At midday the Governor of the Reserve Bank will descend from the mountain-top, having communed with himself for some months, and tell us how much more capital locally-incorporated banks will have to hold for each dollar of (risk-weighted) assets.

It is one of the more stark of the democratic deficits in the current Reserve Bank law – which grew like topsy over the years – that a single unelected official, largely appointed by more unelected part-timers, has the unchallengeable power to make such far-reaching decisions, when there is no shared agreement about the appropriate goal policy should be set to meet, no shared agreement on the relevant models of the economy and financial system, and no ongoing accountability for whether this single individual’s choices end up effectively serving the public interest. Instead, we are left with one individual’s whims – in this case, an individual without even much in-depth expertise or long well-regarded professional experience – and one individual’s personal views of “the public interest”. Usually, that is the sort of thing we hire/elect politicians for, including because we have recourse – we can toss them, and their party, out again.

With a better Governor and a better institution beneath/behind him, the legislative framework would still be deeply flawed in principle. In practice, it might matter rather less. But instead we have a relatively inexperienced Governor, a similarly inexperienced (in banking, financial stability and associated regulation) Deputy Governor and a fairly weak bench as well. Search the Reserve Bank’s publications and you will find precisely no serious research or analysis on issues relevant to financial stability or bank regulation. That isn’t the fault of individual staff, but of choices of successive waves of senior management. Key management figures are widely known for their aggressive, but insular, approach, and it is only a couple of years since the independent stakeholder survey of the Reserve Bank as regulator produced damning results. Regulatory capture is often a big concern the public should have about regulatory agencies, and that seems unlikely to be the Reserve Bank’s particular problem. But analytical excellence, an open and consultative approach, willingness to engage, listen, and reflect, willingness to work effectively with others, are the sorts of areas where the Reserve Bank falls well short. A system where the Governor is prosecutor, judge and jury in his own case, with no feasible rights of appeal, doesn’t conduce to things being better than they are.

And thus we come back to the Governor’s proposals for markedly increasing bank capital. These were launched a few days short of a year ago. There had been no working level technical consultation or wider socialisation of analysis and research on any dimension of the issues. There was no cost-benefit analysis – in fact, there still isn’t, we only finally get to see one today and can be sure that will have been artfully constructed to support the Governor’s decision. As the background papers finally came out it emerged that the 1 in 200 year framework had been chosen at the very last minute. There was no evidence of close engagement with APRA, despite (a) most of the major banks being subsidiaries of Australian banks, (b) economic and financial risks being similar, and (c) APRA having greater depth and expertise. To this day we’ve had no serious analysis comparing and contrasting effective capital requirements here and in Australia.

And so it has gone on. The Bank did publish a few more papers designed to support their case. They very belatedly hired some hand-picked chosen overseas experts to give the Governor’s plans a tick – people with no expertise specific to New Zealand. And even then the ticks weren’t exactly ringing endorsements – recall David Miles noting that one could grosly over-specify a bridge, or employ engineeers to do regular inspections and assessments. We’ve had the odd speech – although never once a serious effort from the Governor, the sole decisionmaker – including, most recently, the half-hearted ill-supported attempt by the Deputy Governor to claim that New Zealand was much riskier than Australia. But no indications of any serious engagement with people who had lodged submissions raising technical points of one sort or another on the proposal.

And then, of course, there was the Governor’s style. There were the attempts – open and public – by the Governor to suggest that anyone who disagreed with him was “bought and paid for”, in league with the banks. Even if it were true – which it demonstrably wasn’t – isn’t the onus on a decent policymaker, particular such a powerful one, to engage on the substance and to show where and why someone with an alternative perspective might be wrong.

And then you might recall the succession of Stuff articles on other aspects of how the Governor has been operating this year.

The video of the conference remains on the Reserve Bank’s website. Some reporters said they were stunned Orr would air his anger so publicly and called it bullying.

But other observers were not surprised. Details of Lubberink’s experience were already circulating in Wellington and industry sources say they match a pattern of hectoring by Orr of those who question the Reserve Bank’s plan.

“There is a pattern of [Orr] publicly belittling and berating people who disagree with him, at conferences, on the sidelines of financial industry events,” said one source who’s been involved in making submissions to the Reserve Bank on the capital proposal.

There have also been angry weekend phone calls made by Orr to submitters he doesn’t agree with.

“I’m worried about what he’s doing.”

The source said some companies have “withheld submissions,” for fear of being targeted by Orr.

“They’re absolutely scared of repercussions. It’s genuinely disturbing,” he said.

and

In the cut and thrust of the debate, Orr’s jokey style and everyman charisma fell away. In recent months he’s dogmatically insisted the cost of his plan would be minimal and has picked personally at critics in the media, academia, and the financial services industry.

He’s been variously described as defensive, bullying, and perilously close to abusing his power.

“He’s in danger of bringing scorn on his office,” said long-time industry watcher David Tripe, professor of banking at Massey University. “I used to know him well. I no longer feel so confident.”

Or the strange statement the Governor corralled his entire senior management to sign, rejecting attacks on Bank staff – and thus attempting to play distraction, since most of the concerns were about the Governor himself and his (now) handpicked senior management.

