Late last week Statistics New Zealand released the latest quarterly inflation numbers. For years, the Reserve Bank – explicitly charged with the job – has told us inflation is heading back to settle around two per cent. If anything, most market economists have been even more of that view – typically their forecasts of inflation and/or interest rates have been higher than those of the central bank. Indeed, on the very morning the CPI numbers were to be released one prominent market economist was reported in the Herald as picking that the Reserve Bank would be – indeed, should be – raising the OCR as early as July.

But for years, the Reserve Bank has been consistently wrong. The year to December 2009 was the last time their preferred measure of core inflation was at 2 per cent, the midpoint of the target range (a goal explicitly highlighted in the 2012 to 2017 Policy Targets Agreement). And for six full years now that sectoral factor model measure of annual inflation has been between 1.3 and 1.5 per cent. There is almost nothing in any New Zealand data suggesting any sort of sustained lift in New Zealand’s inflation rate.

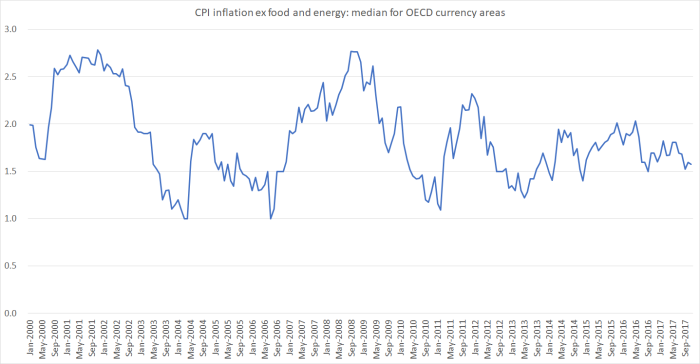

There isn’t much in the rest of the advanced world taken as a whole either. Here is the median rate of CPI (ex food and energy) inflation for the OECD countries/regions with their own currencies.

There is plenty of wishful thinking – among some central bankers, and some market economists – but not much sign of more inflation, even in the handful of countries where central banks have raised interest rates a bit.

Led by the Reserve Bank, a lot of the commentary in New Zealand would have you believe that if there is an issue with low inflation in New Zealand, it is all about tradables inflation – ie inflation in things we import, or produce in competition with the rest of the world. The implication often is that if we just focus on domestically-generated inflation, there isn’t an issue. But mostly that looks like an attempt to muddy the water and avoid responsibility.

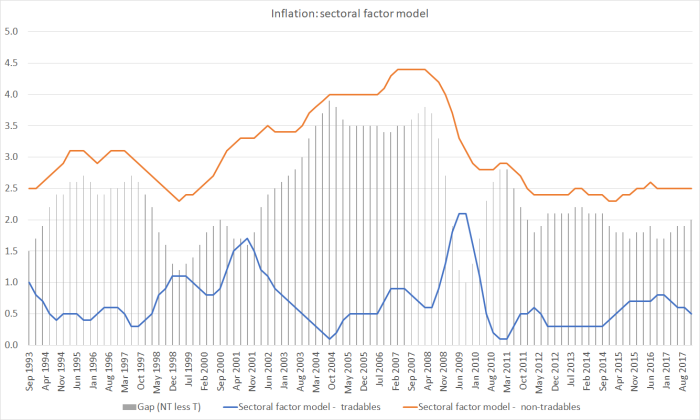

Here is one way of looking at that issue. In calculating the sectoral factor model of core inflation, the Reserve Bank actually calculates (and now publishes) separate estimates of tradables and non-tradables core inflation (that’s why it is called the “sectoral” model). In this chart, I’ve shown both those measures and – the bars – the gap between the two of them (non-tradables less tradables).

The gap between the two series – the extent to which core non-tradables inflation exceeds core tradables inflation – is actually a bit less than average at present.

In looking at the chart, there are perhaps two other things worth bearing in mind.

