It was something of a (perhaps minor) landmark event last Thursday when the Reserve Bank’s chief economist Paul Conway gave an on-the-record speech on inflation. It was only Conway’s second on-the-record speech (the first was on housing, something the Bank has little or no responsibility for) and thus only the second speech from a Reserve Bank chief economist for almost five years. Five years in which chief economists have become statutory decisionmakers (members of the MPC), in which monetary policymakers have dealt with a huge and expensive shock, and in which inflation – prime focus of central bank monetary policy – has been let run amok in ways never seen previously (arguably never envisaged) in the first 30 years of inflation targeting. And when (a) external MPC members are barred from research/analysis, and (b) barred from speaking or disinclined to do so, and (c) the chief economist’s own boss has no qualifications/background in economics or monetary policy, we should be able to look to the Bank’s chief economist for incisive and insightful analysis and perspectives on the macroeconomic dimensions of the Bank’s responsibilities. If not him then who?

Sadly, the answer to that seems to be no one at all.

There have been worse things from the Reserve Bank on monetary policy in recent years. The most egregious have been the (apparently) unscripted one-liners from the Governor. One could think of his claims – never backed by any analysis at all – that the economic gains from the LSAP programme were “multiples” of the $10.5bn (Treasury estimate) direct fiscal loss from the LSAP, or the preposterous spin he tried on Parliament’s Finance and Expenditure Committee just a few months ago

Not even arguable, just false.

There is nothing quite so egregious in Conway, mercifully (he is a more earnest, less flamboyant – or worse – character).

But what is there in his speech is far from the sort of standard we should expect from a senior policymaker addressing the biggest monetary policy failure in decades. And it is not as if his speech was delivered to a bunch of high schoolers or the Gisborne U3A (no offence to either) but to an (at least) expert-adjacent group at the ANZ-KangaNews New Zealand Capital Markets Forum.

The Bank’s PR people billed the speech this way

Item 3 is easy. The only thing the Bank can do is raise the OCR and hold it higher for long enough. Although Conway never acknowledges this, it is hard to be very confident in their view (or anyone else’s) on how high or how long might be required, not just because there are always new shocks, but because neither the MPC nor others really yet have a compelling story for why core inflation went so high so quickly.

So much of the speech is made up of plaintive pleas to the public to believe the MPC when they say they are serious, and to act accordingly, without giving us any basis to believe the MPC really knows what it is doing. After all, not much more than 18 months ago Conway’s predecessor was telling the Reserve Bank’s Board there was no hurry and no real need to worry, and their published forecasts were telling us they expected inflation would be almost bang in the middle of the target range by now. It would have been a bad (and costly) idea for people to have based their plans on those forecasts and the contemporaneous rhetoric. You might have hoped that if he really wanted to jawbone us, and have people take seriously his rhetoric, that the Bank’s chief economist (of all people) would be presenting persuasive analysis that they understand what they got wrong and reasons to think they are better now. But there is none of that in the speech, and it refers us to no serious supporting analysis or research either.

Instead there is lots of spin.

One of the most striking things in the speech was something that wasn’t there. Central bankers often, and rightly, pay a lot of attention to measures of core inflation. But in a major (rare) speech about inflation, there is but one (passing) mention of the term (or cognate terms), simply noting in the final few sentences that core inflation is about middle of the pack among OECD countries/economies.

Instead, we get a great deal about “the pandemic, the war, and floods”, which seems to be a slightly more sophisticated attempt at distraction than his boss’s claims quoted above.

No doubt, as Conway notes, the floods will put some pressure on resources over the next few years (particularly to the extent losses are covered by offshore reinsurers, as distinct from being net NZ wealth losses), as the 2010/11 and 2016 events did, and may result in some direct price pressures (some fruit and vegetable prices) in the next couple of quarters. But, thanks to New Zealand’s infrequent and badly lagging CPI, none of that is in the published inflation numbers yet.

