The annual Demographia report on housing affordability across a range of English-speaking advanced countries was released earlier this week.

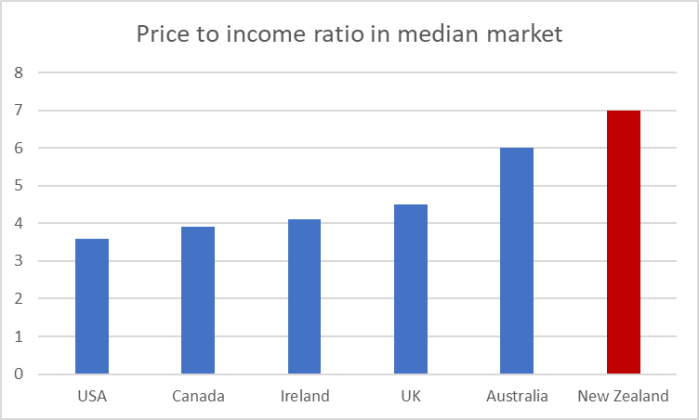

If you are a New Zealander who cares at all about efficiency, fairness (especially to the rising generation), functioning markets it makes pretty bleak reading. The focus of the analysis is on the ratio of median house prices to median household income. Here is ratio for the median urban market in each of the countries they look at

(They also look at the two city states Singapore (which is in the middle of the pack) and Hong Kong (which is off the charts, see below).

And here is a chart focused just on fairly large cities (>1 million people). I’ve shown the ten cities with the lowest price to income ratios, the ten with the highest ratios, and a selection (every ten or so rank places) of those in-between.

and here are the New Zealand cities in the wider sample

You’ll see people sometimes talk about Christchurch house prices being affordable again but it is worth keeping that claim in perspective – and, in fact, rubbishing it lest anyone think that the Christchurch outcomes are in some sense good or acceptable.

The Demographia reports looks at just over 300 urban housing markets. In 46 of them, mostly in the US but not exclusively, the estimated price to income ratio is three or less (what the Demographia authors regards as a normal longer-term level), and 103 have ratios of 3.5 or less. There are large cities and small cities. Fast-growing places and stagnating ones. A house price to income ratio of 5.4 (Christchurch at present) mightn’t be the worst in the world, but by no stretch of the imagination is it good. We – and people in Christchurch – shouldn’t be settling for it. Only 60 cities in the entire sample are worse, on this count, than Christchurch. And Christchurch is a fairly small city with abundant land, and yet its house price to income ratio is the same as those for Miami and New York.

This particular isn’t perfect by any means. No indicator is. Among other things, median household income is likely to be partly endogenous to house prices: more people working (particularly both parents of young children) and for longer hours to attempt to afford a house. And if house sizes are probably fairly similar across New Zealand, Australia, Canada, and the US as a whole, the typical house in the UK is considerably smaller than in those other markets, and no attempt is made to adjust for this difference – whether across countries or across major cities. Auckland might be in the top 10 most unaffordable ‘major markets’ but on average you will be getting more house and land for your money in Auckland than in London (let alone Hong Kong). But while it is fair to recognise this latter point, to make very much of it is simply a cop-out. You won’t be getting more house for your money – and quite possibly less – in Auckland, Wellington or Tauranga than in Lincoln, Nebraska (ratio 3.3) or Louisville, Kentucky (3.2) or the dozens of other affordable cities across the United States.

One of my slight frustrations with the Demographia report is that it does only focus on English-speaking countries. While they are often the ones we like to compare ourselves to, it would be more reassuring if there was data on a range of continental European countries and Japan/South Korea. Russia wasn’t one of the countries I had in mind but in this year’s report, they have a snapshot on Russian cities. Across Russia, population growth certainly isn’t a factor in driving house prices, although some individual cities (including Moscow and St Petersburg) are growing. Most of the 17 cities have price to income ratios of three or less (and while Russian houses/apartments are probably fairly small, Russian incomes are fairly low even by New Zealand standards). But both Moscow and St Petersburg have price to income ratios of 4.2. That’s above the Demographia threshold, but well below Christchurch, Wellington, Auckland (or Tauranga).

