Read the first page of the Reserve Bank’s Monetary Policy Statement yesterday (the press release) and it is hard to find anything to quibble with. It was a strong statement, backing up another large OCR increase, and referencing a further increase in inflation pressures (and thus a revision up in the forecast track). One might wish they had gotten this serious back in November/December when the issues were already becoming stark and the upside risks high, instead of doing one 25 point increase in November and then heading off for a very long summer recess. But if they have got serious, and a bit worried, now, then better late than never.

And given where we are now – which is not a good place – if they manage to deliver core inflation next year at 2.6 per cent (as in the projections) I’d probably count that as quite a reasonable outcome: still some way from the 2 per cent they are required to focus on, but at least comfortably back within the target range. It would be much more acceptable than the persistently high inflation forecast track The Treasury published last week (but finalised two months ago).

But then the questions etc started.

Notably, given that all the core inflation measures the Bank lists are currently 3.9 per cent or above, what is it is in the forecast track that brings about so much lower core inflation (and forecasts that far ahead can be treated pretty much as core inflation)? The Bank no longer publishes a quarterly track for the output gap – their assessment of excess (or surplus) capacity pressures – but in the table of annual forecasts the output gap average for the year just ended (to March 2022) is shown as 2.1 per cent, and for the 22/23 year ending next March it is also shown averaging 2.1 per cent. It is lower the following year – averaging 0.6 per cent in 23/24, and finally goes slightly negative (-0.4 per cent) in 24/25. But on standard models (a) inflation lags behind output gap developments, and (b) a lower but still positive output gap should slow the rate of increase in inflation, but should not lower the inflation rate itself (it takes a negative output gap to do that).

The situation isn’t much clearer if one looks at their unemployment rate forecasts. They have the unemployment rate rising to 3.8 per cent by the March quarter of 2023 (materially higher than Treasury expects), and then increasing a little more to reach 4.7 per cent by March 2025. They don’t publish a NAIRU estimate but in their forecast description they say

“employment gradually returns towards its maximum sustainable level over the medium term ….this is in line with the unemployment rate increasing from a low of 3.1 per cent in the June 2022 quarter to 4.8 per cent by the end of the forecast horizon [June 2025]”

There is no hint in that description that they think a negative unemployment gap will have opened up either – and certainly not in time to produce sharply lower core inflation next year.

I don’t know how they are generating so much lower core inflation, and so quickly.

One of the startling gaps in the document is any discussion of history – past successful substantial reductions in core inflation. Surely with all those economists on staff they would have been well-placed to have provided us with some thoughtful insights on lessons/experiences? But I guess that might have involved acknowledging that it is very rare – almost unknown – to see significant reductions in core inflation without also experiencing a recession (often quite a nasty one). A recessionn isn’t strictly necessary. but perhaps the MPC could have enlightened us on why they think one will be avoided this time. As it is, search the entire document and you will not once find the word “recession” – not as a risk, not as a phantom the Bank thinks will be avoided, nothing. It seems quite a gap (and in fairness when the Governor was asked at FEC about the possibility of recession, he did note the wide margins of uncertainty, even if he tended to focus all the risk discussion on the big world out there, not on New Zealand.

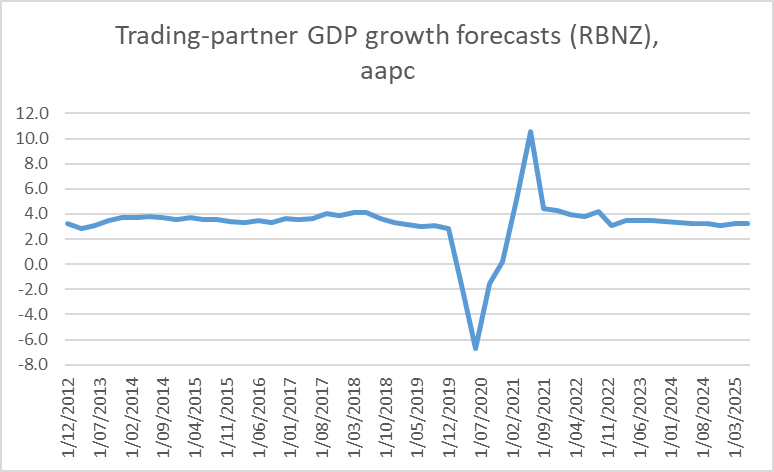

But all that was a little odd too because as the Governor noted a lot of countries are grappling with similar inflation and excess demand pressures to those in New Zealand. But on the forecasts/assumptions the Bank is using their inflation largely goes away again, and GDP growth just settles back to something pretty normal. Sure, some of the one-offs around food and energy etc will probably settle down, but the Bank seems to be assuming the ultimate in global soft landings. Quite why isn’t clear.