What of the pandemic? It is clear that here Conway is not talking about the (with hindsight) gross macroeconomic mismanagement (the RB MPC being the last mover, and thus primarily responsible) that delivered us, several years on, really high core inflation, but the direct price effects of pandemic-driven supply chain disruptions several years ago. Some of those effects may have been material contributors to headline inflation back in 2020 and 2021, but it is now 2023, and if we could do a good decomposition (a good topic for some RB analysis) it seems likely that if anything the unwinding of those disruptions is probably holding headline inflation down a little now (eg global freight costs have fallen a lot). Perhaps he has in mind airfares – where capacity has been slow to return – but that is a good reason to look at, and cite, analytical core inflation measures.

And then there is “the war”. At the Reserve Bank, they are very keen on “the war” as distraction and cover.

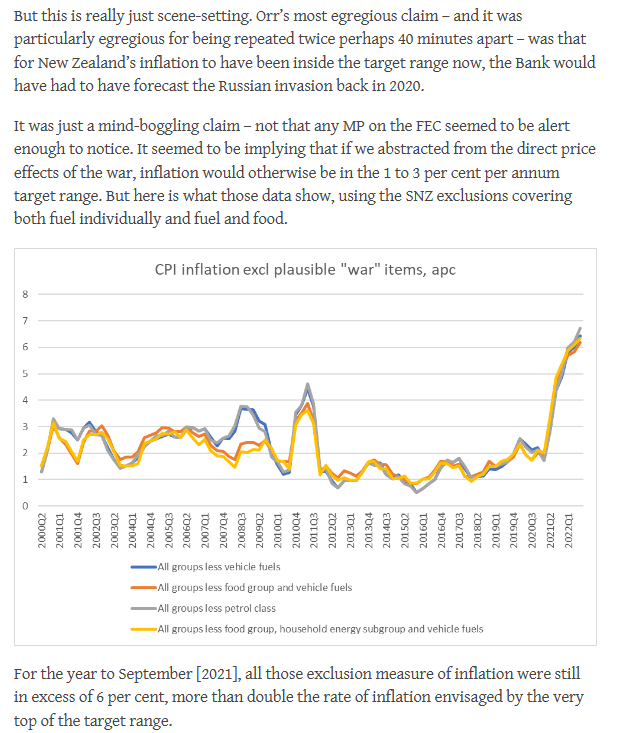

We all know world oil prices shot up quite a bit in the immediate wake of Russian’s invasion last February. But not only are world oil prices now lower than they were (real and nominal terms) prior to the invasion, but New Zealand headline annual CPI inflation is still held down artificially at present by the kneejerk petrol excise “temporary” remission put on last March and still in place (strangely, Conway never mentions this). Where else might we find these “war” effects in New Zealand inflation? Wheat prices also rocketed upwards initially, but again they are lower now than they were at the start of last year. I guess fertiliser prices are still higher than they were, but it hardly seems likely to add up to much in NZ CPI inflation. Especially when we know – although Conway never mentions – that core inflation had already risen a lot, to quite unacceptably high levels, well before the invasion.