- the core tradables measure is influenced by developments in the exchange rate (as one would expect) – see the surges in 2001 and 2009 after the sharp falls in the exchange rate, and the dip in 2004 after the sharp rise. It is a reminder that although we can’t control world prices for the stuff we import, New Zealand dollar tradables inflation is directly influenced by New Zealand monetary policy choices (as they affect the exchange rate), and

- the gap between core non-tradables and core tradables is somewhat cyclical. The peaks in the gap coincide with the periods of sustained pressure on domestic resources (as measured, eg, by the Reserve Bank’s output gap estimates). Perhaps unsurprisingly when, as at present, output gap estimates are around zero, and the unemployment rate has still been above NAIRU estimates, the gap between the two sectors’ core inflation rates is pretty subdued.

And, of course, there is little or no sign in the chart of any sustained pick-up in core non-tradables inflation, the bit most directly responsive to New Zealand economic circumstances. And don’t be fooled by the fact that core non-tradables is itself above 2 per cent: non-tradables typically inflate faster than tradables, and if overall core inflation is to be kept near 2 per cent, core non-tradables inflation would typically have to be around 3 per cent. It isn’t, and hasn’t been for years.

This chart has another of my favourite series: SNZ’s measure of non-tradables excluding government charges and cigarettes and tobacco (now heavily affected by rising taxes).

I’ve also shown the “purchase of housing” component of non-tradables inflation – largely construction costs. Non-tradables inflation, ex taxes and government charges, did pick up a bit (as one might expect) when construction cost inflation was surging (back in 2013, and in 2015/16), but (a) the peaks seem to have passed, and (b) this particularly proxy for core non-tradables inflation is now rising at less than 2 per cent per annum.

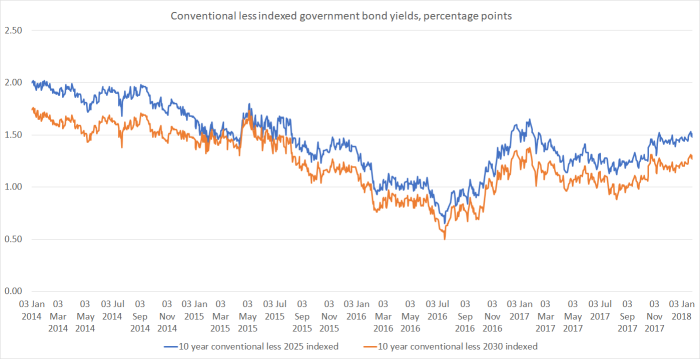

Finally, there isn’t much sign that people are really expecting inflation will soon settle back to, and stay around, 2 per cent. The Reserve Bank’s Survey of Expectations will be out next week, and it will be interesting to see what respondents write down for their expectations five to ten years ahead (with a new government and a new Governor, but an uncertain mandate and unknown committee still to come). When I filled in the form the other day, I wrote down something like 1.75 per cent. But perhaps I was too optimistic? There are, after all, market transactions going on where people take a view – actual or implicit – on what average future inflation will be, as people buy and sell government bonds (conventional and inflation indexed).

The gap between indexed and conventional bonds isn’t a perfectly clean read on inflation expectations – but then neither is any other measure. But here is what the data shows, using the Reserve Bank’s data for 10 year conventional government bonds (a rolling horizon) and the indexed bonds maturing in 2025 and 2030.

At the start of the period, the 2025 bond was nearer to a 10 year maturity, while these days the 2030 bond is nearer 10 years. And whereas implied expectations of average future inflation were close to 2 per cent four years ago (the start of the chart), now they seem to be only around 1.35 per cent. As a reminder, the Reserve Bank’s sectoral core factor model measure of inflation is currently 1.4 per cent, and has been in a range of 1.3 to 1.5 per cent for years. As expectations, the implied market numbers don’t seem irrational at all.