(As I’ve noted previously, I don’t have a personal dog in this fight. If he has been abusing me – which wouldn’t surprise me – I don’t know of it, and fortunately wasn’t one of the submitters subject to one of those “angry weekend phone calls”. But New Zealand deserves a lot better from such a powerful public figure.)

The Reserve Bank’s Board and the Minister of Finance are jointly and individually responsible for the Governor. I wrote to both a couple of months ago expressing my concern, partly because the chair of the Board tried to bat away the issues by suggesting that he had had “no formal complaints” (as if that was the appropriate threshold for concern, in an industry where the Governor has great power to make things difficult for at least soe troublemakers). My letter to the Board was here. I also knew that I wasn’t the only person writing to the Board.

I lodged a request under the Privacy Act for (basically) any Reserve Bank senior management mentions of me during October (the time of the Stuff articles and the letters to the Board). I was mostly after the flavour of the period.

For anyone interested the response (not particularly long) is here

Reddell Personal Information 281119 (1)

It includes the letter, Geof Mortlock, former Reserve Bank (and APRA) official, wrote to the Board chair Neil Quigley (because he referenced something I’d written), quite critical of both the Governor and the Board.

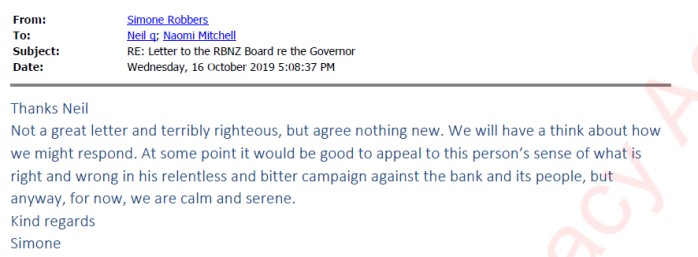

Here was how one of Orr’s deputy chief executives responds when Neil Quigley forwarded the letter on.

I thought that “Sigh” was pretty telling. The SLT statement to which she refers was that extraordinary to suggest that it wasn’t fair that people were beating up on their staff when…..no one was. Play distraction rather than addresss any issues about policy or the Governor.

I sent my letter later the same day. This was the Robbers unguarded response

(I have never met her, but I can assure her (and her bosses) that I’m not “bitter” – I’m not sure what I’m supposed to be “bitter” about, but it is clearly a theme that makes Bank management feel better – and if they looked at all carefully they would find I typically express my concerns more moderately than some others commmentators on the Bank – see eg some of the Mortlock articles and, indeed, letter to the Board. Never mind though, she is “calm and serene”).

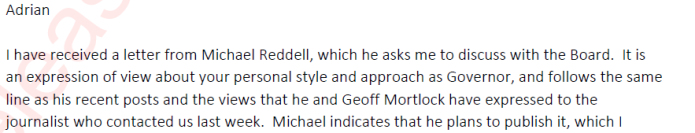

Having received my letter, Quigley contacted Orr. An excerpt

Actually, I didn’t ask for it to be discussed at the Board (although I appreciate the fact that it was so discussed – see below). More importantly, perhaps, I had not talked to Kate MacNamara for the articles, and have never had any contact with her.

Orr responds a few minutes later, not at this stage having seen the letter

One has to chuckle at the lack of any apparent self-awareness in that second paragraph, written just days after the Governor had had his SLT put out that unsolicited statement attempting to distract from real concerns. I guess it wasn’t the Governor who was making those “angry phone calls”, or engaging as he did with Jenny Ruth, and so on.

A few minutes later Quigley responds, rather characteristically it would seem (one of the consistent criticisms of the Board is that they repeatedly acts as if their role is to cover for the Governor, not – as the law provides – to hold the Governor to account on behalf of the public and the Minister.

This is, presumably, a reference to the episode in which Graeme Wheeler used public resources and his official position to attack me as “irresponsible” for bringing to light what proved to have been a leak of the OCR and associated systemic failures, and when I expressed concerns to the Board – on which Quigley was then a member (generally one rather sceptical of Wheeler) – they all circled the wagons to defend the Governor.

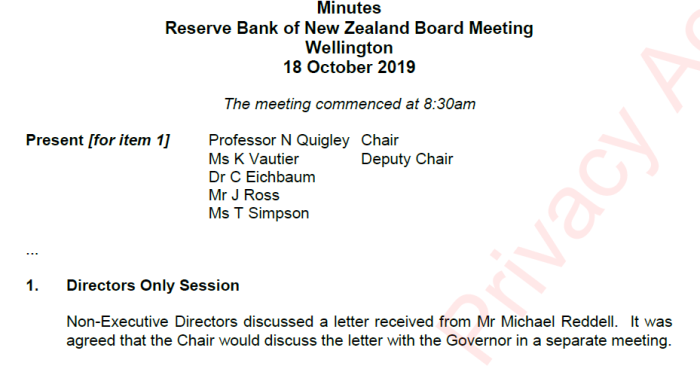

The Board met a few days later. A few days later Quigley confirmed to me that the non-executive directors (Orr is also a director) had discussed my letter. The Board’s minutes confirm this.