There was a little media coverage of the Demographia report. But just a few months out from another election, where is the sense of scandal, of outrage, of a commitment to produce very different outcomes in the future? No significant political party is willing to talk in terms of dramatically lowering house prices, or of making the structural changes (mostly to land use policies) that would bring it about, or about supporting in the transition people caught out by the rigged market our central and local government politicians have delivered in the last 30 years. The scandal – the sheer unaffordability – that is so recent now seems to be taken for granted as something normal, inevitable etc. It is highly abnormal. It is a disgrace. The burden falls most heavily on the youngest and most marginal parts of the population. It is indefensible. And yet neither National nor Labour (nor NZ First nor the Greens) are interested in serious change making a serious and sustained difference. Oh, they’ll tweak things at the margin, but none of them will talk about aiming for price to income ratios of three, or of rendering incredible the notion that small houses on tiny sections in Berhampore would sell for $1million.

Reblogged this on Utopia, you are standing in it!.

LikeLiked by 1 person

It grieves me that so many Kiwi’s have come to accept abnormal as being normal in this season. It’s almost like the only issues they get concerned about any more are those that Big Media tells them they need to get concerned about. New Conservatives NZ housing policy delivers on this and many issues that concern critical thinkers though. Their leader is a builder by trade. Even though there is a rapidly growing movement in their support it’s only due to word of mouth because they get no media coverage and are omitted from Big Media’s polls despite having more support than a number of parties that are included. Will there ever be change while the fourth estate is running propaganda for their masters? https://www.newconservative.org.nz/housing-policy

LikeLiked by 1 person

Their problem is that once again they are God botherers. Not criticizing them for that but reality is past performance shows that its not a good combination with politics.

And hey, don’t shoot the messenger.

LikeLike

Cerrtainly don’t agree with the point about religion and politics not mixing – religion/worldviews underpin all societies and (implicitly or explicitly) their politics – but I remain somewhat sceptical about the New Conservatives, even though I’m probably the sort of person they should expect to appeal to (social conservative, Christian, market-oriented, totally disillusioned by both main parties).

LikeLike

The housing problem is just a byproduct of our ponzi scheme of an economy. For decades it has been reliant on large immigration giving us a sugar hit of money. Made to appear better by failing to spend on the infrastructure needed for the burgeoning population. Our politicians are reluctant to do anything because when it is taken away our economy will have serious problems and the party in charge will be blamed for it all. So they take it in turns pretending they are doing something, revelling in our ‘rockstar’ economy. Failing to accept that the reality is you need to be a rockstar to buy your first house.

Which begs the question, is either party really deserving of our vote, let alone the reins of power.

LikeLiked by 1 person

I don’t think references to ponzi scheme of an economy actually helps anyone understand the issue. Our fastest growth industries are in health, aged care and tourism industries which are predominantly the Services industries. The very nature of services is that it needs people to service people issues. Population growth is the by product rather than the cause.

LikeLike

So we grow minimum wage industries by giving access to cheap immigrant labour. This puts more strain on our infrastructure, so we bring in more immigrant labour to fix the problem. Which puts yet more strain on, so we bring in more immigrant labour to fix the problem. No need to invest to make staff more productive, just ask for more people.

At what point does this roundabout stop or are you saying it is no problem. That we can continue this scheme forever.

LikeLiked by 2 people

Gissie, health and old age are not exactly industries that we can decide not to grow. Yes we can mitigate that worker requirement by adopting Japanese best practices of 90 patients to 1 nurse ratio in dementia health care by adopting the latest Japanese technology ie strap a patient onto the bed with disposable bungy rope and administer sedatives. Or adopt wholesale ACT Party/David Seymour’s Euthanasia policy.

Tourism, we could do something about but this is a $16 billion dollar foreign exchange juggernaught which gives our NZD value so that we can buy our overseas goods and overseas holidays. Not quite so easy to just chuck away and do something else when our other $17 billion juggernaught ie Meat and Milk industries have reached peak cow.

Lets hear some realistic ideas to fix this problem rather than just harping on about fixing effects when anyone with any common sense knows you fix problems by focusing on the cause and not the effect. Clearly population growth from immigration is the effect and not the cause.

LikeLike

Correction: Tourism and International Students, our $16 billion Foreign Exchange juggernaught

LikeLike

Um you forgot the IT (including film) industry.

Technology is the fastest growing sector in New Zealand and digital trade is especially important for the New Zealand economy,” he says.

https://www.sunlive.co.nz/news/232464-new-digital-partnership-deal-will-help-nz-business.html

LikeLike

To one of simple mind, to me it seems that much of the problem could be elimination of excessive immigration. At this time we seem to allow more immigration much of it to try to fill the needs of problems created by the previous excesses.

