In recent times, we’ve heard endlessly from The Treasury and the government about the emphasis they want to place on the “living standards framework” Treasury has been cooking up for some years for a left-wing government (the previous government had little interest). We are constantly told that there should be less emphasis on GDP-based measures.

This was a news report just a few week ago

Prime Minister Jacinda Ardern was enthusiastic about the new approach in her speech in a church on Wednesday about the Government’s plans beyond the first 100 days. From 2019, Budgets would be delivered using new metrics designed to paint a more accurate picture of New Zealanders’ lives and encourage government to tailor spending to lift the country’s performance across those metrics, she announced.

Budgets would go beyond GDP per capita and debt to GDP ratios to analyse the wider effects on people’s wellbeing and the state of the environment in an inter-generational way, she said.

“By Budget 2019 Grant and I want New Zealand to be the first country to assess bids for budget spending against new measures that determine, not just how our spending will impact on GDP, but also on our natural, social, human, and possibly cultural capital too,” she told the crowd.

I’m among those who’ve long been sceptical of the Living Standards Framework, and the “four capitals” approach that is now its shop window. It has always seemed content-light, and more about product differentiation (on the one hand), and a way of avoiding focusing on the decades-long record of productivity growth underperformance (on the other). Treasury has had no compelling answers to the productivity failure, and so it must have been tempting to shift the focus. Since the new government evidently has no plan, and they have “feel-good” constituencies to please, it must have seem doubly appealing.

I’ve been meaning to write some more about some of the papers and speeches The Treasury has released recently, expecting to cast further doubt on whether the new framework is likely to add any analytic value, or improve the quality of policymaking.

But yesterday I noticed that The Treasury had saved me the effort. On their Twitter feed was this retweet

#GDP vs. #wellbeing: What makes countries better off? IMF economists crunch the numbers. Read #IMFBlog http://ow.ly/Bdgr30iOdyZ

It was drawn from this IMF piece. In it, the IMF reports

For years, economists have worked to develop a way of measuring general well-being and comparing it across countries. The main metric has been differences in income or gross domestic product per person. But economists have long known that GDP is an imperfect measure of well-being, counting just the value of goods and services bought and sold in markets.

The challenge is to account for non-market factors such as the value of leisure, health, and home production, such as cleaning, cooking and childcare, as well as the negative byproducts of economic activity, such as pollution and inequality.

Charles Jones and Peter Klenow proposed a new index two years ago (American Economic Review, 2016) that combines data on consumption with three non-market factors—leisure, excessive inequality, and mortality—in an economically consistent way to calculate expected lifetime economic benefits across countries. In our recent working paper, Welfare vs. Income Convergence and Environmental Externalities, we updated and extended this work, attempting to include measures of environmental effects and sustainability. In this blog we look at our results from updating the new index.

Our findings clearly suggest that per capita income or GDP does capture the main component of well-being. And health—a key component of well being—is critical to raising welfare and income.

The well-being index

What emerges from Jones and Klenow’s work is a consumption-equivalent index that measures welfare derived from consumption, then adds the value of leisure (or home production) and subtracts costs related to inequality. This calculation is made for each country over one year and then multiplied by the life expectancy in each country. This gives us a measure of average expected lifetime welfare based on consumption, leisure, inequality, and life expectancy. (Click here for a further discussion of the well-being index.)

