I hadn’t been going to write any more about last week’s Monetary Policy Statement and associated comments from the Bank’s senior management, but then I heard the Prime Minister on Radio New Zealand this morning invoking the Bank in support of her story that everything is just fine in the economy and that we are in the midst of some transition or rebalancing of the economy towards one that is more productive, less driven by immigration etc etc.

The Governor was interviewed on TVNZ’s Q&A programme, broadcast on Sunday night. He was remarkably upbeat – in line no doubt with the rather glib claim in his press conference last Thursday that he thought the New Zealand economy was in a “wonderful spot”. While acknowledging that economic growth had slowed – and how could he not with even rather lagged hard data like this

he claimed there was only “a very low risk” of the economy “stalling”. The Governor didn’t attempt to define “stalling” and nor did the interviewer push him to do so. To me, “stalling” doesn’t sound disastrous – not the economy going off a cliff into a deep recession – but perhaps zero or negative per capita GDP growth might qualify? If so, the data suggest we were already there months ago and the Governor’s own forecasts don’t suggest that June quarter was any better (forecast GDP growth of 0.5 per cent, at a time when population growth is about 0.4 to 0.5 per cent per quarter).

Another dimension of “stalling” might be something around productivity growth. There has been none – at all – for the last three years. And the Governor’s forecasts suggest productivity growth will have been negative in the most recent quarter (GDP growth of 0.5 per cent, and hours worked – average of the two measures – up 1.2 per cent).

Of course, the Reserve Bank predicts that things turn up from here. But that is almost par for the course. In their August MPS last year, they predicted real GDP growth of 3.8 per cent over the four quarters to June 2018. Now – with three quarters of actuals in the bag – they reckon that growth rate will have been more like 2.2 per cent. Perhaps they’ll be right this time – they now reckon 3.5 per cent for the three quarters to June 2019 – but the recent track record isn’t encouraging.

Actually, even the Bank’s chief economist seems a bit uneasy. He was quoted in an interview the other day suggesting that really people just needed to think more positively

“Animal spirits in an economy matter,” McDermott said. “It is possible to talk yourself into a recession. You can generate self-fulfilling expectations, we recognize that. The more that happens, the more we’ll try and lean against that. The economic fundamentals say it should be okay, but there’s a psychological problem that sits there.”

without seeming very confident that it would happen.

“In the September quarter we’re expecting things to be more back to normal, the fiscal policy starting to get some traction at that point, the net exports to start picking up,” McDermott said. “If we don’t hit that one, it’s like oh, have we got it wrong? That will be a real test.”

But back to the Governor. What can he cite in support of his story? Not very much as it happens. He listed a lower exchange rate, world growth that is “strong”, fiscal stimulus, private consumption, and the fact that in his view “business investment should be increasing”. A little later in the interview he went on to elaborate his investment story, asserting that with capacity constraints, demand very strong, and the labour market very tight, it was a good time to invest. What’s more, he suggested, interest rates were low and firms “should be investing”.

It always seems a bit rich of public servants to be trying to tell businesses, with their own money on the line, what they should and shouldn’t be doing, but even setting that to one side, there isn’t very much in the Governor’s claims.

For example, the Governor knows better than to suggest that interest rates are low for some random reason unrelated to the economy. On his own reckoning neutral interest rates have come down quite a bit, and (again on his own reckoning) the actual OCR is far below the neutral OCR because there just isn’t enough aggregate demand, or inflationary pressure, to support higher interest rates.

What about world growth? Well, we can all read the headlines around Turkey and other emerging markets, but even putting those to one side for now, the most recent IMF numbers suggest world growth this year and next much the same as that last year (the world backdrop to New Zealand’s mediocre performance), and the IMF observes

Global growth is projected to reach 3.9 percent in 2018 and 2019, in line with the forecast of the April 2018 World Economic Outlook (WEO), but the expansion is becoming less even, and risks to the outlook are mounting.

There is a probably bit more fiscal stimulus in New Zealand than there was last year, or than there might have been under previous projections, but the differences of magnitude are pretty second order (government operating surplus forecasts are about half a percentage point of GDP lower than the forecasts the Reserve Bank published a year ago).

What of business investment?

It has been pretty subdued right through this decade. That has also been true in a number of other advanced economies, but three things most other countries didn’t have should have been supporting business investment here: the earthquakes (commercial buildings needed replacing/repairing too, and these are gross measures), a strong terms of trade – another thing the Governor likes to quote – and very rapid population growth. Oh, and we had huge opportunities to catch-up with the OECD productivity leaders. But businesses – looking to their own bottom lines – just haven’t seen the opportunities here. It isn’t clear why that is about to change to any great extent. Sure, the labour market is a bit more in balance (on the Governor’s own NAIRU estimates, not “very tight”) but on the other hand population growth is projected to slow, the global environment doesn’t look overly propitious, and there is a great deal of uncertainty about various aspects of domestic policy, and some measures which are simply hostile to business investment.

Incidentally, the Governor’s business investment forecasts don’t back his rhetoric. Here are projections (for growth in real business investment) from the latest MPS

Growth in the next few years is projected to be less than in the last few years.