Bite the bullet, endure the pain!

Another excess is the love of buying investment property. The investor for a small amount of their own money gets the use of very cheap mortgage at the expense of depositors. So why not place a premium on borrowed cash either via a premium payable to the central tax pool or by non-deductiblity of interest.

This would push property toward owner occupiers and lower house prices due to decreased investment demand. Any investor who already owns their property 100% could not complain they are being hard done by.

Governments of all hues have been complicit in the current situation. They are all gutless.

LikeLiked by 1 person

Slashing immigration would ease the pressures for a while but wouldn’t fix the underlying problem ( see eg Dunedin where there isn’t much population growth at all).

LikeLiked by 1 person

What do you think of the idea of a premium on borrowing other than for a new build or a family home? Perhaps it would be passed on to tenants, and probably would be as unpopular as CGT though.

LikeLike

I’m not a big fan, since it adds a whole new distortion (in addition to the biases against investors in the LVR system). There would be a lot of enforcement challenges, some of which were dealt with here

https://www.rbnz.govt.nz/monetary-policy/about-monetary-policy/mortgage-interest-levy-a-detailed-option – a piece I coauthored back in 07 when the govt was interested in putting an extra premium on all mortgage lending.

LikeLike

Residency immigration has been slashed under this government although likely more due to incompetence by having a massive logjam from bad administration rather than intentional. But faced with the reality that there is a massive shortage of staff, the government has increased foreign worker numbers very significantly. You really can’t fixed a problem by focussing on the effect and the cause is much harder to fix. The cause is that our fastest growth industries are in services ie, health, aged care and tourism/international students.

LikeLike

Faffinz, NZ borrowing interest rates are one of the highest already in the OECD. We are already paying a premium on borrowing. Not exactly a new idea.

LikeLike

The real purpose of the concept of an investor premium is to make borrowing less attractive for gearing up thus balancing the cheap money incentive. The result should be a drop in property values so that while an occupying owner pay more in interest the lower price paid would be lower borrowed capital. Longer term benefits include less to pay back.

LikeLike

The Dom Post covers a little bit of this today. The main person interviewed for the article states the real reason councils are not releasing land for development is because they can’t afford to build the necessary 3 waters and roading infrastructure in advance as their debt levels are approaching the allowable limits. I think there is something in this claim, although it is by no means the only reason.

LikeLike

And in fairness to the govt they are taking some actions which may help to address this. However, as I understand it developers themselves can do the three waters infrastructure. More generally, debt shld be a lot higher in places with fast growing populations.

LikeLike

The issue is none of these things. The issue is and has been for lots of years around 2 things. The RMA which stops most things in their tracks, feeds an army of lawyers, councilmen, politicians, nimby’s, Maori’s and every johnny come lately who doesn’t like life at anything but what THEY want. ( can give you examples if you don’t already know of plenty. Should we ask about Island Bay Cycleways etc. etc. ad infinitum.)

Much of this stop’s stuff happening but more importantly wastes a lot of money time and effort.

The second reason is basic to building. Very few towns or cities can you buy a section and place a cheaply built house on the section. Think factory-built or even onsight construction. The reason for that is nimby’s and property developers. All developers place covenants on the sections to stop that happening so anyone building has to fund a large B& T house with garage and all the mod cons.

Back n th 50’s, the sixties and 70’s whole subdivisions were built with these houses. I own several my self and sure they don’t have internal garages, tv rooms and so (you get my drift), but they are comfortable small houses mostly they were less than 100 sq mtrs.

Its always puzzled me why we need garages for our cars for example. They are steel or plastic, designed to sit in the weather and so on but we apparently need to put them in a room at night or when not in use.

People wanting to get on the housing ladder don’t care about a garage for the company car. The want to house thier kids.

The only way to fix this is to require all developers to have non-covented sections in the subdivision. They will kick and scream but they have already made their cash and run away. They actually have no responsibility for their work once it’s done and so should have some restrictions on what they develop.

So no ability to build 180k houses only 380k houses.

Now I live in Tauranga and have done for 45 years and I see this daily.

Bob Clarkson (who actually wanted to fix this when and MP. but the nice Mr Key just didn’t like him and preferred our current pretty boy leader who doesn’t know how to fix things.) wanted to develop such a subdivision and the council and the developers essentially stopped it.