But if the Bank assumes the world settles back to normal quite easily, the New Zealand medium-term story seems quite a lot bleaker.

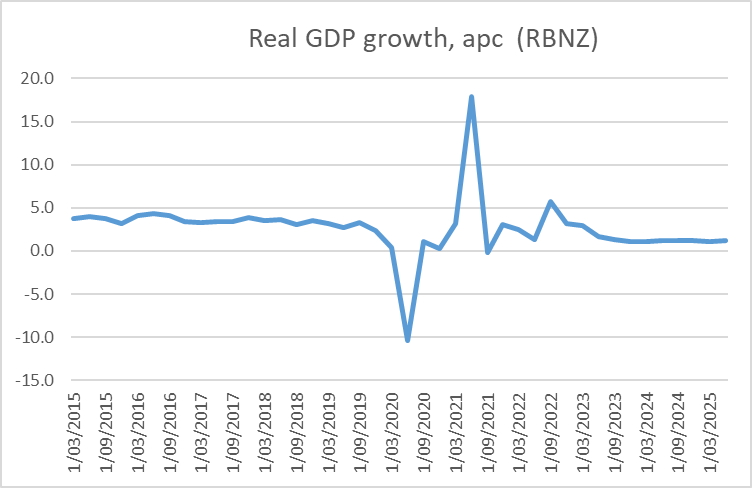

Well beyond when inflation is back in the target range, annual GDP growth seems to settle at annual rates of 1.1 and 1.2 per cent per annum. The working age population is forecast to be growing at 1.2 per cent per annum towards the end of the forecast period. In other words, no growth in per capita GDP at all (and probably almost no productivity growth). Even if there is no recession it is a pretty bleak picture.

And for those inclined to worry about the current account deficit – I don’t, but it fluctuations are often pointers to imbalances – the Bank expects the current account deficit to average about 6.5 per cent per annum throughout the forecast horizon. I’m not sure quite what to make of these numbers, but they are hardly a reflection of buoyant business investment: on the Bank’s forecast business investment three years from now is no higher than it is estimated to have reached in the March quarter this year.

Overall, I don’t find the picture very persuasive at all. I’m a bit sceptical that the OCR will need to rise as much as the Bank thinks (3.9 per cent) but if it does get that high it would be astonishing – and I’m sure without precedent – were there not to be a recession here. Especially when, as Orr rightly reminds us, a lot of other countries are now tightening quite aggressively as well, and there is open talk abroad about recession risks more widely. And – to hark about to the point earlier – the Bank does not project a negative output or employment gap (at best until well after inflation has fallen a lot), so how does the Bank think (core) inflation is going to fall so much. It may not be wishful thinking – the risks of recession in the next 12-18 months are already quite high, and such a recession would open negative output gaps and lower inflation, especially in parallel with similar corrections abroad – but it does look like poor forecasting and – more importantly – worse storytelling. I guess official agencies never forecast recessions until we are already in them, but how else does the Bank really expect to lower core inflation that quickly, that much?

