A consistent theme of this blog over the 3.5 years since the Monetary Policy Committee was established has been the severe inadequacies in the way the MPC was designed, and in the way it has been staffed. Last Tuesday, Stuff journalist Tom Pullar-Strecker had an article that reported on a variety of similar concerns, informed by extensive comments from former Reserve Bank chief economist John McDermott. A particular focus was on the role of the non-executive members (“the externals”).

At the press conference for the Monetary Policy Statement Pullar-Strecker asked the Governor about the externals, and if he didn’t get far (the awkward questions at that press conference were mostly left completely unaddressed), he did get from Orr an observation that externals were free to talk, subject to (Orr’s interpretation of) the MPC Charter provisions (in turn agreed by Orr and the Minister) under which for the first 24 hours after an MPS the Governor was the sole spokesperson for the Committee. It rather invited questions once that 24 hour window had passed.

And it seems that Pullar-Strecker did. Just before 5pm yesterday a document headed “Monetary Policy Committe (MPC) external committee member Peter Harris responds to media questions” dropped into the inboxes of anyone signed up for Reserve Bank announcements. Given the context, it was pretty obvious that the questions were from Pullar-Strecker (later confirmed by him and his story), but the Reserve Bank was at pains to keep anonymous the media outlet, even deleting a reference to Stuff in one of the reporter’s questions.

Kudos to Pullar-Strecker for pursuing the issue. In 3.5 years of the MPC’s life, it is only the second interview ever granted by an external MPC member (there was some comments by Harris to Bloomberg a couple of years back), despite the huge power that (on paper anyway) MPC members wield, not to speak of the mayhem (inflation, looming recession) now following in their wake.

Unfortunately, if the Bank can now push back and say “see, Harris did (another) interview”, the substance of the interview mostly just serves to confirm doubts about the institution and the individuals. From their perspective it is hard to see what, if anything, is gained by choosing to make him available in this way (and I don’t think we need to doubt that doing the interview will have had the sign-off of the Governor, and was perhaps encouraged by him). At times, Harris displays all the grace and constructive open and engagement we might expect in a rebellious 15 year old told they have to make conversation with Grandma at the family Christmas celebrations. If the answers aren’t quite monosyllabic grunts. most of them might as well be.

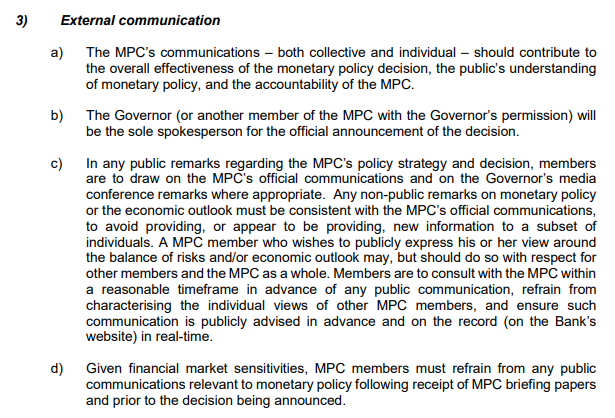

Since it is important background to the interview, here is the relevant section of the MPC Charter.

I don’t suppose anyone has any particular problem with a), b) and d). In fact, from a) one might positively welcome the explicit mention of the notion that communications should contribute to the accountability of the MPC. The focus is on c). If one interprets the first two sentences as being about the most recent decisions, there isn’t too much problematic there, at least in principle, given the model that favours consensus decisionmaking. After all, good minutes of the MPC meetings (unlike the ones we have) would give considerable weight to outlining the conflicting arguments, perspectives, considerations, and some members might reasonably emphasise some of those rather than others (a consensus decision that everyone can “live with” – the Governor’s own word – does not necessarily mean everyone came to that decision for the same reasons.