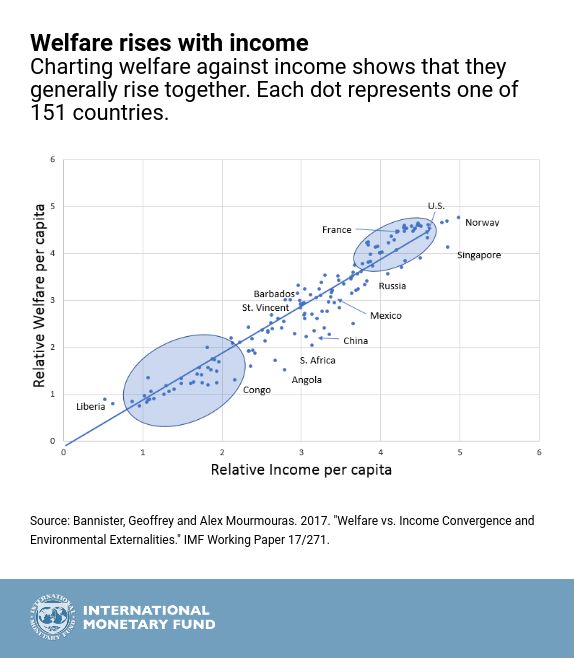

There is a close relationship between our calculation of per capita welfare for 151 countries in 2014 and per capita income or GDP. The chart above [reproduced in the tweet] shows that most countries line up fairly well along the 45-degree line (where relative welfare and income per capita are the same) indicating correlation, but there are significant differences, too. Poorer countries on the left are largely below the line, showing that welfare is lower than income. Richer countries at the top right are above the line, reflecting welfare that is higher than income.

Enough said really. There is little sign of any obvious gain from shifting the focus of the Budget, or The Treasury’s advice from GDP per capita, and the productivity measures – GDP per hour worked, and MFP – which are associated with them – to amorphous living standards/ “four capitals” measures.

Of course GDP isn’t perfect. And of course governments can boost GDP is welfare-detracting ways (eg conscription and forced labour), and yet The Treasury ends up promoting new research from the IMF suggesting that in fact countries don’t do so to any material extent (if it were otherwise more countries would be much further from the 45 degree line). It suggests what everyone has always known – that in setting policy governments do think about other stuff, not just GDP (check out all those Cabinet papers with “Treaty implications” section, as just one example). And that measures that free people and economies to lift productivity, and with it potential GDP, remain the most salient and reliable way to lift key elements of living standards (not just material consumption). Fix productivity and many other possibilities comes with it. It still won’t capture everything, but beyond that a great deal involves explicit value judgements, in which area Treasury has no superior expertise or insight.

Perhaps instead of diverting so much of their analytical resource into the new-fangled, not particularly robust, tools and frameworks, The Treasury could return to getting the basics right: robust advice on expenditure, calling out bad or rushed policy when it is proposed/promised, and focusing in – with a genuinely open mind – on the specifics of why New Zealand’s long-term productivity performance has been so poor.

In order to measure if GDP tracks wellbeing you need to first measure wellbeing, why not just measure wellbeing directly then and use that as a country’s chief index? At least in developed countries where measuring things is not too difficult.

LikeLike

Wellbeing through the ages certainly has changed. From cave dwellers happy to just be able to start a fire, to being able to own a horse, which changed now to owning a car. My thoughts now are on buying an electric car for the well-being of all humanity including my own. I feel rather impoverished because a nice new Tesla will still set me back $130k. My old Lexus SUV once a symbol of prosperity now considered a polluter on a global scale does make me feel rather sick. Of course there is the option of the Nissan Leaf and second hand ones around $15k. But who makes to be seen driving an old model Nissan Leaf?

But what about those remote controlled electric powered drones? Free of the congestion of roads. That would be the ultimate in wellbeing, at least in the near future. Perhaps next stop Mars mission control?

LikeLike

Doesn’t seem like a good thing to measure as part of wellbeing if it’s going to change from century to century. If people didn’t care about it 1000 years ago it probably shouldn’t be part of a wellbeing index today.

LikeLike

Mostly, in my view, because pursuing wellbeing (defined however – eg subjective vs “objective” measures) directly is less likely to lead to a sensible long-term policy framework than focusing on policy frameworks that are consistent with lifting productivity and long-term productivity growth. The argument, in essence, is that there is a causal link from (sensible) things that lift productivity to the other good stuff captured in wellbeing measures.

LikeLike

I had seen a similar chart recently from the OECD: https://t.co/yaaDASLOIp. Australia is now way below the 1:1 line, and NZ is below the line when it used to be above the line. I put this down to extreme congestion in the big cities combined with housing inequality. In both countries economic migrants are coming in faster than the ability of the society to construct housing and infrastructure. So productivity is the most important thing in the long term, but in the short term housing inequality is equally important.