Why does it all matter? After all, 1.5 per cent isn’t really that far from 2 per cent. I think there are three reasons:

- first, the Reserve Bank undertook to keep (core) inflation near 2 per cent, and not only hasn’t done so, but doesn’t have a compelling explanation for their failure, in the area they are supposed to be most expert in,

- second, the lost opportunities. Economic growth over the period since the last recession hasn’t been particularly strong, and the unemployment rate has been consistently above credible estimates of a “natural” non-inflationary level. Monetary policy that had been run a little looser not only would have delivered inflation nearer target, but would have allowed some (modest) real economic gains as well, In particularly, some of those unemployed – who most monetary policy commentators seem not to care much about – would have been back in jobs sooner, and even now the unemployment rate could have been lower, and

- third, when the next recession comes many countries are going to be in considerable difficulty because they can’t cut interest rates very much at all. Our problem isn’t as severe as that in some countries, but it is hardly a trivial issue either (given that the Reserve Bank cut the OCR by 575 basis points in the last recession). The best contribution the Reserve Bank can make to miminising that threat is to get inflation back up to – perhaps even a bit above – target, and keep it there. By doing so, expectations of higher inflation will underpin higher average nominal interest rates.

Much of the problem in recent years has been that the Reserve Bank has been operating with the wrong model. In particular, we’ve heard repeated claims from the (previous) Governor that monetary policy was extraordinarily stimulatory, and repeated talk about “normalising” interest rates. How much better if our Reserve Bank – with more policy flexibility than many of their northern hemisphere peers – had been willing to declare themselves genuinely agnostic about what was going on with neutral or “natural” interest rates, and been willing to focus – with real intent – on doing whatever it takes to get and keep core inflation back to, or perhaps a little above, 2 per cent. Caution might have been excusable in the immediate aftermath of the last recession, but after years of persistently low domestic inflation, it looks like indifference – which really should be inexcusable.

I saw the other day an article which seemed to suggest that the new Governor’s job (and that of his forthcoming statutory committee) just got harder. To the contrary, it is even clearer now than it was a few quarters ago that if it is time for anything, it is time at last to take a few risks on getting, and keeping, core inflation back to target.

One thing that is changing Michael is the external environment. Crude oil prices are rising and the supply-demand dynamic points to further upward pressure. This will impact headline inflation and there will probably be some spill-over into core. The second factor is the outlook for the NZD. The current account deficit is set to widen meaningfully this year as weaker dairy production, higher oil prices and rising global interest rates weigh while the resumption of funding of NZ Super and collapse in interest rate support weigh on capital flows.

I don’t think this fundamentally changes the outlook for the Bank but I do think conditions are beginning to shift towards a stronger inflation dynamic, at least at the margin.

No one knows what exactly this will mean for the RBNZ but my own take is that we are moving gradually in the direction of interest rate hikes, possibly late this year or early next.

LikeLike

The demand for oil is weakening as transportation a prime user switches out of oil and into electric. This morning on RNZ it was made clear by the transport industry experts that the road maintenance fund is being rapidly depleted as cars become more fuel efficient and use less fuel and the increasing numbers of electric vehicles on the road.

OPEC is trying to control oil output but realistically keeping its members to a restricted quota is going to become increasingly difficult when they come to a realisation that if they don’t get it out of the ground and sell it, they would not be able to sell it when it becomes a redundant fuel source as electric replaces oil as a fuel source. Many EU countries have already opted to ban petrol cars from 2040. Singapore will ban any new car growth from February 2018 this year and will instead spend $30 billion on enhancing public transport based on electricity as the power source.

Also the industry continue to be faced by an American shale oil and gas industry that starts pumping as soon if oil prices rise further.

LikeLike

Also with the hot and dry weather throughout NZ, parts of the South Island have already sought declaration for disaster relief from the government. With drought threatening this record hot summer, winter feed is going to be feeble. Dairy and agricultural output and farmers will be under the gun and unable to meet mortgage payments. Can’t see how the RBNZ would even be considering interest rate hikes this year or early next year with $60 billion in farmers debt struggling to meet payments.

LikeLike

Time will tell. But on your NZS point, I must be missing something. Since they fully hedge their fx exposures why will resumed contributions make any difference to the exchange rate outlook (taking your general point that the NZD outlook doesn’t look that strong.

Even if you are right about the outlook, with core at 1.4 per cent there should be considerable room to wait and actually seeing it getting very close to 2 per cent. The expectations climate isn’t one in which people are likely to credibly fear inflation running out of control just because, say, core gets up to, say, 2.3% for a year.

