Yesterday’s post focused on the puzzling events around the adoption of last year’s Reserve Bank budget: the board planned to spend massively above what the Funding Agreement had allowed and for reasons still totally obscure neither Treasury nor the Minister of Finance raised any concerns whatever.

A few months ago now, after Orr had left the scene (with many questions still unanswered), a new Funding Agreement for 2025-30 was signed. I noted then that while the new spending allowances were well down on what the Bank had itself egregiously planned to spend in 2024/25, they didn’t appear to represent much of a cut at all relative to previously agreed levels (past Funding Agreement and 2023 variation), despite the huge increase in allowed spending that had been granted on the Orr-Quigley-Robertson watch. A few weeks ago – and only a day or two beyond the statutory deadline – the Bank released its Statement of Performance Expectations (SPE) for 2025/26. You’ll recall that, by law, the Minister (and hence Treasury) will have had a chance to provide comments on the draft.

The SPE contains the Bank’s budgets for 2025/26, and enables us to use some directly comparable numbers over time for total operating expenses. One of the sleights of hand in the new Funding Agreement was moving more items – some potentially quite significant – out of scope of those particular limits. It turns out that in the Bank’s 24/25 budget 13 per cent of operating spending was out of scope, while in their 25/26 budget, as reported in the SPE 24 per cent is.

It is fair to observe that the relationship between recent Reserve Bank budgets and actuals seems to have been surprisingly loose – Orr seems to have been unable to spend all the money that board allowed him when they set annual budgets – but for 2024/25 and 2025/26 budgets are all we have to go on. For 2024/25, the Minister was still happy to have used the budget numbers in her March Cabinet paper on the new Funding Agreement and we know (from that document) that there had been a big increase in actual staff numbers (FTE) between 30 June 2024 and 31 January 2025 (up about 10 per cent in 7 months), and staff expenses are by far the largest item of opex.

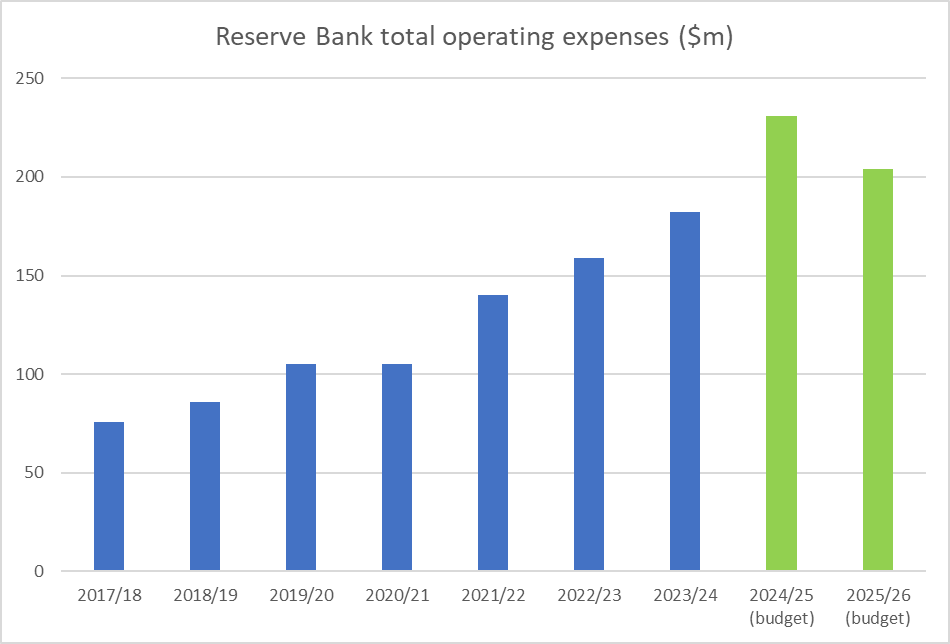

Anyway, here is the best chart I can put together, using Annual Reports for actuals and the SPE budget numbers for 2024/25 and 2025/26.

Since the Bank has been in full-on retrenchment mode in recent months (eg top management numbers have more than halved, and they’ve been reduced to laying off a quarter of their first and second year new graduates), it isn’t impossible that the 2024/25 actuals will come in a fair way below the budget adopted last June (although there will be unforecast redundancy costs).

But what really caught my attention was the budget for 2025/26. You’d have to think that, having been adopted only last month, with a Board chair and temporary Governor wanting to show how they’ve moved with the spirit of the times, these aren’t vapourware numbers, but the best hardnosed estimate of what the Bank expects operating expenses to be in 2025/26. That number is 12 per cent above actual operating expenses in 2023/24, the last year in which budgets were adopted under the previous government – the one the current Minister of Finance rightly and regularly attacked for extravagant levels of spending. 12 per cent above…..(this only becomes apparent now because it is only now that we can put hard numbers on how much spending was moved out of scope of the Funding Agreement limits, in a way that allowed the Minister to sell the extent of restraint as materially greater than it turns out to have been). How many other government agencies have budgets this year 12 per cent above levels of spending in 2023/24? Not many would be my bet. It is quite astonishing.