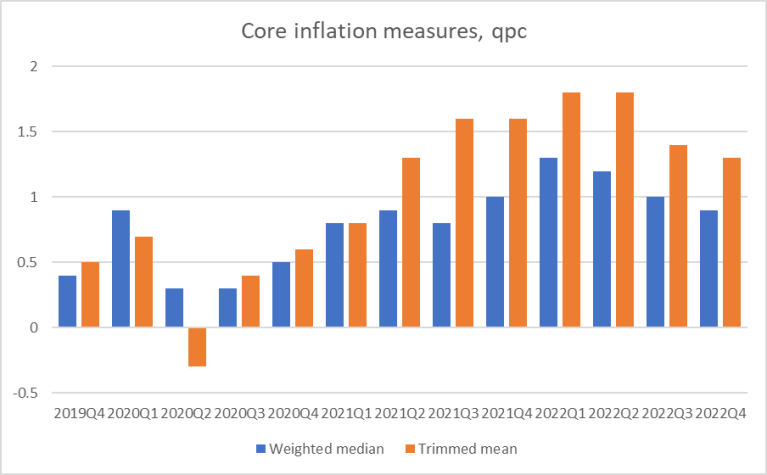

Conway does acknowledge that monetary policy should have started to tighten earlier (and doesn’t even fall back on the silly line he and Orr have previously used, that a slight difference in timing would have made only a slight difference to inflation – well of course, but the real problem, with hindsight, was not “slight” differences in timing), but engages in a fairly sustained effort to leave readers thinking there really was not an evident problem in 2021, just a few “one-offs”. But this is where analytical measures of core inflation come in. Trimmed mean and weighted median measures are pretty standard parts of many monetary policy analysts’ toolkits.

The big increase in quarterly core inflation took place in 2021.

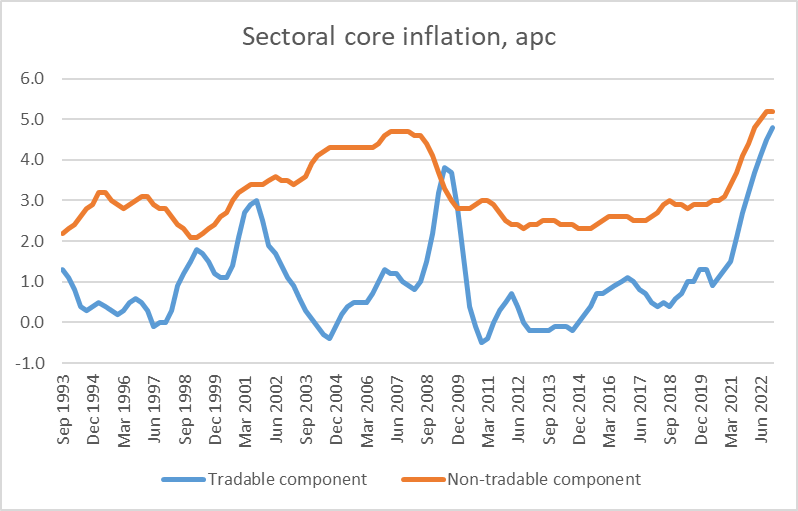

The sectoral core factor model, like all models of its class, has end-point issues and estimates prone to revision, but the best guess now is that core inflation had already doubled (to in excess of 4 per cent) by the end of 2021.

But none of this mentioned at all in the speech. Nor is the fact that by late 2021 the unemployment rate – best simple measure of changes in excess capacity – was dropping rapidly to below levels anyone regarded as sustainable.

Many of these events took the Reserve Bank (and others by surprise), but they are the ones paid to get these things right. We live with the consequences when they don’t. But nowhere in the speech is there any acceptance of responsibility.

We also get attempts to suggest there is nothing the MPC can do about inflation sourced from abroad…….in a speech where the exchange rate gets no substantive (and only one formal) mention at all.

There is a chart in the speech which purports to illustrate the problem, showing tradables inflation as a share of headline inflation, without any acknowledgement that if tradables tend to average 0% and non-tradables 2.5 per cent (loosely the case pre-Covid) and then tradables average 2% and non-tradables 4.5% tradables would make up a larger share of headline inflation even though nothing about the relationship between tradables and non-tradables had changed at all. Yes, tradables inflation has increased relative to non-tradables but if we look at the core components of each the recent change isn’t unprecedented, tradables didn’t lead non-tradables, and (in any case) the Reserve Bank’s own past analysis has tradables as a typically fairly small component in the overall sectoral core inflation measure.

If – as happened – other countries run high inflation, the job of the Reserve Bank of New Zealand is to tighten monetary policy here to lean against importing that inflation. That will generally occur through a higher-than-otherwise nominal exchange rate.

I’m not going to spend any more time on the jawboning rhetoric. No doubt it feels good inside a central bank – I’ve run plenty of it in my time, in writing and in speeches – but it is really a distraction from the core issues (MPC responsibilities) and less persuasive now – when, with the best will in the world, the central bank has just messed up badly – than perhaps it might have been decades ago when we first trying to transition from high inflation to low inflation, with a newly-independent central bank.