Unfortunately, Bob has now got Parkingsons so has sold the block to another developer who will not allow the build of cheap houses. and so the cycle goes on.

Apparently we can’t fix stupid anymore.

LikeLiked by 2 people

“Take a drive along Papaiti Road northwest of the Whanganui suburb of Aramoho and rising out of a maize field you’ll find the $2.5 million Upokongaro Cycle Bridge.”

McDouall said council failed to take into account the imminent passing of Te Awa Tupua (Whanganui River Settlement) Act in 2017 which recognised the river “as a living and indivisible whole” with “all the rights, powers, duties and liabilities of a legal person”.

Unfortunately these days you have to pay a bribe to Maori before getting any infrastructure completed.

LikeLiked by 2 people

Unfortunately in NZ it is illegal to offer a bribe and it is illegal to accept a bribe. So we have this eyeball to eyeball standoff between Maori and Other parties because they want a bribe and no one is prepared to offer a bribe so the standoff and consultation continues until someone realises all Maori wants is to get paid and offer a Maori Earthworks monitoring contract and invoiced to make it a legal bribe.

LikeLike

Given the low level of average income in NZ versus say USA, would be interesting to see what the relative position is if you adjust for that – ie is the cost of housing somewhat similar (although we know everything in NZ tends to be more expensive) but incomes are relatively lower

LikeLike

Building costs themselves tend to quite a bit higher than in the US.

I guess one comparison that would go to your point is to look at poorer US states, which might have similar GDP per capita in NZ. Eyeballing the Demographia tables, most cities in such states have much lower house prices than NZ cities.

LikeLike

Better Micheal to look at the land component. That’s where they wind Miles and miles of cheap land. and no RMA or Maoris in most of those places.

LikeLike

Well, I was in the states last year and apart from the big cities, small places were paying$10 per hour still. And no prospect of that going up at the time.

I haven’t paid a worker $10 in 15 years. so your assumption that people in the states are paid more is simply not correct. Ask any Mexican labourer who crosses the border each day to work.

LikeLike

Real GDP per capita is a great deal higher in the US than in NZ. So are all-up median labour costs, altho of course in a US context a great deal of that is taken up in health care costs, which employees never see directly.

On your other point, yes in principle I totally agree that the focus should be on land costs, altho it is much harder to get consistent (across time, across country) land prices, esp for land which already has dwellings on it.

LikeLiked by 1 person

Micheal, the USA is 300 years older than us. They signed the constitution at the same time Cook arrived on our shores to be meet with stoneage people. At that point, they were about 150 years down the track.

When you can plough thousands of acres with big John Deeres on remote control to grow crops then there will never be a way NZ can match that.

Still doesn’t make the average American outside of the main cities get paid a high rate. The only thing to change that is the Wall that stops the constant flow of people over the border. Like here those people are still better off than where they came from and if they behave and work they get ahead. Try driving around in some of the Ubers in Philly or Detroit an ask them. Meet some cool people working hard.

But you have to say many Americans are lazy.

Our issue here IMHO is the very low calibre and world education of the people who engage in National politics. Some of them are just appalling and it seems to me the Parties could do well to look for better people. We still have a faux class war between the left and the not so left and the evil now called the far-right, which of course is what they are not.

David Seymour would be the most outstanding person in politics currently. Principled listens, argues very cogently about his subjects and ok some of his efforts don’t always go down with others including nasty maggie. but that’s the religious trying to impose their views on others who simply have a different view. I can tolerate Seymour because I just don’t want some cranky religious nutter like Barry telling me how to run my life. That is for me to choose.

I respect your religious views even if I may or may not disagree and that is how it should be.

Late lasst year a gentleman by the name of Trevor Bently published a book about NZ. Its called Pakeha Slaves, Maori Masters. If you read nothing else in a while (and I know you do), get a copy. It will open your mind to what is going on in NZ, how the Maori society still works/doesn’t work. Its a really good read. you can then understand the Joneses, Peter’s, and all the rest of that lot.

LikeLike

Thanks for the suggestions (altho I’d say the US was 150-170 yrs older than us, not 300).