Note that the Charter does not prevent – in fact explicitly allows for – members from expressing “his or her view around the balance of risks and/or economic outlook”. As the Governor put it last week, there are some courtesies to be observed (let your colleagues know in advance, don’t attack other individual members’ views in public). And there is the requirement that “such communication is advised in advance and on the record (on the Bank’s website) in real-time”. There is certainly no obstacle to recent MPC members reflecting on what has passed, or on the structure, processes etc of the MPC. Note too that the Charter applies to all MPC members, not just the externals

That final provision in c) looks to have been designed to cater for MPC member speeches. It is easy to announce in advance that an address will be being given and to commit to release the text on the Bank’s website when the address is being given. Whether speakers stick to their written text – Orr apparently rarely does – is perhaps harder to police.

Note, however, that there was no advance notice of the Harris interview, so the Bank – which issued the statement on Harris’s behalf – appears to have been complicit in breach of the Charter. More generally, although the text of this interview is available on the Bank’s website, no other interviews by MPC members are (in the last few days for example, Conway with Bernard Hickey, Hawkesby with Stuff, Silk with Reuters – as it happens, each of those MPC members talking about more market-sensitive stuff than Harris ended up doing). It isn’t uncommon for (internal) MPC members to give interviews to media outlets and (a) never provide transcripts, and (b) which are behind paywalls. The Charter looks like it could do with an amendment to require that the text of any media interview with an MPC member in their MPC capacity should be published on the Bank’s website simultaneously with the story published by the interviewing outlet. That is the sort of approach an organisation seriously committed to transparency would take.

On this occasion, the Bank’s approach – emailing out the text – looks to have been some sort of revenge play, undermining the capacity of the journalist to break a story from the interview, in return for the offence of challenging the Bank/MPC. The rules and practices depend on how compliant the journalist is. Pullar-Strecker noted on Twitter that the Bank had not even told him this was the approach they were going to take.

What of the substance of Peter Harris’s interview.

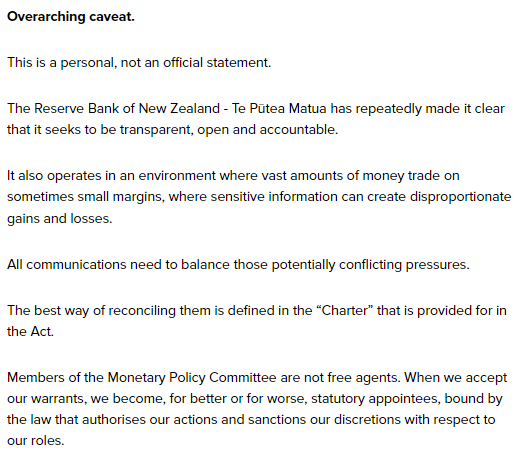

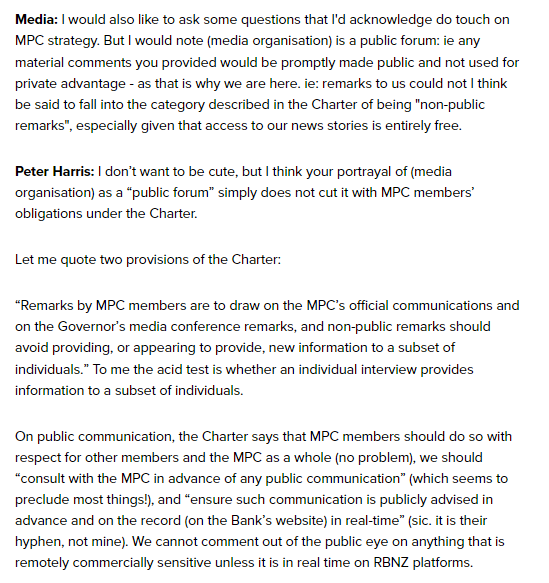

It begins with this rather defensive ‘overarching caveat”

Except that Conway, Silk, and Hawkesby had each given fairly extensive interviews in recent days. The Charter just is not that constraining, unless you want to avoid scrutiny/comment (or, more generally, Orr seems to favour internal members, who of course directly answer to him). Now, it is fair to note that none of those internal member interviewees were actively advancing alternative perspectives on the inflation and monetary policy outlook, but they weren’t all simply reciting already-published lines either (from Silk we learned that apparently we will have only a “technical recession”, from Hawkesby – rather better qualified to comment – that actually these things are often quite a bit sharper than forecast).

