I’ve been reading the papers released the other day by Treasury (in one case written jointly with IRD) on the Minister of Finance’s hankering to tax Australian banks more heavily, retrospectively.

There seem to be three such papers, a 10 February Treasury Report, a short 17 February Treasury aide-memoire, and a 10 March joint Treasury/IRD report. Nothing appears to have been withheld from the first two, but there are several, quite lengthy, bits withheld from the 10 March paper, in many cases apparently references to legal advice officials may have received.

The 10 February paper is titled “Windfall gains in the New Zealand banking sector, and responses”, apparently part of something called “Project Cricket”. Retrospective taxes targeted at companies the Minister of Finance doesn’t like and are just considered politically ripe for the plucking are…..really not cricket. But perhaps that irony escaped both the authors and the Minister. The paper is signed by Treasury’s Manager, Tax Strategy, and as tends to be the way with Treasury, when one looks him up he seemed to have no background at all in tax (or banking), and little in New Zealand either. It wasn’t a promising start.

It is a fairly long paper (24 pages)

The Minister already had his enemies in sight but wanted a fishing expedition as well.

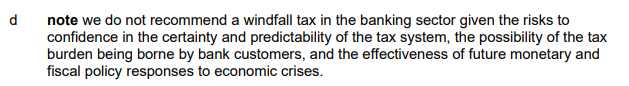

The Treasury paper wasn’t a very compelling piece of work. Without any serious analytical framework at all, it (slightly grudgingly, or perhaps just diplomatically) concludes “there is no clear evidence that banks made windfall profits during the recovery from COVID-19”. And instead of concluding strongly that since there is not the slightest evidence of anything that could seriously be called “windfall profits” and thus there was no serious analytical case at all for anything like a “windfall profits tax”, we just get this lame conclusion

as if otherwise it would okay.

As for those other sectors

All based on this

Quite how the agricultural sector “may have derived windfall gains” is left to the reader (and us) to guess. It all seems very loose and incoherent stuff. (Had one been interested in regulatorily-induced windfall profits, surely one place to look might have been the supermarkets that were given a monopoly position during Covid lockdowns at the expense of other food retailers, but….lets not encourage them.)

So lacking in any serious analytical framework is the discussion around “windfall profits” that Treasury apparently never thinks to point out that an unexpected burst of inflation (perhaps a 10 per cent change in the price level, engineered – albeit inadvertently – by the government’s own central bank), came closest to a true set of windfall gains and losses. Who gained – entirely unexpectedly? Why, that would be people with long-term fixed rate debt. And which party has the most long-term fixed rate debt on issue? Why, that would be the government itself. On the other hand, holders of fixed rate financial instruments were subject to fairly marked, close to genuinely “windfall”, losses.

I mentioned there windfall losses. That is more than the Treasury (or Treasury/IRD) advice ever does. Over time, true windfalls, such as they are, are pretty randomly distributed – gains, losses, sectors, individuals. But of course there was no sense here of a coherent or comprehensive approach to the issue, some systematic search for windfalls across the economy that the government might tax (or compensate). No, the MInister had his four Australian banks in target. With not the slightest evidence – even with Treasury doing what it could to try to find it for him – that there was anything that anyone other than the Green Party could seriously consider “windfall profits”.

And in this first paper, officials didn’t even think to point out that retrospective legislation of any sort – but perhaps particular one targeted at four of the king’s (or his Minister of Finance’s) enemies is generally pretty abhorrent. If anything, they seemed to quite like the idea of a retrospective tax (check the table on p15 of the release). On whatever strange definition of “coherence” these officials were using a retrospective tax aimed by four companies, when the advice said there was no serious evidence of windfall profits, also apparently raised no concerns.

(In passing, I would note that the Treasury is quite open in calling the Reserve Bank’s Funding for Lending programme a direct “subsidy” to banks. That is, perhaps unsurprisingly, not language the Reserve Bank has used. But as Treasury notes, there does seem to have been reasonable evidence that the subsidy – put in place as a conscious matter of policy – had mostly been passed on the customers.)