(Yesterday, I linked to someone else’s OIA published on the Bank’s website. It included this plaintive appeal to the Minister of Finance not to cut the funding agreements amounts further in a report dated 14 March

The Board chair owning up to the culture of excess that had developed over recent years. Who had been the board chair right through that period? Why, that would be Neil Quigley. Who is the board chair still today? Why, that is Neil Quigley. )

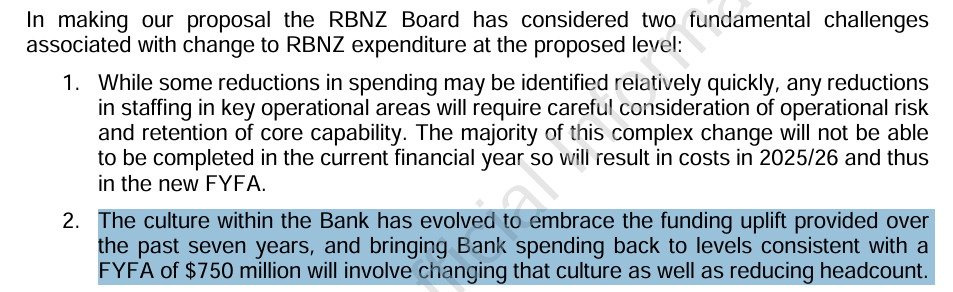

What of the rest of the Statement of Performance Expectations? It is very little use to anyone (I’d have thought). There is less of a breakdown of planned spending this year than last. This was from last year (bother only about the spending column)