Before proceeding further I should say that I didn’t think all the questions to Harris were particularly well-framed. But it is pretty standard media advice that you answer the question you want to answer. If the question is ill-phrased or not really to the point, answer another one. And if you and your organisation are really committed to being “transparent, open, and accountable” do it in an open, constructive and positive way, not grudgingly or petulantly.

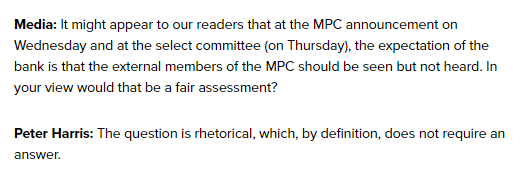

Surely he could have come up with a more constructive response than that? It was, after all, a reasonable question when Orr highlights that all the MPC members were present, but only he and his direct reports were able to say anything. No one forced them to be there, so what did they themselves see the point as having been?

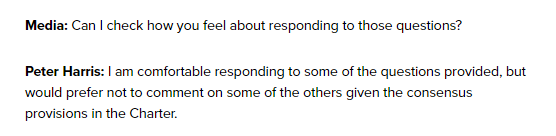

This was interesting, suggesting that Harris had the questions in writing so had had the opportunity to think – and take advice – about how to respond.

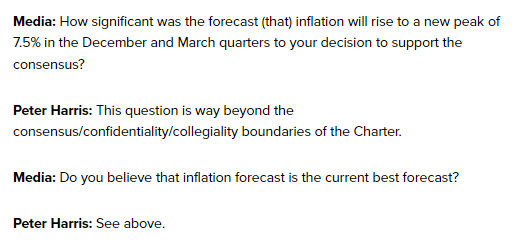

As far as I can see none of the questions on monetary policy itself went beyond the sort of thing the internal MPC members were answering in their recent interviews. The journalist pushes back

Which surely leaves everyone confused. The transcript of this interview was published in full on the Bank’s website. If MPC members really aren’t allowed to interviews, why is he doing one?

Even if you don’t want to say much of substance, there are ways of answering these questions that don’t come across as deliberately obstructive, and indeed might offer some insight on the value (or otherwise) a particular MPC member is adding. To take the second question as an example, it was an easy invitation to say something like “yes, but of course any medium-term forecast is inevitably not that much better than a shot in the dark – that is the nature of economics and economies – and mostly likely a lot will turn out different. It is our – my – best view for now, but our processes emphasise holding any view lightly, and regularly updating our forecasts and policy”.

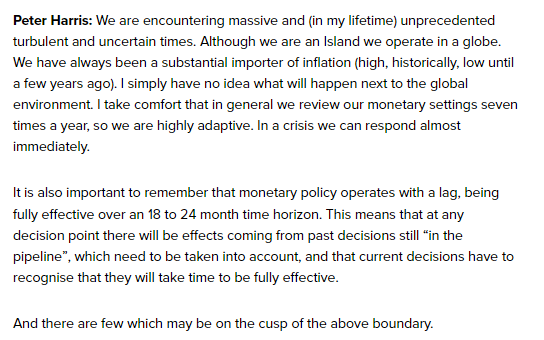

The interview continues

I have no idea what the final sentence is supposed to mean. Of the rest, when a family member read the interview they commented of the first sentence “is he 35?”. In fact, Harris is a lot closer to 70. If he really believes the first sentence – against the backdrop of the 1970s and 80s New Zealand – at very least the claim needs more elaboration. As it is, it simply seems designed as cover for the Bank’s failure (in company with many other central banks).