Both the Prime Minister and the Governor like to talk up the fall in the exchange rate, but again it is a case of nothing much there. The Governor knows that, and having now been in office now for almost a year, the Prime Minister should too. Despite headline talk of a sharp fall in the exchange rate, the TWI at its current level (71.6 this morning) is less than one standard deviation below the average level for this decade to date: a decade which, notwithstanding the high terms of trade, has seen the share of exports/imports in GDP shrinking. The TWI was lower than the current rate only three years ago. Morever, no small part of the fall in the TWI over the last year is likely to have been because markets have become less optimistic about the (relative) performance of the New Zealand economy (see, for example, those downward revisions in even the Bank’s own growth forecasts). The Governor talks often of some other countries moving to tighten monetary policy (although really only the US has done so to a significant extent), but his own stance is no change is likely here for some considerable time, and that a cut is as likely as an increase (the McDermott comments above suggest he thinks a cut in perhaps more likely). Were the Governor’s rhetorical upbeatness (“wonderful spot”) etc prove to be correct, it isn’t likely that the exchange rate would remain low for long.

And, unsurprisingly when dealing with such modest exchange rate moves, the Bank’s projections don’t really back up again sort of “reorientation towards exports” story. In the latest set of projections, the Bank expects export volume growth over the next three years of around 10.5 per cent in total (about 3.5 per cent per annum). Over the previous three years, actual export growth was about 10.3 per cent.

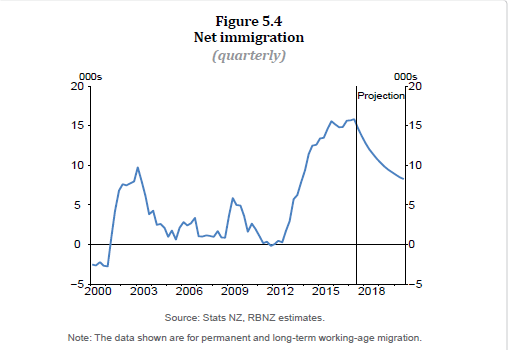

And, finally, what of the Governor’s story (or that of the Prime Minister) that we in the process of transitioning away from an economy that just has more people to one based on…well…something else. Here are the Reserve Bank’s net migration projections from the latest MPS

and here are their projections from 12 months ago

About the only difference is the scale (the top chart is annual, the bottom one quarterly).

For better or worse, the current government’s immigration policy is all-but identical to that of the previous government. There may well be a cyclical fall-off in the overall net inflows, but they won’t be because of any change in immigration policy, but because the Australian labour market is doing better.

Asked explicitly in his TVNZ interview the other day whether he bought the government’s line about the economy being in the midst of a transition, the Governor agreed. But it wasn’t a very compelling answer. He noted that we were moving away from a post-recession recovery phase – but the recession itself ended 9 years ago – and that we were moving beyond the Christchurch repair and rebuild process – which peaked several years ago. And, as I just noted, it isn’t as if immigration policy has changed to any material extent.

So it isn’t clear what this “transition” towards some better tomorrow, that the Prime Minister keeps talking of, really consists of. The real exchange rate remains very high, years of high terms of trade haven’t translated into a business investment boom, and the economic strategy still seems to depend largely on just bringing in lots more people, mostly not overly skilled, every year, to a land where opportunities were (a) always constrained, and (b) are in the process of being made more constrained by conscious government policy (eg oil exploration ban, net-zero carbon targets). And for all the talk of somehow moving away from housing investment towards “more productive” investment, a key element of government policy is Kiwibuild, which is supposed to build more houses.

As for improved productivity, the Reserve Bank’s forecasts certainly assume it. But then they always do. Three years ago, they thought total trend productivity growth for the three years to March 2018 would be 2.1 per cent; they now think actual trend growth over those years was -0.1 per cent. Two years ago, they forecast trend productivity growth for the three years to March 2019 would be 2.0 per cent. They now think it will have been 0.3 per cent. And so on. The Bank doesn’t have a strong focus on productivity, and tends to assume some sort of return towards longer-run averages. We must hope they are right this time, but if so it is likely to be only by chance, rather than because the Governor and his staff have any particularly strong insight on what might improve the longer-term structural performance of the New Zealand economy.

If one tries to work out the mental model the Governor is using, it seems to come down to not much more than that house price inflation has slowed, and that that in itself will put the economy in a better place. But there is little robust foundation for such a story – welcome as the slower house price inflation is likely to be to potential entrants to the market. After all, it isn’t as if the household sector in aggregate has been on some sort of wild spending spree in recent years, backed by the illusory “gains” to real wealth from rising house prices.

It is hard to avoid thinking that both the Prime Minister and the Governor are engaged more in spin (trying to keep spirits up) than in hard-headed economic analysis. We should expect better, especially from the Governor, but then he still has lots of turf battles to fight, and it pays to keep onside with the political masters who will make those decisions.

And to be clear, the deep-seated problems with this economy were already there – and increasingly apparent – under the previous government. Nothing much the current government is doing (or talking of doing) suggests that any of them are likely to fixed under the present government, and the risk remains (seems quite high) that – even cyclical ups and downs aside – the real underperformance just continues to worsen.

10 years ago we had a new government that talked of catching up with Australia by 2025. Perhaps they never quite believed it, perhaps it would have been a stretch to have actually done it by then. But I don’t recall anyone – National or Labour – 10 years ago talking up the prospect of material further widening in the productivity gaps. But that is what happened, and now we start out even further behind.

And yet the Governor can continue to tell us we are in a “wonderful spot”. In what alternative universe?