LikeLike

Economic migrants? Are those the 125,000 international students and the 4 million tourists that spend $15 billion every 12 months that need to sleep somewhere? Or is it the cleaners, waiters, bus drivers, prostitutes, shop attendants and cooks that service this student and tourism industry that are required to service this prople orientated business where the best service is more people? Service is an industry which needs more people. Productivity requires less people. Therefore higher productivity equates to poor service and less sales. The very best service equates to lower productivity.

LikeLike

Thanks. That OECD chart, of course, buys into the whole “don’t emphasise GDP – or GDP-derived productivity measures” approach (and i have trouble with the notion that “material conditions” are better here than in Netherlands, Denmark or Ireland). But, of course, i totally agree about fixing the housing market – it is a hugely distorted market, on account of govt regulation, and makes first best sense to fix whether or not there are any GDP/productivity consequences. Same goes, in a NZ context, for settling legimitate Treaty claims. Or an appropriate law and order/judicial/prisons system. Or a defence policy.

LikeLike

Treaty claims can never be settled. Whe land was exchanged for guns and blankets, today the descendants would view that legitimate transaction as confiscation and the amounts paltry and daylight robbery. But at the time guns and blankets were a highly valuable commodity and land was worth nothing.

In other words, today’s treaty settlements will be viewed by tomorrow’s descendants as paltry, insignificant and insufficient and will require another round of treaty settlement claims in a never ending cycle of claims.

LikeLike

The treaty of Waitangi is a colonial document and should be relegated to the history books. It is also a racist bi party agreement between the British Crown in England and Maori as colonial British subjects which has never been ratified or changed from its original form. It has no place in modern New Zealand with a multitude of cultures and nationalities.

LikeLike

The British have a very established legal framework in any of their undertakings. Most confiscations that the crown undertook was because Maori at the time broke the law and confiscations was the result of Maori breaking the law established at the time.

LikeLike

Your claim that the confiscations were because Maori broke the law is stunningly ignorant.

My family, Pakeha, were in NZ before 1840. In 1870 my great great etc grand father was sent to prison for, allegedly, stealing a dray from the army. Reading the evidence, even as presented in the papers of the day, it looks like a stitch up.

It was also around this time that emigrant Europeans were outnumbering “native born” as Europeans born in NZ were referred to at the time. Notice the word “native” in “native born”. And the prejudice against “native born” is apparent in documents of the time.

If “native born’ Europeans were, as I suggest, being imprisoned on spurious grounds what chance did the Maori have. Your claim about confiscations because Maori broke the law is just horrid.

LikeLike

Not too sure where ignorance comes in. But in those days some people clearly did have more rights than others. I think in the USA today, some people still have more rights than others. And women still argue they are not being treated as having equal rights and equal treatment all around the world. But the legal framework was in place and administered accordingly by people and the correct course of action at the time was confiscations and was lawful at the time. The human element is the gray area and not anything to do with ignorance.

I did wonder where NZ born settlers actually counted in the Treaty of Waitangi as it is a 2 party agreement. If NZ born settlers were being discriminated against perhaps your ranking is not correct. Most Maori are royalists. The Treaty of Waitangi is between Maori as British subjects and the British crown. Maori actually requested the British crown to come and aid disputes with NZ native born settlers in their troubled times. It is questionable if NZ born native settlers are even included in the Treaty of Waitangi.

LikeLike

Actually there are similarities with the legal comfiscations that currently occur under the Proceeds of Crimes Act. This Act allows land to be confiscated as proceeds from crime. Does it mean that in 200 years in the futures we would have to deal with settlement claims from the descendants? More than likely we would have to. Makes me wonder if it is at all wise to confiscate under the proceeds of crime because the payback in 200 years would likely run into the billions of dollars due to asset inflation.

LikeLike

Inequality is likely related to status. Jordan Peterson relates some interesting facts on two studies of London bureaucrats 70 years apart. The higher the status the healthier they were. Seventy years later, though materially richer the status hadn’t changed and neither had health. Also crime is related to low status amongst males (could explain Maori crime?). What does “diversity” do when there is no compensating territorial exchange?