Somewhat surprisingly, when providing the Minister with advice on a tax that would be targeted at four specific Australian-owned companies, there is no discussion at all of the likely reaction of the companies’ owner, or of their government, or of whether and how such an arbitrary tax might raise difficulties in the trans-Tasman halls of financial regulators. Oddly, in all three papers there was not a single mention of the fact that the parents of these four wholly-owned companies also had active operating branches in New Zealand, and what (if any) implications there might be for the future mix between branch and subsidiary business.

Despite Treasury’s recommendation in that 10 February paper, the Minister of Finance must have disagreed. The 17 February aide memoire ( 2 pages only) sets out briefly options that could be done for the Budget, then only three months away. They were retrospective and prospective levies. This was what they had to say about the former

There seems to be no sense that this would be something of a constitutional outrage. Sure, they say they were checking whether there were legal risks (perhaps anything in CER?), but as they and the Minister know Parliament in New Zealand is sovereign and the government easily has 61 votes for budget legislation.

This paper was for a meeting with the Minister on 20 February. The Minister was apparently undeterred.

The final paper in this suite is joint Treasury/IRD report of 10 March (also referring to “Project Cricket”). The introduction to that paper’s Executive Summary illustrates just how far off the rails the Minister was heading.

It was bad enough that the Minister was seriously considering a retrospective tax restricted to four foreign companies he didn’t like, in the face of official advice that there was no evidence of anything seriously akin to “windfall profits”, but now he was proposing such an arbitrary tax-grab specifically to help cover a cost pressure elsewhere in his budget which had nothing whatever to do with the four companies he wanted to tax or any of their activities. One hopes that privately officials were well and truly rolling their eyes by this point.

One might acknowledge that this advice – or perhaps another captain’s call from Hipkins – finally brought this work stream to a halt, but it simply wasn’t very good advice (at least based on what the government has chosen to release). Mightn’t one, for example, have expected some serious reference to a likely Australian reaction? Mightn’t one have expected some serious discussion of the precedent such an arbitrary tax might establish (actual or perceptions)? There is some reference to it – amid a weird sentence that talks about “the favourable position of New Zealand as an investment destination” – on what metric one might ask? – but it is all very muted. There is no discussion at all of the intellectual incoherence of picking on individual profitable firms ministers don’t like and not (say) responding symmetrically when unexpected sharp falls in profits happen (perhaps officials thought it not worth dignifying this nonsense on stilts?). There is no mention of the branches, or anything serious on the possible reduction in the availability of debt finance to New Zealand households and small and medium businesses (really big businesses can finance globally). We even find abstract comments, no doubt tantalising to the Minister, that “in theory, a one-off retrospective tax will not affect behaviour”. That sort of line might be fine from a traineee analyst fresh out of a basic university course, but this was serious budget advice from responsible Treasury and IRD officials

In what they published (perhaps it was in what was withheld, though there is no obvious reason to withhold_, there is also no reference at all to the New Zealand legislation guidelines, which state

Pretty sure the Minister not liking four particular foreign companies isn’t one of those “limited circumstances” in the final bullet.

What was proposed was an abomination, but – even though they didn’t favour what the Minister was hankering for – you get little sense of that in The Treasury/IRD advice. I’ve seen people responding “ah well, didn’t matter, as he didn’t go ahead”. Donald Trump didn’t go ahead with most of his mad, bad, or evil schemes either, but that is slim consolation. We should expect better from someone who has been New Zealand’s Minister of Finance for 5.5 years.