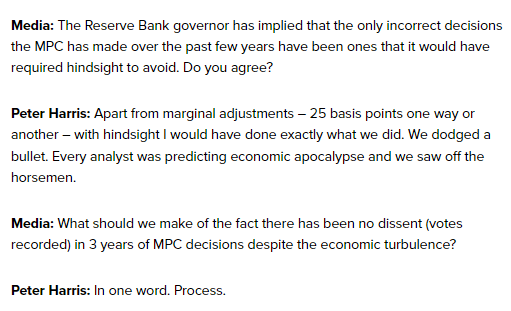

The interview continues

What an extraordinary claim: worst inflation outbreak in decades, MPC now aiming for a recession to reverse it,, not to speak of crisis lending programmes running on years after the crisis (something even management suggests they might have done better) and $9bn+ losses on the LSAP programme, and even “with hindsight I would have done exactly what we did”. It might be one thing to argue that “only with hindsight would I have done things much differently”, but “with hindsight I’d have done exactly what we did” is….well, almost beyond words. And all that apocalyptic rhetoric……I mean, with hindsight it is clear that “every analyst” (and more importantly in this context, every MPC) was wrong. With hindsight, they were mirages not the Four Horsemen.

He does go on after the one word (“Process”) to describe that process. The internal process doesn’t sound to have changed much since the decades I spent on the internal advisory MPC/OCRAG, but perhaps it is worth noting that in those days unanimity among the Governor’s advisers (it was then finally solely his call) wasn’t that common – in fact, successive Governors had us each put our recommendations in writing, initially without seeing what others were recommending, precisely to limit the risk of groupthink or peer pressure towards the end of the process. It is a very poor reflection on all involved that through the period of great uncertainty and the worst monetary policy stuff-up since the 1989 Reserve Bank Act gave the power to the Bank, not one MPC member, not even once, felt and reasoned sufficiently strongly as to dissent, on anything. Even now, no external MPC member has given us their own accounting for the handling of the last three years (beyond Harris’s “with hindsight we did it right”). Note that the recent Reserve Bank self-review is a management document, and I have an OIA request in at present to try to learn what the externals contributed and whether or not they agreed.

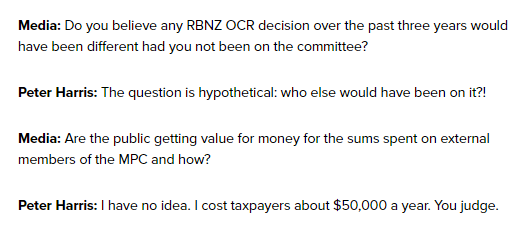

The interviews ends with two answers that sum up the grudging approach

Surely the first of those questions could have been treated as an open invitation to talk expansively about how “I can’t be certain about that, but let me tell you about what I think I as an external member have been able to bring to the table [as someone with decades of experience in New Zealand economic policy, strong connections to the labour market, as someone standing outside the day to day pressure staff and management face, as someone willing to ask awkward questions as part of a confidential deliberative process] – or whatever value he thinks he has offered.

And the final question? What would have been wrong with a more gracious “look others will have to be the judge of that, but I wouldn’t have accepted appointment and reappointment if I hadn’t thought I was adding value. If I can’t be totally detached in assessing my own contribution, when I look at my colleagues – Bob Buckle and Caroline Saunders – I can see the impact they’ve had around the table, the questions they’ve posed, the research they’ve helped spark.” and so on?

It was, of course, a shame that the interviewer didn’t also ask Harris to justify the exclusion of people with current expertise in matters monetary and macroeconomic from serving as external members of the Committee. It wasn’t his choice – Orr, Quigley and Robertson did that – but he now has the benefit of 3.5 years serving on a New Zealand MPC as an external member, and it would be quite reasonable to seek his perspective (and not at all in breach of the charter for him to have given a substantive answer).