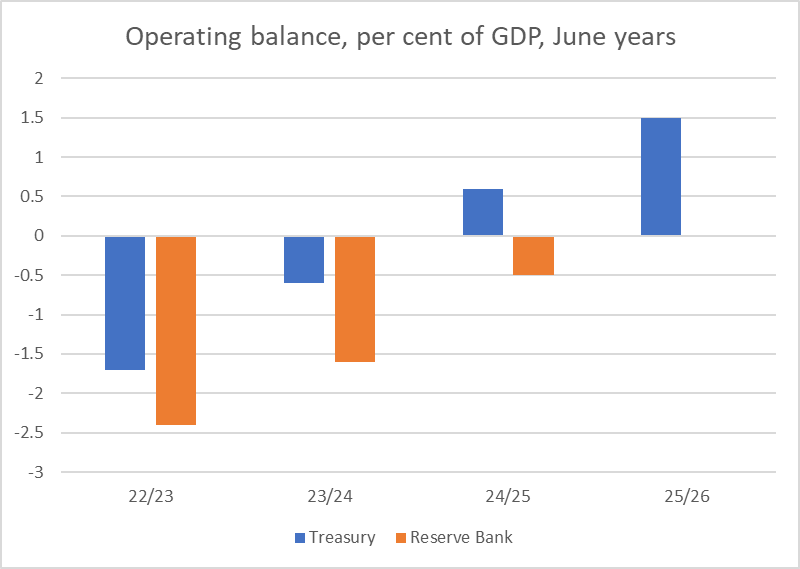

The Bank’s fiscal forecasts never get much attention. There is good reason for that. The Bank does not take its own view on fiscal policy parameters, but uses the government’s own announced parameters and then slots that information into its own macro outlook. But having highlighted in a couple of posts earlier in the week that it seemed pretty irresponsible to be running an operating balance deficit in such an overheated economy, it is perhaps worth noting that the Bank’s picture is even worse than Treasury’s with the same output gap in 22/23 they expect an even bigger deficit, and don’t see a surplus on the horizon, not even in 24/25 (the Minister’s latest promise).

I did a thread on Twitter yesterday making the case (using NZIER Shadow Board views) that, really poor as inflation outcomes have been, it is also hard to realistically think that an alternative MPC would have produced much less bad outcomes either now or any time very soon. That isn’t to say that things could not and should not have been done much better, just that it was hard to identify a realistically different committee which would have got it right (their peers abroad are, after all, often doing at least as poorly – and those Committees often have much deeper pools of expertise, and more commitment to open debate and contest of views). It doesn’t absolve the Governor and MPC of blame – they each put up their hands to take the job, and need to be held accountable for failure – but you might have least hoped that their new MPS would be rich in self-scrutiny, in signs of learning from past mistakes, and in compelling analysis of their current story (if only to open that to challenge scrutiny). As it is, the MPS had none of that.

There was also, of course, no mention of the massive losses the MPC has run up with their huge speculative punt on the bond market, otherwise known as the LSAP. $8billion of losses and counting – $8000 per family of five – is just extraordinary, all supported by probably as little analysis as Nick Leeson deployed in playing the Japanese equity futures markets, but with much much less effective accountability.

A 2 per cent OCR is probably the right call for now, although even then much better if they’d had it their six months ago. But that is about all the good that can be said for the MPS. The Governor told FEC a few weeks back that he had no regrets, and in this document not only is there no sign of any regret, any contrition, there is no sign of even a determination to learn from how we got into this mess. And, of course, no compelling story for how Orr and his MPC plan to get out it. Most likely, even though there medium-term picture is pretty grim across the board, the reality facing the New Zealand economy over the next 12-18 months is likely to be much worse still. Once allowed – even by mistake – to develop, inflationary excess has to be worked off, and that is rarely an easy or smooth process, perhaps all the more so when so many other countries are grappling with much the same problems.

I would normally include some mention of the Bank’s FEC appearance. Orr was in very good form this morning, clear and crisp (if perhaps a little defensive in emphasising all the things the Bank wasn’t responsible for – things he has often felt free to comment on in the past) but the noteworthy thing was just how lacking in serious scrutiny and challenge the questioning from MPs was. It was as if some middling test batsman took guard and the opposition team wheeled about a club bowler. It allowed the Governor to perform at his best, at a cost of no serious scrutiny of the policy failures and massive losses.

The massive expansion of the State will have a huge negative impact on productivity going forward.

https://www.statista.com/statistics/436523/ratio-of-government-expenditure-to-gross-domestic-product-gdp-in-new-zealand/

Government spending as a percentage of GDP is one of the most important metrics available.

35% of GDP in government spending seems to be about optimal for NZ – it’s big enough to fund great health and education, but not so big to crowd out the private sector investment.

How is Labour doing?

2017 – 35.6%

2022 – 43.6%

Government spending as a percentage of GDP has increased 8% in just five years…

The forecasts for future years show spending magically falling back to 35%.

If Labour / Greens win the next election, my forecast would be that government spending as a percentage of GDP will rise to over 50%.

At this point the economy will be completely stuffed.

LikeLike

Reblogged this on Utopia, you are standing in it!.

LikeLike

Let me help you on the FEC – it’s nothing more than a Potemkin Village: an illusion, masquerading as facade, wrapped in a paper-thin veil of parliamentary scrutiny & oversight. Being questioned by New Zealand’s Finance & Expenditure Committee, is ‘like being savaged by a dead sheep’…hardly a decent question asked on the performance/outcomes of monetary policy..mostly just low-grade partisan pot shots & promos. How can the RBNZ Governor have any regrets when he and the Central Bank are never held accountable through well informed and pointed questioning (by all NZ political parties).