We don’t know what was said (and even if it were recorded, it would – rightly – not have been disclosed), although there are rumours – heard from several sources – that the subsequent meeting between Quigley and Orr was a fiery one, suggesting that the Board may actually have taken seriously some of the concerns raised. There were signs in the Governor’s demeanour at the last two press conference that he may have been counselled to rein himself in and act with a bit more gravitas and dignity.

As it happened, I had lodged a parallel Official Information Act request in which I asked for

· all communications received from outside the Bank by Board members (including the Governor) during October 2019 regarding the Governor’s performance or conduct, including (but not limited to) issues raised in recent articles by Stuff’s Kate MacNamara

· any comments on those communications made by the Governor

· details of any external speaking engagements, or contributions to written publications, where the Bank had initially indicated that the Governor would speak but which, during October 2019, were either rescheduled, cancelled, or assigned to some other Bank staffer.

The response was due last Friday. It wasn’t an onerous request. There can’t have been many such communications to Board members, nor (presumably) many written comments by the Governor. The third strand was to attempt to find out whether the reported story was correct, that the Governor had chosen or being prevailed on to pull out of some engagements after the criticism.

Anyway, the Bank has extended the deadline for this request by another 2.5 weeks, claiming the need for “consultations”. But I guess it also conveniently pushes any release beyond today and close to the Christmas break. Perhaps there is more there than I assumed. More probably they are just being deliberately obstructive.

As I noted, I also wrote to the Minister of Finance about these issues, mostly to reinforce the point that the Governor was his responsibility, and he couldn’t just fob things off to the Board. The Minister’s stance right through this year has been to distance himself from the proposed major new regulatory initiative, claiming it is just up to the Governor, and refusing to exercise any of the powers he does have. Here is that letter.

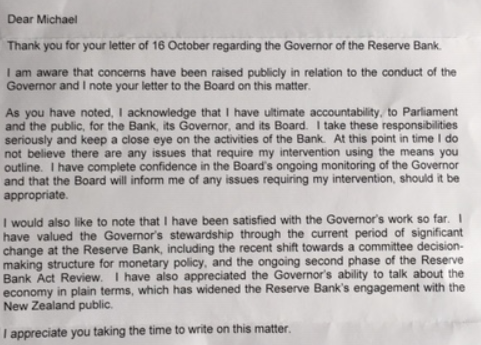

I didn’t really expect to get more than a one sentence reply, but a fuller response turned up in the post the other day. Here is the heart of it

I thought there were two interesting statements in this letter, neither of which he was compelled to make:

- first, the statement of “complete confidence” in the Board, even though almost non one shares that view, and his own consultative documents as part of the Phase 2 Reserve Bank Act review recognised the serious weaknesses of the current model and proposed scrapping it, and

- second, the line that “I have been satisfied with the Governor’s work so far”. I guess “satisfied” isn’t a terribly strong endorsement, and arguably “work” might not include style, but it clearly sees the Minister of Finance line up behind the Governor including around the Bank capital proposals and decisions (almost certainly the Minister would have been informed of the final decision by last week when the letter was dated). That is a brave choice, given the serious pitfalls in the Bank’s work in this area that I and various others have highlighted.

Before long we will have the Governor’s final decision. Perhaps after a year and more of weak performance, his presentation (there is apparently a press conference) will be marked by grace, insight, rigour, and gravitas, and the documents will be penetrating, complete and convincing, addressing comprehensively, whether directly or by implications, many of major concerns that have been raised. Perhaps, but it seems unlikely. If it so, I hope I will one of those saying tomorrow how pleasantly surprised I was.

We need a high-performing Governor, a robust and rigorous Bank, and the sort of openness that really should characterise a strongly-performing powerful institution in a free society. On each count, they’ve been a long way short this year, covered for by both the Bank’s Board (in pretty predictable fashion) and now by a Minister of Finance who refused to take any responsibility – including when questioned on the issue in Parliament – and now seems happy to line up behind the flawed Governor he is responsible for – but, no doubt, a Governor whose personal politics and championing of issues well outside his lane warms the hearts of MPs on the government benches.

New Zealanders deserve better – behaviour and substance – than we’ve had this year. As I noted just last week, even at this late date the groundwork the Governor was laying for this decision was shaky and incomplete at best.

I did notice Adrian Orr referred to increased competition as one of his rational. This is about levelling the playing field between the new entrants wholly dependent on Capital versus the Australian banks domination of the $190 billion in savers deposits and being able to leverage off that.

LikeLike

The thing about competition is usually a downward pressure on prices.

The Chinese compete on price in every other product around the world, there is no reason that the new capital requirements reduces the monopoly reliance on savers deposits by the Australian banks, the logical end result would likely put downward pressure on retail interest rates.

Today’s residential mortgage interest rates by the Chinese banks are still at the lower end of 3.15%.

LikeLike

Would like to know if the 2% capital margin between the big banks and the small banks big enough to give the smaller banks enough of an assist to make them seriously competitive

LikeLike