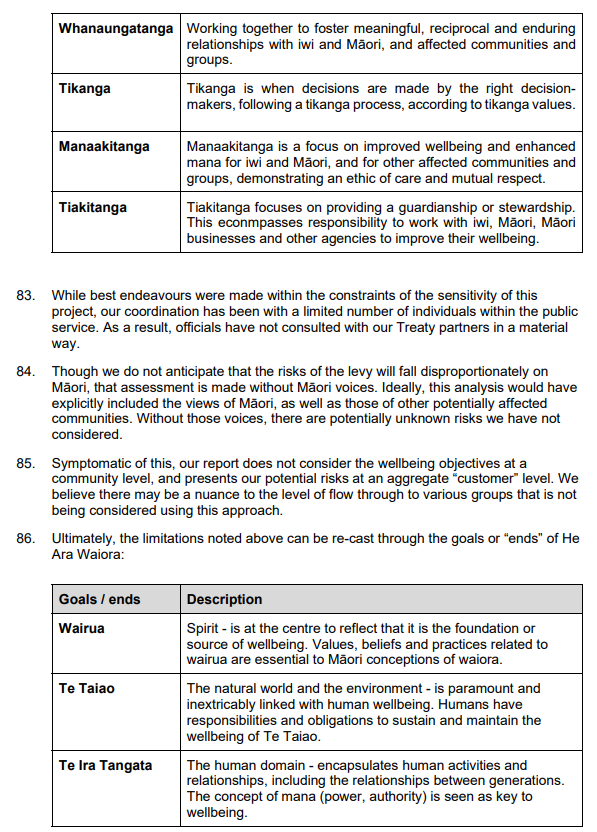

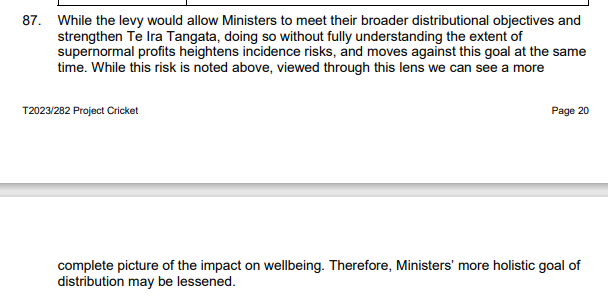

But at this point the advice gets a whole lot worse, losing all touch with reality and descending into some spirit world of officials’ imagining. I’m including the entire section

One wonders if officials are able to opt out of this nonsense on grounds that no one should be forced to practice someone else’s religion. Do other worldviews count? I guess not, at least if this advice is to be taken seriously.

Or which of “our Treaty partners” were consulted on this highly sensitive matter of tax policy, even in a not very material way?

Or look at that footnote 87: a retrospective tax grab from four named foreign companies for purposes unrelated to anything to do with the activities of those companies would apparently “strengthen” “the human domain” (whatever that means). I suppose it would indeed have played to the “concept of power” – power in an arbitrary retrospective way, much more akin to an abusive act of attainder than anything. People would then have known the Minister (and his ministerial colleagues with him) as an unconstitutional thug.

In the end, Robertson didn’t proceed with his egregious scheme and for that small mercy we should be grateful. But we now know that ideas of such egregious grabs do play in his mind – not just an idle fancy, but weeks of work – and who knows when they might return, or which other company or individuals might then be in his sights. It wasn’t exactly Treasury at its best either.

UPDATE:

Meant to include this tweet

Hello I am interested that you speak of Australian owned banks In fact the major “Australian” banks all have majority USA ownership and “local” ie Australian shareholdings are mostly leases than 20%

Thank you

Graham Gibbs ________________________________

LikeLike

That number sounds very (implausibly?) high, but even if the number were that high the Aus govt has a strongly proprietorial attitude to these big Aus-based banks. Do you have a reference for your number?

LikeLike

Thanks your response Just leaving for a family dinner Will respond tomorrow ________________________________

LikeLike

Actually I did find some numbers more or less along those lines.

LikeLike

I have twice tried to send more info but seems to be rejected bat this email address

Graham ________________________________

LikeLike

mhreddell@gmail.com

LikeLike

Reblogged this on Utopia, you are standing in it!.

LikeLike

Cricket , insect or game?

Off subject for which I apologise.Hugely important for NZ producers though!

Would love to see some of your educated comment on the OCR movement or not.

Inflation seems to be roaring along ,food prices 12.5%. Energy prices going north ,Orr suggesting housing prices may have plateaued returning to increases,many job seekers joining the wage price spiral with enthusiasm. Government spending rampant , Etc etc. Let’s not look at productivity!

Inflation is not done yet ,

So why has the MPC not continued to do their job?

Must be election year or something

LikeLike

At present, I think the election year comment is unwarranted. Perhaps, but time will tell.

For me, I can see arguments both ways at present, but with the CPI coming out on Wed there sin’t much value in commenting further before then (given how rare CPI observations actually are in NZ!)

LikeLike

[…] Project Cricket (and other nonsense) […]

LikeLike