When asked about its use of QE the RBNZ once again resorts to the magician’s trick of misdirection & distraction by trotting out ‘market dysfunction’…. perhaps in the act of ‘re-engaging’ with other Central Banks they could save the taxpayer the cost of a flight (and carbon emissions) and just read what their peers are saying about market dysfunction:

Click to access mc_insights.pdf

A few salient points from the publication, and comments:

(1)…‘Another consideration for limiting negative side effects is that the timeframe of the intervention should broadly match that of the dysfunction or elevated risk of dysfunction’…

– Buying a large percentage of the outstanding long dated Government debt over a multi month period hardly fits with that requirement.

(2)…’On the other hand, such actions must not be a substitute for the primary obligation of market participants to manage their own risks, reinforced through appropriate macro- and micro-prudential regulation and supervision.’

– The RBNZ were simply ‘gamed’ by ‘market participants’…if things were really so bad the emergency facilities would have been heavily utilised …they weren’t even touched.

(3)…’For asset purchases, the potential to generate system-wide externalities and moral hazard, and risks to taxpayers’ funds via the central bank balance sheet, are typically greater than for lending operations as the central bank acquires the full risk of purchased assets’……

-Long dated asset purchases done at low yields are unlikely to be ‘cost neutral -rolling out the Expectations Hypothesis to say that it will is, at, best naïve.

(4)…‘In light of large differences in market structures and central bank mandates, answers must necessarily be country specific’….

-New Zealand’s capital market structure and associated transmission channels in no way resembles those of the larger economies in US, UK, Europe or even Australia. Lifting & Shifting such policies is both lazy and risky.

So, perhaps 8 billion shades of regret for the New Zealand taxpayer if not the members of RBNZ’s MPC- but they (internals) are handsomely remunerated (both on past and international comparators) and are unlikely to feel the pain their policy mistakes are going to have on the general population.

LikeLike

I’d probably generally be as cynical as you about FEC, but over the last few quarters that had been some reasonably searching questions asked of Orr by some members – sufficiently so to get under his skin, and have him in bristling defensive mode. Some of that was David Seymour (of whom I’m generally no fan) but the substitute he sent along yesterday seemed quite out of his depth.

LikeLike

Michael, to the extent that construction costs have been such a big driver of CPI inflation (and the core measures too), do you think perhaps a sustained downturn in the housing market – to the extent it alleviates capacity pressures in the sector – could contribute meaningfully to a moderation in core inflation? A cursory look at construction costs within the CPI and house prices suggests this inflationary pressure ‘should’ come off the boil next year if economists forecasts of house prices play out. I know this isn’t the whole story (wage pressures strong etc), but it would certainly be helpful if it came to pass.

LikeLike

It certainly won’t be the Bank’s own formal forecast story, since the level of residential investment spending keeps rising (modestly) over the forecast 3 years. But at FEC yesterday the Govenor noted that housebuilding is typically highly cyclical, so if there were to be a signif econ downturn, one might expect building to be prominent in the decline, and it is a very labour-intensive sector too

LikeLike

If the inflation is driven by temporary supply bottlenecks, shouldn’t prices be forecast to fall once these bottlenecks are released. We should have negative inflation next year or the year after because of a release of supply bottlenecks on energy and manufacturing.

LikeLike

The Bank says they assume that supply chain etc disruptions last longer than previously, and that oil prices only come down quite gradually over the whole forecast period. Of course, there could be big quick surprises on either component, but it doesn’t look as if the unwind is a big factor in why inflation falls away so sharply next year from current (core) rates.

LikeLike

A recession is baked in the cake, the Bank just doesn’t want to forecast it and be blamed for engineering it, but between a negative fiscal impulse, rapidly tightening monetary and credit conditions, falling real incomes amid a drop in the terms of trade and ongoing supply chain issues, its a pretty sure bet. Only questions are whether its started already (yes) and how deep (1991 deep)…

LikeLike

Interesting possibility Peter. Your 1991 comparison sounds plausible: 3-4 per cent fall in GDP and a 2pp increase in the unemployment rate in fairly short order (a difference of course being that the final increase in the unemployment rate came on the back of several years of large increases). Core inflation prob fell 2.5-3pp during 1991.

Big uncertainty at present of course is the path the world economy takes.

LikeLike

[…] Source_link […]

LikeLike