I’m more sceptical of any of our MPs. Of the two you mention, no time at all for Maggie Barry (even if I might agree with her on euthanasia) and not much for David Seymour. We seem locked in some low-level equilibrium where the parties have no real incentive to seek exceptional people, and any such people prob have little desire to be part of the mediocre status quo. But, sadly, it isn’t clear that the public demands something much different.

LikeLike

1) Worldwide low interest rates pushing up asset prices (human nature to mortgage what they can afford at current interest rates

Otherwise simply insane and total failure of governance by successive governments. Government is meant to be for the people by the people, not by the house-owners for the house-owners.

2) Failure to set an equitable tax system – we have a tax system that doesnt/hardly taxes capital gains in the residential market.

3) Failure to reform the RMA – The RMA is near inelastic and totally dominated by rules written by planners (with no individual cost benefit assessment of each rule) who do not have to bear the costs of the rules. The RMA is meant to be effects based. There should be no zoning and no density restrictions, and limitations on development only if the national environmental effects standards arent met. (not the government has bothered to enact them)

4) Failure to manage the immigration rate at a sustainable level – Very high immigration rate per capita (https://www.stats.govt.nz/news/new-zealand-net-migration-rate-remains-high) – we don’t need that many to serve tourists, and help the health sector.

5) Failure to set up user pays in the housing market – Up front developer levies simply raise the upfront house prices. It isnt the developers that cause the infrastructure demand but the occupants. Better to have targeted rates / development bonds clawed back annually from the occupiers

6) Failure to price road use – No congestion tolls. Transport & land use are totally inter-linked. Congestion tolling will drive land use densification around public transport hubs.

7) Failure to provide market conditions where a mass building market can develop – Where I currently reside villas/apartments are turned out at cookie cutter rates (same design, same layout over large developments) far in excess of that in NZ, & the population here is less.

LikeLiked by 3 people

4. Failure to manage immigration rate is just nonsense, tourism and international students is people intensive, you need bus/cab drivers, cleaners, hoteliers, Air BnB, retailers, accountants, bankers because there is so much money involved. What you do not understand is the Foreign Exchange effect is $16 billion but the flow on into the domestic economy is pretty much multiples of $16 billion. If you want to talk about trickle down then tourism and international students foreign cash inflow is the most efficient form of trickle down.

LikeLike

The immigration rate should be managed at a sustainable rate to maximise total welfare/capita growth (inclusive of externalities) (gdp/capita as a first proxy) not to simply pump the economy via absolute gdp growth (the sugar rush) with the collation of substantial externalities. e.g. NZ’s immigration policy, with one of the higher rates per capita in the world is totally at odds with NZ’s own carbon policy.

I’m not saying we shouldn’t have immigration, or that we should necessarily unwind it instantaneously (given multiplier effects), but the current very high rate is unlikely to maximum total welfare/capita growth in NZ (inclusive of externalities).

If the immigration tap is turned down, the exchange rate and interest rates will adjust and compensate.

LikeLike

Just checked and 269,000 tourists per year – assuming an average 2 week visit that is an average of roughly 10,000 tourists in the country – they need hotels and guides and bus drivers – say one employee for every two tourists so about 5,000 jobs.

My experience of studying at Massey Uni was the number of students and the number of lecturers, cleaners and coffee shop employees was almost unrelated. So if 50% of the students were foreign that would make the university far more profitable but hardly effect the number of its employees.

If the number of students and tourists arriving is roughly balancing the number leaving then why is there any need for ever more immigrant workers to provide services to them?

The current number of permanent residents per year is about 35,000 which seems high for keeping international education and tourism growing. Sadly we live in a society which only wants foreign born carers for our infirm elderly and we probably need a few hundered extra every year as our population both grows and ages. About half the permanent residents are partners of Kiwis, partners of skilled immigrants and refugees but the other half I cannot understand. I do know the immigrant building workers are competing with my building apprentice son which keeps his income low.

Statistics about how our immigrants are earning their living would be helpful.

LikeLike

Bob, I think your numbers are way way too short. Auckland airport handles 20 million inbound and outbound traffic a year. It’s more like 4 million tourists throughout NZ.

LikeLiked by 1 person

Bob, the number of people employed by the tourist industry directly is 269,000 not the number of tourists. You need to visit SpecSavers. The number of foreign tourists visiting NZ this year is closer to 4 million and if you include local tourists that number is more towards 9 million. The inbound and outbound traffic in Auckland Airport is 20 million. Count the number of bus drivers and cab drivers you need from that alone.