Conway’s speech was made just a month on from the latest Monetary Policy Statement. In that flagship MPC document, there was a substantial four page section on “The International Dimension of Non-Tradables Inflation”. No doubt, the analysis in that section came from Conway’s own Economics Department. But in a flagship speech on inflation just a few weeks later there is no mention, not even a reference, to that analysis at all. In my MPS commentary (last few paras) I briefly identified a number of apparent weaknesses in the analysis. Perhaps on reflection Conway accepted the issues I had raised, but whatever the explanation it seems odd to have such analysis feature prominently one month and simply disappear from consideration the next.

These were two of the last three paragraphs of the speech (emphasis added)

At one level, it is hard to argue. It all sounds good. Except….where is the substance to back up the words? The Bank’s own published research output has slowed to a trickle, there is no serious analysis or insight in the speech, and we know that the Minister of Finance has reaffirmed only last year his commitment (in league with Orr and Quigley) to ban anyone with an active or even future interest in serious research or analysis from serving as external MPC members. Oh, and the Reserve Bank has the least-qualified deputy chief executive responsible for macroeconomic and monetary policy of any advanced country central bank (and probably most emerging and many developing countries as well). Nothing we’ve seen so far suggests any particular reason to treat these words as anything other than spin.

I was mildly hopeful (prone to naive optimism perhaps) when Conway was appointed. Perhaps things are about to change. There is, after all, a position on the MPC that comes vacant next week, currently held by someone who has no relevant subject expertise, who has never explained her views on monetary policy in four years in the job, and who was (so the papers confirm) pretty clearly appointed mostly because she was a woman. Replacing her with a more serious appointee, and overhauling the protocols in a way that encouraged or compelled externals to be individually accountable, would be a small start in the right direction. If Orr, Robertson, and Quigley were serious. I am not, however, holding my breath.

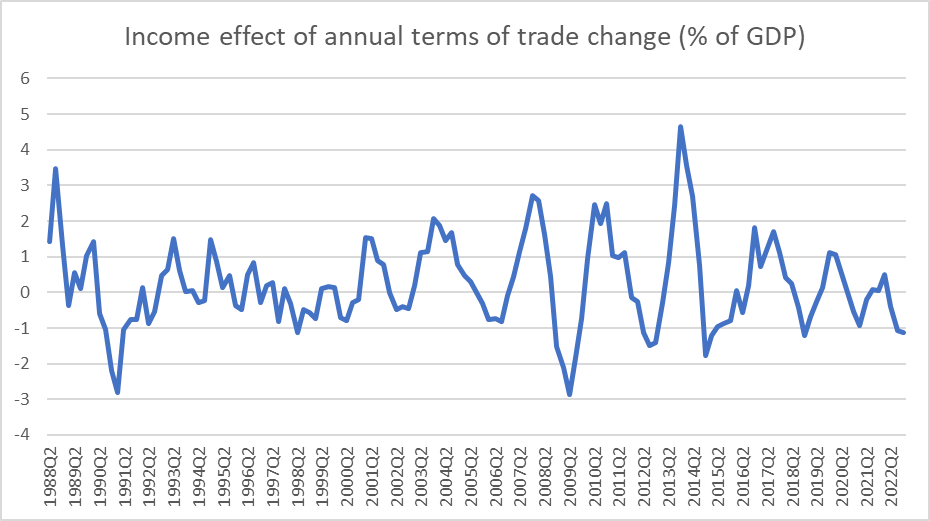

The contrast between Conway’s speech and those of his peers in other advanced central banks once again leaves the New Zealand institution looking well off the pace. Just the slides published for an ECB Board member’s talk yesterday have considerably more substance than Conway’s full speech (and she speaks often). I’ll leave you with this chart, inspired by one of Schnabel’s slides

Terms of trade fluctuations – “direct price effects of the war and the pandemic” – just aren’t a big macroeconomic issue in New Zealand.