We need a better model, and we need better people (internal and external) on the MPC. While perhaps it is better than nothing to have had this Haris interview, the substance (or lack) of it only tends to confirm how poorly we are being served.

I’ve dealt in the past with regulatory organizations like ASIC, MAS, SEBI and other Asian regulatory bodies.

At all times and even with dealing with some tough issues – all queries/questions were dealt with in a polite but obviously tough manner however all parties were respectful to each other.

All I see from this interview and A Orr’s press conferences is a very arrogrant approach from the RBNZ highlighted/evidenced by some of the answers given to questions.

For me watching A.Orr’s Press conference post MPC decision was sad. He did receive at times silly questions and I am sure that they are irritating to receive and then have to answer. But surely we can expect a certain level of professionalism within the organization?

In the previous organizations that I worked with, if I answered/responed to a regulatory body in the way that P Harris did to Stuff with throw away comments and then observing Orr’s interaction with Journo’s etc, I would have faced some form of disciplinary action.

That these standards do not appear to be in place at the RBNZ is pretty surprising to say the least.

LikeLike

Sadly, not too surprising now but very disappointing.

LikeLike

A CEO sets the culture of an organization by his actions and deeds.

Basis A Orr’s interactions with external parties can we really be surprised by the tenor of the answers P Harris supplied?

Poor look for what should be one of the elite organizations within NZ.

LikeLike

Yep, and facilitated/abetted by Grant Robertson as Minister of Finance and Neil Quigley, Robertson’s chair of the RB Board. They could have insisted on better – from Orr or jettisoning him – but consciously chose not to do so.

LikeLike

Thank goodness for your & Tom Pullar-Strecker’s efforts to bring this appalling nonsense out of the shadows. Mr Harris’s comments seem to be delivered from a bubble of arrogant unaccountability far from the people and the nation he is entrusted with serving and who now must bear the consequences of both the pandemic and the responses to it.

LikeLike

If that ‘interview’ was an indication of the calibre of the MPC External members after 3.5 years of silence, better he’d said nothing than remove all reasonable doubt. The whole process comes across as so controlled and contrived that it has the authenticity of a ‘confession’ obtained at the hands of the Gestapo.

As for his comment about ‘process’ – risible: a cursory glance (St Louis Fed – ‘History of FOMC dissents’) shows that the FOMC has a rich history of voting members who have dissented from the majority view, including over the last 2 years. The Bank of England’s MPC has seen a dissension rate of 12.5% since 1997 (including over the use of QE tools). Should we then believe that a lack of consensus at the Fed’s FOMC & BoE’s MPC meetings is symptomatic of a lack of ‘process’ at these two Central Banks?

More likely the lack of dissent at the RBNZ’s MPC ( or in fact any meeting) is an outcome resulting from a combination of: group think/ independents being captured by management/ lack of robust and comprehensive analysis/ a shortfall in relevant skills and experience by committee members.

And on the final question, where Harris challenges others to be the judge of whether taxpayers are ‘getting value for money’ for his and fellow MPC externals’ services, there is now only one possible answer ….’NO’.

LikeLike

Ah yes, I included the “better he’d said nothing than remove all doubt” in my feedback to the Bank (well, they did ask) at the bottom of this page

https://www.rbnz.govt.nz/hub/news/2022/11/mpc-external-committee-member-peter-harris-media-response

Entirely agree with your penultimate paragraph, adding only that the mgmt MPC members themselves presumably operate subserviently to the Governor, their boss, not known for encouraging dissent/challenge.

It is a Governor-dominanted system. That need not have produced really bad results with a really good Governor, but one is supposed to build institutions that are resilient to relatively pooer appointees.

LikeLike

Reblogged this on Utopia, you are standing in it!.

LikeLike