss of personal data by the Bank would be in violation of New Zealand’s Privacy Act 2020, and as such merit an investigation by the Auditor General and not KPMG. Two other points on that episode: (a) The OIA that a KPMG employee was seconded to the Audit department in 2021..hardly makes KPMG’s investigation look independent (b) KPMG note in their report that a breach notification didn’t leave Acclleion’s system – as Accellion has recently settled a class action suit here in the US for $8mio without any admission of culpability it seems very unlikely that they would admit that a notification hadn’t left their system – that smells like sanitised spin.

Bet New Zealanders are mightily relieved that the Government didn’t fritter that money away on frivolous things like ICU capacity, mental health programmes, RAT tests and instead wisely gave it to the RBNZ to be the ‘kaitiaki’ … of New Zealand’s financial system.

LikeLiked by 2 people

Quite. And today many more millions to ‘Maori’ to fight omicron. ON top of many millions in past months. Where exactly do these millions end up…anyone?

LikeLiked by 1 person