LikeLike

As an ex-Physics student (failed) it does seem that economists like measuring attributes which have massive margins of error. Bernard Shaw’s comment springs to my mind about the surgeon who amputates two legs instead of one having double the productivity.

However from the little I know of the world I would rather be an average Barbadian than an average citizen of China despite similar GDP per capita and St Vincent seems more appealing than Angloa. So the diagram makes some sense.

Then I started thinking about the hours worked for the GPD (a colleague said the French office lunch could be a couple of hours but working in Germany it was ten minutes of eating at your desk). Maybe it is only life expectancy that puts Congo so low? Which leads to my own life in NZ; of course a long healthy retirement is ‘well-being’ but what if I spend most of it with my mind gone in a state of constant dread? Even using average lifespan as a factor might be a mistake.

LikeLike

Matrices, permutations and possibiities

The economics profession have trapped themselves into a deadly-handshake of their own making – and now they can’t get out of the trap

I have always considered economics a valuable tool for analysing and understanding past events. When it comes to guiding and directing the future path of an economic activity (read economy), it is not a good idea to be too doctrinaire about it. One can prognosticate about possible outcomes of various choices, till the cows come home. I gave up forecasting outcomes years ago for the following reasons: (a) An “economy” comprises 1000’s of input components (b) The international card game of bridge, each of 4 players receives 13 cards from a deck of 52. The chance of any player receiving the same combination of 13 cards again is 1 in 635,013,559,600. That’s 635 billion.(c) Take 5 components, and using just one, there are 5 possible alternative outcomes. Take 5 components and using any 2 together in combination there are 32 possible outcomes. With 20 components the possible outcomes exceed 1 million. At any moment in time. And that assumes each component in each example is applied in fixed measure

I knew this not – until a professor (with a Phd) from Melbourne University pointed it out to me

They just don’t teach that in Economics

More recently it was calculated that in the game noughts-and-crosses with nine 9 positions there are 366,000 possible outcomes

And doh-rag-wearing rugby international Peter Fitzsimons

Interesting. TFF has been browsing Adam Spencer’ latest book, World of Numbers – which is sort of mathematical quirks and concepts, explained by a geek who can also write bloody well. The one that most stunned me is this. Spencer says that if you truly shuffle a deck of cards, properly, you will have in your hands one of the 52 x 51 x 50 x … x 3 x 2 x 1 =8065817517094387857166063685640376697528950544088327782 4000000000000 different ways you can shuffle a deck. A big number, I know. But what fascinates me is his contention that, “you can be assured that the order of cards you hold in your hands, has never happened before in the history of the universe … and will NEVER happen again! If a billion people, shuffled a billion decks of cards every day for a billion years they would not scrape the surface of the total number of ways a deck can be arranged.” Try adamspencer.com.au for the book

http://www.smh.com.au/comment/enough-already-of-tony-abbott-20151211-gll9j3.html

LikeLike

Human behaviour as a group reduces the number of variables at play. The herd instinct makes predictions and forecasting a lot more reliable than a deck of cards. But don’t forget a card counter can increase the probability of accuracy. That’s why we keep pushing the boundaries of computational power in order to get more accurate predictions.

LikeLike

Have never considered using a deck of card for forecasting – the odds in a game of bridge are merely used to illustrate the odds and probability of something occurring again – and – the number of cards in a deck of cards is static – the only issue that changes is their order or sequence – as for card counting the aim is one of probability within the one “shoe” of 8 decks – if you take set readings at given points and repeat the readings on the next “shoe” the readings are completely different – that doesn’t work – as for a group of people – that may be so for one day or one week but not long term – examine the graphic of brownian motion below – its changing as you watch – and the philosophers heraclitus and parmenides

Heraclitus – “No man ever steps in the same river twice”

The philosopher heraclitus said you can’t step into the same river twice .. by the time you step in the second time the water has changed. parmenides said you can’t step into the same river once, its changing as you enter. I went through a thousand rivers before I got waist deep …

LikeLike

But you have just predicted he would step into that same river. Now the variable is how accessible the river is and at which point and for what purpose at which time of day? All of which becomes predictable once you have Facebook and location services.