LikeLike

Its all very well to have a turnover in dollars for the industry but let’s ask what the cost is to other people. Perhaps if we did a decent analysis including the cosy to us as a society we might not think tourism and education are very good for us at all.

Just puffery for others. at the expense of Kiwi’s.

LikeLiked by 1 person

GGS: thanks for the correction – makes sense too. So 269,000 working in Tourism jobs would mean an increase in 10% in tourism this year would require 27,000 new employees – certainly hard to find that many Kiwi school leavers. I would expect immigration numbers to ebb and flow with tourism. I still doubt the foreign students needing more service staff – many of the services they use are provided by other students.

LikeLike

Interesting discovery today which may be related to allowing non-residents to invest in new builds?

In a part of Auckland suburbia full of 1970s houses on near quarter acres a Chinese builder having demolished the existing house and done major retaining is building two large 5 br each with en-suite houses. There is no worthwhile views and so could not command any price premium.

The only explanation I can think of is to allow an overseas investor to bypass restrictions.

Of more importance is that the size of these takes labour and materials away from more needed smaller homes.

LikeLike

In the last few days, I have heard 4 stories of young kiwis being dumped on by the banks, including our own Kiwibank.

One case was simply appalling. Conditional financing wanting a valuers report which was never going to anything but good, took a few days and when the report came (6 days later), they told the young family that they had no money left as they had spent their allocation. WTF is that about? The house was a nice 2 bedroom, 10 years old initial type home in central Tauranga for 395K. Unbelievable and worse they put him through the expense of a valuation that he couldn’t use. Customer service of the wrong kind. Never would use Kiwibank.

Seemingly they have started a campaign hitting back at the RBNZ and that other outfit that is running around telling them how to run their business. Stopping loans to young Kiwi’s will soon come to MP’s notice one would hope.

We need a new RBNZ governor who is not fixated with his own pomposity.

The last one was awful but this one is even worse.

LikeLiked by 1 person

Here’s a today example of what goes on. Paeroa racecourse. Fat land easy to work.

https://www.stuff.co.nz/business/property/118800496/sections-for-sale-in-parking-lot-of-paeroas-former-racecourse

Sections $161K + signature homes and so on. In a place where noone really wants to live. Can be flooded.

https://www.signature.co.nz/house-and-land/waikato/oranmore-cres-paeroa

What do we think the final cost would be.

And they are short of cheap affordable houses. Ain’t going to happen though.

LikeLiked by 1 person

https://www.realestate.co.nz/3683157/residential/sale/11-oranmore-crescent-paeroa

$585000 is the price for this one. Cheap but not cheap enough for basic buyers.

LikeLiked by 1 person

Based on that evidence the traditional Kiwi dream of owning your home for most young people is dead in the water. As a couple in our early thirties 25 years ago, my wife & I bought our home, which we still live in. Back then a single income family (and my salary probably a bit over the median), but purchase price worked out at 3 times my salary and we got in with a $20K deposit borrowed from parents. On a 25 year table mortgage, what’s left today is under $50k and will be paid off in 5 years. Nice capital gain for us, but on the current market a very bleak prospect for our sons to follow, even with funding assistance from us.

The problem with property is sort of a perfect storm of demand from cashed up immigrants coming in (or returning Kiwis) and low bank deposit rates causing more funds from retired “boomers” to be diverted into residential investment properties rather than go into the sharemarket and term deposits. And yes you could add the stranglehold on the RMA in tying up land for years rather than quick release of affordable sections.

I believe as a country we need to discourage investment in residential properties by investors. Until you get the cash rich investor out of the residential property market (by all means go and buy a commercial building), especially at the lower “first home” end, nothing will improve. With values going up over 10% per year in property (higher in some locations) why would they get out? Only the big stick of the Capital Gains Tax will work, and unfortunately none of the political parties have the courage or ability to push that through.

The present affordability trends are likely unsustainable on various levels, but it may take social upheaval to trigger reform. History tells us whenever a segment of the population is locked out of land ownership eventually unrest and people power forces change.

LikeLike

I’d put a different emphasis on various possible policy response that you do (more on freeing up land), but am pretty sympathetic to your final para. Of course, the dreadfulness of our political class on this issues is striking, but so too is the way the populace (not even those aged 20-30 and their parents) don’t demand something different (yet).

LikeLike