LikeLike

I don’t think that inflation would rise to 2% when macroprudential tools are still being used. Credit liquidity is still very tight at 35% equity LVR.

LikeLike

Reblogged this on The Inquiring Mind and commented:

As usual this economic numpty thinks the post’s author makes a compelling case

LikeLike

I just listened to this bbc doco on QE – which it seems to me would be the next step in NZ in the next recession given 1.75% OCR (that probably needs to go lower – as you say – even now in the “good times”).

http://www.bbc.co.uk/programmes/b09pl66b

Would be interested in your thoughts.

LikeLike

The RBNZ has macroprudential tools previously at 40% equity restrictions on LVR which they have just eased to 35% equity restrictions on LVR.

The other restriction the RBNZ have in their tool kit is the banking licence covenants that restricts local lending based on the percentage level of local bank savings. This in effect places upward interest rate pressure on the savings rates by the new bank entrants and as a result a higher uncompetitive lending interest rate. That is why the big Chinese banks are not able to leverage their parent companies massive liquidity to challenge the established Australian owned NZ banks and behave like embarrassed little banks instead of the giants that they actually are.

Both these tools can still be managed to boost NZ out of a recession by loosening the current tight liquidity controls that the RBNZ exerts.

LikeLike

Interesting getgreatstuff.Thank you.

But the question the radio doco raises is the fundamental one that “increasing bank liquidity” (via QE in this case) didn’t really help the real productive economy as much as hoped and definitely widened inequality.

Inflating house prices further through lower LVRs and easing bank regulation on lending surely can’t be the answer?

Though I do have some friends in Auckland who continue to up and up their mortgage to travel and consume new cars because they feel the growing equity in their house justifies it. Wealth effect working I guess.

Not a strategy I would entertain. But maybe I am wrong.

LikeLike

Every business needs liquidity to expand. You either seek angel investors and equity investments or you borrow. Dependence on just organic growth from retained profits is slow and market opportunity demands that you act fast otherwise the competition can overtake your market share. Most small businesses would rely on debt secured against their residential home. This is the cheapest form of debt available. The problem with equity investments is the loss of control and loss of a share of the trading profits. With debt you still have full control of the business and independent decision making and 100% of the profits. Most kiwis get into business so that they do not report to a boss. Once you have equity investments you have to report to a board of shareholders and every 20% held by someone else allows them discretion to appoint a director which equates to reporting to many bosses.

Debt is actually cheaper than equity investments.

Debt gives you the power of leverage. The higher the leverage the higher the returns on your original investment. 20% invested and 80% borrowed equates to a 50% return for every 10% increase in the value of your business.

LikeLike

Of course discipline is important in managing good debt versus bad debt. If you buy a car to add value to your business is good debt otherwise the car is a depreciating asset with no added value to your business deteriorates your equity value. Personally I have a problem with using the wealth effect to spend in NZ because it puts upward pressure on interest rates. My preference would be to travel and spend overseas so that any increased borrowing to fund travel would not add to my interest rate burden in the future. But of course you have to balance out equity and debt ratio. If your equity has risen $500k and you decide to borrow $50k to have a nice holiday and your income have risen to cover the $50k borrowed I would say go for it.

The alternative is to sell some of the equity to spend it but then you do lose control and you do lose a share of trading profits and a share of future capital gains.

LikeLike

The problem with economists is that they refer to the productive economy but never identify what constitutes a productive economy? Productive suggests production but we have chosen to decimate our production industries in favor of a agricultural and service industries. Agricultural is land based dependent and our productive land use is clearly already at its peak and service is people intensive and requires accomodation, Both of which puts upward price pressures on property.

LikeLike

One of the objectives of the foreign buyers ban legislation is to assist in moving capital from the non productive housing sector to the more productive economy. Another nonsense use of the terminology by people who clearly do not understand how capital moves around. If you ban foreign buyers from buying then a local kiwi does not get the benefit of the higher international prices of property and therefore is not able to sell in order to release their equity from property for use elsewhere.

LikeLike

[…] As it happens, the Reserve Bank produces estimates (from its sectoral factor model) of core tradables and core non-tradables inflation. I ran this chart of those data a few weeks ago […]

LikeLike