Yes, except for your comment that “the only thing the Bank can do is raise the OCR and hold it higher for long enough.” They could also sell some of the LSAP assets they are holding and take some money out of circulation to offset the continued increased spending by the Government and their foolish and mistaken LSAP injection in the first place. After all they don’t realise any losses, the Government does…

LikeLike

Would be no harm in selling some more bonds but it would make as little difference to macro outcomes as the initial purchases did (they involved assuming lots of risk for very little plausible economic return).

LikeLike

Agreed, macro effect limited (decreasing settlement balances vs increasing them with the LSAP) BUT it would put upwards pressure on bond yields and thus contribute an indirect deflationary effect (amplifying the contractionary effect of the OCR increases, and making Govt borrowing more expensive, like the LSAP amplified the stimulation of OCR decreases, and made Govt borrowing cheaper during the expansionary period (which they are paying for in spades now of course!) Some significant signalling value too perhaps?

LikeLike

Reblogged this on Utopia, you are standing in it! and commented:

It would be nice to know what macroeconomic model the bank uses apart from it is not our fault?

LikeLike

Yet again, the RBNZ drives the car looking out the rear view window.

They should have started the speech by disecting the CPI, showing what’s sticky and what’s transient. Spoiler alert, there’s a LOT of transient inflation.

Then focussed on the Monetary tightening that has occurred, and is still in the system.

Then turned to the economic impact of that tightening. For instance, the impact on housing, the flow on effect this will have on household consumption expenditure, residential and business investment. My own projections suggest residential investment could fall by 1/3 by end-2024. Noting that GDP has been supported by stock building – which will reverse- and the one off gains coming from border re-opening.

Then delving into the labour market. Labour supply is rebounding as demand wilts, and how the unemployment rate will rise and wage pressures dissipate.

Concluding with how inflation is likely to come back to target and this is why longer term inflation expectations remain well anchored.

Anyway, that’s how I’d have tackled it, with 22 years experience of doing hundreds of these presentations…

LikeLiked by 1 person

Seems to me there are a variety of reasonable approaches he could have taken to a speech – including the one you suggest – but any of them should have called for more depth and insight than was actually displayed.

LikeLike

‘I want to leave you with four key messages from this speech:’

Great, I can hardly wait.

1. ‘Inflation is high and widespread because strong demand outstripped supply.’

This is a tautology. It is true, by definition. 2 + 2 = 4 is a tautology. This equation can be useful, but it is meaningless.

Alas, the Reserve Bank ‘key message’ is a tautology, and in this case, isn’t useful or meaningful.

2. ‘We are worse off because of the pandemic, the war and floods.’

Okay, now we’re rolling. The Reserve Bank Book of Revelation. The Four Horsemen of the Apocalypse.

Pestilence = tick. War = tick. Flood = tick.

What is the key message here? We’re missing Famine? Is this some sort of Reserve Biblical code? I’m lost. Ah, just excuses.

3. ‘Monetary policy is lowering inflation… We are incredibly determined to get inflation and inflation expectations back to target.’

For some reason, this great takeaway had me thinking about the Spice Girls, for the first time in twenty years. I’ll take away this:

‘Yo, I’ll tell you what I want, what I really, really want…

So tell me what you want, what you really, really want

I wanna (ha), I wanna (ha), I wanna (ha), I wanna (ha), I wanna

Really, really, really wanna zig-a-zig ah’

4. ‘Returning inflation to target could be made more difficult if businesses and workers try to push up their real profit margins and real wages’

Okay, yoda addressed this issue:

‘Do or do not. There is no try.’

ECON 101 suggests yoda is wrong in this case. Businesses and workers will inevitably try.

However, maybe yoda is correct insofar as the issue that matters is if they ‘do or do not’ – not whether they try.

For me, the key messages didn’t illuminate the past, present or the potential future.

Overall, it read like a schoolkids homework exercise. C+.

LikeLike

Harsh, but……perhaps not unfair

LikeLike