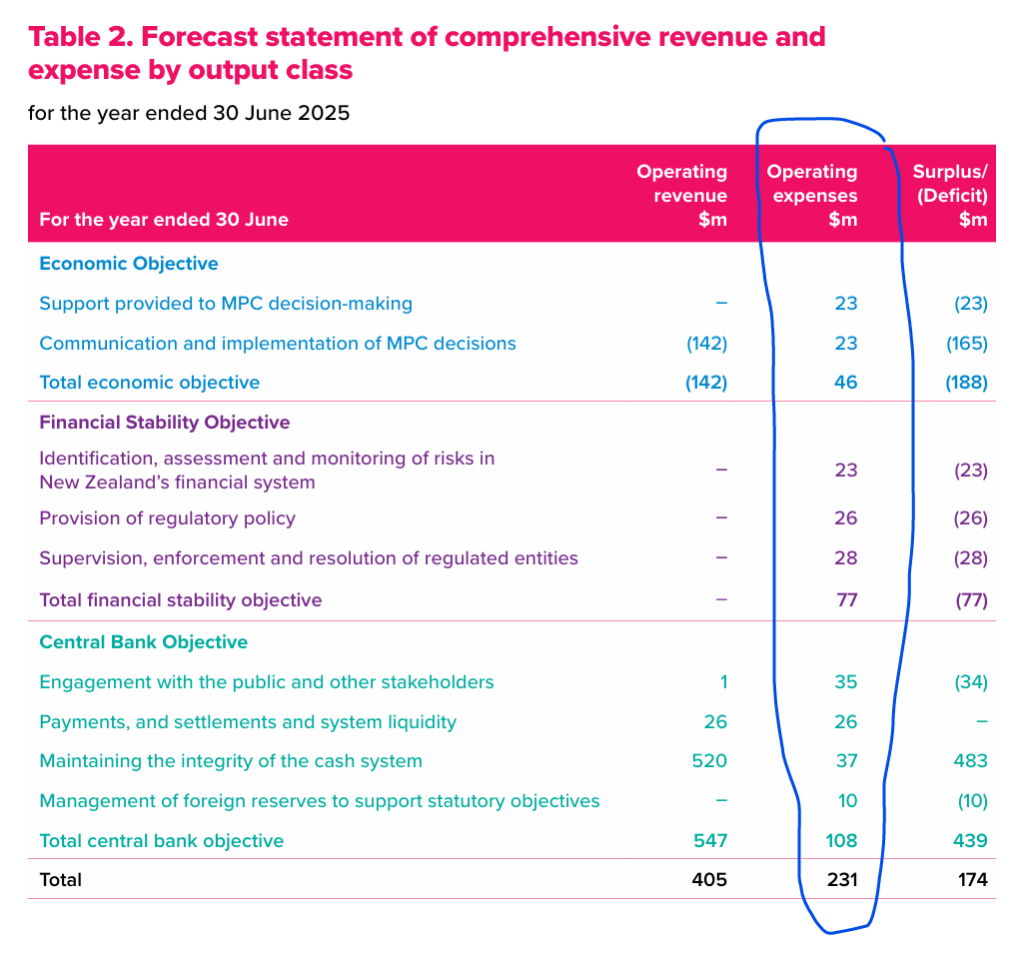

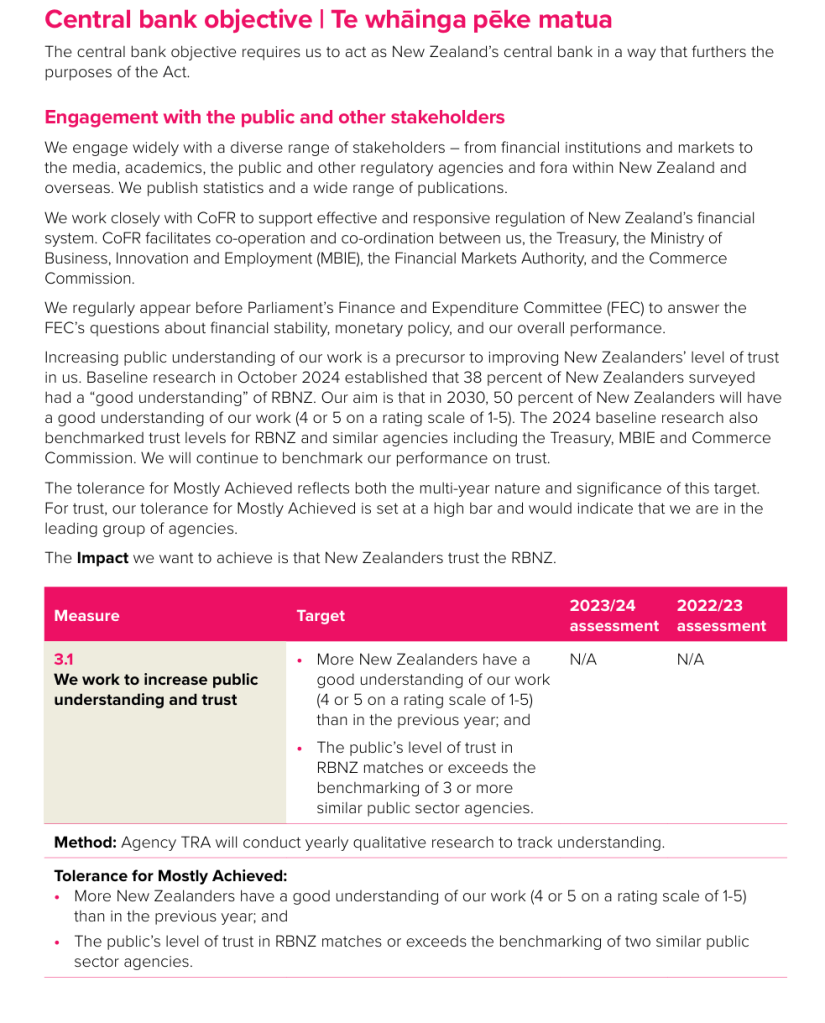

It raised several questions then (I had a post about the extraordinary $35 million of planned spending on “engagement with the public and other stakeholders”, which seemed so egregious that the truth surely couldn’t be quite as bad as it seems (but we have never any answers). This year, they’ve collapsed the categories so we get only this

With that utterly-meaningless “central bank functions” heading hiding almost everything that might be interesting.

And then there is this (with no numbers at all)

After the six months the Bank has had (coming on the back of the last few years – $11bn of losses, worst outbreak of inflation in decades), you really wonder how they can write this stuff with a straight face. But I guess that is the sort of quality bureaucrats (and associated board members) are recruited for. Well-grounded trust usually requires a record of achievement or at very least a record of open and self-critical transparency when things don’t go so well. The Orr-Quigley-Hawkesby Reserve Bank is still failing on both counts. A Governor just disappears, with no notice and no explanation. Or recall all those unanswered questions in my recent post (let alone all the ongoing OIA obstructionism), and the inability to even give straight answers regarding the actual level of spending restraint when the Funding Agreement was released three months ago. (Note too the odd benchmark: while the Commerce Commission has some independent powers, Treasury and MBIE are simply ministries whose activities or advice are rarely directly visible to the general public in a way the Reserve Bank’s independent exercise of its powers is. They aren’t similar, and I don’t think “no worse than how the public thinks of (or trusts) Treasury” is really an adequate benchmark at all.)