LikeLike

If anyone is not aware of Location Services, it is available in every smart phone which Google and Facebook uses to pin down your exact location via satellite GPS instant tracking. I used Google direction finder with instant GPS updates travelling in a moving vehicle travelling at 160km/hr in Italy and it is accurate 99% of the time working out the fastest travel route and how much time is needed and where traffic jams are occuring. I needed to get a Hertz internet signal booster for the Iphone though to maintain a consistent internet signal.

LikeLike

Another take on indicators rather than pure gdp/capital

The Inclusive Development Index 2018

Click to access WEF_Forum_IncGrwth_2018.pdf

LikeLike

So how do we get better productivity without increased investment in technology/human capital? And why invest in labour saving devices when 11% are underemployed? You can just hire another worker cheap as chips. Surely here it is a question of a lack of demand depressing investment. No more sales, why invest? Just chug along but no improvement.

LikeLike

Re human capital, consistent OECD estimates suggest that the skill levels of NZ workers are among the highest in the advanced world. So the issue is why do more businesses not see/find/take more opportunities here? At the margin, demand might be a bit of an issue (my criticism of the Rb holding monetary policy a bit tight throughout this decade), but the bigger issues appears to be the paucity of opportunities. In turn much of that seems to come down to location – the remotest significant land mass on earth at a time when personal connections and networks etc seem to be mattering more than ever. We have too many people here for the opportunities that are available – and yet successive govts have been determined to keep driving the population up. (Don’t get me wrong: there are other useful things that could be done – lower taxes on businesses, less of a regulatory burden, fixing the housing market etc – which could lift NZ productivity a bit, but none of them is likely to be transformative, or create a credible path to get back to US or N European productivity levels for a population approaching 5m, and growing (trend) faster than almost other advanced country.)

LikeLike

Simple answer to a simple question. No jobs for the skills we train.

LikeLiked by 1 person

A NZ designed rocket and NZ innovative technology now belongs to the USA. The reason is the lack of funding in NZ. Not location. Xero, a internet cloud based accounting software company is now an overseas owned company and Rod Davies is relegated to a minority shareholder and remains as a director but not in management control. Again its is not about the location. It is also about where the funding comes from.

LikeLike

On my argument, in both cases it is a combination of factors (altho I suspect location is more important). If our interest rates were consistently matching those abroad – instead of having been above for decades – the cost of domestic equity capital would be lower, and more firms would remain relatively more valuable to NZ owners.

As you’ll probably recall I’ve said for a time that Xero would be an interesting test case. Now listed on the ASX (sensibly enough) rather than NZX as well, with a new MD who shows little interest in being in NZ, it increasingly looks as tho it is only a matter of time before effective corporate control moves abroad – whether it remains a standalone company, perhaps based in Aus, or – more likely I suspect – it ends up taken over and incorporated into some much larger global group based in Europe, North America or North Asia.

LikeLike

Do you think Xero would have achieved what it has without the imprimatur of Peter Thiel

LikeLike

Logically Xero could be located anywhere. Maybe there is even some small advantage in having development done during the night for the customers in EU and USA. Companies with a more tangible product exist at a distance from their customers – Lego in Denmark, Samsung in Korea, Ikea in Sweden, etc.

Maybe NZ’s problem is not the distance (what is the significant difference between say 7 hours doorstep to doorstep travel from California to NY compared to 28 hours Auckland to UK – both waste a day).

The problem NZ has is talent is so easy to steal. Educated Kiwis are well travelled when young; they can and will pick up their family and move to London, Singapore, NY, etc. Because NZ offers lower wages than most countries staff are stolen cheaply. English is a universal language for business so a Kiwi employee is productive immediately anywhere they go.

The aim is to make Kiwis feel homesick. Most Papua New Guineans really feel homesick and it is only our welfare state and rewarding jobs that keeps most of the small number resident in NZ here. If I’m right then keeping our talent requires offering a uniquely NZ life experience. Something like hunting, shooting and fishing and the great outdoors as part of teenage schooling and then an inexpensive quality house in a crime free area with a congestion free commute. Given a return to top schooling for the kids and who would want to leave?.

LikeLike